Inside the IMF-World Bank Spring Meetings as leaders navigate the global trade war

International Monetary Fund Director Kristalina Georgieva sent a sobering message to financial leaders: Expect “notable markdowns” in forecasted economic growth and, for some countries, a hike in inflation.

Those projections were released at the IMF-World Bank Spring Meetings, where central bank governors, finance ministers, and other economic leaders met. There, many sounded the alarm about the global economy’s trajectory and discussed their plans to cushion their countries from the blow of low growth and high inflation, which are expected to result from US President Donald Trump’s sweeping tariffs.

Amid an economic climate of great uncertainty, we dispatched our experts to the center of the action in Foggy Bottom to share their biggest takeaways from a pivotal week for the global economy. Read what they want you to know below.

This week’s expert contributors

THE LATEST

Dispatch from IMF-World Bank Week: Success, in one underappreciated way

The actions needed to support those who are financially underserved in Africa

Egypt’s Rania Al-Mashat on navigating today’s global shocks

This week shifted our understanding of everything from dollar dominance to trade wars

The Bank of England’s Megan Greene: On tariffs, the “risk is now on the disinflationary side”

Slow progress on debt restructuring

Catch up with everything happening at the Atlantic Council on day five

APRIL 26 | 12:01 PM ET

“Those who seek to deconstruct the system… have an obligation to share the vision of what comes next”

Wrapping up the week, GeoEconomics Center Senior Director Josh Lipsky, who is also the chair of international economics at the Atlantic Council, reflects on the founding of the Bretton Woods institutions and calls for visionary leadership to shape what comes next.

Read the remarks

The US dollar has been the global reserve currency for approximately a century, and we can sit here as we did this week and talk about all the macroeconomic factors of why that is—liquidity and capital markets and all the ins and outs that make something a reserve currency or not.

But the fundamental reason something becomes a reserve currency, the world’s leading experts on currency will tell you, including at the Atlantic Council, is the rule of law.

But another way to say that is trust: Trust that, fundamentally, you will be treated fairly, there will be a process if there’s a dispute, that you understand the system, how it works, and how it doesn’t. That trust was hard fought for and hard won by the United States.

We often romanticize the three weeks in New Hampshire in 1944, as when the world came together and set out a new international economic order and created the dollar as the global reserve currency. But the truth is much more complicated. There was wrangling and backstabbing and negotiation and suspicion, countries not wanting to deal with each other, bilateral negotiations just like we see this week.

And what emerged from that meeting was not a consensus. It was a precarious and tenuous agreement to see if the United States, as the leader of an international economic system, could earn the trust of the world. And they did it.

The United States did something that no superpower in the history of the world had ever done before. They shared their power. They built a rules-based international system, and that system benefited the world, but it also benefited the United States. It generated enormous prosperity in this country.

We overlook that history at our own peril. Are there deep flaws in that system? Of course, there are. Have they built up, especially in the past twenty, thirty years to the detriment of American workers and workers around the world in advanced economies? There is no doubt. Is reform needed? Of course, there is absolute unity across the IMF and World Bank about the need for reform.

But those who seek to deconstruct the system that was built over nearly a century have an obligation to share the vision of what comes next.

This world that we have built, this economic order, is imperfect. But it represents the consensus of the citizens of the countries that these ministers and governors represent. And the brilliance of this system is that every country has a voice.

And working together, they build a stronger global economy. We may have forgotten those lessons as a century has moved on, and it may be painful for all of us as we seek to relearn them. But we have to come out of the other end of this, not just in a bilateral world, the way we operated before the Bretton Woods system, but a way that shows we have learned and not forgotten the lessons of history. That is what we will be committed to at the Atlantic Council, and that is what we will continue to work on in the days, weeks, and months ahead.

APRIL 26 | 11:24 AM ET

Thanksgiving in April

Last year at the Annual Meetings, my colleague Martin Mühleisen likened these gatherings to Thanksgiving, as both ‘sides’ of the family come together in good spirits—though there may be a kick under the table. On this, I agreed, noting there is meaningful cooperation, collaboration, and respect between the IMF and World Bank.

Despite the overarching sense of gloom at these Spring Meetings, as the trade war heightens economic uncertainty, there were encouraging signals that much-needed coordination and partnership between these two institutions and beyond can and is happening.

For example, take domestic revenue mobilization and debt, two connected challenges listed prominently on the agenda. That’s the case for good reason: Emerging market and developing economies collectively face a financing shortfall in the trillions. As I discussed on Tuesday with the French Treasury’s William Roos, who is also co-chair of the Paris Club, these countries lack fiscal space to invest in growth or climate resilience, mainly due to declining development assistance and hamstringing debt (at least half of these countries are in or at high risk of debt distress).

The implications for macro stability, economic development, and poverty alleviation give both the Bank and Fund a shared interest in prioritizing action. They have similar tools at their disposal—financing, concessional lending, trust funds, policy advice, and capacity building. But too often these tools are utilized in isolated, fragmented, and (at times) even counterproductive ways.

This is why joint efforts such as the IMF-World Bank Debt Sustainability Framework for Low-Income Countries and the Domestic Resource Mobilization Initiative are so critical. So is the new, much-anticipated “Playbook” for debt restructuring released on Wednesday by the Global Sovereign Debt Roundtable, which the Fund and Bank co-chair along with the Group of Twenty presidency. Ceyla Pazarbasioglu—the director of the Strategy, Policy, and Review department at the Fund—got giddy discussing these collaborations with Pablo Saavedra, vice president of Prosperity vertical at the Bank, and me.

As much as ongoing and strengthened coordination between these two institutions is important, I am even more encouraged by what I heard from them and others, on and off the 19th Street campus, and in front of cameras and behind the scenes. The people I spoke with acknowledged the need to revisit the broader international financial system for better cooperation (including with regional international financial institutions), improved ownership of national policies by and alignment with governments, and ultimately more effectiveness in an era when everyone has to do more with less. Keep an eye out for momentum that can and should enable progress, not only in the lead up to the Annual Meetings in October but also ahead of the fourth Financing for Development Conference in Seville this summer. If you’re curious about what that will entail, watch my conversation with United Nations Assistant Secretary General for Economic Development Navid Hanif and Ambassador of Zambia to the United Nations Chola Milambo.

APRIL 25 | 6:27 PM ET

Dispatch from IMF-World Bank Week: Success, in one underappreciated way

In the meetings and panels I attended this week, the air was thick with existential dread over the Bretton Woods institutions’ very future. Delegates came prepared for the worst, bracing for a difficult set of discussions with the new US administration.

Considering the expectations for these meetings were so low, I would say they wound up a qualified success. The mood had already improved after the United States supported an IMF deal with Argentina, struck the week before, and after US Treasury Secretary Scott Bessent delivered a speech providing reassurance that the United States values the Bretton Woods institutions—as long as major reforms are undertaken.

Even though most people focused on the gloomy outlook for the world economy over the course of the week, some gave in to guarded optimism as markets stabilized on the hope for a US stand-down on several trade fronts.

The shift in mood wasn’t the only sign of success; there were concrete deliverables. One came from the Global Sovereign Debt Roundtable, which issued a roadmap for debt restructuring negotiations, signaling important consensus among major creditor countries. Moreover, the IMF and World Bank announced that they will engage with the new Syrian government to help restore their country’s war-damaged economy.

In addition, the statement by the International Monetary and Financial Committee chair (issued in lieu of a communiqué) struck a tone that was clearly aimed at addressing the United States’ stringent demands—although it did not give any indication of how the IMF would do so, and the real work still lies ahead.

Despite these positive signals, the global financial system faces considerable uncertainty. The Argentina program is a risky bet, the Trump administration could switch its view on the Bretton Woods institutions, and there is now a bigger question mark attached to the dollar’s future as the world’s dominant currency.

This week proved the value of IMF-World Bank meetings in troubled times. In speaking at Atlantic Council headquarters on Thursday, Spanish Finance Minister Carlos Cuerpo told us that the most important deliverable this week, with difficult decisions looming over the next few months, was simply for people to keep “talking to each other.” I couldn’t agree with him more.

APRIL 25 | 3:48 PM ET

The actions needed to support those who are financially underserved in Africa

At World Bank headquarters, the Atlantic Council’s Ruth Goodwin-Groen sat down with Admassu Tadesse, president and managing director of the Trade and Development Bank Group, to talk about the absence of venture capital in Africa and the need to promote inclusive finance.

APRIL 25 | 3:02 PM ET

Egypt’s Rania Al-Mashat on navigating today’s global shocks

APRIL 25 | 1:57 PM ET

This week shifted our understanding of everything from dollar dominance to trade wars

This week’s IMF-World Bank Spring Meetings have only highlighted that no one is coming to save the global economy. There is no rescue committee, no stimulus plan, and no quick Fed cuts around the corner.

Most of the ministers knew this was the state of affairs coming in. But it’s one thing to talk about a trade war. It’s another to see the IMF cut the growth forecast for nearly every country in the world because of a single policy decision.

In the beginning of the week, I sensed gloominess and anxiety in the hallways and in our private conversations with finance chiefs. But by the end, I noticed something else, the same thing I remember back in 2008 during the financial crisis: a steely sense of resolve. These leaders understood that at some level, the tariffs are here to stay, trade deals would take months or longer, and the global economy is being restructured. It would be, as one minister said privately, just something we have to weather.

That’s true, but how bad will the storm be? No one knows. That doesn’t mean this week didn’t offer clarity, however. Our team walked away from these meetings with a transformed understanding of three issues:

- There’s a difference between wanting dollars and needing dollars. The dollar’s status as a reserve currency is safe for the time being. That’s what Bloomberg’s Saleha Mohsin told me in our conversation, and she brought the data to back it up. But while the world still needs dollars for a functioning global economy, there were many people this week who wouldn’t mind finding some plan Bs. Do they exist? Not exactly. The European finance chiefs we spoke to were skeptical that a move to the euro would stick—and some, such as the Banque de France governor, weren’t sure it was a good thing given it was a result of instability in the United States, not a vote of confidence in the euro area.

- The Trump administration is as focused on the IMF as it is on the World Bank. There was chatter going into the week that the administration was more focused on putting pressure on the World Bank than the IMF. But US Treasury Secretary Scott Bessent, in a speech on Wednesday, spent as much time—if not more—talking about the Fund going beyond its mandate than he did on the Bank lending to China. That surprised many, and it means there are fights ahead as the IMF—and the Bank—tries to respond to its largest shareholder in the months ahead without alienating the other 190. Considering the Trump administration has an end-of-July review deadline to decide its policy on US involvement in international organizations, the eighty-first anniversary of the creation of Bretton Woods institutions (July 22) could be one of the most significant since their founding.

- Emerging markets and developing economies are already getting hit hard. Our conversations made it clear that a range of countries across regions is already feeling the impact of the trade war and economic slowdown in the form of job loss and increased poverty rates. These countries are going to need assistance from the IMF and World Bank in the near future. Even if the US president reversed his policy and slashed tariffs back down as soon as tonight, that wouldn’t fix the problem. It’s the volatility that feeds the uncertainty that pulls back investments. As the old saying goes, trust arrives on foot but it leaves on horseback.

APRIL 25 | 11:03 AM ET

The Bank of England’s Megan Greene: On tariffs, the “risk is now on the disinflationary side”

APRIL 25 | 10:15 AM ET

Slow progress on debt restructuring

Amid the week’s focus on trade tensions and economic uncertainty, the lingering issue of developing country debt has received little attention. However, reports released on Wednesday by the IMF and World Bank’s Global Sovereign Debt Roundtable (GSDR) suggest that the frustratingly slow process of restructuring unsustainable debts—a problem that took center stage amid the economic dislocations of the COVID-19 pandemic—has made important, albeit incremental, gains over the past few years.

A handful of countries have passed through the restructuring process, most of them low-income economies whose debts were supposed to be addressed by the Group of Twenty governments’ Common Framework for debt “treatment.” But some other nations—notably Sri Lanka—did not fit within that framework. What has emerged has been a case-by-case process in which government and private-sector lenders have worked through complex roadblocks, many of which were posed by the world’s largest sovereign lender, China.

The GSDR co-chairs’ Progress Report lays out many of the nuts-and-bolts issues that have been addressed, ranging from “comparability of treatment” across different creditor groups to the restructuring of “non-bonded commercial debt,” which generally means bank loans. It also lists several areas that need to be addressed going forward, including how to enhance coordination of private-sector creditors.

While the reports are careful not to point fingers at any specific lenders, the reality is that many of the issues before the roundtable have been posed by China, which is loath to take write-downs on its massive portfolio of loans. Beijing’s position on these issues has at times been opaque, but a recent paper put out by the Harvard Kennedy School usefully illuminates much of the back and forth that has taken place during the recent restructurings—as well as the work that remains to be done.

APRIL 25 | 9:17 AM ET

Catch up with everything happening at the Atlantic Council on day five

WATCH | Day 5 of IMF-World Bank Week is underway. Tune in to #ACDailyBrief as @JulietteFdezTV and @ACGeoEcon’s Lize de Kruijf walk you through today’s top events, highlight key speakers, and break down the topics driving the conversation. https://t.co/BOspPYGH3o

— Atlantic Council (@AtlanticCouncil) April 25, 2025

DAY FOUR

Dispatch from IMF World Bank Week: Why surveillance matters

Catch up with everything happening at the Atlantic Council on day four

A common tone among key leaders is a sign for optimism

In defense of “boring”: A European leader’s message to Trump

APRIL 24 | 7:57 PM ET

Dispatch from IMF World Bank Week: Why surveillance matters

This morning, I watched as IMF Managing Director Kristalina Georgieva unveiled her Global Policy Agenda (GPA), a biannual document that outlines the managing director’s vision for the IMF’s work over the coming year.

The most notable part of this year’s GPA is its focus on surveillance—in other words, the IMF’s work to assess the economic health of its members. As part of that focus, the GPA discusses the Comprehensive Surveillance Review, the IMF’s way of setting priorities and updating its processes for conducting bilateral and multilateral surveillance. There are some things to applaud in the outline for the upcoming review, including the emphasis on the IMF’s core areas of expertise: fiscal, monetary, and financial issues—and, most importantly, the persistent theme of external imbalances.

However, some will not applaud the fact that there were few passing references to climate and no mentions of gender, despite the IMF having increased its budget for these and other emerging topics within the past few years. The GPA proposes instead “adapting surveillance” by setting principles around the topics to be covered. This approach aligns well with US Treasury Secretary Scott Bessent’s remarks from yesterday that the IMF has suffered from “mission creep.” But European partners will no doubt have concerns that the Fund is abandoning its climate strategy, approved just four years ago.

My own view is that the GPA’s focus on surveillance is a welcome departure from the past. Surveillance may not get as many headlines as the IMF’s lending programs, but it provides an enormously valuable public good, particularly in those countries that do not receive regular market coverage. The IMF’s policy advice can also steer bilateral and multilateral donors and their efforts to prioritize assistance.

Watch this space closely to see whether the Comprehensive Surveillance Review delivers concrete reforms and real modernization efforts to help serve both advanced and developing economies.

APRIL 24 | 4:38 PM ET

Why Europe being a “safe haven” for the world is “good news for everyone,” according to Spanish Finance Minister Carlos Cuerpo

APRIL 24 | 2:56 PM ET

Greece’s Kyriakos Pierrakakis: “Unless you create positive tailwinds, you cannot counter the negative headwinds”

APRIL 24 | 1:42 PM ET

Experts and leaders focusing on Central and Southeastern Europe discuss the challenges facing the region

APRIL 24 | 9:22 AM ET

Catch up with everything happening at the Atlantic Council on day four

#ACDailyBrief: It’s day 4 of #SpringMeetings2025. Watch @JulietteFdezTV and @ACGeoEcon’s @bart_piasecki discuss the top events, speakers to watch, and key economic issues shaping the day. pic.twitter.com/VI2utmSt0f

— Atlantic Council (@AtlanticCouncil) April 24, 2025

APRIL 24 | 8:43 AM ET

A common tone among key leaders is a sign for optimism

All things considered, the IMF-World Bank Spring Meetings are generating surprisingly optimistic and positive messages.

Weeks of policy volatility, market volatility, and much hand-wringing over the Trump administration’s stated effort to reconsider the multilateral arrangements laid the groundwork for a tempestuous set of meetings. Yet we are just past halftime with no existential crisis (yet) at the IMF or the World Bank.

At this point, the European Commission, World Trade Organization (WTO), and US Treasury have all spoken publicly. They may not have been singing from the same sheet music, but they were all certainly singing in harmony.

EU Commissioner Valdis Dombrovskis, speaking at the Atlantic Council, said that the EU “is not giving up on our closest, deepest, and most important partnership, with the United States… And we will need each other even more in tomorrow’s increasingly conflictual and competitive world.”

His tone matches that of European Commission President Ursula Von der Leyen earlier this month, who declared that “we know that the global trading system has serious deficiencies. I agree with President Trump that others are taking unfair advantage of the current rules. And I am ready to support any efforts to make the global trading system fit for the realities of the global economy. But I also want to be clear: Reaching for tariffs as your first and last tool will not fix it.“

WTO Director-General Ngozi Okonjo-Iweala, speaking at the Council on Foreign Relations, highlighted how there are promising overlaps in looking at the administration’s unilateral objectives and the objectives of multilateral organizations. “In every crisis, there is an opportunity between multilateral objectives and unilateral objectives,” she said. “I do agree with the administration now… when they say there needs to be dynamism in the system, I share that. Some of the criticisms they make, I agree with because I have said the same. We need to get more results. We need to re-dynamize the system. We don’t need to have things cast in cement that may not be relevant to twenty-first-century issues anymore.”

She also agreed with the White House’s complaint, as stated in an April 2 executive order, that the economic framework supported by the Bretton Woods system “did not result in reciprocity or generally increase domestic consumption in foreign economies relative to domestic consumption in the United States.” In addition, Okonjo-Iweala urged resource-rich African nations to focus more on building value-added enrichment and employment within the region to increase domestic demand, even as she urged China also to increase domestic demand.

US Treasury Secretary Scott Bessent, speaking at the Institute of International Finance, said, “China can start by moving its economy away from export overcapacity and toward supporting its own consumers and domestic demand.” In addition, he said that “the IMF and the World Bank serve critical roles in the international system. And the Trump administration is eager to work with them—so long as they can stay true to their missions.”

Bessent also said that the IMF will need “to call out countries like China that have pursued globally distortive policies and opaque currency practices for many decades” and “call out unsustainable lending practices by certain creditor countries,” adding that “a more sustainable international economic system will be one that better serves the interests of the United States and all other participants in the system.”

In his IMFC-DC Statement, released yesterday, Bessent said, “we need to restore the foundations of the IMF and World Bank. The United States continues to appreciate the value the Bretton Woods Institutions can provide, but they must step back from the expansive policy agendas that stifle their ability to deliver on their core missions.” He added that “for low-income countries in particular, both the IMF and World Bank should promote policy discipline for countries to strengthen their institutions, tackle corruption, and ultimately lay the foundation for sound investment so that they see a future that no longer relies on donor assistance.“

These leaders this week are sending a clear signal that they are not walking away from decades of established relationships and structures that have served the world well. Of course on the other hand, there is no guarantee that China and other countries will agree with the policy trajectory previewed on various stages in Foggy Bottom. Policy volatility will remain a reality for the next few years. But the initial messaging from the first days of the 2025 IMF-World Bank Spring Meetings gives reason for optimism.

APRIL 24 | 8:00 AM ET

In defense of “boring”: A European leader’s message to Trump

Warren Harding, a genial but bland Republican senator from Ohio, won the US presidential election of 1920 behind the campaign slogan “Return to normalcy.” It was a salve for an American electorate, giving him more than 60 percent of the vote, following US President Theodore Roosevelt’s adventurism, American engagement in World War I, then the failed postwar idealism of US President Woodrow Wilson.

“America’s present need is not heroics but healing,” Harding said, “not nostrums but normalcy; not revolution but restoration; not agitation but adjustment; not surgery but serenity; not the dramatic, but the dispassionate…”

It was certainly unintentional, but I heard echoes of Harding when Valdis Dombrovskis, a Latvian who serves as an executive vice president for the European Commission, came to the Atlantic Council yesterday in defense of “boring” predictability. While mentioning US President Donald Trump only once in his opening remarks, he underscored what Europe has long seen as its shared virtues with its American partners.

“You see our fundamental values, individual liberties, democracy, and the rule of law often painted as weakness by authoritarian regimes to prey upon,” said Dombrovskis, who previously served as the European Union’s (EU’s) trade negotiator and is one of Europe’s longest-serving commissioners. “However, in times of turmoil, predictability, the rule of law, and willingness to uphold the rules-based international order become Europe’s greatest assets. We are committed to doing whatever it takes to defend our “boring” democracies, because boring brings certainty and a safe haven when a rules-based order is questioned elsewhere. Our processes allow for debates and consultations to take place, building buy-in from our key stakeholders and enabling us all to pull in the same direction.”

This week’s meetings of the International Monetary Fund (IMF) and World Bank in Washington, DC, are arguably the most important since the financial crisis of 2008-2009, because the Trump administration is seeking fundamental changes to the world trading and financial system not seen since the Bretton Woods agreement of 1944. In that year, the United States and its partners brought down protectionist trade barriers, established a new international monetary system, and laid a foundation for post-World War II global economic cooperation. One of the results was the creation of the IMF and the World Bank.

The last thing the Trump administration appears to want is a return to the normalcy of the eighty years that followed that agreement, arguing that the United States has been taken advantage of by its trading partners and that international system. One can say many things about Trump’s first hundred days in power, but “boring” certainly isn’t one of them.

Read more

DAY THREE

Dispatch from IMF-World Bank Week: Don’t forget the real theme of the week

These meetings mark a milestone for Syria. But more political engagement will be necessary.

How can the IMF return to its core mandate in a vastly different global economy?

Banque de France Governor François Villeroy de Galhau says further rate cuts likely this year

Treasury Secretary Scott Bessent signals conditional support for the IMF and World Bank

Scott Bessent’s calls for reform are reasonable. The IMF should deliver on them.

What ever happened to climate change?

EU Commissioner Valdis Dombrovskis on why the EU is “not giving up” on the United States

Catch up with everything happening at the Atlantic Council on day three

APRIL 23 | 6:04 PM ET

Dispatch from IMF-World Bank Week: Don’t forget the real theme of the week

With tariffs and trade continuing to dominate conversations taking place in the halls of these Spring Meetings, it would be easy to forget that there is an official theme, and it isn’t trade: It’s jobs.

That is fitting, in my view. Here’s why:

There are two numbers that I’ve seen over and over again as I dash from building to building on 19th Street. One, of course, is the 2.8 percent global growth forecast, down from 3.3 percent as projected in January. But the other is 1.2 billion: That’s the number of young people set to enter the labor force in emerging markets and developing economies over the next decade. I often see it alongside the number 420 million, which is the estimated number of jobs to be created. Even if the models are way off, the math will not add up.

Beyond this jobs gap equation, jobs are being discussed (including at yesterday’s World Bank flagship event) as a factor, if not a multiplier, in the broader economic growth equation. Jobs are linked to trade and, in many ways, to other dynamics of the global economy. That includes the challenges that many emerging markets and developing economies face, such as debt, demographic pressures, domestic-resource and private-capital mobilization, and facilitating the digital transformation.

You could say we have heard this all before. We have. But in this era of geopolitical fragmentation and geoeconomic tension (some might say “turmoil”), it’s helpful to drive attention and meaningful action toward an agenda that leaders and investors from all regions and income groups can and should rally behind. And job creation is apt for that.

That’s even the case for the United States. US Treasury Secretary Scott Bessent acknowledged as much in his speech this morning, noting that job creation and promoting prosperity are key US interests.

Watch more

APRIL 23 | 4:48 PM ET

These meetings mark a milestone for Syria. But more political engagement will be necessary.

The participation of a Syrian government delegation in the 2025 IMF-World Bank Spring Meetings in Washington, DC, marks a significant milestone in Syria’s efforts to reintegrate into the global economic community. Led by Finance Minister Mohammed Yosr Bernieh and Central Bank Governor Abdelkader Husrieh, this visit represents Syria’s first high-level engagement with these institutions in over two decades.

At the Spring Meetings, Syrian officials are participating in discussions focused on restoring financial support and aid to Syria. Notably, a roundtable hosted by the Saudi Finance Minister Mohammed Al-Jadaan and the World Bank garnered strong international interest in Syria’s reconstruction efforts. Additionally, the United Nations Development Programme (UNDP) has announced plans to deliver $1.3 billion in aid over the next three years to support Syria’s rebuilding initiatives.

One of the critical challenges facing Syria is the existing US sanctions against the country, which have hindered reconstruction efforts. Recent developments indicate a small shift in this dynamic. The UNDP has received a sanctions waiver from the US Treasury Department to raise fifty million dollars for repairing the Deir Ali power plant south of Damascus. Furthermore, Saudi Arabia’s commitment to pay approximately fifteen million dollars in Syria’s arrears to the World Bank is a significant step toward enabling Syria to access funds through the International Development Association, which provides grants to low-income countries. Following Syria’s engagements in Washington, the IMF appointed Ron van Rooden as its first mission chief to Syria in fourteen years, signaling a potential revival of economic cooperation aimed at supporting Syria’s recovery.

Despite these steps, more political engagement is necessary to achieve substantive progress. Washington has signaled its hesitancy for more engagement by reportedly limiting Syrian Foreign Minister Asaad Al-Shaibani’s travel visa to New York only and restricting his ability to participate more broadly in meetings in Washington. However, a bipartisan letter issued on Monday by Senators Jeanne Shaheen (D-NH) and Jim Risch (R-ID) of the Senate Foreign Relations Committee reflects a growing bipartisan recognition among US policymakers of the potential benefits of reengaging with Syria under carefully considered conditions. The letter advocates for a strategic approach to US-Syria relations, emphasizing the importance of facilitating dialogue and cooperation to support Syria’s reconstruction and regional stability.

But for momentum to build, both Washington and Damascus must explore more robust diplomatic channels, including incremental confidence-building measures and expanded humanitarian coordination. This could create a framework conducive to deeper economic collaboration, ultimately serving US national security interests while fostering stability in Syria and the region.

APRIL 23 | 3:55 PM ET

How can the IMF return to its core mandate in a vastly different global economy?

At the Institute of International Finance conference today, US Treasury Secretary Scott Bessent said that the United States will exercise strong leadership in the IMF and World Bank to push those institutions to refocus on their core mandates after years of “mission creep.” For the IMF, this means promoting members’ policies that are conducive to sustained and balanced trade. And when trade imbalances occur, the adjustment should be symmetrical for surplus and deficit countries, not aimed only at deficit ones. The IMF’s other critical mission is to provide short-term, temporary assistance to member states in balance-of-payment crises—provided the member in question changes the policies that led to the crisis.

While the push for the Bretton Woods institutions to focus on their core mandates is necessary and timely, many questions remain on how the IMF, in particular, will do that under international conditions drastically different from the ones eighty years ago.

The Bretton Woods Conference in 1944 produced a fixed but adjustable exchange rate system with largely closed capital accounts. Now, many countries want free trade, free capital flows, free exchange rate markets, and monetary sovereignty—even though not all of these can sustainably coexist without tension. So the question is, how can the IMF, with its current toolkit, rectify today’s persistent trade imbalances and prevent them from happening again? It would be a missed opportunity if delegates to this week’s meetings fail to come up with some ideas for how the IMF can accomplish this.

It is also important to clarify the line between the core mandate of short-term temporary assistance and longer-term, structural lending. How should the IMF approach the mandate of giving short-term financing to help members in balance-of-payment crises, given the reality that it can take a long time for countries to make the structural reforms necessary to avoid falling into further crises? At the same time, lending to support structural reforms is a longer and more intrusive process than short-term financing, opening up the IMF to criticisms of mission creep and interfering with borrowing nations’ sovereignty. As the IMF-World Bank Spring Meetings delegates discuss how to best return the IMF to its core mandate, such important issues need to be clarified as soon as possible.

APRIL 23 | 3:39 PM ET

Banque de France Governor François Villeroy de Galhau says further rate cuts likely this year

Read his remarks

APRIL 23 | 2:43 PM ET

Treasury Secretary Scott Bessent signals conditional support for the IMF and World Bank

One might be tempted to think—after Treasury Secretary Bessent’s remarks at the Institute of International Finance today—“another US administration, another call for Bretton Woods reforms.” On the surface, the speech does not seem fundamentally different from ones heard during previous administrations, with remarks that reminisce about the original Bretton Woods Conference, convey support for the mission of the institutions, and call upon the institutions to focus on their core mandate.

But it would be wrong to understand these remarks as a signal that the role of the IMF and World Bank will remain unchanged over the coming years. Instead, the secretary’s speech opens up fundamental challenges for the IMF and World Bank, both to their identity and their futures as global multilateral organizations.

First, it is not clear that the continued support of the Bretton Woods institutions expressed today will be the final word of the US administration. The White House is conducting a review of US membership in international organizations, and there are voices in the administration that would prefer the United States withdraw from the IMF and World Bank. While Bessent’s speech is an important opening statement, he will need to be able to point to concrete deliverables in order to win the internal debate against the isolationist wing in the US government.

Second, a return of each institution to its “core mandate” would involve a significant change in activities, running counter to the objectives of a large part of the IMF and World Bank’s membership. Eliminating workstreams on climate policies and social issues would imply a 180-degree turn for the current management of the institutions and the climate-conscious governments that have supported them in recent years; it would also mark such a turn for the constituency of developing countries that benefited from subsidized lending with relatively easy conditionality in recent years.

Third, for the IMF, the Treasury secretary’s missive to “call out countries like China that have pursued globally distortive policies and opaque currency practices” is reminiscent of an episode in the late 2000s, when the IMF was called upon to speak out more forcefully against Beijing’s exchange-rate practices. The result then was a refusal by China to meet its Article IV obligations, a standoff that was only resolved after the IMF softened its stance a few years later.

This is not to say that the United States does not have a valid point. The IMF has been reluctant to call out China for its distorting trade practices and could have been more attentive in looking into accusations that China has also been unduly managing its exchange rate. Given the lack of an explicit mandate on trade policy issues, and the need to work with government-provided data, the IMF will have to think carefully how it can accommodate the demands of the US government, and it will likely run into bitter resistance from Chinese authorities along the way. The ensuing confrontation could well lead to a breakdown of the IMF’s consensus-based way of operating and perhaps a deeper split in the membership of the institution.

Fourth, Bessent also called on the IMF to be tougher in enforcing conditionality for its loans and for the World Bank to cease lending to countries that no longer meet its eligibility criteria. Again, the United States has a valid point here, but it will result in a conflict with European countries that will worry about economic development in African partner countries (due in part to migration pressures across the Mediterranean). And China would, of course, benefit if development lending from multilateral institutions shrinks at a time when official development assistance is already on the decline.

In sum, the secretary’s speech, while providing much welcome support for the IMF and World Bank, has raised a host of issues that will require tough decisions within a relatively short timeframe. Expect intense meetings of financial diplomats to continue long after the flags in front of the IMF building have been put back into storage, awaiting the next formal gathering of the IMF and World Bank in October.

APRIL 23 | 2:11 PM ET

Scott Bessent’s calls for reform are reasonable. The IMF should deliver on them.

Today’s remarks by Treasury Secretary Scott Bessent at the Institute of International Finance were probably more closely watched than many of the IMF-World Bank official events. The remarks represented the first real statement of the Trump administration’s priorities for the Bretton Woods institutions.

Bessent made clear that the Trump administration remains committed to maintaining its economic leadership in the world and in the international financial institutions. You could almost hear the huge sigh of relief coming from the institutions on 19th Street following this comment. Bessent also steered clear of grandiose proposals to reform the core mandates of the World Bank and IMF. Instead, his remarks made clear that both institutions have “enduring value,” and the focus should instead be on limiting “mission creep.” Another good sign that the Trump administration wants to work with, rather than step back from, the Bretton Woods institutions.

Some of Bessent’s key messages echo points delivered in the IMF managing director’s curtain-raiser last week, another welcome sign of potential alignment between the IMF and its largest shareholder. In short, the current global economic model is not sustainable, and large and persistent external imbalances need to be addressed. Bessent’s call on China to stop relying on overcapacity and exports to grow its economy could have been lifted straight from a speech by former Treasury Secretary Janet Yellen. But Bessent did something more novel by emphasizing that the United States also needs to rebalance and by calling on the IMF to critique both the United States and surplus economies. I could not agree more that the IMF’s External Sector Report needs to be more direct on what countries can do to address unsustainable imbalances.

Other reforms called for in the speech urge the IMF to execute its mandate of temporary lending, call out unsustainable lending practices, and hold countries to account for not delivering on reforms. Again, these are not new messages from the United States. My question is whether IMF management, alongside its executive board, will feel more urgency to fulfill these types of reforms. I certainly hope so.

APRIL 23 | 1:37 PM ET

What ever happened to climate change?

At the 2024 Annual Meetings, climate change appeared to be front and center on the IMF agenda. Before the gatherings, the Fund released papers with provocative titles such as “Destination net zero: The urgent need for a global carbon tax on aviation and shipping” and “Sleepwalking to the cliff edge?: A wake-up call for global climate action.” The World Economic Outlook (WEO) elevated “combating climate change” to equal status with the task of promoting medium-term global growth.

But at these spring meetings, climate change is not to be seen—no recent papers and only six brief mentions in the first chapter of the WEO, including a single paragraph at the very end of the section on medium-term growth.

The IMF certainly has no hard and fast rules on what should be addressed in the WEO. With global economic and financial uncertainty demanding the attention of world leaders, other pressing issues also get short shrift this spring. For example, “poverty” gets few mentions. But downgrading attention on climate change appears to reflect a conscious decision at a moment when the United States, the Fund’s largest shareholder, is rejecting policies intended to address climate-related issues.

Speaking at the Institute of International Finance today, US Treasury Secretary Scott Bessent made clear the Trump administration’s view of climate issues on the agenda of the IMF. “Now I know ‘sustainability’ is a popular term around here. But I’m not talking about climate change or carbon footprints,” he said. “I’m talking about economic and financial sustainability… International financial institutions must be singularly focused on upholding this kind of sustainability if they are to succeed in their missions.”

The obvious question then is whether the IMF will respond by shifting away from climate-change mitigation in its core work of advising governments and lending.

APRIL 23 | 1:21 PM ET

Bloomberg’s Saleha Mohsin: “Everyone wants to talk about the dollar’s reign ending, but no one wants to claim the crown”

APRIL 23 | 11:10 AM ET

EU Commissioner Valdis Dombrovskis on why the EU is “not giving up” on the United States

Read the full transcript

APRIL 23 | 9:10 AM ET

Catch up with everything happening at the Atlantic Council on day three

LIVE NOW | #ACDailyBrief: It’s day 3 of #SpringMeetings2025. Join the Atlantic Council’s @JulietteFdezTV and @ACGeoEcon’s Jessie Yin for insights on the top events, key speakers, and global economic trends to watch. https://t.co/ltOTShrfL3

— Atlantic Council (@AtlanticCouncil) April 23, 2025

DAY TWO

Economy and Finance Minister Felipe Chapman on Panama’s relationship with the United States

Mapping Washington’s and Beijing’s next moves in the trade war

The Global Financial Stability Report highlights strains in the US Treasury bond market

Dispatch from IMF-World Bank Week: Behind the World Economic Outlook’s new call for “rebalancing”

The flagship reports walk a fine line

Ukraine’s Serhiy Marchenko: Why not discuss the seizure of Russian assets?

What to know as China’s and the IMF’s forecasts continue to diverge

The IMF released its World Economic Outlook. Let the debate begin.

No recession, says IMF. That’s good news—but perhaps not as good as it sounds.

Catch up with everything happening at the Atlantic Council on day two

APRIL 22 | 9:06 PM ET

Turkish Minister of Treasury and Finance Mehmet Şimşek: “Global trade fragmentation cannot be good for anyone”

APRIL 22 | 6:03 PM ET

Economy and Finance Minister Felipe Chapman on Panama’s relationship with the United States

APRIL 22 | 5:17 PM ET

Mapping Washington’s and Beijing’s next moves in the trade war

APRIL 22 | 5:01 PM ET

The Global Financial Stability Report highlights strains in the US Treasury bond market

The IMF’s Global Financial Stability Report (GFSR), released today, comprehensively describes the market turmoil triggered by the tariff war. So far, financial market conditions have been orderly, but risks of further asset price losses remain elevated.

Yields on US Treasury bonds have risen, lowering bond prices, contrary to their usual behavior when investors have flocked to them as safe haven assets like in previous bouts of market turmoil. The GFSR highlights the growing strains in the intermediation capacity of broker-dealers—which bid for Treasury securities at issuance to distribute to investors—in the Treasury market. In particular, the holding of Treasury securities has overburdened the balance sheets of broker-dealers—rising from just above 100 percent in 2008 to more than 400 percent in 2024. Repo rates’ heightened sensitivity to the volume of issuance also suggests that broker-dealers’ intermediation capacity may approach its limit. This has contributed to the growing illiquidity observed in the Treasury bond market, which will eventually make it less efficient and raise US financing costs.

Moreover, hedge funds have significantly piled into highly leveraged basis trades—taking long positions in Treasury futures contracts while shorting the cash market. Rising bond yields (or falling bond prices) have caused losses, forcing many hedge funds to liquidate their positions, amplifying bond price declines.

Many US banks have attributed the strains on broker-dealers’ balance sheets to regulatory constraints—especially the Supplementary Leverage Ratio (SLR)—and have argued for a relaxation or even removal of the SLR. At present, it looks like banks are making headway in their deregulation push under the Trump administration against a full implementation of Basel III, a proposed international banking regulatory framework. Similar demands have been made by bankers and some officials in the European Union as well.

However, banks’ deregulation efforts, which are enjoying political tailwinds in the United States, are at odds with the GFSR’s recommendations that member countries fully implement international prudential standards, including Basel III and the SLR. It will be interesting to see how the IMF reconciles these differences.

APRIL 22 | 3:19 PM ET

Dispatch from IMF-World Bank Week: Behind the World Economic Outlook’s new call for “rebalancing”

The IMF released its latest World Economic Outlook (WEO) today, downgrading its estimates for global economic growth this year and next, following the beginning of the tariff war and the considerable policy uncertainty surrounding it. Global growth projections for 2025 dropped 0.5 percentage points; US growth estimates are down 0.9 percentage points, while China’s have dropped 0.6 percentage points.

As Managing Director Kristalina Georgieva put it in her curtain-raiser speech last week: “Uncertainty is costly.”

Here at IMF HQ2, people are abuzz with worry about these downgrades. But those downgrades are old news, soft-launched at Georgieva’s speech last week.

Instead, here’s what I’m focused on: To deal with the tariff war and its negative impacts, the IMF—in the WEO—recommends that member countries “reform and rebalance,” sorting out imbalances between saving and investment at home (looking at you, United States) and imbalances between domestic consumption and production (what China needs to work on). It also calls on developing countries to more effectively mobilize domestic resources. Such reforms would balance out trade relationships and make them more sustainable, benefiting all.

Those recommendations are all well and good, but the IMF has not explained how it expects countries to be able to make these reforms. These countries have failed to make recommended reforms in the past when the international environment was much more benign, including during previous eras of low interest rates.

By highlighting the importance of balanced trade, the IMF has harkened back to its original mandate, formulated at the Bretton Woods Conference in 1944. And that is a good thing: Persistent trade imbalances (mainly with countries such as China and Germany posting surpluses while others, mainly the United States, incur deficits) have made the trading system unsustainable, both practically and—as the United States’ unilateral tariff moves show—politically.

Watch more

APRIL 22 | 3:07 PM ET

The flagship reports walk a fine line

The IMF faced some unique challenges in drafting this April’s World Economic Outlook (WEO) and Global Financial Stability Report (GFSR). The recent rapid trade and market developments make it next to impossible to produce a reliable baseline forecast for global growth. The IMF also had to walk a fine line in assessing the impacts of US actions without too overtly criticizing its largest shareholder—not an easy task on both counts.

In this context, the IMF’s flagship reports do an admirable job of striking a balance between highlighting significant risks to the global economy from recent trade actions while also noting that markets have remained broadly resilient. The WEO’s “reference forecast” downgrades global growth 0.8 percent across 2025 and 2026, and growth forecasts for almost every country are also downgraded. But the WEO does not go so far as to forecast a global recession, and the IMF’s Pierre-Olivier Gourinchas stated in his remarks that financial markets have largely been resilient in the face of recent shocks. Likewise, the GFSR highlights recent volatility and elevated financial-stability risks without declaring a financial crisis to be imminent.

But the flagships do not shy away from laying out risks should trade tensions persist. Scrolling down in the WEO to page 33 (Box 1.1), the IMF lays out a more dire scenario from an extension of the US Tax Cuts and Jobs Act, continued weak domestic demand in China, and the lack of productivity growth in Europe. The GFSR highlights forward-looking vulnerabilities from a correction of asset prices and turbulence in sovereign bond markets.

The real message from both documents is heightened uncertainty. In fact, across the WEO and GFSR, the word “uncertainty” appears more than one hundred times. This message is on point, as uncertainty abounds and poses its own strains on the global economy. But how countries, including advanced economies, deal with this uncertainty will be the real determinant for future global growth.

APRIL 22 | 2:34 PM ET

Ukraine’s Serhiy Marchenko: Why not discuss the seizure of Russian assets?

APRIL 22 | 2:02 PM ET

We’ve seen these risks before

The IMF’s flagship reports have achieved a remarkable feat—bringing a clear-eyed view to what recent tariff announcements and financial volatility in recent weeks imply for the global economy, without pretending to know much about what will happen in the near future.

The 0.5 percentage-point drop in projections for global growth was expected, following a slowing in the global economy in recent months and the April 2 US tariff announcements. Interestingly, the suspension of many US tariffs, increases in the US tariff rate on China, and Chinese tariff increases in response have not led to a forecast upgrade but rather changed the composition of growth away from the United States and China and toward other countries.

Focusing on specific numbers does not yield much insight, however, as both the World Economic Outlook (WEO) and Global Financial Stability Report are clear on the uncertainty that still prevails. Further asset price corrections in the United States (where share prices still look expensive), coupled with higher interest rates (due to impending fiscal stimulus) and exchange rate fluctuations, have the potential to create significant shocks that could destabilize financial markets. Emerging markets could be in for a rude shock, but the prospects for advanced economies with high debt are not much better, given leveraged balance sheets and strong interlinkages between financial institutions and other market participants that could quickly propagate shocks throughout the system.

Hence, there should be no illusion about the risks facing the world economy. Such risks are reminiscent of the 2008 financial crisis, and continued uncertainty about tariffs and other policies could move markets closer to the abyss. Uncertainty goes in both directions, however. The WEO rightly points out that a resolution of the tariff issue and an end to the Ukraine war, however improbable right now, could provide a major boost for the global outlook. Whether global projections become reality, therefore, depends largely on actions being taken by the White House over the coming months.

APRIL 22 | 1:55 PM ET

Pakistan’s Muhammad Aurangzeb: Working with the US on commerce and trade is an “opportunity” for constructive engagement

APRIL 22 | 1:52 PM ET

What to know as China’s and the IMF’s forecasts continue to diverge

The IMF forecast of 4 percent growth for China both this year and in 2026 probably won’t go over well in Beijing.

The IMF’s World Economic Outlook (WEO) number for China’s projected growth is down from its January forecast of 4.6 percent. That puts the IMF more at odds with China’s official forecast of “about 5 percent” growth, released last month. It also contrasts with last week’s announcement out of Beijing that the Chinese economy grew 5.4 percent during the first quarter as exporters tried to get ahead of US tariffs (a result that was released after the WEO’s drafting ended). The IMF now puts China’s growth last year at five percent, which accords with the government’s figure.

IMF Economic Counsellor Pierre-Olivier Gourinchas told reporters that US tariffs actually will take a 1.3 percentage-point bite out of China’s growth this year, but that fiscal expansion announced by Beijing last month will offset some of that loss in momentum. However, the WEO says that China is still struggling to shift away from export-driven growth: “The rebalancing of growth drivers from investment and net exports toward consumption has paused amid continuing deflationary pressures and high household saving.” Small wonder then that the IMF is now forecasting that “stronger deflationary forces” will result in zero inflation this year, down from the IMF’s earlier forecast of 0.8 percent inflation. The IMF’s China growth forecast is at the midpoint of projections from foreign investment banks. Goldman Sachs and Nomura forecast 4 percent, Citi and Morgan Stanley predict 4.2 percent, while UBS projects 3.4 percent. By contrast, the Rhodium Group is seeing the possibility of China’s growth being stronger than last year’s 2.4 to 2.8 percent growth (according to Rhodium Group’s own estimates).

APRIL 22 | 11:40 AM ET

The IMF released its World Economic Outlook. Let the debate begin.

The latest IMF World Economic Outlook (WEO), released today, has three separate projections for global growth, each based on different outcomes for the Trump administration’s tariffs. The projection the WEO’s authors emphasized in their press conference this morning (which they call a “reference forecast”) is based on the impact of the tariff increases announced between February 1 and April 4 and sees global growth of between 2.8 percent and 3 percent this year. Overall, that represents about a 0.5 percentage point cut in the IMF’s growth forecast from its last WEO update released in January.

There is a cottage industry of economists who dissect WEO forecasts, many of whom view their IMF brethren as being too inclined to accentuate the positive. The latest of these critiques came last weekend from Alex Isakov and Adriana Dupita at Bloomberg Economics. “In the four large crises we studied,” they wrote, “the fund’s initial assessment of the immediate impact on global growth understated it by 0.5 percentage points. However much the IMF may downgrade the growth forecasts to start, history suggests the ultimate blow will be worse.”

That said, the IMF’s take hardly falls into the realm of Pollyannaish forecasting. IMF Economic Counsellor Pierre-Olivier Gourinchas made it clear at the press conference this morning that the risks facing the global economy lean “firmly to the downside,” with the risk of a worldwide recession currently at 30 percent, up from 17 percent at the time of the WEO released in October 2024.

APRIL 22 | 10:03 AM ET

No recession, says IMF. That’s good news—but perhaps not as good as it sounds.

This morning, while launching the new World Economic Outlook, IMF Chief Economist Pierre-Olivier Gourinchas said that “while we are not projecting a global downturn, the risk it may happen this year [has] increased substantially.”

But what is a global downturn or, to use a more ominous term, a global recession?

In an advanced economy, such as the United States, a recession is usually defined as two successive quarters of negative gross domestic product (GDP) growth. Not all countries use that standard, but most include negative GDP growth as part of the definition of a recession. But it’s different when you are talking about the global economy. Because many developing and emerging markets can grow at 5 percent or more during a given year, a global recession can occur even when overall global GDP growth is positive. Think of it like this—if your car only goes 20 mph, going to 0 mph is a major problem.

But it’s also a problem if your car is going 40 mph and you suddenly can only drive at 20 mph.

The IMF has a broad range of criteria it uses to try to determine a global recession, including a “deterioration” in macroeconomic indicators such as trade, capital flows, and employment. Translation? They know it when they see it. When I was at the IMF, there was a debate about whether GDP growth under 2.5 percent would constitute a recession. It seems like today the IMF has made a determination about what this looks like in the current situation—2 percent GDP growth—although they call it a global economic downturn.

Pay close attention to how Georgieva answers this question in her press conference later this week. And just because the global economy isn’t in a recession (or global downturn) by the IMF’s standards at the moment, it doesn’t mean in a few months we won’t cross the threshold.

This post was updated at 1:20 p.m. to clarify the IMF’s position on a global economic downturn.

APRIL 22 | 8:58 AM ET

Catch up with everything happening at the Atlantic Council on day two

LIVE NOW | #ACDailyBrief: It’s day 2 of IMF-World Bank Week. Join the Atlantic Council’s @JulietteFdezTV and @ACGeoEcon’s @alisha_chh for a preview of the top events, key speakers, and global economic trends to watch. https://t.co/X5DyXZt3G7

— Atlantic Council (@AtlanticCouncil) April 22, 2025

DAY ONE

How countries are reacting to the trade war

Dispatch from IMF-World Bank Week: The “stealth meetings” kick off

Our experts outline the debates and topics on the minds of global finance leaders this week

APRIL 21 | 8:52 PM ET

How countries are reacting to the trade war

As central bank governors and finance ministers gather in Washington, DC, for the IMF-World Bank Spring Meetings, they will be engaging in some of the most important trade negotiations since the creation of the Bretton Woods institutions in 1944.

History offers some perspective: In July 1930, after US President Herbert Hoover signed the Smoot-Hawley Tariff Act, a range of countries immediately retaliated against the United States, including France, Mexico, Spain, Japan, Italy, and Canada. Others, such as the United Kingdom, chose negotiation instead.

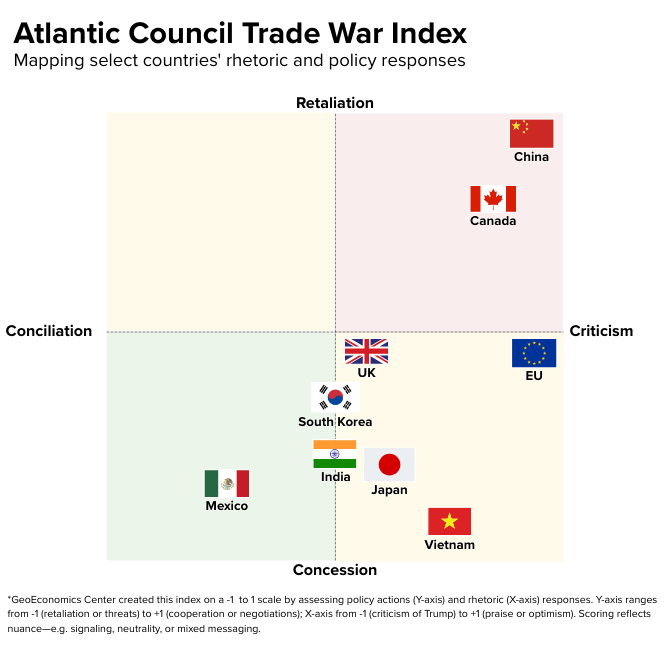

Today, the GeoEconomics Center has a Trade War Index, tracking countries’ policy actions and rhetoric in response to the Trump administration’s tariffs as central bank governors and finance ministers prepare to meet their US counterparts.

In this index, countries receive scores from -1 to +1 based on their responses. Take Vietnam, for example: It scored a +1 on policy after the country’s officials sent Trump a letter offering to eliminate tariffs on US imports (though this offer has already been rejected by the United States) and followed up by dispatching a special envoy to Washington to keep talks moving.

On the rhetorical front, Vietnamese trade officials called the tariffs “unfair” but focused their comments on domestic impacts rather than directly criticizing the United States—earning the country a -0.5 on the communication scale.

Separating policy from rhetoric reveals how these governors and finance ministers are approaching the negotiation table. Are they feeling domestic pressure to respond? Do they believe they have leverage over the United States? How much economic pain can they withstand?

Countries such as India and Mexico know there is an enormous amount at stake. Their leaders have thus far proven willing to make both conciliatory statements and concessions to Trump in the hopes of securing a deal. Global markets are watching nervously. The outcome of the sideline negotiations at these Spring Meetings will signal whether the White House is truly in deal-making mode or whether, as we have argued at the GeoEconomics Center, many of these tariffs are in fact here to stay.

APRIL 21 | 4:57 PM ET

Dispatch from IMF-World Bank Week: The “stealth meetings” kick off

The IMF-World Bank Spring Meetings have long been marked by pageantry. The Washington headquarters are normally draped with banners. Cultural events have competed with panel discussions on headline economic issues featuring government ministers, captains of finance, and Nobel laureates. Over the years, the event has earned the moniker “Davos on the Potomac” among jaded staffers.

But this year’s gathering is very different. Call it the “stealth meetings.” The signage is gone from outside the building, and inside is a bare-bones schedule of panels.

The tone is somber—and small wonder why. Just blocks away from the meetings sits the White House, where US President Donald Trump has spent his first one hundred days in office disrupting the global economy with tariffs unseen for a century. The United States is pulling back from international organizations, and its support for issues such as climate-change mitigation and poverty reduction is in question. Its position on the role of the IMF and World Bank in a rapidly changing international economy is unknown.

With the outlook for global growth clouded by the tariffs, all eyes turn to tomorrow’s release of the IMF’s World Economic Outlook (WEO). In last week’s curtain-raiser speech for the meetings, IMF Managing Director Kristalina Georgieva said that the WEO’s growth projections “will include notable markdowns, but not recession,” along with increases in the inflation forecast for “some countries.” Global recessions are relatively rare; the last occurred in the aftermath of the 2008 Global Financial Crisis. But there is plenty of room in a forecast of slower growth for individual countries to fall into recession—including some of the world’s largest economies.

To break down the WEO and all the other news from the week, keep checking out our analysis throughout the week.

APRIL 21 | 4:31 PM ET

Our experts outline the debates and topics on the minds of global finance leaders this week

KICKING OFF

Spring Meetings unlike others—and not just because of trade

Why these meetings are existential for the IMF and World Bank

Dispatch from IMF-World Bank Week: A fractured foundation

Three ways to think about Trump’s tariffs

What to make of Argentina’s new $20 billion financial rescue

The true impact of Trump’s tariff war, beyond the stock market

No one is coming to save the global economy

Trump can make the IMF more effective

APRIL 20 | 5:15 PM ET

Spring Meetings unlike others—and not just because of trade

In Washington, DC, the flowers are blooming, the skies are blue, and the streets are filled with finance ministers and central bank governors from around the world.

The scene at the start of this year’s IMF-World Bank Spring Meetings is familiar, but the context could not be more different. Questions about tariffs, trade wars, and the Trump administration’s broader stance on multilateralism abound. IMF Managing Director Kristalina Georgieva kicked off the Spring Meetings with her curtain raiser last week, and she did not shy away from making clear that trade tensions and the on-again, off-again tariff increases generate significant risks for growth and productivity. She rightly pointed out that smaller countries will be caught in the crosshairs and need to put their own houses in order to withstand trade shocks.

But what was more notable was Georgieva’s focus on macroeconomic imbalances, shorthand for the disparity seen between, for example, the massive current account deficits of the United States and the surpluses of China, the European Union, and Japan. These imbalances have gotten scant attention from the IMF in recent years, despite being a persistent issue for decades. The IMF’s latest External Sector Report declared that imbalances were receding.

Yet macroeconomic imbalances represent a key element of US complaints about the unfairness of the international trading system. Surplus countries have relied on US import demand to fuel growth for years, and the United States has played its part by sustaining large fiscal deficits. Last week’s speech rightly brought this issue back to the forefront.

For a sense of how far the IMF will take this message, pay close attention to the World Economic Outlook, Global Policy Agenda, and International Monetary Fund Committee (IMFC) communiqué, which will all be released later this week.

APRIL 20 | 4:52 PM ET

Why these meetings are existential for the IMF and World Bank

While the trade war is top of mind for delegates at the IMF-WB 2025 Spring Meetings, there is also concern about US policy towards the two Bretton Woods institutions.

It isn’t yet clear what that policy will be—it will depend on the conclusions of the review of US participation in multilateral organizations, the findings of which are due in August. From my discussions with individuals who will be participating in the IMF-World Bank meetings this week, I could sense worry about a number of possible US policy stances, ranging from insistence that the two institutions strictly focus on their core mandates (reversing a perceived mission creep going on for some time) to US withdrawal from one or both institutions.

Since the United States is the largest economy in the world and the biggest shareholder of the IMF and World Bank, these institutions can only function effectively with the constructive engagement and leadership of the United States. Thus, this year’s spring meetings are of existential importance to the IMF and World Bank. While going through the public agenda, delegates should spend time to discuss and find ways to address the concerns raised by the US administration with minimal negative spillovers for the rest of the world: including the US concern about persistent trade imbalances, which it attributes to unfair trade practices, including high tariffs and other non-tariff measures, implemented by other countries. Progress in these discussions will be important to retain active US involvement in the two institutions.

For example, as a part of such progress, the IMF could put greater emphasis on its recommendations to countries running persistent current-account surpluses to make adjustments, including by strengthening their currencies, to promote more balanced trade relations over time, instead of putting the burden of adjustment solely on deficit countries.

The open, rules-based trading system—which has promoted aggregate world economic growth but failed to equitably distribute the fruits of free trade—is unraveling. Usual calls for member countries to lower tariffs and walk back other protectionist measures won’t be sufficient to stop it.

APRIL 20 | 3:16 PM ET

Dispatch from IMF-World Bank Week: A fractured foundation

If you’re at Dulles Airport this evening, look around. You might see one of the world’s finance ministers and central bank governors, representing over 190 countries, who are arriving for the most important IMF-World Bank Meetings since the 2008 Global Financial Crisis.

They land in a very different Washington than the one they left in October. US President Donald Trump has launched a global trade war, and, as a consequence, the IMF is set to forecast a major downgrade for the entire global economy. Whether the countries these financial leaders represent end up in a recession—or worse—depends in part on what happens over the next five days.

Usually, delegates’ time at these meetings is focused on a wide range of topics, from sovereign debt to new lending arrangements to financial technology. But this spring, there’s no debate over attendees’ focus: Trade will dominate, as each country looks to meet with the Trump administration to see whether any trade negotiation is viable. The main event will be when senior US and Chinese officials meet, if they do. It would be their first meeting since their countries levied tariffs higher than 100 percent on each other.

But here’s the irony of the week ahead: By engaging in all the bilateral negotiations, these countries are unintentionally undercutting the case for multilateral economic coordination that is the foundation of the Bretton Woods system.

Each country will work to secure the best arrangement for itself and its citizens. None of this would be surprising to the creators of the IMF and World Bank; just look at the minutes from the original conference to see all the wrangling between the forty-four founding nations.

But this is a first: The world’s largest economy, and the one that created the Bretton Woods system in the first place, is trying to completely uproot it.

For every country, the challenge of this week is to not get trapped in the past. There will be time to consider all the successes and failures of the past eighty years. But right now, the international economic order is being reshaped in real time.

That’s what this week is about: not who has complaints about the system—nearly every country has its fair share—but who has the vision for what comes next.

Watch more

APRIL 18 | 2:16 PM ET

Three ways to think about Trump’s tariffs

The second Trump administration has embarked on a novel and aggressive tariff policy, citing a range of economic and national security concerns. Our GeoEconomics Center is monitoring the evolution of these tariffs and providing expert context on the economic conditions driving their creation—along with their real-world impact.

The Trump administration utilizes tariffs in three primary ways, depending on the objectives of any particular action.

- Negotiation tool: The administration sees tariffs as a way to put pressure on trade partners during negotiations, as well as a potential bargaining chip. Used in this way, tariff rates can increase US leverage and result in new trade agreements, like the US-China Phase One trade deal signed during Trump’s first term.

- Punitive tool: Trump administration officials have stated that they would like to avoid overuse of financial sanctions as a form of coercive economic statecraft, since they believe it can incentivize countries to reduce their reliance on the US dollar. As an alternative, the Trump administration is relying more on tariffs to “punish” or “sanction,” including for non-trade issues. The administration values the ability to easily escalate the tariff rate and, therefore, its punitive power.

- Macroeconomic tool: The Trump administration also, more conventionally, wields tariffs in support of a wide range of macroeconomic goals:

- Protecting domestic industries, such as steel, from unfair trading practices and encouraging domestic manufacturing.

- Decreasing US trade deficits.

- Increasing revenue from duties. Of course, the “Catch-22” is that if reshoring is successful, the United States will not be able to increase revenue from import duties.

Explore the full Trump Tariff Tracker

APRIL 16 | 3:52 PM ET

Four questions (and expert answers) about Argentina’s new $20 billion financial rescue

Buenos Aires is getting a boost. On April 11, the International Monetary Fund (IMF) approved a twenty-billion-dollar, four-year loan to Argentina, with the first twelve billion dollars arriving on April 15. The Inter-American Development Bank (IDB) and World Bank followed up by releasing another $22 billion in financing. In response, Argentina lifted large elements of its currency and capital controls, known as the “cepo,” which had long stifled investment and growth. Marking the twenty-third IMF loan to Argentina since the 1950s, the deal comes as libertarian President Javier Milei has dramatically cut Argentina’s spending in an effort to stabilize government finances. Atlantic Council experts answered four pressing questions about Argentina’s latest financial rescue and the road ahead.

Read their answers

APRIL 11 | 7:22 AM ET

To understand the impact of Trump’s tariff war, watch the bond market and the Fed—not just the stock market

The imposition of US tariffs and retaliatory tariffs by some trading partners, combined with a ninety-day pause of most “reciprocal” tariffs by US President Donald Trump, have led to extreme financial market volatility in recent days. While the equity market gyrations have occurred in relatively orderly market conditions so far, some recent developments have signaled that selling pressure may have spread to other markets—particularly US Treasury securities and short-term US dollar funding.

To understand the financial stability impacts of the current market turmoil, it is important to monitor the pressure on these markets, which are crucial for the smooth functioning of the global financial system. Left unaddressed, these strains could trigger a freezing up of financial markets, raising the risk of a serious financial crisis.

Continue reading

APRIL 8 | 11:46 AM ET

No one is coming to save the global economy

US President Donald Trump has launched a global economic war without any allies. That’s why—unlike previous economic crises in this century—there is no one coming to save the global economy if the situation starts to unravel.

There is a model to deal with economic and financial crises over the past two decades, and it requires activating the Group of Twenty (G20) and relying on the US Federal Reserve to provide liquidity to a financial system under stress. Neither option will be available in the current challenge.

First, the G20. The G20 was created by the United States and Canada in the late 1990s to bring rising economic powers such as China into the decision-making process and prevent another wave of debt crises like the Mexican peso crisis of 1994 and the Asian financial crisis of 1997. In 2008, as Lehman Brothers collapsed and financial markets around the world began to panic, then President George W. Bush called for an emergency summit of G20 leaders—the first time the heads of state and government from the world’s largest economies had convened.

What followed was one of the great successes of international economic coordination in the twenty-first century—the so-called London Moment, when the G20 agreed to inject five trillion dollars to stabilize the global economy. With this joint coordination, the leaders sent a powerful signal to the rest of the world that they would not let a recession turn into a worldwide depression.

Nearly twelve years later, at the outbreak of the COVID-19 pandemic, the same group of leaders convened to work on debt relief, fiscal stimulus, and—critically—access to vaccines.