The 2020 Global Energy Forum—hosted by the Atlantic Council Global Energy Center on January 10–12, 2020 in Abu Dhabi—identified that the conversation around US energy markets tends to focus on gas and coal versus renewables, how to meet emerging state-level carbon goals, advancing battery storage, and how to update and future-proof our extensive grid infrastructure that already exists. Discussions at the forum applied an international lens with a look at oil markets in a changing world, gas as a bridge fuel, co-financing of nuclear plants, widespread energy poverty and how to bring electricity to all, and the potential vulnerabilities of grid interconnections between nations.

Polls taken in the United States indicate that 19 percent of the population does not believe human activity contributes to climate change. Whereas outside the United States—where climate denial is much less prevalent—multinational companies, governments, start-ups, and individuals agreed on the need to collaborate in order to keep carbon emissions low enough to prevent a 1.5 degree Celsius increase on our planet’s surface.

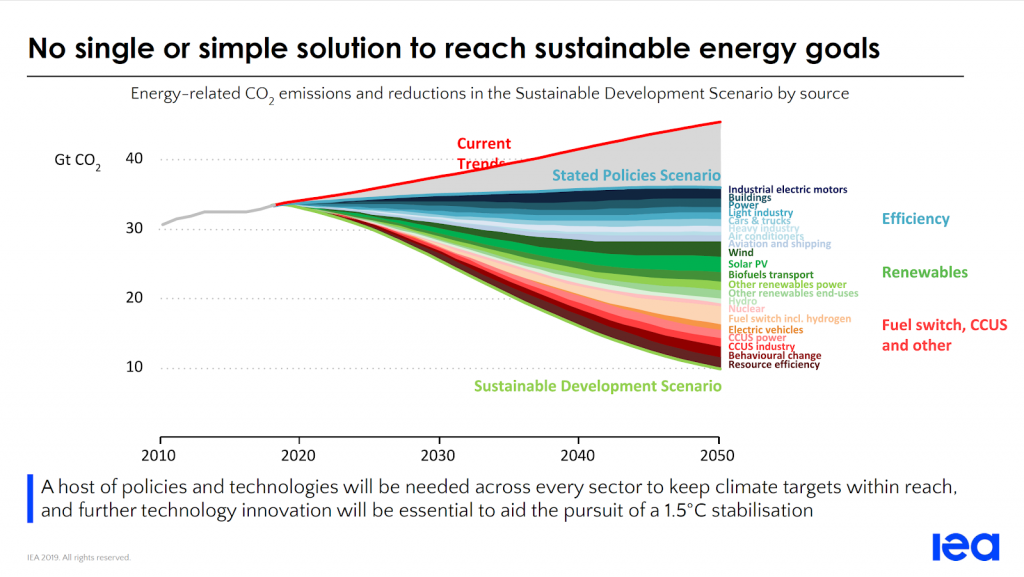

Dr. Fatih Birol, executive director of the International Energy Agency (IEA), presented the below slide at the beginning of the forum to demonstrate the breadth of opportunities that could be sought out by sustainable investors. As stated at the forum, we need most, if not all, of these to succeed in order to truly achieve the goal of stabilizing global temperatures.

Topics such as carbon pricing; Environment, Sustainability & Governance (ESG) ratings; and energy source planning through 2050 were covered with great detail at the forum, but what will it take to drive more sustainable investing to keep our planet temperature below a 1.5 degree increase?

Investment decisions are primarily based on two criteria: Internal Rate of Return (IRR) and relationships (investor to investor or investor to company). IRR is simply the return on capital invested while incorporating the time value of money. Profits are what determine that return, so either increasing revenue or decreasing operating expenses are what drive the profits that return capital to investors.

One solution that has spurred sustainable investment internationally is carbon pricing—essentially putting a price on carbon emissions that is equivalent to increasing operating expenses. The intent is to level the playing field, so that high carbon-emitting energy producers, such as coal plants, yield similar profits as solar and wind energy producers that are still in the process of achieving economies of scale, in order to compete for energy demand. During the 2020 Global Energy Forum, emphasis was placed on successful carbon pricing, but also on the possibility of such policies becoming more efficient. Think of it as price discrimination as applied to companies at the country, state, or city level based on carbon output (and its impact in on the environment for that region), which would improve transparency for investors as they determine how to best deploy their capital.

One other solution to drive sustainable investment is to build out a more accessible clean energy investment network. CleanTX is uniquely positioned as a clean technology economic development nonprofit, where clean energy start-ups are striving to grow in the energy market while investors are looking for future-proof investment opportunities. Connecting and financing among these entities also relies on experienced investors, government buy-in, and trust. Building rapport and driving co-investment from the public sector in order to de-risk sustainable investment is necessary in order to attract sophisticated and unsophisticated investors towards opportunities that are good for the bottom line and for our planet.

Ryan Edwards is a Veterans Advanced Energy Fellow with the Atlantic Council Global Energy Center’s Veterans Advanced Energy Project. He is a former US naval flight officer, now a finance manager in the solar industry and chairman of the Board of Directors for CleanTX. You can follow the Veterans Advanced Energy Project on Twitter @vets_energy

Learn more about the Veterans Advanced Energy Project

Image: Dr. Fatih Birol, executive director of the International Energy Agency (IEA), speaking at the 2020 Atlantic Council Global Energy Forum, January 11, 2020 in Abu Dhabi.