Is China decelerating or recovering?

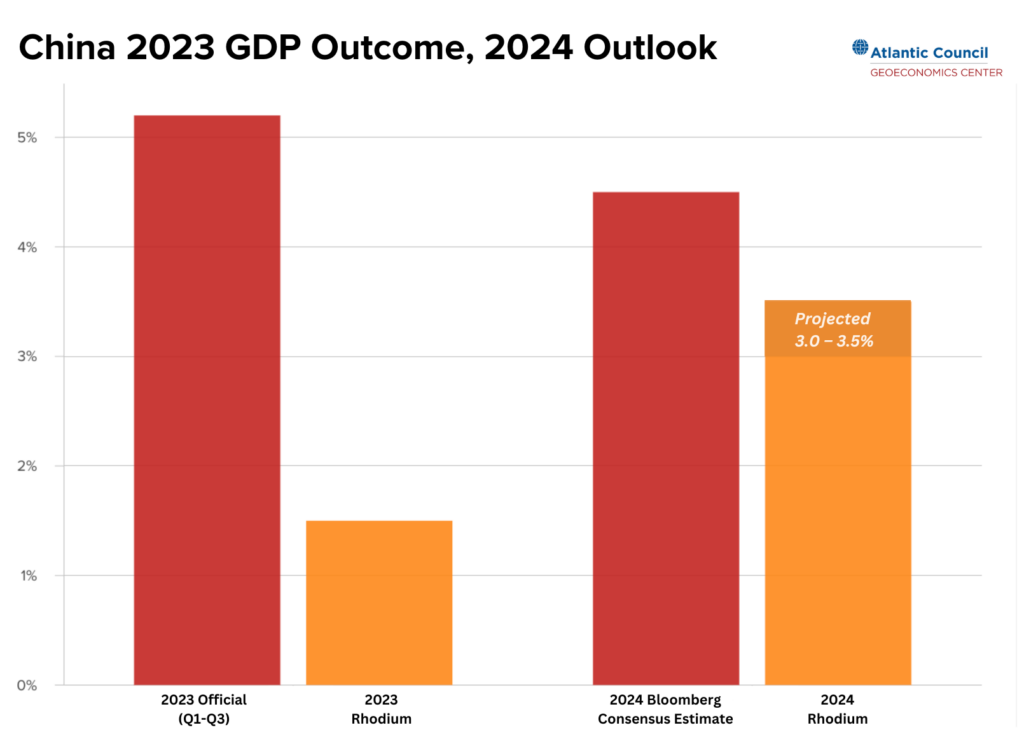

One year ago, only wonky economists cared about China GDP debates. “Will it be 5 percent or only 4.8 percent growth?” is inconsequential. Twelve months later it’s a different story. On January 17 Beijing claimed to have achieved 5.2 percent growth for 2023 but the parade of economic disappointments all year was impossible to square with that.

Given how far from credibility China’s 2023 statistics were, closer attention will be paid this year. Institutions which previously took China’s official numbers at face value, including the IMF and OECD, know that individuals, firms and countries with fewer analytical resources depend on them to check the math. Updated IMF WEO projections released January 30 upgraded China’s 2024 forecast by 0.4 percentage points, to 4.6 percent. Meanwhile, the Fund’s Article IV report on China, with its franker Staff Report section, should come out soon. Together these will clarify how international organizations assess the health of China’s economy.

Rhodium Group’s growth outlook for China in 2024 is again lower than consensus, as it was last year, but because our 2023 estimation was so much lower than the official figures (a mere 1.5 percent GDP growth at best) we see 2024 as a modest recovery rather than the continued deceleration reflected in consensus numbers. This is a cyclical stabilization resulting from property hitting rock bottom.

Still more secular stagnation will come—until Beijing gets back to long-deferred structural reform work that President Xi Jinping started in 2013 only to pause in the face of challenges. But a cyclical breath may be what Beijing needs, and explains People’s Bank of China (PBOC) Governor Pan Gongsheng’s remark last week, “now that China’s economy is recovering, we have greater room for maneuver in terms of macro policy”. Greater room, yes; but not a great amount of room. Even the 3-3.5 percent GDP growth we imagine possible for 2024 will require Governor Pan and peers to regain credibility by doing what is necessary to sustain economic growth even when it requires political sacrifices.

Daniel H. Rosen is a nonresident senior fellow with the Atlantic Council’s GeoEconomics Center and a founding partner of Rhodium Group where he leads the firm’s work on China, India and Asia.

At the intersection of economics, finance, and foreign policy, the GeoEconomics Center is a translation hub with the goal of helping shape a better global economic future.

Further reading

Wed, Oct 4, 2023

Running out of road: China Pathfinder 2023 annual scorecard

Report By

The China Pathfinder project examines whether China’s economy is converging or diverging with the world's leading open market economies.

Wed, Jan 10, 2024

China’s local government debts are coming due

Econographics By Jeremy Mark

China's economic slowdown brings local government debts into sharp focus, threatening infrastructure and social services.

Mon, Dec 11, 2023

China’s manufacturing overcapacity threatens global green goods trade

Econographics By Niels Graham

Chinese lending is exacerbating a growing glut in its green manufacturing sector. Beijing is increasingly looking abroad to absorb excess capacity. This may have devastating effects for the global trading system as economies move to protect their own domestic industry.

Image: Stock Market Graph next to a Chinese banknote (showing Mao). Red downtrend indicates the stock market recession period