It’s time to salvage US-Saudi relations. And no, it’s not just because of oil.

A recent headline from The Economist declared Gulf countries as “winners from the world’s turmoil.” While this may be the case, there is still good reason to maintain the US-Gulf partnership. More importantly, the recent tensions between Saudi Arabia and the United States is no reason to jettison the longstanding relationship.

In September, OPEC+ announced a two million barrel per day cut in oil production. Two months earlier, President Joe Biden’s visit to Saudi Arabia, amid turbulent economic and geopolitical dynamics, had provoked a torrent of pundit and media commentary about the agenda, the dynamics of the exchange, and conflicting expectations about outcomes. The US media expressed concerns over Saudi Arabia’s human rights records and its war in Yemen. Regional analysts were equally skeptical of the visit, but for different reasons: they cited inconsistencies in US foreign policy and its commitment to the region.

The scrutiny of the trip was so intensive that President Biden wrote a Washington Post op-ed explaining the importance of the region to US national interests and outlining a list of goals for the visit, including seeking an end to the war in Yemen, dealing with the Iran nuclear issue, and seeking the help of Gulf Cooperation Council (GCC) countries to lower oil prices.

Such negative perceptions of US foreign policy come as no surprise and are reasonably justified based on the inconsistencies in US policy. The divergent US domestic and regional views capture broad constituencies on both sides and reflect the realities of global and regional changes underway.

For its part, the United States skirted the rhetoric of democracy and human rights by promoting the concept of partnership with countries that support a rules-based global order, while feigning amnesia about Biden’s political campaign bluster promising to make Saudi Arabia a “pariah state.” As for regional leaders, there was no denying the underlying sense of schadenfreude throughout the visit. Although crude oil prices have declined by nearly 25 percent since July (until the OPEC+ production cuts announced in October), this decline was more likely due to a drop in demand from the global economic slowdown and rising expectation of a global recession.

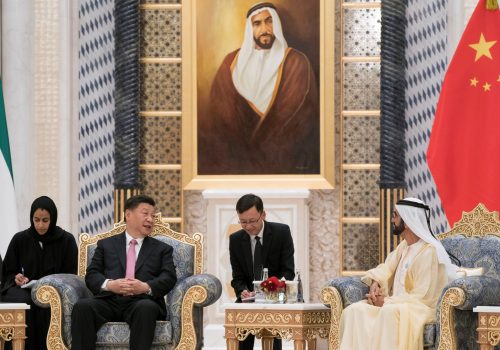

The confluence of rapidly growing trade between the GCC and China and the emerging schisms with the United States have created closer ties for the region with Beijing as politics followed economics, leading to further estrangement with the United States.

The timing of the OPEC+ decision to cut oil output, however justifiable from a technical perspective, could only deepen the rift with the United States against a background of tectonic shifts in the global economic and geopolitical order. The OPEC+ decision was later followed by Saudi Aramco’s announcement on raising prices on oil shipments to the United States while holding prices steady or lower for European and Asian shipments.

Though the decision about the production cut is smaller than the headline and the differential pricing is technical and small, the optics and the timing could be viewed as a challenge to the United States both for economic reasons—as fighting inflation is now at the center of US policy—and political reasons, since the United States is embroiled in a proxy fight against Russia in Ukraine.

Underpinning the emerging US-Saudi rift are powerful economic forces shaping future regional and global issues. This includes: the changing structure of the US-GCC strategic relationship, the region’s fragile economics, the Western pattern of clawing back money paid for energy, and changing US power and stature in the region.

Changing structure of US-GCC strategic relationship

Coming on the heels of supply chain disruptions, the Russian invasion of Ukraine has unleashed new forces that have reaffirmed the role of the Gulf as an important global economic power, propelling Saudi GDP, for example, to nearly $1 trillion. Offsetting such recognition is a potential change in the structure of the US-GCC strategic relationship. The cornerstone of this relationship is an energy and military security bargain—a pact that is undergoing transformation. The primary pillar of the relationship entails an unwritten agreement: in return for ensuring the flow of energy at reasonable prices, the United States offered an implicit assurance of stability for the region. The secondary pillar of the bargain involves the region’s commitment to purchase US arms. Both pillars were important drivers for US interests in the region.

Since 2000, however, US oil and gas output has nearly tripled, with output rivaling both Russia and Saudi Arabia. So, while the Middle East will remain an important energy source for the foreseeable future, it is no longer critical for US energy security per se. Meanwhile, while military sales have been an important component of US economic interest in the region, Russia’s invasion of Ukraine and tensions with China have shifted the arms market. NATO members will likely raise military spending to 2 percent of their respective GDPs, or an estimated additional $100-$120 billion annually—much of which will flow to the US defense industry. As such, this large new flow will reduce the importance of the GCC as a major buyer of US weapons. Similarly, the US preoccupation with China and Ukraine may reduce its appetite to commit large resources to a region of increasingly diminishing returns.

Region’s fragile economics

Notwithstanding the recent Economist article’s claim of $3.5 trillion in future wealth transfer to the GCC countries, the region’s economics remain fragile. Apart from the implicit assumption about the sustainability of high energy prices, the region’s finances remain shaky. First, the region’s public sovereign wealth funds, estimated at $2 trillion, have suffered large declines in value of about 20-30 percent through September 2022. Second, the cost of the region’s $500 billion in imports of goods and services have increased by 8-10 percent.

As a result, while the region’s income from rising energy prices has been significant, the net impact on the region’s wealth has been negative. When such losses are added to those incurred by private investors, the total losses to the region may be as high as $600 billion, or 30 percent of its GDP. Hence, the region could emerge with a net deficit in 2022.

Western pattern of clawing back money paid for energy

Despite the loss of wealth, higher oil income will lead to an annual transfer of wealth of over $1 trillion from consuming nations to the OPEC+ countries. During past energy shocks starting with the 1970s, the West has always found ways of clawing back most of the money it paid to import energy. This was done through multiple mechanisms, including inflation and currency devaluation (reducing the purchasing power of the oil producers who import most of what they consume), through wars and conflicts, and finally weapons sales. This time may not be different. The use of sanctions by the West, particularly the United States, (that have gone beyond historical precedent after the Russian invasion of Ukraine) against state and private citizens is one tactic of increasing concern. The promiscuous use of sanctions as a form of economic warfare and the extra-legal use of the US dollar as an instrument of coercion will heighten such anxiety.

Changing US power and stature

Costly, failed wars abroad in the past, its present involvement in Ukraine, and its concerns over China have overstretched the US’s foreign policy. The credibility and consistency of US policy in the region are further tested by its declining share of global economic power. As one Economist article recently pointed out, the collective GDP of the G7 economic alliance now represents 44 percent of the global economy, which is down from 66 percent in 1991—a 33 percent drop in thirty years. A construct of the 1970s, it excludes China, whose GDP in 2021 was larger than the six G7 members combined, except for the United States.

It is, therefore, not surprising that the region views the United States as a declining power. This perception has led policymakers to seek alliances and sources of weapons and technology to meet the region’s vulnerability to multiple threats. This drive to diversify its economic and security architecture has serious implications for the region and beyond.

While China and Russia will sell weapons to the region, neither can nor will displace the United States as a security guarantor in the near term. Weapons alone are inadequate in safeguarding against the region’s vulnerabilities to non-state actors that could damage the region’s economy. A map of the GCC shows that most power and water desalination plants are located along the waters of the Gulf. As the attacks on Aramco’s facilities in Abqaiq and other multiple drone attacks on Saudi Arabia and the UAE demonstrate, Iran or other actors can inflict damage that could cripple the region’s economy. Few weapons can defend against such threats, as modern asymmetric warfare has amply illustrated the inadequacy of modern militaries against motivated insurgencies.

Options under consideration for US retaliation

Facing a Hobson’s choice in past confrontations, the United States has deployed its considerable power to strip adversaries of their wealth through direct intervention or economic sanctions, using the dollar as a powerful, low-cost tool to respond to perceived threats. While the history of sanctions shows their limited effectiveness, they can inflict severe damage. As an unintended consequence of recent events, the US Senate has moved swiftly to consider several options, none of which are favorable to the oil producers. These include a bipartisan bill entitled “No Oil Producing and Exporting Cartels Act” (NOPEC), which is aimed at enacting an antitrust law to revoke the sovereign immunity that protects OPEC+ and its national companies.

This proposed legislation was initially opposed by the Biden administration, which now seems to be more open to it. In attempting to meet current oil shortages, the United States is considering easing sanctions against Venezuela as it weighs measures to advance reviving the Joint Comprehensive Plan of Action (JCPOA) with Iran. Both measures have long-term repercussions, including adding additional long-term oil supplies to the market. Worse, even if the region finds alternative security arrangements, the present architecture of the international banking system and the dominance of the US dollar limit the region’s options.

The US-Saudi alliance is ninety years old and, while nations act in their perceived interests, a breach of this alliance has potential negative consequences for both sides and the region. In the absence of a clear winning strategy, mending fences appear to be the only wise choice before the current cycle of escalation takes on new inertia. Economics has historically followed politics, and this time may prove no exception.

Dr. Hani Findakly is an investment banker and former vice chairman of the Clinton Group, Inc. He is also the former director of investments of the World Bank Group.

Further reading

Thu, Jul 14, 2022

Biden’s Middle East trip focuses on the region. But China is the elephant in the room.

MENASource By Ahmed Aboudouh

US President Joe Biden’s visit to the Middle East on 13-16 July won’t directly focus on China. However, the rising power will be the elephant in the room at the Saudi summit in Jeddah.

Mon, Aug 1, 2022

Biden’s trip to the Middle East: Outcomes and opportunities

Event Recap By

On July 21st, the Middle East Programs’ Israel Project, in collaboration with the Scowcroft Middle East Security Initiative, hosted a virtual event titled “Biden’s trip to the Middle East: Outcomes and opportunities.”

Tue, Oct 18, 2022

The New Middle East is dismissing great power competition—for now

MENASource By Jean-Loup Samaan

The more local actors grow confident about their own autonomy, the less tempted they will be to align themselves on the agenda of another external power.

Image: FILE PHOTO: Egypt's President Abdel Fattah al-Sisi; Bahrain's King Hamad bin Isa bin Salman al-Khalifa; US President Joe Biden; Saudi Crown Prince Mohammed bin Salman; Jordan's King Abdullah II; Qatar's Emir Sheikh Tamim bin Hamad al-Thani; and Kuwait's Crown Prince Meshal al-Ahmad al-Jaber al-Sabah pose for the family photo during the Jeddah Security and Development Summit (GCC+3) at a hotel in Jeddah, Saudi Arabia July 16, 2022. Mandel Ngan/Pool via REUTERS/File Photo