Trade trumps strategic competition in the Middle East

The dynamics of United States-China-Russia relations make strategic competition a compelling framework for thinking about international politics. The meeting between Xi Jinping and Vladimir Putin in Beijing during the 2022 Winter Olympics was emblematic, with the two pledging a friendship “with no limits” and “no ‘forbidden’ areas of cooperation.” The Chinese response to the war in Ukraine and the overall deterioration of US-China relations, all emphasize the enormous chasm between Washington’s preferences for global order on the one side and Beijing’s and Moscow’s on the other.

At the same time, strategic competition runs the risk of great power narcissism. Leaders in Washington and Beijing, looking at countries and regions around the world, see themselves competing. Meanwhile, the rest of the international community sees a fragile order at risk, threatening political and economic stability. The binary options increasingly on offer are unappealing and world leaders are always aware that there are more than two choices.

The view from Abu Dhabi is illustrative. The United Arab Emirates’ (UAE) response to US-China competition reflects deep concerns. At an October 2021 conference, presidential diplomatic advisor Anwar Gargash worried that the rivalry is forcing countries in the Middle East to “make impossible choices.” The US-UAE relationship is at a low point, described as a “stress test” by Ambassador Yousef Al Otaiba. The UAE was upset by Washington’s response to the January 17 Houthi attacks on Abu Dhabi, and remain frustrated by the Joe Biden administration’s frosty relations with Saudi Arabia. Despite recent attempts by the US to reset the bilateral relationship, it will require a lot of diplomacy to untangle.

Meanwhile, the UAE’s growing relations with China have continued to prosper. Talks on the long-discussed F-35 deal were suspended by the Emirati side in December 2021, citing concerns with “technical requirements, sovereign operational restrictions, and cost/benefit analysis.” This announcement was followed in February by another announcement that the UAE would purchase twelve Chinese L-15 trainer aircraft. While the L-15 and the F-35 serve different purposes, the purchase from China is significant, demonstrating that the UAE has options in its efforts to diversify its sourcing of weapons.

Against this backdrop, a series of recent agreements underscore that great power competition isn’t the only game in town. Shortly before the suspension of the F-35 deal, French President Emmanuel Macron paid a visit to the UAE on December 3, 2021, which resulted in a $19 billion deal for eighty Rafale fighter jets and twelve Caracal military transport helicopters—the largest such sale France has ever made. Weeks later, on January 16, then-South Korean President Moon Jae-in also visited Abu Dhabi—a trip overshadowed by the dramatic Houthi drone attacks—and signed a deal worth $3.5 for Cheongung II surface-to-air missiles. Another significant outcome was progress towards a proposed South Korea-Gulf Cooperation Council free trade agreement.

Free trade agreements are the order of the day in the UAE. In February, India and the Emirates announced the Comprehensive Economic Partnership Agreement—New Delhi’s first significant foreign trade agreement (FTA) since signing one with Japan in 2011. Remarkably, it was activated in only eighty-eight days, coming into effect on May 1. It is expected to increase trade and services from $61 billion to $115 billion within five years. In late May, the UAE and Israel announced a free trade agreement as well, with the goal of tripling the value of trade within three years.

This is reflective of a larger trend. In much of the world, the overriding concerns are economic and developmental, and the Middle East is certainly no exception. Increased trade builds political capital and drives deeper relations. As US Commerce Secretary Gina Raimondo recently said at the World Economic Forum in Davos: “In the era between World War II and now, the US has used traditional trade agreements to get close to our allies.” The same logic explains the growth in FTAs across Eurasia.

However, the domestic political environment in the US makes trade deals very difficult to achieve. Abandoning the Trans-Pacific Partnership in 2017 was good for election campaigns in certain districts but it was a diplomatic disaster. Since then, the result has been a widespread perception, especially in the Middle East, of a US focused solely on strategic and security issues, engaging with other countries largely in response to competition with China.

Secretary of State Antony Blinken’s speech on May 26, “The Administration’s Approach to the People’s Republic of China,” did little to dispel this. In it, he described China as “the only country with both the intent to reshape the international order and, increasingly, the economic, diplomatic, military, and technological power to do it.” He said the Biden administration “will shape the strategic environment around Beijing to advance our own vision for an open, inclusive international system,” to be accomplished with a three-word strategy: invest, align, and compete.

Investing and competing are good—they create more wealth and options. Aligning is more problematic. First, the world is all too aware that the Republican party under and since President Donald Trump has very different views about the utility of alliances and partnerships. Diplomatic engagement under the Biden administration could change dramatically after the 2024 general election. Second, alignment against China is hard to achieve when many countries—especially in the global south—don’t see it in the same negative light that Washington does.

In countries with pressing development needs, China’s transformation since beginning the Reform Era in 1978 is an admirable achievement. After decades of failed Washington consensus policies, many are willing to learn from Beijing. When the developed global north warns against the perils of Chinese predatory loans or suspicious tech practices, the message is worse than hollow in the global south—it’s hypocritical.

Returning to the case of the UAE, alignments show how to strengthen the US’s position vis-à-vis China. In its deepening engagement with India, South Korea, France, and Japan, Abu Dhabi is increasing interdependence with a broad set of US allies and partners—all of which have their difficulties with Beijing. The great power binary typically describes the US as the security partner and China as the economic partner. There are, however, many other partners.

China was the UAE’s top trade partner in 2021, with bilateral trade valued at an impressive $75.6 billion. Simply saying China is number one gives an incomplete picture, however; numbers two and three also count. India, with its freshly minted Comprehensive Economic Partnership Agreement, a strategic partnership agreement with the UAE, and an expatriate community of nearly 40 percent of the UAE population, was the second-largest trade partner in 2021 at $61 billion. It was followed by Japan at $37 billion. More significantly, Japan is a major energy customer for the UAE, typically its second-largest export destination (just behind India), and also has a strategic partnership agreement with the Emirates. The binary of great power competition misses the important role that other powers play.

For the US to successfully compete with China, the alignment part of Secretary Blinken’s equation is key. Partners and allies can be a force multiplier, creating opportunities and leverage when US domestic politics get in the way of its foreign policy. Free trade agreements and security cooperation between allies can contribute to stability and prosperity. At the same time, a one-dimensional view of China doesn’t help. Washington would do well to understand that many outside the US have a different view of China, and very few are interested in being a theater of strategic competition.

Jonathan Fulton is a nonresident senior fellow with the Atlantic Council and host of the China-MENA Podcast. He is also an assistant professor of political science at Zayed University in Abu Dhabi. Follow him on Twitter: @jonathandfulton.

Podcast series

Listen to the latest episode of the China-MENA podcast, featuring conversations with academics, government leaders, and the policy community on China’s role in the Middle East.

Further reading

Wed, Feb 23, 2022

China and Russia are proposing a new authoritarian playbook. MENA leaders are watching closely.

MENASource By Ahmed Aboudouh

It’s on major Western democracies to make democracy appealing again by aggressively filling the gaps China and Russia exploit to make the world more accommodating to their political models and the new trend of rising authoritarianism.

Thu, Jan 27, 2022

China is trying to create a wedge between the US and Gulf allies. Washington should take note.

MENASource By Jonathan Fulton

Recent events indicate that leaders in Beijing are no longer satisfied with the logic of strategic hedging and are pursuing a more muscular approach to the Gulf.

Thu, Feb 3, 2022

China may now feel confident to challenge the US in the Gulf. Here’s why it won’t succeed.

MENASource By Ahmed Aboudouh

Despite China’s growing aggressive approach towards the United States in the region, it has no detailed plan to execute it successfully.

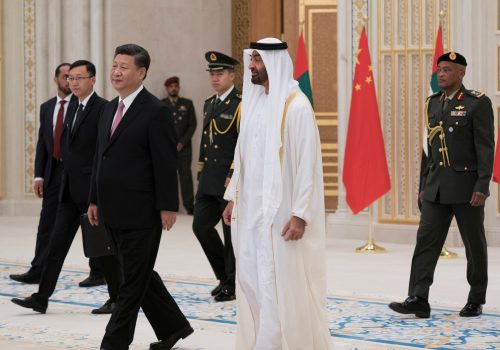

Image: Abu Dhabi's Crown Prince Sheikh Moahmmed bin Zayed al-Nahyan presents an Arabian horse as a gift to the Chinese President Xi Jinping at the Presidential Palace in Abu Dhabi, United Arab Emirates July 20, 2018. WAM/Handout via REUTERS