Missing Key: The challenge of cybersecurity and central bank digital currency

Table of contents

Foreword

Executive summary

Background: How the United States currently secures its payment systems

Payments overview

Looking ahead to CBDCs

Chapter 1: Cybersecurity of CBDCs – threats and design options

Roles and trust assumptions

Threat model

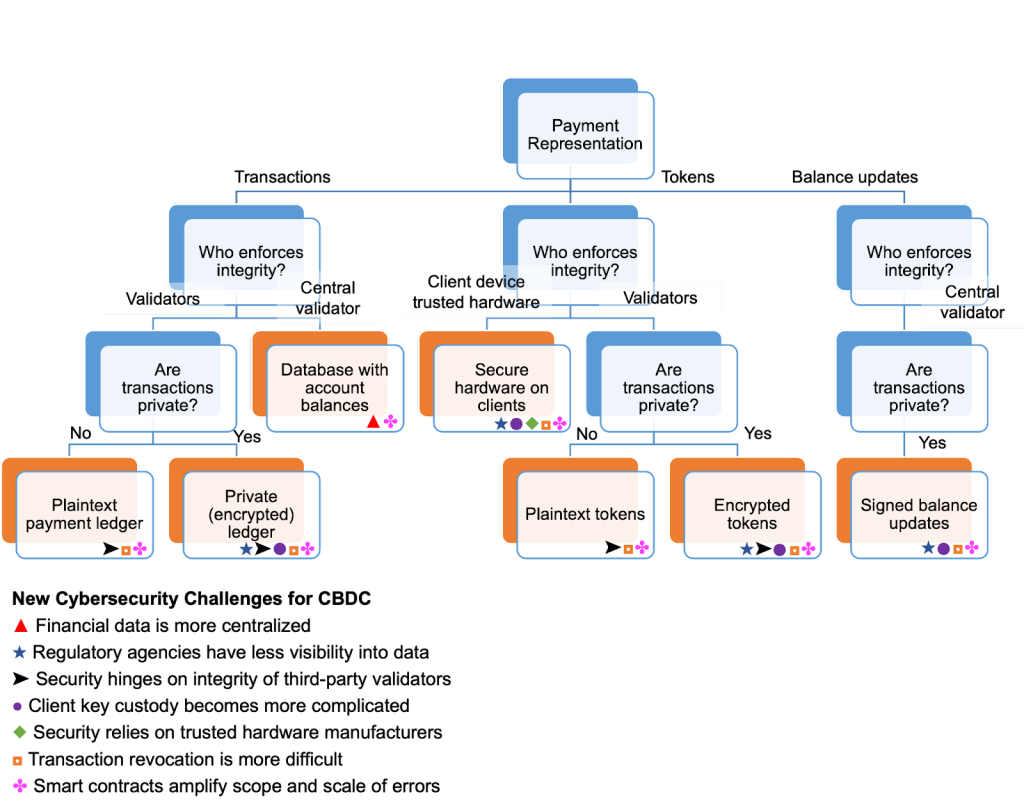

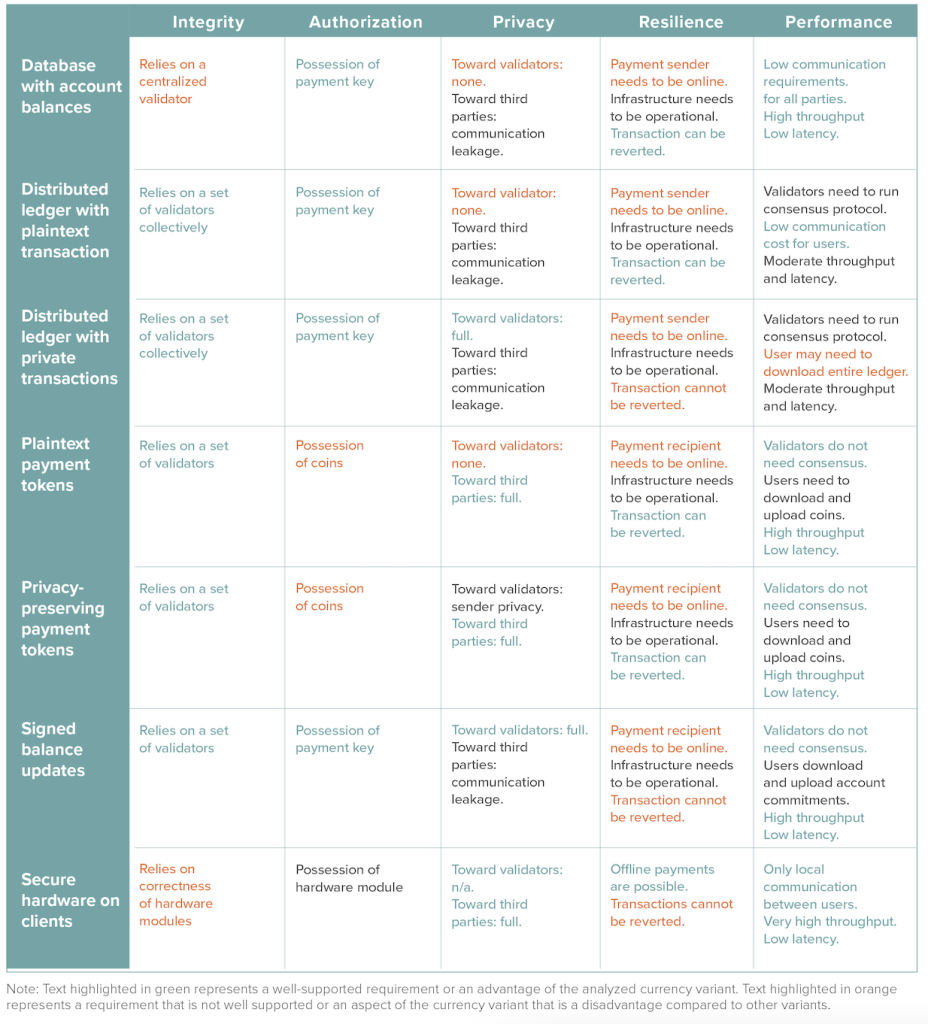

CBDC design variants

Additional key design choices

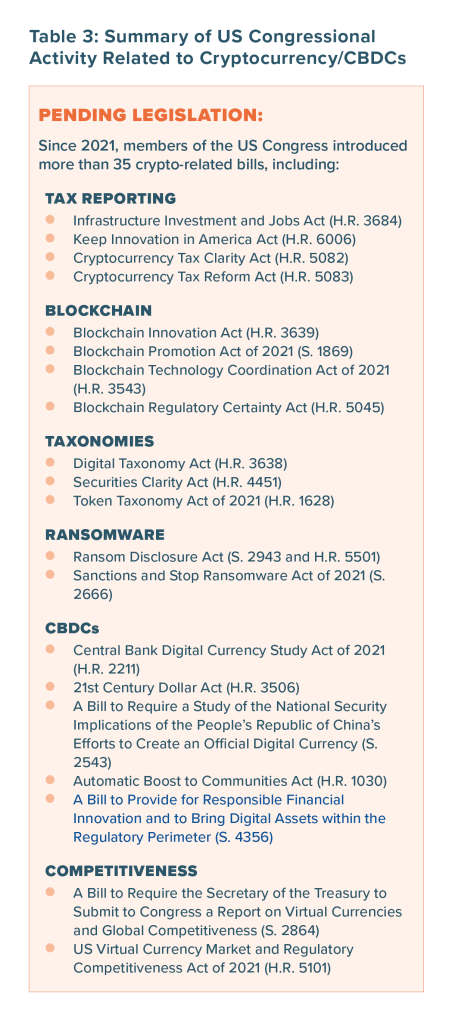

Chapter 2: Policy recommendations – Principles for future legislation and regulation

Principle 1: Where possible, use existing risk management frameworks and regulations

Principle 2: Privacy can strengthen security

Principle 3: Test, test, and test some more

Principle 4: Ensure accountability

Principle 5: Promote interoperability

Principle 6: When new legislation is appropriate, make it technology neutral

Conclusion

Appendix: Lessons from the Federal Reserve’s Current Cybersecurity Measures for Deploying CBDCs

Public wholesale layers

Private wholesale layers

Retail payments

About the authors and acknowledgements

Key takeaways

- Cybersecurity concerns should not prevent creation of a CBDC. It is up to policy makers to make the appropriate foundational design choices that will enable central banks and private payment service providers to develop safe CBDCs. All of this is possible under current technological systems.

- Current US payment systems, administered by the Fed, industry associations, and commercial banks, face a complex cybersecurity landscape and represent a major point of attack for both organized crime and state-sponsored actors.

- Deploying a CBDC would create new cybersecurity risks for the financial system and its participants. The exact set of new risks will depend on the digital currency variant that a country chooses for its CBDC system.

- Each CBDC currency design variant presents different trade-offs in terms of performance, security, and privacy. Legislatures, finance ministries, and central banks should choose which CBDC design variant to deploy based on a country’s policy priorities.

- The design space for CBDCs is larger than the often-presented trifecta of centralized databases, distributed ledgers, and token models. This offers policy makers and regulators ample options to choose a technological design that is both reasonably secure and leverages the unique benefits a CBDC can provide. Our report encourages the use of best practices from system design, such as proven consensus protocols and cryptographic primitives, as key components of CBDC deployments.

- A privacy-preserving currency design can strengthen security. In a privacy-preserving CBDC deployment that initially declines to collect or subsequently restricts sensitive user data even from trusted system insiders, breaches will have significantly less severe security consequences. Given the overlap of privacy and security in CBDCs, Congress should consider certain key areas in future legislation including data collection and deletion, universal searches, Fourth Amendment protections, and potential penalties.

- Cash-like privacy and regulatory oversight do not have to be at odds in a CBDC. It is possible to design systems where users enjoy reasonable levels of payment privacy and regulatory authorities can at the same time advance other important policy goals. For example, a CBDC could keep payment details fully private if the total value of all payments by the same individual does not exceed a certain predefined threshold value (e.g., $10,000 per month).

- To address cross-border cybersecurity risks of introducing a CBDC, policymakers should promote global interoperability between CBDCs through international coordination on standard setting. Crafting international CBDC cybersecurity and privacy regulations with democratic values is in the United States’ national security interest. It will help safer models proliferate as opposed to alternatives which do not protect privacy and do not have the most advanced cybersecurity technology.

Foreword

The challenge of securing the dollar dates back to the earliest days of the United States. Benjamin Franklin famously printed currency with the phrase “to counterfeit is death”—and colonial England used fake currency to try to devalue the Continental Dollar during the American Revolution.

In the modern era, security issues have multiplied with the rise of the Internet and the threat of cyberattacks. The United States Federal Reserve (Fed) considers cybersecurity a top priority and sees securing both the dollar and the international financial system as a core national security challenge. We are entering a new era of security and currency, one that requires responsible innovations in digital currency. This report examines the novel cybersecurity implications that could emerge if the United States issues a government-backed digital currency—known as a central bank digital currency (CBDC) or “digital dollar.”

This topic is fast-moving, consequential, and still somewhat nascent.

CBDCs have quickly landed on the international policy landscape. As of June 2022, according to Atlantic Council research, 105 countries representing 95 percent of the global GDP are researching and exploring the possible issuance of CBDCs. In the United States, spurred on by various domestic and international factors, the Fed has begun studying the issue and published a white paper in January 2022 that examines the potential benefits and risks of issuing a CBDC. In February 2022, the Federal Reserve Bank of Boston, in collaboration with the Massachusetts Institute of Technology, released test code and key findings on what a possible US CBDC might look like. But the government has so far demurred on whether it will actually issue a digital dollar, calling upon Congress to authorize such a major decision. Further complicating matters is the rapid ascendance of privately issued crypto dollars, sometimes referred to as stablecoins, which now surpass $130 billion in total market capitalization. As Fed Vice Chair Lael Brainard testified to the US House of Representatives’ Committee on Financial Services in May 2022, the recent collapse of the stablecoin TerraUSD raises new questions about the ways in which a CBDC could stabilize the digital asset ecosystem.

The security of CBDCs has real-world import and is one of the major challenges to overcome if a CBDC is to be issued in the United States. Not just because of the classical counterfeiting scenarios or the possibility of a hacker looting the digital equivalent of Fort Knox, but also because a government-administered digital currency system could—depending on how it is designed—collect, centralize, and store massive amounts of sensitive data about individual Americans and granular details of millions of everyday transactions. For example, a CBDC could contain large volumes of personally identifiable information ranging from what prescription drugs you buy or where you travel each day. This could become a rich trove of data that could be stolen by advanced hackers or nation-states (similar to reams of personal data collected from federal employees that was stolen in 2016). Separately, other security issues could arise, for example, misuse or exfiltration of data by inside employees, smaller-scale identity theft, or “gray” charges via opaque fees. However, as our analysis shows, many of these risks already exist in the current system and could be mitigated through an effectively designed CBDC.

The security of CBDCs has real-world import and is one of the major challenges to overcome if a CBDC is to be issued in the United States.

The debate around CBDCs in the United States is also, relatively speaking, in its infancy, with the Fed and Treasury Department often taking the lead thus far, and several CBDC-related bills percolating through Congress. Part and parcel of the conversation about how and whether to develop a CBDC in the United States is what it will look like and how secure it could be. These intertwined questions of policy, design, and security should be an increasing focus of the conversation, both among federal agencies and between the executive branch and Congress. The United States can, and should, play a leading role in international standard setting. US President Joseph R. Biden, Jr.’s recent executive order highlighted the importance of digital assets protecting democratic values.

This report introduces key concepts, potential design trade-offs, and some policy principles that we hope can help federal stakeholders make foundational decisions around the future of CBDCs in the years ahead. While it is too early for a CBDC to be designed with ideal cybersecurity, efforts to dismiss a CBDC as uniquely and categorically vulnerable to cyberattacks have overstated the risk. This report puts forward a road map for policy makers to build secure CBDCs.

Executive summary

This report examines the novel cybersecurity implications that could emerge if the United States or another country issues a Central Bank Digital Currency (CBDC). Central banks consider cybersecurity a major challenge to address before issuing a CBDC. The United States Federal Reserve (Fed) sees securing both the dollar and the international financial system as a core national security imperative. According to Atlantic Council research, currently 105 countries have been researching and exploring the possible issuance of CBDCs, with fifteen in pilot stage and ten fully launched.1“Central Bank Digital Currency Tracker,” Atlantic Council, last updated June 2022, https://www.atlanticcouncil.org/cbdctracker/. Of the Group of Twenty (G20) economies, nineteen are exploring a CBDC with the majority already in pilot or development. This raises immediate questions about cybersecurity and privacy. A government-issued digital currency system could, but does not necessarily need to, collect, centralize, and store massive amounts of individuals’ sensitive data, creating significant privacy concerns. It could also become a prime target for those seeking to destabilize a country’s financial system.

This report analyzes the intertwined questions of policy, design, and security to focus policy makers on how to build secure CBDCs that protect users’ data and maintain financial stability. Our analysis shows that privacy-preserving CBDC designs are not only possible, but also come with inherent security advantages, compared to current payment systems, that may reduce the risk of cyberattacks. Divided into three chapters, the report:

(1) provides a brief background on the Fed’s process as a baseline for central banks’ current cybersecurity measures;

(2) explores the novel cybersecurity implications of different potential CBDC designs in depth; and

(3) outlines legislative and regulatory principles for policy makers in the United States and beyond to set the conditions for secure CBDCs.

Payment systems’ status quo: How the Federal Reserve currently secures payments

Current wholesale and retail payment systems face a complex cybersecurity landscape and represent a major point of attack for both organized crime and state-sponsored actors. Cybersecurity risks posed by CBDCs must be assessed relative to this landscape.

A targeted attack on wholesale payment infrastructures, such as the Fed’s domestic funds transfer system, Fedwire, could cause major global financial shocks, including severe liquidity shortfalls, commercial bank defaults, and system-wide outages that would affect most daily transactions and financial stability. There would also be secondary effects, including severe market volatility. To minimize the risk of cyberattacks and reduce the impact of successful hacks, the Fed’s current measures include regular contingency testing for high-volume and high-value Fedwire participants; redundancy requirements, such as backup data centers and out-of-region staff; and transaction value limits. Other risks for the wholesale payments infrastructure include attacks on the Society for Worldwide Interbank Telecommunications (SWIFT) messaging system. After recent attacks revealed significant vulnerabilities, SWIFT and its member banks have taken several steps to shore up their defenses, focusing on stronger security standards and quicker response.

Key cybersecurity risks for retail payment systems include credit and debit fraud, which collectively caused nearly $25 billion in damages in 2018 worldwide; fraud by system insiders affecting platforms like the Automated Clearing House (ACH) in the United States; and user error, such as falling prey to phishing scams. Risk management strategies for retail payments often rely on voluntary industry standards, such as the Payment Card Industry Data Security Standard (PCI DSS). To counter phishing and other types of user error, ACH and other platforms require unique user credentials and offer merchants additional steps like micro validation, tokenization and encryption, and secure vault payments.

In sum, the various technical systems administered by the Fed, industry associations, and private banks already face considerable cybersecurity challenges.

Cybersecurity of CBDCs—Threats and design options

While a CBDC would be subject to many of the same cybersecurity risks as the existing financial systems, deployment of a CBDC would also create new risks. Depending on the choice of CBDC design, potential new cybersecurity risks include (but are not limited to):

- Increased centralization of payment processing and sensitive user data. It is possible a central bank would store user activity and transactions.

- Reduced regulatory oversight of financial systems

- Increased difficulty reversing fraudulent or erroneous transactions

- Challenges in payment credential management and key custody

- Susceptibility to erroneous or malicious transactions enabled by complex, automated financial applications

- Increased reliance on third parties (e.g., non-banks)

The exact set of new cybersecurity risks depends largely on the digital currency variant that a country chooses for its CBDC system. Each digital currency variant also provides different properties in terms of system scalability, system robustness, user privacy, and networking requirements. Since each currency design variant presents different trade-offs in terms of performance, security, and privacy, the choice of which digital currency design variant to deploy as a CBDC is a policy choice for finance ministries, central banks, and legislatures. It should be driven by a thorough analysis of the relative technical trade-offs. This report reviews various possible digital currency design variants and compares the benefits and risks of each. Our analysis also challenges the prevailing thinking in several ways and outlines the following findings:

Finding 1: The design space for CBDCs is larger than the often-presented trifecta of centralized databases, distributed ledgers, and token models.

- For example, this means that both ledger and token-based payments can embody robust privacy protection through certain cryptographic measures.

Finding 2: CBDCs can enable both strong user privacy and (some level of) regulatory oversight at the same time.

- It is possible to design systems where users enjoy reasonable levels of payment privacy and regulatory authorities can at the same time advance other important policy goals.

Finding 3: A privacy-preserving currency design can inherently provide security advantages.

- In a privacy-preserving CBDC deployment that initially declines to collect or subsequently restricts sensitive user data even from trusted system insiders, breaches will have significantly less severe security consequences.

Finding 4: It is critical to use best practices from system design, such as proven consensus protocols and cryptographic primitives.

- Distributed security protocols, such as those used to secure distributed ledgers, can introduce subtle new design challenges and security trade-offs. This report encourages the use of well-tested protocols with provable security guarantees as key components of CBDC deployments.

Principles for future legislation and regulation

With most governments, including in the United States, still weighing whether to develop a CBDC, this report identifies key principles to help guide policy makers and regulators on how to deploy a CBDC with robust cybersecurity protections in mind.

Principle 1: Where possible, use existing risk management frameworks and regulations.

- Depending on the CBDC design, policy makers and regulators should assess which areas of a new CBDC ecosystem will be covered by current laws and regulations and where novel statutes—or new technical frameworks—might be necessary to provide adequate protection.

- When crafting new regulations for a CBDC, policy makers and regulators should set the conditions for a safe digital currency ecosystem that enables financial intermediaries to innovate and compete.

Principle 2: Privacy can strengthen security.

- Privacy-preserving CBDC designs can have security benefits because they reduce the risk and potential harmful consequences of cyberattacks associated with data exfiltration and the centralization of detailed personally identifiable information.

- CBDCs can offer cash-like privacy, while potentially providing reasonable oversight options to regulatory authorities. A CBDC’s level of privacy is a legislative and political choice that will filter through to the digital currency’s design and determine its cybersecurity profile.

Principle 3: Test, test, and test some more.

- Governments should ensure that they have full access to, and can directly oversee, security testing and audits for all CBDC implementation instances. To enable extensive testing and security audits, the US Congress should consider the appropriations accordingly as part of next year’s budget process and allocate a pilot project.

- Open-source CBDC code bases may be valuable for various reasons, including because they allow for more participation in the security testing process, especially when combined with longer-term bug bounty programs. Nonetheless, they still require due attention, funding, and staffing to maintain and monitor the code base over the long run.

Principle 4: Ensure accountability.

- The overall framework governing CBDCs needs to establish clear rules and policies surrounding accountability for errors, breaches, and resulting consequences (both technical and financial).

- For CBDCs that rely on distributed ledger technology (DLT), it is paramount to clearly establish accountability requirements among validators on the blockchain.

Principle 5: Promote interoperability.

- To increase the resiliency of countries’ existing financial systems, policy makers should develop rules to ensure that a CBDC is interoperable with the country’s relevant financial infrastructure.

- To strengthen the security of CBDC systems, US leadership is critical to promote global interoperability between CBDCs through international coordination on regulation and standard setting through fora like the Group of Seven (G7), the G20, the Financial Stability Board (FSB), and the Financial Action Task Force (FATF).

Principle 6: When new legislation is appropriate, make it technology neutral.

- The US Congress can help study and oversee the application of federal cybersecurity laws to a potential CBDC with the goal of developing laws that apply evenhandedly to different technologies over time.

- Congress may consider using incentives and accountability for CBDC development or set security requirements by empowering a federal agency to develop a cybersecurity framework for a CBDC as part of a pilot project.

Background: How the United States currently secures its payment systems

Cybersecurity is an area of concern not only for CBDCs but also the current financial and payment systems. Any study of CBDCs’ cybersecurity must assess them relative to this current infrastructure and recognize how they will interact to alter and potentially remedy existing vulnerabilities. Additionally, it must draw lessons from how central banks currently handle payments’ cybersecurity.

The Fed has recognized the immense risks posed by cyberattacks to the current financial system. Asked in April 2021 about the chances for a systemic breakdown like the 2008 financial crisis, Federal Reserve Chairman Jerome Powell said that “the risk that we keep our eyes on the most now is cyber risk.” He specifically singled out a scenario in which a “large payment utility…breaks down and the payment system can’t work” or “a large financial institution would lose the ability to track the payments that it’s making.”2Scott Pelley and Jerome Powell, “Jerome Powell: Full 2021 60 Minutes Interview Transcript,” CBS News, April 11, 2021, https://www.cbsnews.com/news/

jerome-powell-full-2021-60-minutes-interview-transcript/. At a conference in October, Loretta J. Mester, president of the Federal Reserve Bank of Cleveland, argued “there is no financial stability without cybersecurity.”3Federal Reserve Bank of Cleveland President Loretta J. Mester, “Cybersecurity and the Federal Reserve,” speech to the Fourth Annual Managing Cyber Risk from the C-Suite Conference, October 5, 2021, https://www.clevelandfed.org/newsroom-and-events/speeches/sp-20211005cybersecurity-and-the-federalreserve.aspx. As the issuer of the world’s reserve currency, the Fed’s cybersecurity models hold outsized importance for the global economy. The Fed’s standards have also become models for cybersecurity across central banks.

Payments overview

The current payment system comprises three categories: retail, wholesale, and cross-border.4Eswar S. Prasad, The Future of Money: How the Digital Revolution Is Transforming Currencies and Finance (Cambridge, Massachusetts: The Belknap Press of Harvard University Press, 2021), 45–48. Retail payments are what the vast majority of Americans interact with: purchasing groceries with a credit card, buying Cracker Jack at a baseball game with a five-dollar bill, or shopping online with payment service providers. The wholesale system operates in the background, serving as the plumbing of the financial system by enabling the transfer and settlement of funds between financial institutions. Cross-border payments are between different countries and require international coordination to bridge national systems.

All three of these systems could be impacted or overhauled by CBDC. CBDC is the digital form of a country’s fiat currency that is also a claim on the central bank. Instead of printing money, the central bank issues electronic coins or accounts backed by the full faith and credit of the government. This differs from current “e-money” because it is a direct liability of the central bank, like paper cash. A CBDC could take multiple forms: a retail CBDC would be issued to the public to enable fast and secure payment, while a wholesale CBDC would only be accessible by banks and would facilitate large-scale transfers. According to the Atlantic Council’s CBDC tracker, forty-five of the 105 countries pursuing a CBDC are focused on its retail use, while eight are exclusively developing it for a wholesale purpose, and twenty-three are doing both (with the remaining twenty-nine undecided).5“Central Bank Digital Currency Tracker.” On the cross-border payments front, multiple partnerships between countries, such as Project Dunbar among South Africa, Singapore, Malaysia, and Australia, are piloting cross-border payments using CBDCs.

A CBDC could take multiple forms: a retail CBDC would be issued to the public to enable fast and secure payment, while a wholesale CBDC would only be accessible by banks and would facilitate large-scale transfers.

The key components of the United States’ current payment systems are described below.6See the appendix of this report for a detailed analysis of US payment system providers’ current cybersecurity measures.

- Fedwire is the Fed’s domestic and international funds transfer system that handles both messaging and settlement.

- Clearing House Inter-Payments System (CHIPS), privately operated and run by its member banks, handles dollar-denominated domestic and international funds transfers.7“CHIPS,” Clearing House, accessed January 14, 2022, https://www.theclearinghouse.org/payment-systems/chips.

- The Society for Worldwide Interbank Telecommunications (SWIFT), operated as a consortium by member financial institutions, is a global messaging system that interfaces with Fedwire and CHIPS for the actual settlement of payments.8Financial Crimes Enforcement Network, Feasibility of a Cross-Border Electronic Funds Transfer Reporting System under the Bank Secrecy Act, US Department of the Treasury, October 2006, https://www.fincen.gov/sites/default/files/shared/CBFTFS_Complete.pdf.

- FedNow will complement the Fed’s Fedwire with instant, around-the-clock settlement and service. A full rollout is planned over the next two years.

- The Automated Clearing House (ACH) is a network operated by the National Automated Clearing House Association (Nacha) that aggregates US transactions for processing and enables bank-to-bank money transfers.

While CBDCs will likely play a role in all three levels of the payment system, this background chapter as well as the report’s appendix predominantly examine risks to payment systems in which central banks are involved. That currently means the wholesale system. The Fed’s approach to securing wholesale payments sheds light on its current cybersecurity practices and how it might handle a CBDC. We also briefly examine the retail payment system to understand cyber risks that a retail CBDC could impact.

A targeted attack on wholesale payment infrastructures, such as Fedwire, could cause major global financial shocks, including severe liquidity shortfalls, commercial bank defaults, and system-wide outages that would affect most daily transactions and financial stability. There would also be secondary effects, including severe market volatility. To prevent cyberattacks and reduce the impact of successful hacks, the Fed’s current measures include regular contingency testing for high-volume and high-value Fedwire participants; redundancy requirements, such as backup data centers and out-of-region staff; and transaction value limits. Other risks for the wholesale payments infrastructure include attacks on the SWIFT messaging system. After recent attacks revealed significant vulnerabilities, SWIFT and its member banks have taken several steps to shore up their defenses, focusing on stronger security standards and quicker response times.

Key cybersecurity risks for retail payment systems include credit and debit fraud, which collectively caused nearly $25 billion in damages in 2018 worldwide; fraud by system insiders affecting platforms like ACH in the United States; and user error, such as falling prey to phishing scams.9“Credit Card Fraud Statistics,” SHIFT Credit Card Processing, last updated September 2021, https://shiftprocessing.com/credit-card-fraud-statistics/ Risk management strategies for retail payments often rely on voluntary industry standards, such as the PCI DSS. To counter phishing and other types of user error, ACH and other platforms require unique user credentials and offer merchants additional steps like micro validation, tokenization and encryption, and secure vault payments.

Information security is generally assessed along three core principles known as the CIA triad: confidentiality, integrity, and availability.10“The Three Essentials Pillars of Cybersecurity: Preventing Losses from Cyber Attack,” Lexology, https://www.lexology.com/library/detail.aspx?g=03734e1f-98d0-47ef-908f-f29ad6f69a7b. Confidentiality requires that data are only accessible to those who are authorized.11Debbie Walkowski, “What Is the CIA Triad?” F5 Labs, July 9, 2019, https://www.f5.com/labs/articles/education/what-is-the-cia-triad. For payments, this means that data about participants and their transactions are kept private. Countermeasures to ensure confidentiality focus on areas like authentication, encryption, and educating users.12Ibid. Integrity means that data are “correct, authentic, and reliable” and can thus be trusted to not have been tampered with.13Ibid. This is accomplished via hashing and controlling access.14Ibid. In payments, integrity is linked to the need for non-repudiation: the payor cannot deny sending the payment, and the payee cannot pretend to have not received it.15Ibid. Finally, availability means that the system is up and running, allowing users to have timely and reliable access.16Ibid. In payments, this could be hampered by an attack on a specific institution or by the failure of supporting infrastructure like data centers. Securing availability can be done by hardening systems against attacks and building in redundancy.17Ibid.

Looking ahead to CBDCs

Chapter 1 assesses the cybersecurity risks facing CBDCs and how design choices will shape vulnerabilities using a framework derived from the CIA triad but customized to the challenges of CBDCs. Understanding how CBDCs will fit into the existing landscape is crucial for turning this insight into actionable steps for policy makers, which we explore in Chapter 2.

Chapter 1: Cybersecurity of CBDCs—Threats and design options

This chapter discusses the cybersecurity of CBDCs. A central theme, which pervades all aspects of this chapter, is how CBDCs may centralize data and control over the financial system. Although the current financial system is already relatively centralized (e.g., in the United States, more than 50 percent of banking assets in 2022 are controlled by just four banks)18“Large Commercial Banks,” Federal Reserve Statistical Release, accessed March 13, 2021, https://www.federalreserve.gov/releases/lbr/current/default.htm. CBDCs have the potential to significantly increase centralization by storing a single ledger or similar data repository that aggregates transaction data from all participants. The ledger could even include data from payment modalities that are currently difficult to monitor, such as cash. Such dramatic centralization of CBDCs could have downstream effects that are difficult to predict or manage. For example, a database containing an entire nation’s financial transactions would represent an unprecedented target for cybercriminals. It can also provide unscrupulous regimes with a mechanism for mass surveillance. Such threats can be mitigated in part through technical design choices, but every design comes with implications (and trade-offs) regarding security, privacy, performance, and usability, to name a few. This chapter discusses a landscape of possible design variants, while highlighting the relevant trade-offs.19Federal Reserve Bank of Boston, The Federal Reserve Bank of Boston and Massachusetts Institute of Technology release technological research on a central bank digital currency, press release, February 3, 2022, https://www.bostonfed.org/news-and-events/press releases/2022/frbb-and-mit-open-cbdcphase-one.aspx#resources-tab.

We start our discussion by introducing the different roles that would be involved in a typical CBDC deployment, their primary tasks, and trust assumptions. After that, we introduce a threat model for CBDCs by discussing the main security requirements and involved threat actors. Then, we review common digital currency variants and analyze them with respect to the established threat model. We complete our analysis with a comparison that shows the main advantages and drawbacks of different currency designs. Finally, through case studies, we show how a few noteworthy CBDC pilot projects fit into our classification. The key contributions of this chapter are as follows.

Key contributions of this chapter

Systemize knowledge: We define a framework for systematically analyzing and comparing digital currency designs. We show the main pros and cons of common digital currency variants and explain how noteworthy existing CBDC pilot projects fit into our classification. We also identify potential cybersecurity risks involved in each currency variant.

Highlight recent research advances: As part of our review, we also highlight recent developments from the research community and possible digital currency design alternatives that are not yet typically considered in most CBDC reports. Such designs can enable improved user privacy or transaction validation scalability, for example.

Clarify common misconceptions: Throughout our discussion, we also point out common misconceptions, recurring harmful practices, or otherwise bad patterns related to the design and deployment of digital currencies.

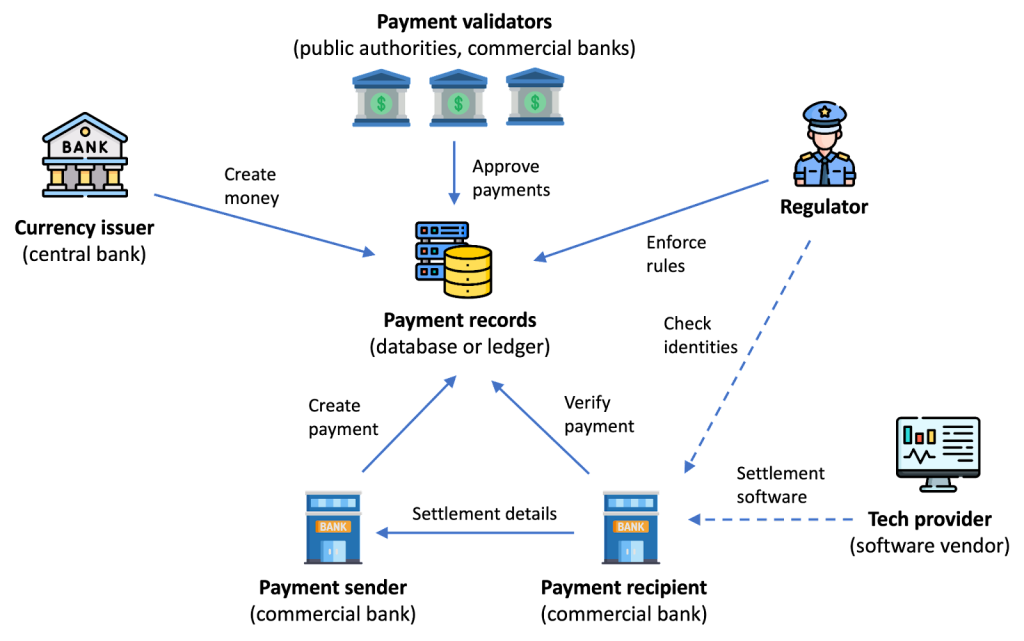

Roles and trust assumptions

Currency issuer. Every CBDC system needs an entity that creates money. We call this role currency issuer. In most envisioned CBDC deployments, this role would be played by a central bank. In a private digital currency, this role could also be played by a private company. The currency issuer should be trusted by all system participants for the correctness of money creation. That is, the money created by the issuer is considered valid by everyone involved in the system. This entity does not necessarily need to be trusted for all other aspects of the system, such as user privacy or payment validation.

Payment validator. CBDC systems require entities that keep the system running and provide the needed infrastructure for other participants. One such infrastructure role is the payment validator that approves payments and records them into data storage, such as a database or ledger. The role of the payment validator could be distributed among several nodes for increased security and performance, as will be discussed later in this chapter. The role of the payment validator could be taken by the central bank, or alternatively, it could be delegated to another public authority or to commercial banks. The payment validator needs to be trusted to verify the correctness of payments, but not necessarily for other properties, such as money creation or user privacy.

Account provider. Another infrastructure role in a typical retail CBDC system is an account provider that allows users to register, obtain payment credentials (e.g., in the form of a digital wallet), and start making CBDC payments. In most retail CBDC deployments, the account issuer would need to verify the identity of the user before account creation. Most likely, central banks would not want to interface with users directly and, therefore, this role would be better served by commercial banks that already have existing customer relationships. The account provider, such as a commercial bank, would need to be trusted for the verification of users’ identities. In a custodial solution, the account provider could be also trusted with the management of users’ payment credentials and it could control users’ monetary assets. In a non-custodial solution, the account provider would not control any monetary assets on behalf of the users. The role of account provider may not be needed in a wholesale CBDC deployment where the end users are financial institutions like commercial banks.

Payment sender and recipient. We consider two types of end users: payment senders and payment recipients. In a retail CBDC system, such users could be private individuals, commercial companies, or other legal entities. Such users would typically perform payments through a client device such as a smartphone that holds the payment credentials obtained from the account provider. For specific use cases like visiting tourists other solutions are likely to be needed for obtaining payment credentials. In a wholesale CBDC, the payment sender and recipient could be commercial banks performing an inter-bank settlement. Payment senders and recipients are generally not trusted by other system participants. Instead, it is assumed that users may behave arbitrarily or even fully maliciously.

Regulator. Another role that we consider is the regulator. The task of the regulator is to ensure that all payments in the system conform to requirements such as anti-money laundering rules. For example, in the United States, the recipients of a cash payment worth more than $10,000 are required to report the payment details to the Internal Revenue Service (IRS). In a CBDC deployment, all payments that exceed a similar threshold amount could be automatically forwarded to the regulator for audit. While the regulator is trusted to examine specific payments and report non-conforming payments, in a well-designed CBDC system, all details of all payments do not necessarily need to be visible to the regulator. For example, receiving $50 fully anonymously (i.e., such that even the regulator cannot see the payment details of the transaction) should be possible. We discuss the challenges involved in realizing such privacy-preserving regulation later in this chapter.

Technology provider. In a retail CBDC, the needed payment application could be provided by a technology company. For example, in the digital yuan pilot in China, the CBDC payment functionality is integrated into popular smartphone payment applications, such as Alipay from Ant Group and WeChat Pay from Tencent. In addition to providing the payment application, in a custodial deployment, the technology provider may assist the user in payment credential management. The end users (i.e., payment senders and recipients) need to trust the technology provider for the correctness of the payment application and potentially also for the management of payment credentials. In a wholesale CBDC, the payment senders and receivers (commercial banks) could obtain the needed (settlement) technology from an external software vendor.

Figures 1a and 1b below illustrate the typical relationships between these roles in retail and wholesale CBDC deployments, respectively.

Figure 1a. Main roles involved in a retail CBDC system

Figure 1b. Main roles involved in a wholesale CBDC system

Threat model

To understand the cybersecurity implications of CBDCs, it is important to first specify the threat model. In this section, we will highlight the security requirements and the threat actors that are relevant to CBDCs.

Requirements

CBDCs should satisfy a number of properties, both security and performance related. These requirements are intertwined: different design variants can have different implications for each of these requirements.

Integrity. The integrity of a financial system refers to its ability to ensure that money transfers and creation is correct. In other words, it should not be possible to create or delete money out of thin air. It should also not be possible to transfer funds that do not belong to the sender.

Authentication and authorization. Only the legitimate owner of money should be able to transfer said money. In current payment systems, this is typically achieved through a two-step process. Authentication refers to the process of verifying a user’s identity.20The initial process of linking a digital identifier to a user can be achieved through offline channels, for example. A detailed discussion of this topic is beyond

the scope of this report. Authorization refers to the process of verifying the transaction details, such as the recipient’s identity and the amount to be paid. In some CBDC design variants, these two processes can be intertwined, so we address them jointly in this report.

Confidentiality. Transactions should not be visible to unauthorized parties (e.g., telecommunications providers). Confidentiality is typically achieved via encryption of data in transport over untrusted channels. Such techniques are widely used in the banking industry today, and we do not expect them to vary significantly across different CBDC variants (though they may need to be updated due to emerging technologies, such as quantum computing). Because of this, we will not analyze confidentiality separately in the remainder of this document.

Privacy. Whereas confidentiality aims to protect data from unauthorized parties, privacy aims to protect user information (e.g., payment transaction details) from authorized parties, such as payment validators. While these two concepts are closely related, we treat them as separate. Deciding what level of privacy to provide is a political decision as well as a technical one, and has repercussions for the architecture and design of the CBDC.

Incorporating privacy protections into a CBDC design is important for two main reasons. The first reason is that the privacy of end users is valuable in itself. CBDCs will inevitably aggregate tremendous amounts of financial data, and consequently some national banks have indicated that their goal is not to build a tool of mass surveillance.21David Chaum, Christian Grothoff, and Thomas Moser, How to Issue a Central Bank Digital Currency, Swiss National Bank Working Papers, March 2021. https://www.snb.ch/n/mmr/reference/working_paper_2021_03/source/working_paper 2021_03.n.pdf. Additionally, the successful adoption of CBDC technology may require that the deployed system meets the privacy expectations of end users. In a recent survey on the digital euro, participants rated privacy as the most important feature of a possible CBDC deployment.22Eurosystem Report on the Public Consultation on a Digital Euro, European Central Bank, April 2021, https://www.ecb.europa.eu/pub/pdf/other/Eurosystem_report_on_the_public_consultation_on_a_digital_euro~539fa8cd8d.en.pdf. The second reason is that a system with strong privacy protections is also inherently more secure. If a system that collects huge amounts of sensitive user data does not include privacy protections and is breached, then all the sensitive information will be disclosed to the attacker and, potentially, to other unauthorized parties, which violates confidentiality. In a privacy-preserving design that hides sensitive user data even from trusted system insiders, a similar breach or insider attack will have significantly less severe consequences for security and confidentiality.

Takeaway: Privacy-conscious design can also provide security benefits

If a CBDC deployment without privacy protections is breached, either by an external attacker or a malicious insider, then all the sensitive user information is disclosed to unauthorized parties. In a privacy-preserving CBDC deployment that hides sensitive user data even from trusted system insiders, breaches will have less severe security consequences.

Resilience. The system should be robust to faults, or failures, of different components of the system. Typical faults include infrastructure failures (e.g., a server crashes), software-level failures (e.g., a program stops executing), and protocol-level failures (e.g., a validator node misbehaves). Faults can be either accidental (e.g., random infrastructure failures) or intentional (e.g., caused by misbehaving nodes).

An important aspect of resilience is availability. System availability is often specified in terms of uptime; a common goal is “five nines,” i.e., the system is operational 99.999 percent of the time. As a result, the system must be able to process payments even if some parties are offline, including back-end infrastructure, the payment sender, or the payment recipient.

Another relevant dimension of resilience is transaction revertability. Fraudulent transactions are very common in financial systems. Ideally, if a transaction can be shown to be fraudulent, authorized parties, such as payment validators, should be able to revert the transaction, i.e., add the paid amount back to the payment sender’s account balance and deduct the paid amount from the recipient’s balance.

Network performance and costs. The system must be highly performant to process nation-scale financial transactions. Common performance metrics include throughput (number of transactions that can be processed per second) and latency (time to transaction confirmation). For comparison, the Visa credit card network currently processes 1,700 transactions per second on average and is capable of processing up to 24,000 transactions per second.23“Visa Acceptance for Retailers,” Visa, accessed May 16, 2022, https://usa.visa.com/run-your-business/small-business-tools/retail.html. Meanwhile, typical transaction latencies for digital payments are in the order of seconds.

In exchange, CBDCs will inherently incur communication (or bandwidth) and computation costs. These costs are divided between the back-end infrastructure and end users. In general, a CBDC is expected to impose high costs on back-end infrastructure, both in terms of computation and communication. As such, we do not focus further on back-end resource costs in this report. However, certain potential designs (e.g., privacy-preserving ledgers) require access to the entire ledger, in encrypted form, to verify the validity of transactions. This imposes significant bandwidth requirements on end users, as well as substantial computational requirements. These costs must be weighed against the associated privacy benefits.

Governance. The maintenance of a CBDC may involve the participation of multiple parties, including application developers, hardware manufacturers, cloud service providers, and transaction validators. It is important to ensure that these parties have well-designed guidelines for managing operations and conflicts. In addition, all parties should be incentivized to behave correctly and reliably. For example, in the case of distributed transaction validation pipelines, validators should be incentivized to validate transactions promptly and correctly (e.g., in the order they were received), and there should be clear policies in place for managing unfulfilled commitments.

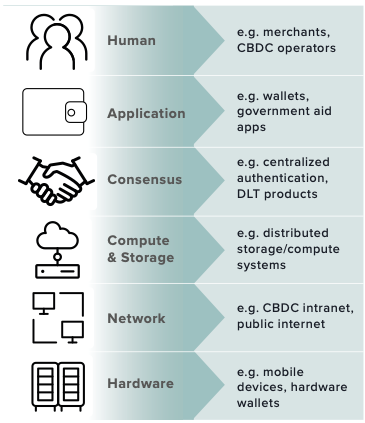

Layers of the technical stack

Attackers can exploit different components of a CBDC to achieve their goals. In this section, we outline the CBDC technical stack, illustrated to the right. In other words, these are the conceptual components that an attacker could target using different vulnerabilities and offensive capabilities. These layers are not exhaustive and attackers can launch cross-layer attacks.

Human. Although end users are not part of a technical CBDC implementation, they can be exploited to affect system security at large. Users can be both a vector for launching attacks as well as victims. Examples of relevant attacks include fraud and money laundering. Operators of the CBDC can also pose vulnerabilities, e.g., through phishing attacks to gain access to the CBDC’s control mechanisms.

Application. CBDCs are expected to usher in an ecosystem of new applications that can interface seamlessly with the digital payment system. Potential use cases include mobile applications for seamless disaster relief, more efficient tax processing, and everyday transaction processing.

Figure 2: CBDC technical stack

Many of these applications will likely be developed independent of underlying CBDC infrastructure, just as mobile application developers are typically independent of device issuers. This has several security implications. In particular, it may be difficult to control the security specifications and properties of applications. Developers can introduce vulnerabilities (consciously or not) that can be exploited to steal money or exfiltrate data. While application-level threats or failures may not be directly the fault of the CBDC, they can affect the viability of the CBDC as a whole, as seen in the early release of the eNaira in Nigeria, for example.24Alexander Onukwue, “Nigeria’s eNaira Digital Currency Had an Embarrassing First Week,” Quartz, October 28, 2021, https://qz.com/africa/2080949/nigeriasenaira-android-wallet-deleted-days-after-launch/. The application ecosystem is, therefore, an important layer in the CBDC stack from a security perspective.

Consensus. In order to provide redundancy against unforeseen factors like faulty devices, compromised infrastructure, and resource outages, many proposed CBDC designs involve the use of consensus protocols: decentralized processes for determining the validity of financial transactions among multiple payment validators, for example. Consensus protocols can be designed with varying degrees of robustness to adversaries of varying strengths. At a high level, they provide robustness through redundancy: transactions are approved only pending the approval of multiple parties, according to specific, carefully designed protocols. The participants in consensus protocols could be different stakeholders in the systems (e.g., different banks running validator nodes) or they could be different servers controlled by the central bank but running on different infrastructure (e.g., in different data centers). For example, the Swedish e-krona uses distributed ledger technology (DLT) for consensus in which different stakeholders like banks run their own payment validator nodes.25“E-kronapiloten – test av teknisk lösning för e-krona” [“The e-Krona Pilot – Test of Technical Solution for the e-Krona”], Sveriges Riksbank, last updated April 6, 2021, https://www.riksbank.se/sv/betalningar–kontanter/e-krona/teknisk-losning-for-e-kronapiloten/.

Attacks on the consensus protocol typically involve the corruption of one or more parties. Good protocols are designed to be robust up to some threshold number of corruptions. However, consensus protocols are notoriously subtle; to provide true robustness to malicious faults, they should be accompanied by mathematical security guarantees. Further, even when those security guarantees exist, they rely on assumptions about the adversary that may not hold in practice (e.g., many protocols assume the adversary can only corrupt up to one-third of all validator nodes).

Computation and storage. CBDCs require back-end infrastructure to maintain a secure and functional payment system. For example, they may require distributed computation nodes to parallelize transaction processing in the face of stringent performance requirements. To the extent possible, ledger storage may also be distributed to reduce the load on any single node. However, some security mechanisms are easier to parallelize than others. For example, ledger-based systems typically require the full ledger to ascertain transaction validity; hence splitting the ledger into shards can affect the system’s ability to correctly validate transactions.

Network. The validation of transactions, issuance, deletion of money, and all other events in a CBDC will be communicated to the relevant parties via an underlying network. This network will very likely rely at least in part on private infrastructure to communicate updates among payment validators and CBDC internal parties. Interactions between account providers and end users will likely occur on the public Internet. These networks can be used to launch attacks such as denial of service, censorship attacks, or even partitioning attacks that cause different parts of the network to have different views of the global state. This causes the network layer to interact with the consensus layer.

Hardware. CBDCs will ultimately run on hardware, including mobile devices, hardware wallets, and servers that maintain the state and functionality of the system. Hardware can become an attack vector through insecure firmware and/or vulnerabilities that are hard coded into the products (e.g., backdoors in a hardware wallet). Such vulnerabilities tend to be difficult to exploit by all but the most sophisticated adversaries.

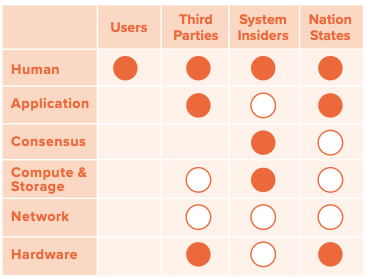

Threat actors

Security is defined with respect to a particular adversary. In a CBDC, there are several potentially adversarial actors of interest. We consider the following, in increasing order of strength.26Note that in security analysis, threat modeling typically considers an adversary’s means (what are their capabilities?) as well as their motives (what are they

trying to achieve?). We, therefore, discuss both.

Users. Users are typically limited in their ability to affect the internal mechanics of the CBDC. They are generally able to access and exploit applications only to the extent that they can manipulate other users. End users may be motivated to steal money from other users.

Third parties. Various types of third parties can threaten a CBDC, including scammers, application developers, or hardware manufacturers. Such adversaries are generally more powerful than typical end users, with more resources to attack the CBDC at layers ranging from hardware to application. For example, they may release malicious applications into the ecosystem, or manufacture backdoored hardware wallets. Their motives may range from stealing money to destabilizing the currency (e.g., particularly at the behest of a nation-state).

System insiders. Insiders refer to individuals (or groups of individuals) who have access to the internal operations of a CBDC, including infrastructure operators or CBDC developers; their capabilities range from modifying system-critical code to exfiltrating data to bringing down key infrastructure (e.g., unplugging servers). Such attackers are notoriously difficult to defend against. Their motivations can be political, financial, or even personal. Common goals of malicious insiders include stealing resources or simply bringing the system to a halt.

Foreign nation-states. Foreign nation-states are among the most powerful adversaries that a CBDC must defend against. Such adversaries may have effectively limitless resources to spend on offensive tactics, including the development of zero-day attacks as well as deployment of sophisticated attacks on applications, operating systems, and hardware. Additionally, they may coerce third-party producers of hardware or software to hard code backdoors into products, thus giving easier downstream access. Such attacks can affect payment validator nodes, end user wallets, and custodial wallets hosted by account providers, to name a few. Their motivations are typically assumed to be political in nature.

Attack matrix

Different threat actors have different capabilities for infiltrating a CBDC. Table 1 indicates which attackers have access to which portions of the CBDC stack. Here, solid circles indicate that there exists the potential for full corruption of at least some portion of a given layer, whereas half-filled circles indicate the potential for partial corruption. Notice that all of the adversaries have only partial access to the network layer because CBDCs will rely in part on the public Internet. As such, full corruption is believed to be infeasible even for foreign nation-states. On the other hand, hardware is most easily corrupted through supply chain attacks, which can be executed by third parties as well as nation-states.

Table 1: Which layers of the CBDC stack can different adversaries access or corrupt?

Note: Solid circles indicate (the potential for) full access, whereas half-filled circles indicate the potential for partial access.

CBDC design variants

In this section, we discuss major design choices related to cybersecurity for CBDC systems. The space of CBDC designs is vast, with each design presenting its own trade-offs.27James Lovejoy et al., “Project Hamilton Phase 1: A High Performance Payment Processing System Designed for Central Bank Digital Currencies,” Federal

Reserve Bank of Boston, February 3, 2022. https://www.bostonfed.org/-/media/Documents/Project-Hamilton/Project-Hamilton-Phase-1-Whitepaper.pdf. We present six digital currency variants that could form the basis of a CBDC system. This review does not attempt to cover all possible designs, but rather to give representative examples of different styles of digital currency schemes. For each design variant, we summarize the security, privacy, and performance trade-offs according to our requirements from the previous section. The design variants we discuss are reflected in Figure 3; orange boxes represent design variants, and blue boxes represent differentiating factors. Additionally, each design variant is annotated with one or more new cybersecurity challenge that arises in this CBDC design compared to the current financial system. These challenges are summarized below.

New cybersecurity challenges for CBDCs

The design variants discussed here pose various cybersecurity challenges that differ from challenges seen in the current digital financial system.

- Financial data can be more centralized. Some design variants rely on a single, centralized database of financial transactions that is visible to system operators. This presents a central point of failure and a unified target for potential attackers. Although such databases exist with digital payments today (e.g., credit cards), CBDCs present an even greater potential for data centralization, and hence increased cybersecurity risk.

- Regulatory agencies have less visibility into data. Some design variants prevent regulatory or law enforcement agencies from accessing transaction data, typically because said data is encrypted or stored only on local devices. This reduces regulators’ visibility into financial transaction flows compared to the current digital financial system and has implications for tracking illicit transactions, for example.

- Security hinges on the integrity of third-party validators. Some design variants use third-party validators (e.g., banks, telecommunications providers) to validate transactions. Transaction integrity is dependent on a (super-)majority of these validators not being compromised. This poses new challenges in terms of auditing and monitoring validators, as well as coordinating incident responses across validators, who may have different policies and procedures for dealing with breaches.

- Client key custody becomes more complicated. Some design variants require transactions to remain encrypted to provide client privacy. Custodial key management solutions, which are commonly used in the current financial system, would, therefore, compromise the promised privacy guarantees because the custodian could access client financial data. This requires client-side key management tools, which can present significant usability challenges. This problem has materialized in many cryptocurrencies and remains prevalent.

- Security relies on trusted hardware manufacturers. Some design variants use trusted hardware to enforce transaction integrity. This places an increased supply chain risk specifically with trusted hardware manufacturers compared to the current financial system.

- Transaction revocation is more difficult. Some design variants prevent an authority from unilaterally revoking fraudulent or contested transactions. This could be because client keys are stored locally, because there are multiple validators, or because data is encrypted so the central database is unable to ascertain the amount and endpoints of a contested transaction.

- Programmable transactions can amplify the scope and scale of errors. Applications built on CBDCs are expected to rely on programmable transactions, or smart contracts (these are explained in more detail at the end of this chapter in the section on Additional Key Design Choices). Incorrectly specified smart contracts could result in misdirected funds at a massive scale, especially if these smart contracts are deployed naively. When coupled with Risk 6 (difficulty revoking transactions), this could lead to substantial financial losses.

Figure 3. CBDC design variants discussed in this chapter

Note: Each variant is annotated with cybersecurity challenges that are new or elevated compared to the current financial system.

Takeaway: The design space for digital currencies is large

The discussion in many CBDC reports focuses on currency designs that are based on a centralized database, distributed ledger, or token model. We argue that the design space for digital currencies is larger than that. As will be discussed below, a digital currency can also be realized as signed balance updates or as a set of trusted hardware modules, and both the distributed ledger variant and the token model can support privacy-preserving transactions in addition to plaintext ones.

Database with account balances (status quo)

We start our review with a simple payment system that we call database with account balances. This design variant captures the payment approach used by the existing credit card payments, mobile payments, and bank account transfers. We assume that both the payment sender and the payment recipient have already established an account and obtained the needed payment credentials. We also assume a database (payment records in Figures 1a and 1b) that maintains an account balance for each user.

To initiate a payment, the sender first requests the payment details, such as account number, from the payment recipient. In the case of card payment, this would happen during interaction with the recipient’s payment terminal. In the case of a bank account transfer, the payment details could be obtained manually or by scanning a QR code. Then, the payment sender creates a payment request that defines the identity of the recipient and the payment amount, signs the payment request using their payment credentials, and sends it to the payment validators. The payment validators check from the database that the sender has sufficient funds associated with their account, and if that is the case, update the account balances of the sender and the recipient accordingly. This process may be distributed among multiple nodes for resilience and performance reasons, as in the recent Project Hamilton proposal.28Lovejoy et al. “Project Hamilton Phase 1: A High Performance.” Finally, the payment validators send a payment completion acknowledgment to the payment recipient.

In this approach, all payment details necessary for validation are visible to the payment validators. The payment database stores the latest account balance for each user and such account balances are not disclosed to the public (only validators know the balance of each user account).

Analysis

Integrity. The integrity of the database is entirely governed by the payment validator(s), who must (collectively) check that users do not overdraw their accounts. Assuming the currency issuer and payment validators perform these operations correctly, no money can be created out of thin air and no money will disappear from the system. To violate payment integrity, either an adversarial insider would need to manipulate the operations of the currency issuer or a sufficient number of payment validators’ nodes or an external adversary would need to compromise these entities through remote attacks.

Authentication and authorization. Users are authenticated upon logging into the system. Payments are authorized when an (authenticated) sender approves a transaction within a secure payment application. The easiest way for an adversary to break payment authorization is to compromise the initial authentication process, for example, through phishing attacks or malware. These threats can be mitigated through multi-factor authentication (MFA), including the use of hardware tokens.

Privacy. The database model inherently provides no privacy to users. In terms of privacy, this design variant is comparable to current credit card and smartphone payments where the payment processors learn all transaction details. Any party with access to the database (i.e., payment validators) can see all transaction details: sender, receiver, amount, and time. If privacy is desired, it must be accomplished through non-technical means, such as implementing strict access control policies that prevent internal operators from accessing this data without approval. Hence, the primary attacks on privacy will be at the human layer, by corrupting operators and processes.

Resilience. To process a payment, the sender only needs to submit the payment to the validator nodes. The receiver does not need to be online and can retrieve the funds the next time they access their wallet. However, to preserve availability, the validator infrastructure must be active at all times to confirm incoming transactions. Attacks on availability in this model are likely to target underlying infrastructure layers (e.g., network, storage, and/or compute). Transaction revocation is straightforward and can be executed unilaterally by the database operator (similar to credit card payments today).

Network performance. In terms of throughput, this design is very scalable and flexible. In particular, it can be implemented in a fully centralized fashion. This removes a major bottleneck to scaling throughput: communication bandwidth constraints. In this setting, we can feasibly achieve throughput comparable to existing financial services like banks or credit cards.

This model has potentially the lowest communication costs overall. If implemented as a centralized service, transactions do not need to be validated by multiple parties. This reduces back-end communication costs. End users do not need to store any data except their own; this minimizes user-facing communication costs. Note that a “centralized design” can still boost throughput through parallelization.29Federal Reserve Bank of Boston, The Federal Reserve Bank of Boston and Massachusetts Institute of Technology.

Governance. The governance requirements for this design are equivalent to those of the current financial system. In particular, as the system is centralized, there is no need to manage the threat of misbehaving validators. However, there is still a need for well-documented policies governing incidents at various layers of the stack, including insider attacks.

Takeaway: CBDC deployment might centralize user data collection

The main difference between a database with account balance CBDC and the current financial system is that the CBDC may result in a greater centralization of user data and financial infrastructure. This can have advantages, such as greater efficiency in implementing monetary policy. It can also have disadvantages, including the privacy threat of storing a single database containing users’ (or banks’) every transaction.

Case study: JAM-DEX (Jamaica)

In 2021, the Bank of Jamaica ran a pilot of a retail CBDC with vendor eCurrency Mint Inc. The Bank of Jamaica specifically chose to avoid blockchain technology for this pilot not because of technical misgivings, but in order to seamlessly interface with existing payment structures within the nation.30Natalie Haynes, “A Primer on BOJ’s Central Bank Digital Currency,” Bank of Jamaica, accessed March 31, 2022, https://boj.org.jm/aprimer-on-bojs-central-bank-digital-currency/. Over the course of the pilot, the bank issued CBDC to banks and financial institutions as well as small retailers and individuals. After continuing these trials in early 2022 to test interoperability and transactions between clients and wallet providers, the Bank of Jamaica announced a phased launch of the Jamaican Digital Exchange (JAM-DEX) in May 2022.31Bank of Jamaica, “Bank of Jamaica’s CBDC Pilot Project a Success,” Jamaica Information Service, December 31, 2021, https:// jis.gov.jm/bank-of-jamaicas-cbdc-pilot-project-a-success/.

Advantages

Centralized databases are a mature technology and can in many cases be more easily integrated with existing infrastructure.

Risks

A primary risk is related to privacy; this architecture exposes all users’ transactions in plaintext to the Bank of Jamaica. Even if the bank itself does not abuse this information, the transaction database poses an attractive target for hackers. The consequences of a data breach in a centralized setting may be very serious.

Distributed ledger with plaintext transactions

Another popular design variant that we consider captures the way payments work in the currently popular public blockchain systems like Bitcoin and Ethereum. We call this approach distributed ledger with plaintext transactions. As above, the payment process starts such that the sender obtains the payment address of the recipient. The payment sender prepares a transaction that includes the payment details (sender and recipient identities, payment amount) in plaintext, authorizes the payment by signing the transaction with their payment credentials, and sends it to the validators. The validators check that the sender has sufficient funds (such a check is trivial because all payment details are in plaintext in the transaction) and then append the payment transaction into a ledger that records all the transactions of the system.

In a public payment scheme like Bitcoin and Ethereum, the sender (or any other third party) can verify that the payment was approved by checking that it appears in the public ledger. For a CBDC deployment, most likely the ledger would be private and only accessible by authorized parties like the payment validators, currency issuer, and regulator. In such private ledger deployment, the payment recipient could verify the completion of the payment by querying the payment validators, instead of verifying the payment directly from the ledger.

Analysis

Integrity. The integrity of a ledger with plaintext transactions relies on two properties. First, regular transactions must not draw upon funds that have already been spent. This is verified by checking the transaction source against the set of all unspent transactions from the ledger. To bypass such a check, a sufficient number of validator nodes need to be manipulated or compromised. Second, the payer must be authorized to spend the transaction; the next paragraph explains how to verify this. In the case of minting new money, the first condition is not relevant, as the money is being created; authorization is still essential, though.

Authentication and authorization. This design variant can involve separate authentication and authorization processes, but they can also be merged. Payment authorization requires a cryptographic signature on the transaction. Hence, for each payment, validators must verify that the signature is valid (which is itself a form of authentication, as cryptographic keys are meant to be linked to a specific user) and authorized to spend the money in question. The easiest attack on authorization is for an adversary to steal a user’s private keys, for example via phishing attacks. More recent “ice phishing” attacks trick users into signing a transaction that delegates the right to spend a user’s tokens.32Microsoft 365 Defender Research Team, “‘Ice Phishing’ on the Blockchain,” Microsoft, February 16, 2022, https://www.microsoft.com/security/blog/2022/02/16/ice-phishing-on-the-blockchain/.

Privacy. Ledgers with plaintext transactions do not inherently provide privacy to the transaction sender or receiver. Payments will be visible to any party with access to the ledger, including (at least) account issuers. At best, the system can provide pseudonymity with respect to parties that have access to the ledger; in other words, users are represented by pseudonymous public keys, and privacy is maintained only as long as these keys cannot be linked to a real-world identity. However, pseudonymity guarantees are known to be easily broken.33Josyula R. Rao and Pankaj Rohatgi, “Can Pseudonymity Really Guarantee Privacy?” 9th USENIX Security Symposium Paper, 2000, https://www.usenix.org/events/sec2000/full_papers/rao/rao_html. Moreover, providing pseudonymity with respect to account issuers inherently complicates Anti-Money Laundering (AML) and Know Your Customer (KYC) efforts, and may, therefore, be less favored.34Bank of England, “Central Bank Digital Currency: Opportunities, Challenges and Design,” Discussion Paper, March 12, 2020, https://www.bankofengland.co.uk/paper/2020/central-bank-digital-currency-opportunities-challenges-and-design-discussion-paper.

Resilience. To process a payment, the sender only needs to submit the payment to the validator nodes. Notably, the receiver does not need to be online and can retrieve the funds the next time they access their wallet. However, to preserve availability, the validator infrastructure must be active at all times to confirm incoming transactions. In this design variant, transaction revocation can be more complex. For example, suppose a transaction sender requests that the transaction be revoked by appealing to their bank (which happens to be operating a validator node). However, the transaction receiver may argue to their bank (also a validator) that the transaction should stand. In this case, no bank has the authority to unilaterally revoke the transaction, absent legal or policy frameworks for handling such situations. Such challenges can be mitigated if a central authority (in this case, the central bank) is given the authority to revoke transactions and freeze assets. However, this requires the central bank to be directly involved in dispute resolution. Moreover, it changes the core threat model by involving a central trusted party in the validation process, thereby introducing a central point of failure.

Network performance. Ledger-based designs inherently require sequential processing that can limit throughput. In particular, validators must verify that each transaction is not drawing on previously spent funds. The only fully safe way to ensure this is by serially processing every transaction. Although there has been work in the research community showing how to achieve high throughput in such a setting,35Vivek Bagaria et al., Prism: Deconstructing the Blockchain to Approach Physical Limits, CCS ’19, November 11-15, 2019, London, United Kingdom, https://dl.acm.org/doi/pdf/10.1145/3319535.3363213; Haifeng Yu et al., “OHIE: Blockchain Scaling Made Simple,” 2020 IEEE Symposium on Security and Privacy, https://ieeexplore.ieee.org/iel7/9144328/9152199/09152798.pdf; and Ittai Abraham, Dahlia Malkhi, and Alexander Spiegelman, “Asymptotically Optimal Validated Asynchronous Byzantine Agreement,” proceedings of the 2019 ACM Symposium on Principles of Distributed Computing, July, 2019, 337–346, https://doi.org/10.1145/3293611.3331612. these systems tend to add implementation complexity. Alternatively, account issuers (e.g., banks) may be willing to parallelize the processing of smaller transactions to achieve higher throughput, at the risk of allowing double-spending. This risk can be managed through non-technical means, such as insurance.

Communication costs will depend in part on architectural decisions. In the lowest-trust setting, validators should download the entire ledger to verify correctness. Some designs involve a tiered system, where certain nodes store the full ledger history, whereas others store only the system state that is relevant to them (e.g., a single user’s set of unspent transactions); in these tiered systems, so-called light clients may store only information relevant to their own needs, and outsource transaction verification to third parties to avoid the storage and bandwidth costs of maintaining the full ledger. In a CBDC, users are likely to want this light client functionality to transact from lightweight devices like a mobile phone; in this case, account provider(s) may play the role of the trusted third party, much as in the current financial system.

Governance. This design introduces the need for independent validators. As such, it is important to establish policies that govern situations in which one or more validators misbehave (e.g., approving invalid transactions, changing the order of transactions, or not meeting promised availability or latency guarantees). These policies can be retroactive, punishing entities that misbehave. They can also be proactive, by establishing mechanisms that incentivize validators to correctly and promptly validate transactions. Common examples of such mechanisms include transaction fees, which reward validators for each transaction processed, and block fees, which reward validators for processing a batch of transactions. A third possibility is to allow validators to accrue interest from a reserve pool, which is invested independent of the currency; this was the approach suggested for Libra, now Diem, Meta’s proposed digital currency.36Zachary Amsden et al., The Libra Blockchain, MIT Sloan School of Management, revised July 23, 2019, https://mitsloan.mit.edu/shared/ods/documents?PublicationDocumentID=5859. Another important governance issue is related to the interface between central banks and independent validators, such as banks or other financial institutions. For example, in the event of policy changes internally to the CBDC, do validators have a say, or will changes be imposed unilaterally by the central bank? How much information should validators share with each other and with the central bank, and at what timescales? We touch on these questions in Chapter 2.

Case study: Digital Won (South Korea)

In 2021, the Bank of Korea announced plans to pilot a digital won. This pilot study, which started in late 2021, is an example of a distributed ledger with plaintext transactions. It is running on a Klaytn ledger,37“Consensus Mechanism,” Klaytn, accessed May 16, 2022, https://docs.klaytn.foundation/klaytn/design/consensus-mechanism. which uses a custom DLT consensus protocol that was initially proposed for the Ethereum blockchain.38ConsenSys, “Scaling Consensus for Enterprise: Explaining the IBFT Algorithm,” June 22, 2018, https://consensys.net/ blog/enterprise-blockchain/scaling-consensus-for-enterpriseexplaining-the-ibft-algorithm/. The validators in this blockchain are currently being run by various companies, including banks and payment providers. The technology is being provided by GroundX, which is the blockchain unit of Korean communications giant Kakao.

Advantages

The use of DLT technology can provide better integrity against certain adversaries. Specifically, decentralized validation protects against the threat of corrupt insiders arbitrarily modifying, rejecting, or creating transactions.

Risks

The DLT consensus protocol used by Klaytn, while derived from well-established consensus protocols, is relatively untested and has not been publicly peer reviewed (to the best of our knowledge). Indeed, early versions of this consensus protocol had design errors that affected the integrity and robustness of the system.39Roberto Saltini, “IBFT Liveness Analysis,” 2019 IEEE International Conference on Blockchain, 245–252, 10.1109/Blockchain.2019.00039 DLT consensus protocols are notoriously subtle to design, and care should be taken with new, untested protocols.