US-Brazil trade dashboard

The United States and Brazil have a long-standing trade relationship and decades of robust economic ties. The United States runs a persistent bilateral trade surplus with Brazil and has emerged as Brazil’s primary source of foreign direct investment. But new US tariffs on Brazil in 2025 have altered that relationship. This tracker monitors the evolving trade dynamics between the United States and Brazil, providing essential context on the underlying effects of tariffs and how they are reshaping the trajectory of US-Brazil commerce and trade dynamics more broadly.

How US trade with Brazil is evolving

In April 2025, US President Donald Trump imposed a 10 percent tariff on Brazil as part of the administration’s “Liberation Day” tariffs on nearly every country in the world. Then in July 2025, Trump imposed an additional 40 percent tariff on Brazil specifically, which further raised tariffs on products not affected by the Trump administration’s other Section 232 duties on certain industrial goods. Our analysis of both US and Brazilian trade data shows that initially, since the implementation of these new tariffs, US imports of Brazilian products have deviated significantly from the pre-tariff trend line. At the same time, US exports to Brazil have remained consistent with the pre-tariff trend line

US purchases of products in which Brazil plays a key role as a supplier have also decreased significantly since the imposition of the new tariffs. Brazil supplied at least 20 percent of US imports for a number of goods in 2024, including coffee, orange juice, cane sugar, iron ore, aluminum oxides and hydroxides, vanadium products, various tropical woods, pig iron, fuel ethanol, meat, and a range of agricultural byproducts.

Our analysis shows that US imports of these products declined dramatically through September 2025; however, as of November 13, 2025, several categories, including coffee, orange juice, and meats, were granted exemptions from both the reciprocal and Brazil-specific tariffs, and we await the release of new trade data to assess the impact of these measures.

What these evolving trade dynamics look like in practice

This section analyzes a subset of specific products for which Brazil is a key supplier to the US market.

The bigger picture

The United States has consistently posted trade surpluses with Brazil.

In goods, US exporters have seen strong Brazilian demand for machinery, chemicals, aircraft, and high-value manufactured products, helping sustain a steady merchandise trade surplus over many years. The US advantage is even more pronounced in services, where American firms lead in sectors such as finance, technology, and professional services, generating a reliable services surplus. Tourism flows further reinforce this trend as part of the services trade: Brazilian travelers visiting the United States typically spend significantly more than US visitors to Brazil, adding to the overall US surplus.

How Brazil’s international trade partners are changing

Since the imposition of new US tariffs on Brazil, Brazil’s export markets have changed significantly, while the source of its imports, particularly from the United States, has remained relatively stable.

The US export market share declined 5.3 percent in October 2025 compared to October 2024, while China’s rose by 5.2 percent. Meanwhile, the US market share of Brazil’s imports grew 1.2 percent year over year in October 2025.

Acknowledgements and data

Authors: Ignacio Albe, assistant director, and Valentina Sader, Brazil lead, from the Adrienne Arsht Latin America Center.

Data: All data used in this dashboard can be found here.

The research team would like to thank Apex Brazil, the Brazilian Trade and Investment Agency, for its support for this research project.

Further reading

The Adrienne Arsht Latin America Center broadens understanding of regional transformations and delivers constructive, results-oriented solutions to inform how the public and private sectors can advance hemispheric prosperity.

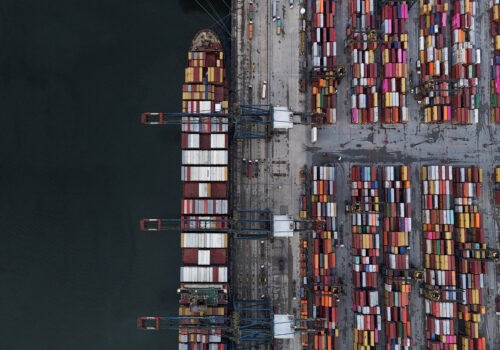

Image: Ships docked at the Guanabara Bay are pictured with the Sugar Loaf mountain in the background in the state of Rio de Janeiro, November 19, 2014. REUTERS/Pilar Olivares (BRAZIL - Tags: MARITIME SOCIETY)