The role of oil and gas companies in the energy transition

Keep up with the latest from the Global Energy Center!

Sign up below for program highlights, event invites, and analysis on the most pressing energy issues.

This report was made possible thanks to the generous support of

oil and gas in 2022

Executive summary

As the third decade of 21st century begins, the oil and gas industry faces opposition from a public greatly concerned with the environmental impact of fossil fuels, ever-more skeptical shareholders, and challenges from policy makers seeking to simultaneously meet decarbonization goals and expected oil and gas demand. Amidst a global energy transition, the demand, financial, and social future of oil and gas companies is increasingly in question.

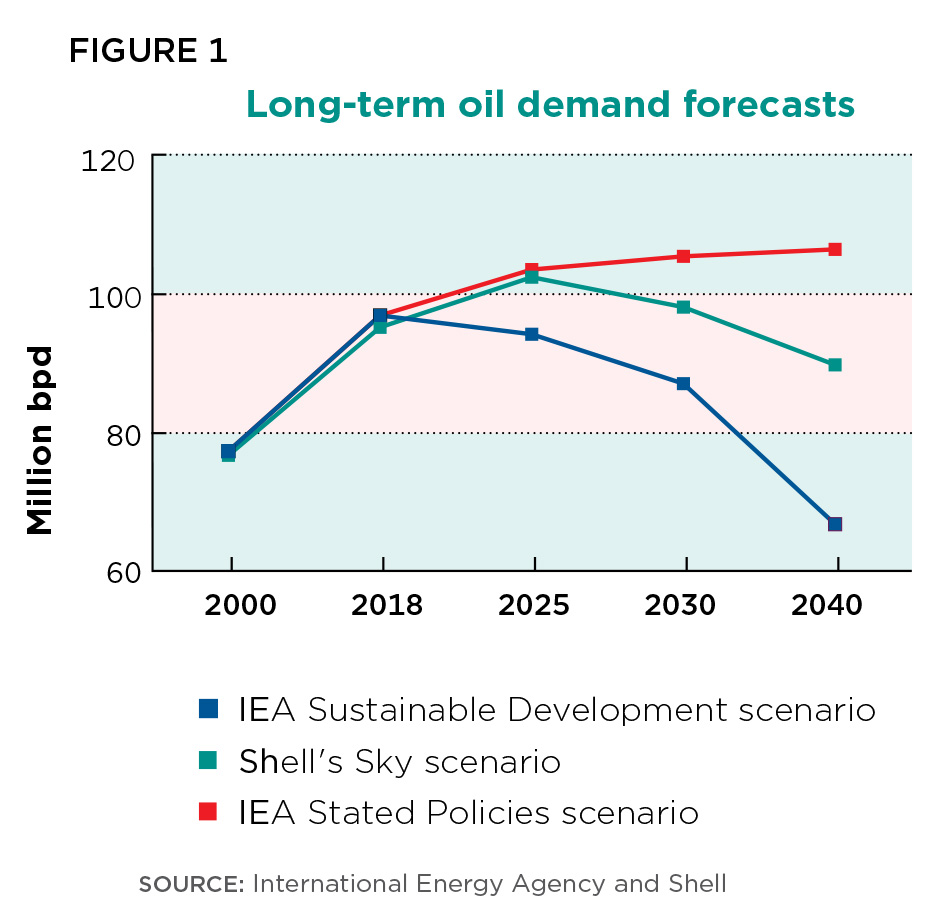

However, even with these obstacles, oil and gas remain an important part of the energy mix, especially in developing regions. The International Energy Agency’s Sustainable Development Scenario (SDS) and the Shell Sky Scenario—both aggressive decarbonization forecasts—show an ongoing, long-term role for oil and gas, even while demand levels are reduced from where they stand today. In the United States, India, and China—the three largest greenhouse gas emitters—natural gas in particular has the potential to remain an integral component of the low carbon energy transition for decades to come, depending on the policy mechanisms and technologies in place.

The challenge for the oil and gas industry is to both engage and adapt to a changing policy and investment landscape, but also to evolve in ways which don’t simply support but contribute and perhaps even lead efforts to decarbonize the energy system.

Around the world there is at least a gradual shift from policies that have supported oil and gas production to policies that instead are starting to disincentivize fossil fuels, including carbon pricing and the European Union’s Emission Trading Scheme. In addition to disincentives, many governments are encouraging the use of substitute technology and fuel, especially renewable energy. A third method of decreasing carbon use is the organization of circular economies, in which materials are reused or recycled instead of disposed of at the end of their service life.

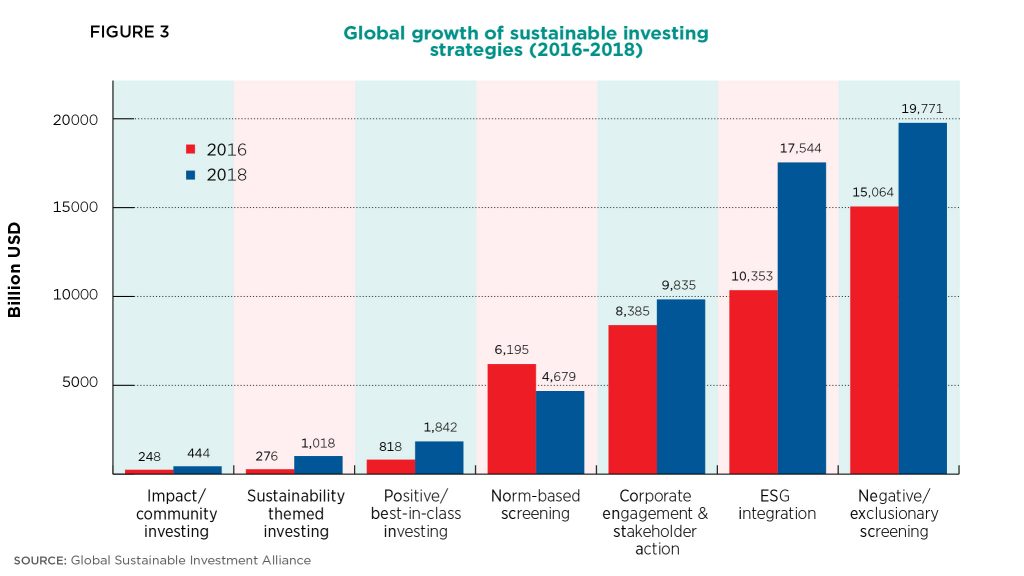

Investors are also becoming a strategic driver of decarbonization action, growing increasingly attuned to the demand horizon for hydrocarbons and shifting attention to the environmental impact of oil and gas production through Environment Social Governance (ESG)-focused investing. Stranded asset risk is a significant concern for shareholders as the future energy mix takes shape.

Oil and gas companies are responding by looking at where and how they do business and confronting a rethink of business models in a decarbonizing world. These companies have a range of tools when it comes to engaging with decarbonization efforts in ways which allow their participation in the decarbonizing economy. Where energy demand is growing rapidly, oil and gas companies can endeavor to support coal-to-gas switching and investing in infrastructure that enables electrification to meet end user demand and support lower GHG upstream operations. Companies can also focus on using renewables and new technologies not just as a hedge against demand risk or to decarbonize their production, but to leverage their expertise with supply chains and market development to support low carbon energy deployment in the energy transition on-the-whole. How oil and gas companies choose to engage with the low carbon energy transition may determine how they are viewed by shareholders, governments, and the general public.

In order for oil and gas companies to be successful in their efforts—not only to survive the low carbon energy transition—but also to support and lead it, this report recommends that they take the following steps:

- Build strategies for low carbon business models that minimize carbon use while remaining profitable, and articulate these strategies clearly to markets and other stakeholders.

- Support the development of ESG metrics that are transparent, objective, and accessible to investors.

- Invest in the promising concepts of net zero emissions and the circular economy while adhering to the nationally determined contributions model of the Paris Agreement.

- Encourage the growth of international carbon markets through Article 6 of the Paris Agreement, and expand the possibilities for joint cross-border projects for emissions reduction.

- Develop a workforce strategy that leverages the above into restoring oil and gas as an attractive destination for younger talent concerned about the ESG footprint and stranded asset risk of the industry.

Introduction

Climate change has taken on new urgency as extreme weather becomes more frequent and captures global headlines, increasingly dire reports are published in multiple sources, and international protests are beginning to seize the collective imagination. The world’s largest greenhouse gas (GHG) emitters—China, the United States, the European Union, Japan, Australia, and Canada—are “insufficient” in meeting their Paris Agreement commitments, according to Carbon Action Tracker.

In this context, a wide range of political and environmental leaders have become wary of the future role of oil and gas companies and are now advocating for the complete removal of fossil fuels from the energy system. The oil and gas industry is under increasing pressure from governments, investors, and the public to support the decarbonization of the energy system.

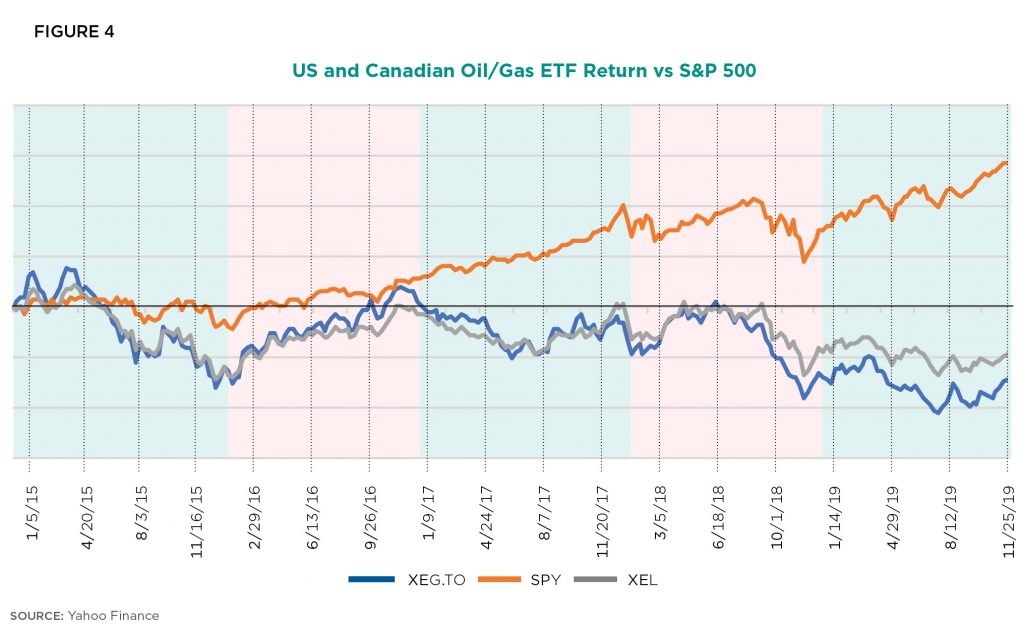

In turn, financial markets have soured on the sector, as investors have become uncertain about the future growth case for oil and gas; the energy sector of the US S&P 500 has fallen by 48 percent since 2015, easily making it the worst performing sector in the index during that period. While lower oil and gas prices since 2014 have proved to be the major headwind to sector performance, the sector outlook is also increasingly clouded by the prospect of policies seeking to decarbonize or lower emissions in the fuel and power sectors. Such policies have caused an increasing number of investors to contemplate the growing possibility of a ceiling for future hydrocarbon demand, absent viable emissions mitigation.

But such pressure does not necessarily imply that there is no future for oil and gas. Rather, continued expected growth in global energy demand—and its potential to outpace the deployment of alternative, non-fossil sources of energy—presents a dual challenge for oil and gas producing companies. Companies must manage a range of policy, investor, and societal pressures to move to a low-carbon energy system while still meeting expected global oil and gas demand over the long term.

To be clear, this report is not making an argument for the status quo. Entering the COP25 discussions in Madrid, Spain, the United Nations (UN) Environmental Program has documented that the world is not on track to hit the goal of holding the increase in global temperature above pre-industrial levels to 1.5 degrees Celsius by 2050, but it is in fact much more likely to reach 3.2 degrees Celsius. While the oil and gas industry has been viewed as a laggard on climate action, the world’s leading oil and gas companies have been rapidly mobilizing over the past several years to prepare for a lower carbon economy.

The energy transition raises existential questions for the oil and gas industry. How can hydrocarbons companies manage a shifting strategic landscape while providing returns to shareholders—and not only survive but also find a way to play a leading role in the decarbonization story? To navigate this challenge, the oil and gas sector is now responding in several ways:

- Diversifying business models to emphasize customer-facing downstream opportunities around electrification and energy services, particularly opportunities around coal-to-gas switching or lower GHG-intensity oil and gas as a complement to renewables.

- Supporting the growth of deep decarbonization technologies for oil and gas at the company and industry level, including carbon capture, utilization, and storage (CCUS); methane efficiency; zero-emissions production; and hydrogen.

- Reexamining geography and geopolitics to reduce exposure to potential “stranded assets,” particularly long cycle oil projects in high cost or high political risk jurisdictions, while identifying projects or partnerships in jurisdictions with more long-term oil and gas demand.

- Adopting climate-focused Environment Social Governance (ESG) principles into business models; organizing messaging to markets, governments, and the public about both the energy transition and the expected need for oil and gas for decades to come, as well as the value of oil and gas companies in building the next generation of clean energy resources and technologies.

There are multiple drivers of this mobilization, and they include pressure from the public, regulators, shareholders, and even employees. The oil and gas sector also sees the potential for substantial new business opportunities, from coal-to-gas fuel switching to advanced biofuels to offshore wind. It is up to the industry to do a better job explaining the future role for oil and gas and how it will adapt to a lower carbon economy. Beyond adaptation, stronger communication of the value oil and gas companies can bring to emerging technologies and business models in the energy transition, through application of expertise in supply chains, capital allocation, and technological deployment, can position companies as allies rather than adversaries. In doing so, companies can go beyond making the case for oil and gas to also explain their value in a time of rapid energy transition.

To explore these issues, this paper will do the following:

- Examine the policy trends and consumer expectations that are driving the low carbon energy transition, and determine which are beginning to manifest in major shifts in the allocation of investment capital and energy supply, demand, and transformation.

- Evaluate strategies being developed by the global oil and gas sector, particularly publicly-traded international oil companies, to manage the energy transition.

- Assess the role of policy as both a potential enabler and disruptor of the role of international oil and gas companies in the energy transition, in addition to geopolitical factors and “black swans” that might further shape the energy landscape.

- Outline a case study that delineates the challenges, hurdles, and opportunities that the oil and gas sector will face in managing the energy transition.

A note on terminology

This paper adopts the term “low carbon transition” rather than “energy transition,” “net zero emissions,” or even more specific language like “Paris Agreement-compliant.” We prefer “low carbon transition,” as it is a broader and more inclusive taxonomy that accurately captures the largest slice of empirical reality. On one hand, the term “energy transition” itself implies a shift away from fossil fuels, where as “low carbon transition” is intended to suggest a focus on the overall lowering of GHG emissions from the energy sector independent of fuel or technology. On the other, terms like “net zero emissions” or “Paris Agreement compliant” are too specific and exclude a wide range of industry and government actions that are moving in the direction of a low carbon transition, although not yet at a scale or intensity to reach net zero or the Paris Agreement’s 1.5 degree scenario. Still, we will argue that net zero and the Paris Agreement are key drivers of the transition, and that they have emerged as the targets by which international oil and gas companies will be measured.

Key Drivers of the Low Carbon Transition

Demand picture

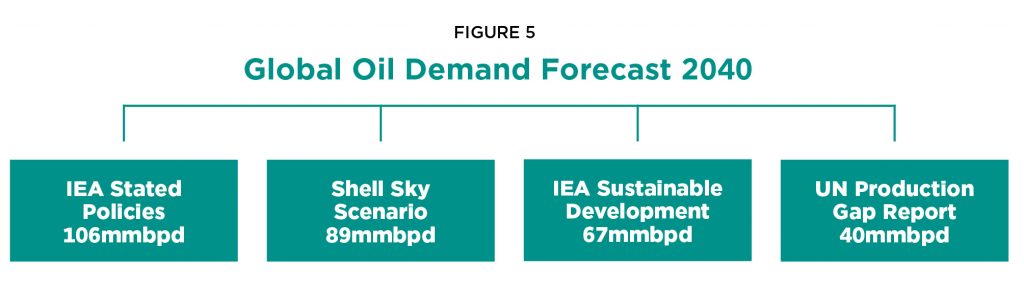

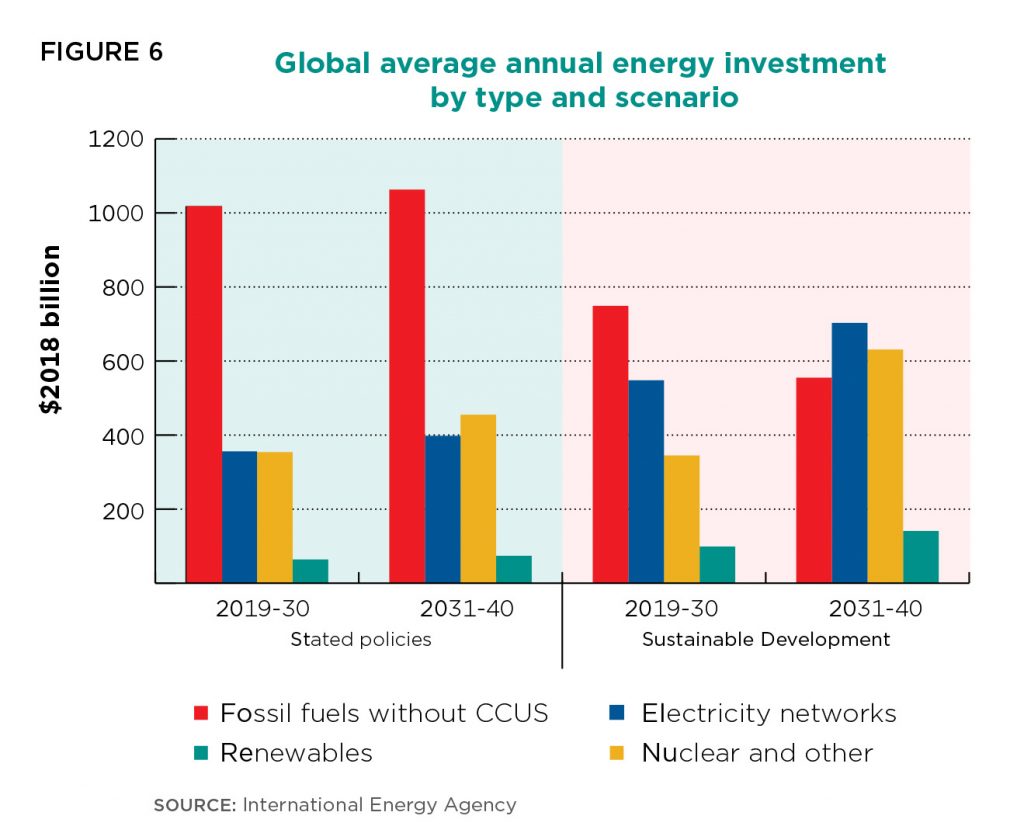

A central argument of this report is that oil and gas will remain part of the global energy mix during an extended period of low carbon transition. Many deep decarbonization pathways and scenarios articulate a total or near-total transition away from fossil fuels, both at the global level and in key energy consuming states. Our analysis of oil and gas’ ongoing role is based on two hypotheses. The first hypothesis is that even some of the most stringent decarbonization scenarios—such as the International Energy Agency (IEA) Sustainable Development Scenario and the Shell Sky Scenario—show an ongoing, long-term role for oil and gas, albeit at reduced levels from current demand or the business-as-usual case. The Sustainable Development Scenario (SDS) maintains global liquids demand at 66.7 million barrels per day (mm bpd) in 2040, or 30 percent below 2018 levels. The shift is buttressed by significant growth in electric vehicles, energy efficiency, biofuels, and hydrogen. Gas demand in the SDS is predicted to remain flat in 2040 from 2018 levels, at 3,854 billion cubic meters (bcm) per year versus 3,952 bcm per year. Shell’s Sky Scenario, built around the objective of economy-wide net zero emissions globally by 2070, predicts oil demand at 4 percent and natural gas demand at 8 percent below 2015 levels by 2050. Bloomberg New Energy Finance, which emphasizes the role of renewables in its scenarios, shows gas-fired power growing at 0.6 percent per year until 2050, as well as a reduction of 24.4 mbd of oil demand from the transportation sector—a future with significant use of hydrocarbons.

The likelihood of these scenarios materializing is primarily a question of politics rather than technology. Given that many of the targeted decarbonization technologies are technically feasible and, in many cases, commercially viable—although not necessarily at scale across all sectors—a key unknown is whether governments will mobilize to provide policy frameworks to enable an accelerated transformation of the economy on the scale envisioned by SDS or Sky, or whether the market will be the primary force behind decarbonization. Without those frameworks in place, the probability of such transformation occurring in reaction to the market alone is unlikely. To date, as the recently released UN Environment Programme data show, governments are showing little capacity to implement decarbonization policies that are consistent with the goals of the Paris Agreement. This is particularly true in the fast growing Asian regions. Even in the SDS scenario, gas demand in Asia is expected to jump from 815 bcm in 2018 to 1322 bcm by 2040.

It is possible or even probable that political dynamics surrounding climate policy will shift, and government policies will move more aggressively to decarbonize. Such actions would likely take oil and gas demand to levels projected by SDS and Sky, but not to a “no fossil fuels” scenario level. Jurisdictions including the United Kingdom, California, New Zealand, and—most recently—the entire European Union, have implemented net zero emissions policies for 2050. Yet these plans, while legislatively binding, have yet to demonstrate that the necessary regulatory follow-through at the industry- or consumer-level will be sustained over time. Meanwhile, such regulatory efforts may be diluted by voter backlash or industry lobbying in the course of implementation.

Furthermore, net zero emissions objectives and policies, such as those proposed in Europe and other Western nations, are comprehensive and direction-setting, but most countries committed to net zero emissions exclude some of the world’s largest emitters, such as the United States, India, and China.

Still, these large emitters have sector-level energy and environmental policies in place that are supporting the low carbon transition, and they are arguably more advanced and well-established than most other emitters in the developing world. Notably, in these three large markets, natural gas is a key element of supporting the low carbon transition.

China and India

China and, to a greater extent, India are building energy strategies that address both air quality and emissions concerns, as well as establish expectations for continued growth in energy demand. Just as the energy shocks and insecurity of the 1970s drove US energy policy, including the eventual development of unconventional oil and gas, China and India now face a similar top-down strategic imperative in managing the “trilemma”: supporting rapid demand growth, maintaining secure supply, and supporting sustainable air, water, and land management.

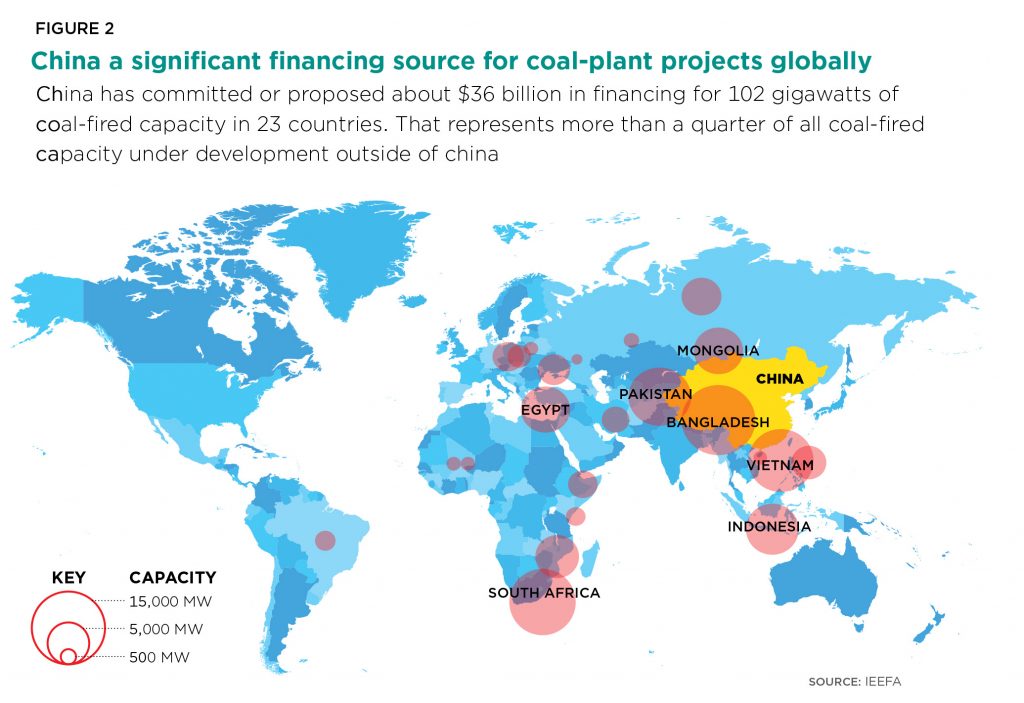

China has prioritized the use of natural gas as city gas to displace residential and commercial coal heating, which has been a large source of GHG emissions and pollutants like particulate matter, among other things. India has replaced China as the home of the highest number of cities with the world’s poorest air quality and also views gas imports as part of the solution for cleaner cooking and transportation fuels, as well as power generation to back up surging solar capacity. Bold electrification and decarbonization targets set by Beijing and Delhi have followed.

However, neither China nor India has the abundant low-cost natural gas resources to switch away from coal. China, producing only 19.4 bcf/d in 2018, has increased its natural gas imports by 30 percent since 2010, becoming a major destination for Qatar, Australia, the United States, and, most recently, Russia. India is even more supply-constrained on gas than China.

China and India have sufficiently high primary energy consumption demand growth such that the “all of the above” strategy is critical, shaping a low carbon transition that includes natural gas in addition to a broader portfolio of fuels and technologies.

As a result, even though China and India have announced and pursued policies which have been widely publicized as having the potential to reshape their demand pictures, the breadth of their energy mixes indicates that the question is not whether oil and gas will be part of the transition in China and India (and the rest of East and Southeast Asia where similar dynamics apply), but rather how large their role will be, especially in the case of natural gas.

The bottom line is that, despite the increasing penetration of renewable energy and the progress of the low carbon transition, without radical policy changes, oil and gas demand is projected to increase until 2035, and potentially beyond, as developing countries demand more energy, the demand for plastics surges (their relative share in the mix grows), and the profile of the fuel mix for aviation and other forms of heavy transportation changes toward specialized fuel grades. Oil and gas will be included in the energy mix for the foreseeable future, even if the nature of that picture—shaped by a range of market and geopolitical concerns—is decidedly different than it has been in the past.

The United States

For its part, the United States has undergone rapid changes in its stated emissions commitments from the Obama Administration to the Trump Administration. The Trump Administration’s decision to leave the Paris Agreement in April 2017 was largely seen by the international community as an abdication of US leadership on climate policy that was seen as a hallmark of former President Obama’s second term. The absence of the United States in the Agreement has been significant, not only because the United States remains one the largest carbon emitters in the world, but because the diplomatic capital brought to the table by the United States to build consensus has not yet been replaced. The continued challenges to implementation of the Agreement, particularly the politically-fraught negotiations on carbon-trading systems at COP 25 in late 2019, provide an example of how the leadership vacuum left by the United States is limiting progress towards global emissions targets.

Domestically, the Trump Administration has largely continued its re-think of the climate and emissions policies of the Obama presidency. The wind down of the Obama-era Clean Power Plan in favor of the 2019 Affordable Clean Energy Rule (ACE) represented a step-change in federal ambition to reduce power sector emissions by 32 percent by 2030 to only 1.5 percent, which, according to Resources for the Future, might increase the number of coal-fired power plants compared to no-policy. In 2018, the Trump Administration had sought to replace Corporate Average Fuel Economy (CAFE) standards and freeze the “overall industry fuel-economy average”; however, in November 2019, the administration was considering a plan, albeit one more modest than that proposed by the Obama Administration, to increase fuel efficiency by 1.5 percent per year. While the Trump Administration’s relative disinterest in decarbonization policy has spurred a host of state-level emissions commitments to decarbonization, the Administration—overall—has pursued a deregulatory agenda with much less ambitious climate targets.

Meanwhile, the continued growth of US natural gas production has had a direct effect on coal consumption, with natural gas representing 35 percent of utility-scale power generation in 2018. The same year, US gas consumption increased by 11 percent, adding 14.5 gigawatts (GW) of natural gas capacity compared to almost 13 GW of coal-fired plant retirements. This support has also facilitated continued growth in US natural gas exports, which the Trump Administration has argued will be necessary to reduce global emissions.

For oil and gas companies, the less-focused approach to climate and emissions policy by the administration has presented its own challenges and opportunities. US international oil companies (IOCs) do not face the same top-down pressure to rapidly decarbonize as their European colleagues, but nonetheless remain sensitive to ESG and, in particular, issues around social license.

As a result, US IOCs have arguably had more flexibility than their EU counterparts. The industry has been supportive of the Paris Agreement and in some cases aligned their own emissions goals accordingly. Due to the development of several frameworks for voluntary methane reductions by industry-led organizations such as ONE Future and the Oil and Gas Climate Initiative, as well as the successful opposition to a US Environmental Protection Agency (EPA)-proposed rollback of methane regulations, suggests that the industry is recognizing long-term policy trend towards more stringent emissions and decarbonization standards, even under a presidential administration with a deregulatory bend and an eye to unleash US energy exports. That said, smaller producers with less capacity for managing complex regulation have preferred the lighter touch of the Trump Administration.

This tension has at times been a complicating factor in industry’s response to the low-carbon transition. New battlegrounds are emerging in high-production jurisdictions such as the Permian, where producers and pipeline operators are caught between environmental concerns due to methane flaring and an infrastructure backlog. State-level regulators have thus far been highly tolerant of flaring permits, primarily out of fear of disincentivizing production, which has resulted in record levels of emissions and caught the attention of environmental groups. However, the first non-unanimous approval of a flaring permit by the Texas Railroad Commission in August 2019, and a recently filed lawsuit against the regulator for lax oversight of natural gas flaring, suggests that the industry is preparing to bear more of a burden to limit emissions, whether by operating under more stringent regulation or paying for more—and less emissions-prone—infrastructure.

Looking ahead, an uncertain policy picture in an election year has left the future of US decarbonization at a crossroads. The topical dominance of climate policy during the 2020 Democratic primary has led to an increasingly fervent series of decarbonization and net zero commitments by candidates in stark contrast to the policies of the Trump Administration. These range from a freeze on new LNG export terminals to the elimination of fracking on federal lands to “complete decarbonization” by 2050. Whether or not these policy proposals will shift during a general election is uncertain, as is the likelihood of their implementation following a Democratic electoral victory in November 2020.

However, the significant policy gap on energy and climate between the right and left in the United States presents its own questions, not only for the global demand picture but in particular US-based oil and gas companies, which—despite having taken self-regulatory steps in the past four years—may not be sufficient to meet the aggressive decarbonization policies proposed by a Democratic White House.

Policy picture

Policies linked to the low carbon transition will have significant impact on the oil and gas sector from three directions, even if demand continues to exist. The oil and gas sector has an existential interest in these policy frameworks.

The first direction is a shift from policies that have historically supported oil and gas production to instead begin disincentivizing those products. Disincentives are generally associated with carbon taxes, which have wide support as an effective way to reduce GHG emissions through the more efficient use of emissions-intensive resources. Yet few countries have implemented carbon taxes at a level sufficient to materially change consumer behavior on fossil fuels or eliminate the need for further subsidies for electric vehicles. Methane flaring restrictions or permitting regulation, either at a multinational level, such as the EU’s Emission Trading Scheme (ETS), or subnational regimes such as the permitting process by the Texas Railroad Commission, exemplify additional policy levers which could disincentivize or inhibit emissions-intensive resources.

The second direction is a suite of policies that are intended to encourage the use of substitute technology and fuel, particularly renewable energy. Moves toward Green New Deal-type policies aim for 100 percent renewables, and may even seek to punish the oil and gas sector through criminal and civil prosecution for alleged past misbehavior on climate change. Such policies center climate action around the elimination of fossil fuels and a “moonshot” type ramp-up of renewables. These programs would also deepen subsidies of emerging technologies like hydrogen and electric vehicles to support massive scaling. These would be paired with restrictions on oil/gas production (carbon capture and storage (CCS) mandates, fracking/offshore drilling bans) and on consumption (internal combustion engines bans, bans on natural gas heating in buildings).

A final policy concept for consideration in the context of the role of oil and gas companies in the low carbon transition is the circular economy. The circular economy is “an alternative to the traditional linear economy (i.e., make, use, and dispose) in which we keep resources in use for as long as possible, extract the maximum value from them while in use, then recover and regenerate products and materials at the end of each product service life.” Circular economy policy will have a particular impact on the downstream operations of oil and gas companies, through their refining, fuel logistics, and petrochemical businesses. As such, it is also a part of the Oil and Gas Climate Initiative (OGCI) agenda. Opportunities for circular economy to leverage oil and gas companies include initiatives such as feedstock recycling from plastics and tires and using waste to generate heat energy. Circular economy policy activity seems to be driven from the bottom up, in terms of actions from cities, universities, and companies, as much as by national or international action.

The low carbon transition plan that is most likely to favor oil and gas is built around the above-mentioned concept of net zero emissions. Yet this is not certain. Some versions of a net zero scenario include severely curtailed oil and gas production. Others, particularly in oil and gas producing states, would be intended to leverage the competencies of the oil and gas industry, extending its viability into a low carbon future. The North Sea region will provide an interesting test case, given that the UK and Norway have already committed through binding legislation to a net zero goal by 2050. Other petroleum jurisdictions like Canada are likely to follow. Central to these programs will be CCUS, hydrogen, and zero-emissions electrification of upstream production, among other technologies in which even major OPEC producers such as Saudi Arabia and the United Arab Emirates are investing heavily. That said, OPEC producers have not yet committed to firm net zero goals.

The net zero objective is the mirror image of the stranded asset perspective. It views petroleum resources as part of the solution to the GHG reduction challenge rather than an “unburnable” impediment. As such, environmentalists are divided on its merits and viability. One perspective is that the world does not have sufficient time or a sufficient “carbon budget” to accept a continued transition away from oil and gas, while others argue that the cost-benefit of net zero technologies such as hydrogen and CCS are not competitive with emerging gains in technologies such as solar and utility-scale batteries. The core argument held by many environmentalists against hydrogen and CCS is that they are too risky—meaning that continuing oil and gas production in the hopes that these and other future decarbonization technologies will emerge could lead to a climate disaster should the technologies fail to materialize, and the population is consuming business-as-usual levels of oil and gas. Fully transitioning from fossil fuels to renewables is seen as a more likely pathway to achieve the 1.5 degree scenario goals.

However, major company-level and industry-wide initiatives are focused on commercializing and scaling the net zero technologies, efforts frequently characterized as “decarbonizing” oil and gas. These include decarbonizing technologies mentioned above to target Scope I emissions (emissions produced directly by company activity); as well as potentially large offset programs to address Scope II (indirect emissions produced by company activity, such as electricity or transport); and Scope III (all other indirect emissions, even by those source which the company does not control, such as downstream users). The most notable of these is the Oil and Gas Climate Initiative (OGCI) led by thirteen of the largest international and national oil companies. OGCI supports both a venture capital and research and development (R&D) program for net zero technologies—notably both for Scope I direct emissions and Scope II indirect emissions—as well as supporting policy frameworks to enable net zero. Key technology priorities are zero flaring, CCUS, and energy efficiency. Notably, while the OGCI believes net zero emissions are possible in the second half of the century, it has not yet committed to any net zero timetable, although several of its members are clearly moving in that direction.

Investor pressure

The above policy pathways toward a low carbon transition are complex and varied, making it challenging for the oil and gas sector to align long-term investment plans in a credible and understandable way. At stake for the oil and gas companies is the stranded asset question: given the variance in the oil and gas demand growth picture, at what point do investments in certain project volumes, time-horizons, or geographies fail to recover upfront costs? Two recent examples include Chevron’s recording of $10 billion in impairment charges in its 2020 budget, and Repsol’s $5 billion impairment (notably on the same day it announced its net zero plan). According to Reuters, Repsol indicated that “basing asset values on prospects for oil and gas prices in line with the Paris Agreement would bring a post-tax impairment charge of 4.8 billion euros in 2019.” By contrast, Chevron made no reference to the Paris Agreement or net zero in its impairment announcement. Nonetheless, some external observers and media sources read the planned scale back in natural gas investments with indications of stranded assets in a more carbon-constrained world. The context for these impairment announcements is that both government and private sector actors are now producing voluminous research on whose oil and gas assets will be stranded in various climate mitigation scenarios. However, there is no clear consensus regarding which oil and gas reserves will be unprofitable in which scenarios, i.e., business-as-usual normal supply and demand imbalances (like the Chevron Marcellus example), Green New Deal-type scenarios, or net zero emissions and circular economy scenarios.

The stranded asset debate highlights the reality that governments are not the only ones making decisions shaping the role of oil and gas companies in the low carbon transition. Major international oil and gas companies have to generate returns for shareholders and, in addition, address decarbonization pressures from the policy community.

For many investors, the stranded asset debate in oil and gas is a question of risk management. The Paris Agreement/SDS scenarios indicate risk that certain oil and gas reserves will be uneconomic, or even that long-cycle assets coming on stream in recent years will become uneconomic. Other investors—focused on impact investment—hold that capital markets should play a role in ensuring the success of the Paris Agreement, with a recent poll showing that 86 percent of fund managers agree that companies should align their investment strategies with Paris climate goals. As such, these investors are both prioritizing investments in “Paris-compliant” companies and divesting from those that are not.

This suggests that what is frequently lumped together as ESG investing in fact includes a diverse range of strategies with differing implications for the role of oil and gas companies in the low carbon transition. According to data from the Global Sustainable Investment Alliance, “negative screening,” or oil and gas divestment-focused investment represents $19.7 trillion of global assets under management. Investors from both companies and countries are also considering divestment; Norway’s sovereign wealth fund, for example, recently decided to divest entirely from oil and gas stocks. This broad category include fossil fuels—mostly coal, but also oil sands, pure play exploration, and even liquefied natural gas (LNG), depending on the fund. However, not all ESG strategies exclude fossil fuels. So-called “ESG integration” funds, representing $17.5 trillion of global assets, do not automatically preclude certain sectors, but rather focus on criteria to measure which companies have the most favorable ESG metrics. These funds focus on the whole of a company’s ESG factors as a means to reduce risk, improve returns, and drive impact. For example, ESG integration can level-set the need to reduce liabilities associated with climate change alongside the need to capitalize on opportunities created by climate change and customer demand, neither of which precludes fossil fuels.

A key question going forward is how what are currently mostly voluntary and highly fragmented ESG guidelines around climate in particular will coalesce into more unitary, formal, and regulated standards, particularly as the policy environment catches up. Already, as of early 2020, the European Union is moving on regulations to formalize ESG standards. The two frameworks that are likely most influential for the oil and gas sector are the Task Force on Climate Disclosures (TCFD) and the Principles for Responsible Investing (PRI).

PRI is centered on a prescriptive vision of the future, with signatory institutional investors committed to driving an ESG agenda as part of their obligation “to act in the best long-term interests of their beneficiaries.” Part of this obligation is to prepare investors for what PRI calls the “inevitable policy response” from governments as the effects of climate change worsen. While explicitly aspirational and voluntary, PRI standards are difficult for any public oil and gas company to ignore given the sheer scale of the financial institutions that have signed up to support the goals of the organization.

The principle of disclosure is intended to allow investors to make more informed decisions about climate risks—not only stranded assets, but potential vulnerabilities to the physical effects of climate change, e.g., flooding, hurricanes, and droughts. Bank of England Governor Mark Carney has been very active on the issue of carbon disclosure, highlighting the need for G20 governments to provide better guidance and regulations to “help investors compare the carbon intensity of different assets” particularly given that there were (at the time) “nearly 400 initiatives” to provide information on the financial risks from climate change. The comment flagged the risk that ESG data on key metrics such as GHG intensity should be of the same quality as any other kind of financial disclosure—objective, data-driven, and auditable.

At present, it could be argued that ESG metrics are too frequently either defined by environmental organizations like Carbon Tracker or from industry directly. Credible third-party metrics, established by governments and audited by trusted independent experts, will be essential to ensure that the ESG performance of the oil and gas sector is accurately measured. Indeed, the research for this paper found that the investment community can be convinced of the value proposition for oil and gas, provided that transparency of the oil and gas companies in question allows the shareholder, investor, or fund to make its own risk assessment.

Social license to operate and reputation of oil and gas industry

An additional problem that oil and gas companies must address is poor public perception of the industry as the urgency to combat climate change grows in public discourse, and renewable energy sources are popularized as alternatives to traditional fossil fuels. The resulting demand for more stringent environmental stewardship and, at the extreme end of the spectrum, the complete removal of hydrocarbons from the energy system, represent a deterioration of the industry’s social license to operate.

Due to a combination of public distrust and inconsistency on behalf of the industry to frame a successful narrative around its value in a decarbonizing energy system, reclaiming this social license further complicates the pressures for oil and gas companies in the near-term.

Popular distrust of oil and gas companies has long been a challenge for the industry. The mixed public record of oil and gas companies on environmental stewardship and the problematic experiences with corruption and resource exploitation in the developing world has, at times, undermined the contributions of oil and gas to global economic growth. In the United States, recent controversies include protests against the Keystone XL pipeline, largely driven by climate concerns, as well as the Dakota Access Pipelines, driven in large part by concerns over the possible disruption of indigenous American lands. These protests echo public responses to environmental catastrophes such as the Exxon Valdez and BP Deepwater Horizon. Internationally, suspicion in countries such as Mozambique or Guyana as to whether the resources developed by major IOC’s will in fact improve the lives of locals is informed by popular perceptions—correct or otherwise—of nearby examples of oil and gas-related corruption in Equatorial Guinea and Nigeria, where revenues seem to fail to reach the communities in which the production occurs. Recent protests in Southern Iraq leading to the shutdown of the Nassiriya oil field provide another example of how popular discontent can be exacerbated by the perceived lack of shared benefits from oil and gas production. The industry’s resiliency to these reputational challenges will depend on whether it can create credible pathways to net zero emissions and effectively communicate them to a skeptical public that believes that the industry may be more of an opponent—rather than an ally—in the fight against climate change.

The industry’s inconsistent communication regarding the value oil and gas companies can provide in a decarbonizing energy system has only hamstrung its efforts to counter this public distrust. A 2019 Boston Consulting Group report framed this issue pointedly, arguing that “many oil and gas companies are highly skilled at building localized support for projects or specific issues. But they have not sufficiently developed compelling narratives about their role in the transition to new global energy systems.” An example of this inconsistency is the successful development of the Permian Strategic Partnership (PSP), a coalition of oil and gas operators dedicated to ensuring the responsible development of the Permian Basin through infrastructure, education, workforce development, and accessible housing for Permian families. Though the PSP’s members include major IOCs such as Chevron, BP, Exxon and Shell, these narratives are not communicated on a global level, as “energy outlooks” are deeply data-driven and fail to resonate beyond energy policy circles. As a result, companies like Shell remain exposed to protests and vandalism despite repositioning themselves to their shareholders as energy companies rather than as oil and gas companies.

Each of these factors reinforces the operational and policy challenges that will confront the oil and gas industry in the near future. Operationally, the risks of project delays due to protests, pressure from investors to apply more capital towards environmental stewardship, and a growing trend of legal challenges against major oil and gas companies for historical damages or defrauding investors on the basis of contributing to or denying the impact of climate change, will weigh against the balance sheets of those in the industry. From a policy perspective, the emergence of policy platforms featuring blanket bans against fracking, and criticism over campaign contributions from oil and gas companies, has grown in part due to public opposition to the role oil and gas companies have played in the energy system and public policy. Neither issue will be mitigated without broader efforts by oil and gas companies—and perhaps the industry as a whole—to improve the gap in public trust and build a broader value statement within a decarbonizing energy system.

Possible strategies and tools for consideration

The low carbon transition is both driving and in turn being driven by a combination of the demand-side, policy, financial market, and social pressures described above. The oil and gas industry is adapting to define its role in the transition, but as argued here, there are multiple pathways toward decarbonization and the speed and direction of each can vary widely. As such, each company is making its own strategic adjustments to the low carbon transition, adjustments that can also vary widely from company to company. Among the factors shaping the diversity of industry responses include obvious considerations such as geographic location of production, location in the oil and gas value chain, and asset mix between oil and gas. Less obvious but highly important factors that account for the variation of responses among oil and gas companies include considerations like activism within the shareholder base, access to long-term patient capital, quality of government policy on the low carbon transition in key markets, ability to deploy financial and human capital on R&D, and investor relations and communications.

Below we review a range of strategies being deployed by the oil and gas sector to adjust for the low carbon transition. The range is intended to be representative, rather than comprehensive. However, these five strategies suggest that there are a number of paths that the industry can take, each with its own drivers, risks, and upsides. Of each path, the communications component should not be underestimated. Because some of the strategic pivots described here are considerable, the ability not just to plan and execute a new strategy, but perhaps equally importantly the ability to explain the plan to markets (due to the untested nature of their ability to generate financial returns) as well as policymakers and the public (to ensure the strategy is engaged as a productive part of a broader low-carbon transition) is of the utmost importance. At times the industry has clearly not devoted enough attention to building public trust around its activities, leaving it vulnerable to counter-messaging from environmental groups on issues like pipeline safety or fracking and groundwater contamination, or the ongoing tar sands versus oil sands branding debate.

Coal-to-gas fuel-switching and supporting electrification

There are strategies available to gas producers that can insulate against environmental pressure risks that are not currently available, at least to the same degree, to oil producers. As described above, a low-carbon transition offers a cloudy, but still-critical, role for natural gas until 2050 to both complement renewables and meet rising energy demand—particularly as a cleaner substitute for coal power generation.

In the power sector, the ability of oil and gas companies to connect the low carbon integrated opportunities along the gas and electricity value chain will be a key competitive advantage. Investment in downstream gas infrastructure (LNG terminals, etc.) can support end-use fuel switching to gas and potentially sustain natural gas demand in the future. Additional support for a hydrogen economy or electric vehicle charging infrastructure are other opportunities for producers to leverage the unique complex project management skills and strong balance sheets that the sector is known for, but also serve the potential for gas to enable renewables and provide firming capacity.

More broadly, the shift away from traditional fuels in support of a demand picture that is electrifying while also decarbonizing can provide a hedge against the variance in demand picture, particularly if presented as an alternative to coal-powered electrification in key demand-growth centers such as Asia. The potential for gas to serve as a low-carbon natural gas baseload, or intermittency solution to renewables, is significant. Of particular interest are emerging integrated gas-renewables projects that specifically are geared to efficiently operate gas generation as a back up to wind or solar. These projects are highly effective in the United States thanks to abundant land for wind and cheap natural gas. In emerging Asia, the prospect of using natural gas as firming capacity for solar in markets such as India and southeast Asia will be closely tied to the ability to lower gas prices through increased volumes of LNG with more flexible pricing structures. However, in the current World Energy Outlook, the IEA finds that the bulk of flexible resources needed to balance the growing amount of wind and solar energy will mostly come from coal, hydro, batteries, and demand response—rather than natural gas—in the high growth markets of China and India.

A key enabling factor for natural gas may be whether gas exporters can earn emissions credits when their product is used to displace coal in the power generation mix—an initiative being considered under Article 6 of the Paris Agreement. If gas can be combined with CCS/CCUS to further lower the carbon footprint, or if upstream electrification can be used to further decarbonize gas production, there are additional opportunities to decouple gas from oil and gas branding as a fossil fuel and convert environmental pressures into assets, positioning gas as a tool in the low carbon transition rather than a roadblock.” At the same time, the recent COP 25 talks in Madrid failed to finalize rules for Article 6, and there are widely divergent views among countries on what offsets should be included, mechanisms for verification, and how the value of offsets should be calculated and shared.

Decarbonization of oil and gas

Developing decarbonized oil and gas is another key strategy that the industry is deploying in response to the low carbon transition. There are opportunities to reduce the carbon and climate impacts of oil and gas production, both through efficiency improvements and new technologies. Most of the focus here is on Scope I emissions, i.e., direct emissions from upstream oil and gas production. However, programs like hydrogen would extend decarbonization further in Scope II and Scope III, customer and indirect emissions. These programs would include:

- Methane Emissions Efficiency: methane emissions efficiency can be economical for natural gas producers, with the majority of methane emissions actually profitable or cost-neutral to abate. This is particularly important in major unconventional production areas in the Permian basin, where nearly five million barrels of oil per day are produced, but accurate methane emissions are poorly understood and have reportedly tripled in the past two years. The potential policy implications of this problem are considerable, as the lack of an industry-acceptable approach to methane emissions has placed significant stress on infrastructure regulators and placed production in the Permian at the center of the energy policy debates in the Democratic primary.

- Zero-Emissions Production: critical for meeting Scope I goals through zero-emissions electrification of upstream are oil and gas production or LNG production. Examples include the proposed use of hydroelectric power for shale gas production and liquefaction in British Columbia, and the “power from shore” offshore production on the Norwegian Shelf in the Johan Sverdrup field.

- Carbon Capture Technology: CCS and CCUS offer another avenue for decarbonizing hydrocarbon production through capture at the wellhead and hydrocarbon use with capture at the point of generation, whether in power generation, refining, petrochemicals, or industrial use. Key CCS projects include the Canadian oil sands and LNG projects in Norway and Australia, where the availability of geological storage for captured CO2 and appropriate public policy incentives and regulatory frameworks are critical enablers.

- Hydrogen: hydrogen is one of the most promising pathways for decarbonizing petroleum. Options include “blue hydrogen,” combining naphtha or natural gas steam reforming and CCS, or “green hydrogen,” leveraging “electricity to liquids” electrolysis from solar or hydro-electric power. Either process results in a zero-emissions liquid fuel with greater energy density and, as such, is better able to power heavy transportation than batteries. Repsol is specifically targeting hydrogen as foundational to managing Scope III emissions within its net zero 2050 goals, and a number of IOCs and NOCs are increasing spending on hydrogen as well. The 2019 Osaka G20 included the first Hydrogen Ministerial, demonstrating the growing focus on the technology’s potential as a clean and sustainable liquid fuel.

Taken together or adopted individually, this suite of technologies can improve the resiliency of oil and gas in a decarbonizing policy environment, particularly as scalability and cost-efficiency allow deep decarbonization to deploy at a greater rate—two areas again where the balance sheets and business experience of major oil and gas companies can be leveraged. Furthermore, these tools also position companies as good faith actors in the broader conversation about combating climate change, notably before the policy environment forces their implementation or limits their necessity through broader restrictions. Arguably, the Repsol announcement on net zero is the clearest indication of this trend. However, the company’s strategy of being an early mover and pre-empting regulatory requirements is not without risk. For Repsol, the imminent announcement of the European Union Green New Deal likely influenced the timing of the company’s announcement. For US IOCs, as there is little sign of regulatory action on net zero—at least on the federal level—it is more difficult to justify allocating capital toward investments tied to those goals at the expense of traditional earnings-generating activities.

Geographic hedges to stranded asset risk

Another specialization route involves the industry tailoring toward a demand center and locking in demand by investing in infrastructure. Some of the most notable steps in this area have been taken by national oil companies, particularly in Russia and the Middle East, which have made structural investments in the high oil and gas demand growth regions of southeast Asia and India. National oil companies exhibit geopolitical influence, which is another key for success in the low carbon transition. The element of “state to state” political support has been critical in major transactions such as the Rosneft-Essar Oil transaction in India, or the Saudi Aramco-Petronas RAPID refinery-petrochemical partnership in Malaysia. The history of the oil and gas markets shows that state to state geopolitical partnerships are critical to de-risking fixed asset investments in riskier emerging markets. In this way, the Russian and Middle Eastern downstream partnerships across South and Southeast Asia may eventually echo the past US and UK geopolitical relationships in support of the Seven Sisters’ upstream growth globally throughout the twentieth century.

There are also several areas where geographic specialization is also evident among international oil companies as a response to the low carbon transition, such as the strategic focus of US IOCs on North American shale, particularly the Permian Basin. The short-cycle nature of the shale opportunity means that the North American IOCs have less exposure to uncertainties around “peak demand” for oil and the more rapid decarbonization scenarios. Shale is a more flexible resource with a shorter payout period, making it ideal for a period of transition and uncertainty on the demand side.

A second geographic response by IOCs has been in Asia. Oil investments by the US IOCs in particular are increasingly concentrated in the US shale, but their natural gas strategy is Asia-facing. This includes both LNG opportunities and petrochemicals. The gas opportunity in Asia is in part driven by moving North American shale gas offshore as exports, but also by new business models targeting a global gas trading and risk management “portfolio.” The ability of the super-majors to offer flexible and targeted gas pricing and sourcing to buyers in Asia is a key source of competitive advantage in the low carbon transition. Over time, these strategies will likely encompass additional “integrated low carbon power solutions”—providing LNG that can support both gas-fired generation and firming capacity for renewables.

These more geographically-oriented strategies might allow companies to place a hedge against a shifting demand picture towards more stable or secure sources of demand over the long-term. Doing so positions oil and gas companies in locations of significant energy demand growth where for policy, accessibility, or availability reasons might otherwise limit the opportunities for renewables. Moreover, it allows the industry to participate in the energy addition part of growing global energy demand and the low-carbon transition, if organized as an alternative to coal, or a complement to renewables, or augmented by deep decarbonization technologies such as CCS.

Renewable energy investment and diversification

Companies can identify ways to diversify their portfolio through investments outside of technologies designed to decarbonize oil and gas or make its production more efficient. This includes venture capital type investments, currently being pursued by companies such as Saudi Aramco and Chevron Technology Ventures, which can participate in new tech startups focusing on micro-grid, electric vehicles, batteries, and a range of technologies going beyond oil and gas.

Offshore wind, for example, could easily blend with the deepwater and offshore expertise of oil and gas companies, making it a compelling diversification opportunity for industry leaders like Equinor, Shell, and BP. Key opportunities are emerging in the North Sea and offshore the US East Coast that directly leverage offshore operating experience, mega-project management, and downstream/offtake partnership capabilities of such longtime operators in the area. Offshore wind also offers the crucial element of scale, which will allow boards and investors to assess whether it will be a legitimate long-term money maker for the super-majors in a way eventually comparable to their oil and gas operations. Another crucial factor is that the barriers to entry in offshore wind are considerable due to operational, financial, and project management complexity, creating competitive advantages that few companies outside the traditional super-majors and international oil companies possess. This means the competitive landscape is less likely to be as saturated as solar power, for example, and the potential for attractive returns is likely greater.

Renewable energy investments by major IOCs have been a pillar of the conversation thus far on how the oil and gas industry can adapt and contribute to the low carbon transition. But as renewable technologies themselves continue to evolve, the question that IOCs may be better positioned to address is less about what renewable technologies in which they choose to invest, but how they choose to invest. The industry’s expertise with supply chains, scalability, and technological deployment is a greater currency than its capital in certain cases, such as Chevron Technology Ventures’ acquisition of Natron Energy in order to scale Natron’s data center and utility-scale battery design to EV fast-charging applications. Investments designed to apply those assets to scale proven technologies provide a more compelling narrative for the industry’s contributions as a strategic partner rather than as an angel investor in the low carbon transition.

Among the available renewable investment and diversification pathways available to oil and gas companies, complete transitions away from oil and gas and into fully integrated renewables remains another option. The former DONG energy’s transition from a Danish oil and gas producer to the full-stream offshore wind company, Orsted, provides one example of a full reorganization. The larger, global scale super-majors would find a total transition on this scale impossible unless measured over a matter of decades. Still, recent divestment programs and write-downs of higher cost oil and gas reserves suggest a broader transition to renewables and net zero emission fuels is possible over the long term.

Embedding climate-based ESG principles into business models, and improving messaging

ESG policies can be adopted as a response to environmental and societal pressure, and oil and gas companies have already begun to adopt these policies, both defining their relationship with environmental standards and ensuring transparency at each level of organization and production.

The policies can assuage investor concerns about the sustainability of a company, not least by transparently articulating an understanding of and approach to the other aforementioned pressures confronting oil and gas companies in the low carbon transition. They can also signal adaptability as the transition continues to take shape. Furthermore, as companies demonstrate commercially viable articulated plans for net zero emissions, they will become more likely to attract sustaining capital to scale the strategies and technologies that underpin what amounts to a significant shift in their legacy business models.

Because the industry is in the early stages of implementing ESG frameworks, particularly carbon disclosure aspects, companies can largely define their own standards and thus craft low-cost but demonstrative policies. Moving forward, how companies choose to manage the environmental, social, and governance aspects of ESG will undoubtedly change in response to signals from investors and the policy environment, but at present whether companies manage these variables as integrated parts of a broader strategy in the low carbon transition, or as individual buckets, remains to be seen. For example, the introduction of board committees focused on sustainability or more transparent auditing of carbon emissions are possible ways in which environmental and governance priorities might be creatively combined. Active engagement with local stakeholders in areas of high oil and gas production, such as the aforementioned Permian Strategic Partnership, provides another example of integrating the environmental with the social.

Arguably, the European super-majors—Shell, BP, Total, ENI, and Repsol—are most effectively building ESG-friendly messaging into their business models and strategies. This reflects both a more activist ESG investor base among major pension and insurance investors in Europe, as well as more acute policy pressure from the European Union member governments, some of which have direct ownership stakes as well.

Time will tell if these strategies will succeed, but with pressure continuing to grow as the low-carbon transition proceeds, ESG policies—with greater depth and a track record of strong implementation—will be a source of credibility with investors and policymakers alike.

Variability, black swans, and future trends

It would be a mistake to assume that the low carbon transition will be even in terms of speed and scope across geographies and industries. There is little so far to suggest that the low carbon transition will be linear, instead there will likely be a series of stops and starts even as overall progress on global climate mitigation is still visible and measurable. There are many high-profile examples in both directions—from the negative impact of US President Donald Trump announcing plans to exit the Paris Agreement, or the positive impact of former United Kingdom (UK) Prime Minister Theresa May enacting a binding net zero emissions goal for the UK on her last day in office. Victories of anti-carbon tax governments in Canada’s largest province, Ontario, were followed just one year later by a national election in which 65 percent of voters supported parties backing a carbon tax. Uneven political trends create uneven policy trends for the low carbon transition. The trends are broadly uneven because the low carbon transition is not yet the dominant factor in energy policy; rather, in large parts of the world, issues of affordability, access, economic competitiveness, and national security remain as or often more important than climate.

What could change the uneven, bottom-up, and intermittent nature of the low carbon transition?

- Oil price shock: History suggests that policy makers mobilize rapidly to support low carbon transition following a shock or disruption in the supply or affordability of an incumbent resource. Consider the European ban of oil-fired power plants after the 1970s oil shocks, the US renewable fuel mandate passed by President George W. Bush amid the $100 price environment of the mid-2000s, or China’s massive nuclear, solar, battery, and wind program following consecutive years of double-digit oil import growth. Notably, each of these transitions moved toward lower GHG fuels.

- Global leadership: The Paris Agreement arguably benefited from extensive political and relationship capital invested personally by former US President Barack Obama in building consensus with other key powers, especially the European Union, Japan, China, and India. Governments recognized the Agreement as a personal priority for Obama and engaged accordingly. By contrast, the COP25 in Madrid had leaders from only fifteen to twenty states present, and Trump was not in attendance. When Trump was first elected, there was some speculation that Chinese President Xi Jinping might assume the mantle of global climate leadership, especially after his high-profile speech at Davos. Yet to date, neither the United States nor China have played a leadership role equivalent to Obama. French President Emmanuel Macron and Canadian Prime Minister Justin Trudeau have been seen as climate leaders, but both have faced stiff domestic political challenges to their policies.

- Investor backlash to ESG and “post carbon” business models: Three risks could disrupt the low carbon transition. First, oil and gas historically have been cyclical, and it is not yet clear that the growing focus on low carbon transition has disrupted the traditional laws of supply and demand. In the current environment, it is certainly possible that under-investment in oil because of the fear of stranded assets could lead to a short-medium term price spike as demand continues to grow. Second, the rise of ESG has coincided with a period of poor market returns for the oil and gas sectors. Investing in ESG portfolios that are “underweight” oil and gas has been a stable position. However, if the supply crunch occurs and prices for oil and gas rise, ESG funds that are underweight oil and gas may underperform. That could test investor willingness to sustain ESG strategies. Finally, it is also possible that governments and investors fail to consolidate around clear rules of the road for ESG. This could lead investors to begin downplaying ESG considerations in their investment decision-making, or to shift capital to other sectors with a lighter overall ESG risk profile.

- Disruptive technology: Although beyond the scope of this paper, it must be acknowledged that rapid scaling of truly disruptive non-fossil fuel-based technologies would create a material stranded asset risk for oil and gas. This could include nuclear fusion, algae-based biofuels, fuel cells, and other breakthrough technologies. On the other hand, a breakthrough along the lines of Direct Air Capture for GHGs could have opposite effect in terms of securing long-term, Paris Agreement-compliant demand for oil and gas.

Conclusion: Surviving, thriving, and leading the low carbon energy transition

The range of policy, investor, and social pressures on the growth case for oil and gas does not preclude a significant and vital role for the industry in the low-carbon energy transition. Multiple pathways for decarbonization include oil and gas when partnered with the right technologies and policies. The baseline of existing skill sets and resources throughout the industry to mobilize new lower carbon forms of energy suggest that there may be opportunities for oil and gas companies.

Failing to take advantage of this opportunity will leave the industry in a position of responding to a changing status-quo in the energy system, driven by each of the pressures previously described. This does not necessarily mean that the sun will set on industry; however, the changes in the status quo will continue to force oil and gas companies to operate with a risk portfolio that is increasingly beyond their control and dramatically more constrained as the market and policy environment continues to take shape—particularly if any of the aforementioned black swan scenarios are realized.

To respond to the low carbon energy transition, oil and gas companies must recognize the role their industry will play in global energy demand growth, and couple that role with the needs and expectations of the low-carbon system as it emerges. It must then communicate its vision of this role and encourage its peers to take similar steps, working as partners with stakeholders in the oil and gas industry, alternative energy sector, and policy community to build structures which support high-energy growth, low-carbon pathways for the future through the following vital steps:

- Building strategies for low carbon business models that are not only low carbon but also profitable and clearly explainable to the markets and other stakeholders.

- Supporting the development of government-drafted and independently-audited ESG metrics that are science-based, objective, and accessible to investors. The only acceptable bar is equivalency to other forms of financial disclosure that are mandated and regulated by governments and that investors rely on.

- Building out the promising concepts of net zero emissions and circular economy with appropriate policy incentives in line with the bottom-up nationally determined contribution model of the Paris Agreement.

- Encouraging the growth of international carbon markets through Article 6 of the Paris Agreement, to expand the possibilities for government-to-government and business-to-business (B2B) joint cross-border projects for emissions reduction.

- Developing a workforce strategy that leverages the above into restoring oil and gas as an attractive destination for younger talent concerned about the ESG footprint and stranded asset risk of the industry.

Taken together, these steps can position the oil and gas sector to not just survive to the low carbon transition, but evolve, thrive, and even perhaps lead the transition to an energy system which can simultaneously meet the 1.5 degree Celsius goal and moreover the energy demands of the future.

Appendix: Gray Canyon Asset Management—a low carbon transition oil and gas case study

The following hypothetical Harvard Business School-style case study was developed following a series of workshops organized by the Atlantic Council Global Energy Center in New York City, Houston, Abu Dhabi, and Singapore to explore the pressures confronting oil and gas companies in the low carbon transition, and the available strategies or business models to mitigate and lead into the future. The challenge posed to fictional investment firm Gray Canyon Asset Management in the following case study, dated in late summer 2019, examines these dynamics, and reflects on the discussion in the first half of the paper addressing the key questions and uncertainties, as well as the opportunities, the oil and gas sector will face.

The case study focuses on access to capital, which is a key element of managing the transition to a low carbon economy. Uncertainty both about the pace of the transition and the ability of oil and gas companies to reposition their legacy business models profitably represents a challenge for investors. This case study demonstrates how the investment community weighs prospective government climate policy changes and assesses whether they align with the wide range of technology and strategic pathways oil and gas companies are taking to manage the transition.

Part 1: The challenge

Martha Radcliffe stepped off the elevator and walked across the football field-sized trading floor at Gray Canyon Asset Management. The meeting ahead would not be an easy one, even for someone with Martha’s reputation as a “fixer”—highly adept at handling underperforming investments and struggling fund managers within the vast Gray Canyon portfolio. Since she joined Gray Canyon in 1991, the firm had seen its assets under management soar to $442 billion, leveraging a multi-asset model and geographic diversification to cement its reputation as the closest thing to a “sure bet” among the varied pensions, insurance companies, and endowments that constituted its customer base.

What made today different was that Martha knew there was a strong chance the meeting she was attending would end with her terminating one of her longest-standing colleagues, senior portfolio manager Richard Hernandez. Hernandez, with a solid but unspectacular record as a portfolio manager, had a disastrous run over the past three years. Martha had been asked by Gray Canyon Chief Investment Officer (CIO) Susan Stanhope to get to the bottom of the situation. Was Hernandez no longer up to the job, or was he simply in the wrong place at the wrong time?

Hernandez had played several roles as he advanced in his career at Gray Canyon. A Wharton grad, Hernandez had a successful run as an oil services analyst and subsequently as a portfolio manager running the $3 billion US Income Fund. But the last three years, Hernandez had run what was once Gray Canyon’s highest return portfolio—the Global Resource Opportunity Fund. Known around the energy investment community as “G-Ro,” the seat running the massive portfolio was, not long ago, not only the most coveted at Gray Canyon but also one of the most prestigious and influential on Wall Street and in energy capitals around the world.

From 2002 to 2015, G-Ro had generated a robust 18 percent annual return to investors. G-Ro was initially led by legendary fund manager Pete “Shark” Briscoe who was smart enough, or maybe lucky enough, to time his run at G-Ro with a massive global commodity boom. Still, Shark Briscoe easily outperformed a strong market and earned his name by “devouring” CEOs of oil and gas companies who refused his advice and frequently faced implacable and often career-terminating board and shareholder resistance in response.

Shark retired to Pebble Beach in 2015, taking his Houston boardroom and Hill Country hunt lodge connections with him. Hernandez was tapped to bring a new approach to G-Ro, one that would include more analytics, big data, technology focus, and, most importantly, openness to diversification into clean and renewable energy. Shark had been contemptuous of renewables and was a key reason why one of the world’s largest super-majors abandoned a significant but arguably ill-timed push into solar power in 2008.

Martha Radcliffe had worked with Shark, admiring both his old school ways and his massive returns that had carried the overall portfolio in more than one year. Yet she had also had to smooth over relations with some CEOs bruised by Shark’s withering speeches at investment conferences and on TV, and she had to manage the analysts who were burned out by his appetite for twenty-hour days and endless travel to oil and gas fields around the world.

Worse, though, was that Martha and CIO Susan Stanhope knew that Shark’s permanently bullish view on oil and gas prices would eventually hurt the fund. From a risk management and diversification perspective, the two were confident that every commodity cycle ran its course, and that G-Ro’s oversized role in driving alpha for Gray Canyon was a major risk when the downturn came.

But even they did not expect the catastrophe that followed. G-Ro was in virtual meltdown and Hernandez, who had taken over the fund following Shark’s retirement, had been unable to stop it. The US shale boom beginning in 2009 and the Saudi-led price war in November 2014 triggered the disaster, which continued even when Saudi Arabia reversed its strategy and formed the OPEC+ arrangement with Russia to try to rebalance markets through production cuts in 2017. As for natural gas, Shark Briscoe’s portfolio of “winners” built from 2005 to 2010 was decimated. Henry Hub prices couldn’t get back to even 25 percent of the levels in the market at that time, leaving the portfolio with a number of impaired balance sheets to work through painfully. Worst of all, the high-flying deepwater services and Canadian oil sands producers had seen returns plummet and dividends cut to near zero as these higher cost plays were particularly unloved by markets in an era of oversupply.

Hernandez, still working with a team of analysts mostly hired and trained by Shark, had convinced Stanhope on several occasions to “buy the dips,” meaning that, as of 2017, G-Ro had doubled down on its oil-heavy portfolio. Even though there were some good companies and assets, the market refused to recognize any growth or upside in the stocks and the underperformance continued. By 2019, the broader S&P 500 was up 47 percent from 2015, while the “Energy SPYDer”—the ETF encompassing the largest US oil and gas stocks—had fallen by 48 percent (Figure 4). Worse, because of buying the dips and a stubbornly bullish team view on commodities, once-mighty G-Ro was down an aggregate of 91 percent. G-Ro investors were furious and calling not only for Hernandez to go, but with many of them hoping that Stanhope would follow him out the door.

Radcliffe could see that Hernandez knew the direction this meeting was likely to take, but knew him well enough to know he would approach the conversation in a measured and data-driven way. He smiled as she settled into her seat: “Well, Martha, I know we have some things to discuss. I am not happy with where G-Ro is at and I know you and Susan aren’t either. I hope you don’t mind but I asked someone else to join our meeting.”

Actually, Radcliffe did mind. This was her meeting and typically there was a well-established protocol at Gray Canyon for these “pre-termination” meetings. But she trusted Hernandez and decided to let him proceed. “Sure, Rich, go ahead, interested to hear whatever you have to say here,” she offered. Hernandez sent a quick text and minutes later a youngish looking woman entered the room. “Martha, meet Josie Theodore. I would like to hire her to be our new ESG analyst.” Now Radcliffe was genuinely annoyed. Had Hernandez turned his dismissal meeting into a request for a new hire? Pretty incredible for a guy whose fund was the worst performer not just within Gray Canyon but really one of the biggest under-performers globally. Yet given that she still had trust for Hernandez, and some curiosity, she thought, “Why not? Nothing to lose at this point.”

“Nice to meet you, Josie. Welcome to Gray Canyon. So, Richard, tell me more about what you are thinking.” Hernandez, for his part, had prepared for this exchange for some time. His epiphany—to bring in Josie—was a bit of a Hail Mary and an unorthodox move for a typically conservative guy. But it came out of frustration with the G-Ro portfolio. What he observed was a global oil market that remained fairly tight, with steady demand growth, plenty of geopolitical risk, and—most importantly—a massive contraction in new exploration and production to replace resources that were declining at a rate of about 3 percent a year. Historically, these conditions had been a winner for the oil and gas sector, but no longer.

“Martha, thanks for being open to this conversation. Here’s my thesis: the old cyclical metrics and business model for the oil and gas sector need to go out the window. From what I can see, the world still needs oil and gas but the market no longer believes in the growth case for the sector.”

Hernandez crossed his arms and sat back. Radcliffe waited for him to continue, and then realized he was pausing to allow her process what he had said. Growing a bit frustrated, she sighed: “Sorry Rich, help me out here . . . how can the market still need oil and gas but not see a growth case for the companies?”