The 2023 Global Energy Agenda

In 2022, Russia’s invasion of Ukraine undermined the global energy system’s return to pre-COVID-19 normalcy, injecting turmoil and uncertainty into the sector. Russia’s gas cuts led Europe to compensate for the loss of energy supply by reverting to coal and oil, leading the global community to confront deepening tensions between national security, energy security, and climate action.

Read the 2024 Global Energy Agenda

However, the crisis in Europe, despite causing an upsurge in carbon-intensive power, provided the world with fresh impetus to change the trajectory of the energy transition. In response, policymakers worldwide are hastening efforts to decouple their economies from foreign hydrocarbons and to decarbonize energy systems. Ultimately, the war may accelerate longer-term energy trends toward a more sustainable and secure system.

Against this backdrop, energy leaders head into 2023 with a greatly revised outlook from 2022, as revealed in the Atlantic Council’s third edition of the Global Energy Agenda. The publication includes an analysis based on our survey of energy stakeholders, representing a wide variety of professions across the sector from more than fifty countries. Complementing our survey analysis, a diverse group of experts, corporate leaders, and policymakers contributed essays that provide deeper insights on the tumult of 2022 and its implications for reshaping energy systems for the future.

Despite a year defined by complications to the energy transition, there is reason to be optimistic as the global energy community doubles down on in-tandem efforts to achieve climate goals and longer-term energy security for all.

Foreword

The 2023 Global Energy Agenda

Last year in this space, I wrote that the world seemed to be in a holding pattern, as we worked together to exit the pandemic while keeping decarbonization targets within sight. The decarbonization imperative remains, but this year’s challenge is now focused on how new geopolitical threats will shape the energy future, precipitated by Russia’s invasion of Ukraine in February 2022. We can only accomplish the energy transition if we, at the same time, pay renewed attention to energy security.

It may seem expedient to treat Russian aggression as the immediate, near-term threat, while deferring the need for climate action. However, both challenges must be met simultaneously.

Although the energy future remains uncertain, many countries, especially those like Germany and Italy that were deeply dependent on Russian energy supplies, have started to chart a new path toward energy security through clean energy sources and more reliable and resilient supply chains. Even as we recognize the need for reliable and affordable energy, it was encouraging at COP27 to see the world come together once again to reiterate commitments to a sustainable and equitable energy transition.

In its third edition, the Global Energy Agenda has again taken the pulse of the global energy policy community, including contributions from leaders in governments, the private sector, and expert communities.

This year, their survey responses revealed new insights into the connections between geopolitics and energy security, the balance between the energy transition and fossil fuels, and challenges and opportunities along the path to net-zero. Respondents tended to vote together as blocs based on their geographic locations, their industries within the energy sector, and their views on the speed at which the energy transition will occur.

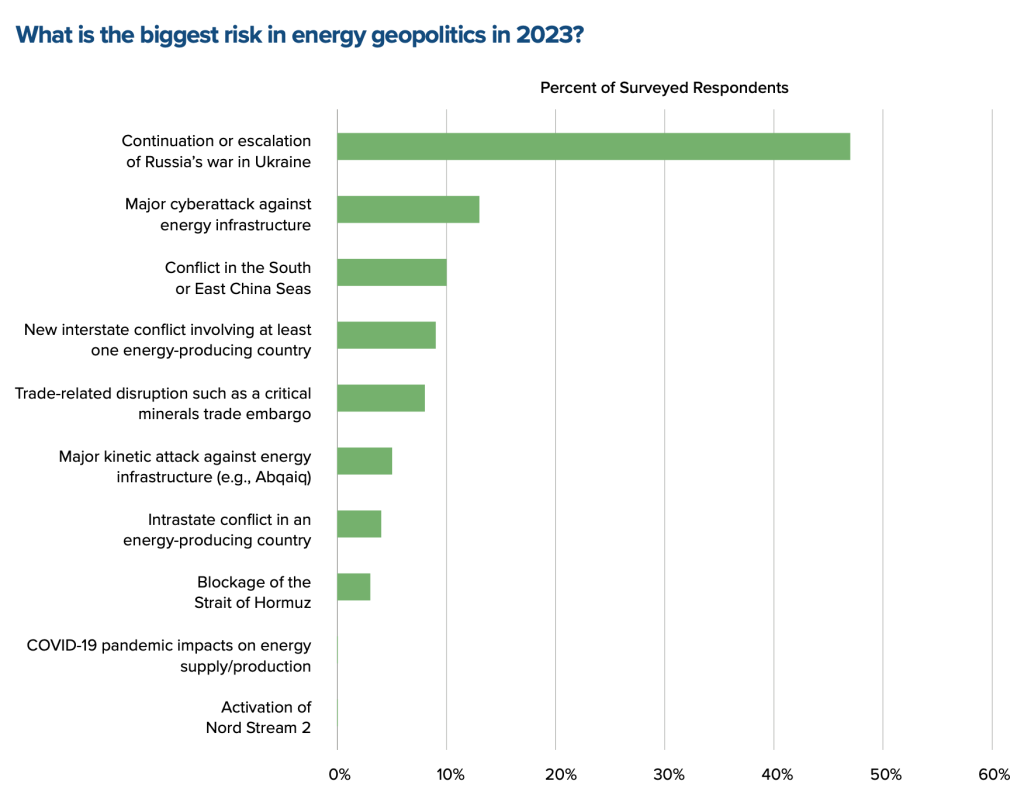

We noticed a few major changes between last year’s Global Energy Agenda survey and this year’s. Most interestingly, but not surprising, nearly half (47 percent) of respondents now believe that the greatest geopolitical risk is posed by conflict with a major energy producer, in contrast to last year, in which respondents were far more divided on their assessment of geopolitical risk with only 26 percent choosing a major cyberattack as the great risk.

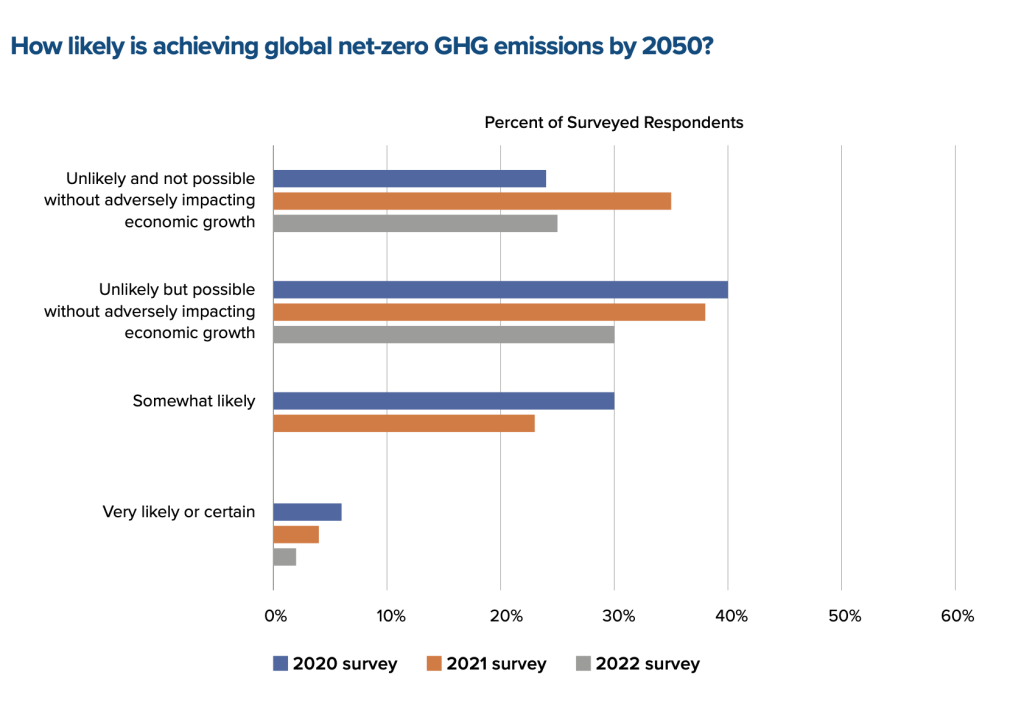

There was also cautious optimism among respondents in their views of the likelihood of achieving net-zero by 2050. This year, 45 percent believe it likely that the world will attain net-zero by 2050, with 55 percent disagreeing. Although the hopeful still constitute a minority, their numbers are up from 27 percent last year. Meanwhile, a slight majority of 51 percent think that reaching net-zero would have at most a limited negative effect on GDP, or even a positive one.

The essays in this publication give voice to diverse perspectives. Coming from different segments of the global energy landscape, the authors naturally put forth divergent views on the future of their sector. But if there is a common thread among them, it is that now is the time to leverage today’s energy crisis for faster progress.

As Winston Churchill said while working to form the United Nations after World War II, “Never let a good crisis go to waste.”

In last year’s Global Energy Agenda, I wrote that “the course that we chart to net-zero must be steady but also ambitious enough to meet the challenge.” And after Davos last year, I wrote that I am going “short” on pessimism and “long” on optimism.

I think that’s the right note to hit in a year that will culminate with COP28. hosted by the United Arab Emirates, which will be colored by attainable, pragmatic solutions to achieve the inclusive and sustainable energy outcomes the world so urgently needs.

Frederick Kempe is the President and Chief Executive Officer of the Atlantic Council.

Introduction

In 2022, as the world was learning to cope with COVID-19 and its deadly toll, Russia’s invasion of Ukraine shattered hopes in the West for a return to normalcy. Over the course of the year, the unprovoked attack and Russia’s weaponization of natural gas rapidly reshaped interdependent energy systems around the world.

Although the humanitarian devastation and mass casualties caused by the war—including the displacement of millions of Ukrainians—have radically surpassed the economic and political challenges imposed on the global energy system, the ongoing energy crisis has and will continue to have far-reaching consequences.

With energy prices retreating from multiyear highs, an apparent calm has settled on the broader market outlook. On the horizon, however, stirs a more complicated future, as the energy crisis complicates the probability of a smooth transition.

Around the world, volatility from higher energy and food prices is further shrinking household budgets already stretched thin, forcing many people to choose between heating their homes and feeding their families. The International Energy Agency’s (IEA) 2022 World Energy Outlook estimates that seventy-five million people who have recently gained access to clean energy are likely to lose the ability to pay for extended electricity services, and a hundred million may no longer be able to afford clean cooking solutions.1International Energy Agency (IEA), World Energy Outlook 2022, Revised Version, 2022, https://www.iea.org/reports/world-energy-outlook-2022. Price and economic pressures associated with today’s energy crisis mean that “the number of people without access to modern energy is rising for the first time in decades.”2Laura Cozzi et al., “For the First Time in Decades, the Number of People without Access to Electricity Is Set to Increase in 2022,” Commentary, IEA, November 3, 2022, https://www.iea.org/commentaries/for-the-first-time-in-decades-the-number-of-people-without-access-to-electricity-is-set-to-increase-in-2022.

Beyond these immediate impacts, the severe constriction of Russian natural gas flow to Europe has raised the question of the war’s long-term effects on the global energy transition and the overall fight against climate change. To make up for the void left by the near shutoff of Russian gas supplies, Europe has turned to the use of carbon-intensive coal and oil to generate electricity, a response criticized by some climate advocates as shortsighted in the face of worsening droughts, extreme heat, rising oceans, and other effects of planetary warming. The current surge in carbon-intensive fossil energy use, however, appears transitory. Laying bare just how tightly interconnected national security is to energy security, policies advanced in Washington and Brussels are emblematic of the urgency with which lawmakers are seeking to decouple their economies from reliance on foreign oil and gas imports. If anything, the war has heightened the urgency around accelerating low-carbon energy deployment as a critical tool for shoring up countries’ energy security.

The European Union’s RePowerEU strategy is expressly designed to make the continent “independent from Russian fossil fuels well before 2030” by empowering a clean energy economy anchored in deployment of renewable energy and energy efficiency.3“REPowerEU: Joint European Action for More Affordable, Secure and Sustainable Energy,” European Commission, Press Release, March 8, 2022, https://ec.europa.eu/commission/presscorner/detail/en/ip_22_1511. This comes in addition to the EU’s continued progress on its Fit for 55 plan to reduce emissions by 55 percent by 2030 compared to 2005 levels. The United States, meanwhile, is working to rapidly implement the nation’s most significant piece of climate legislation, the Inflation Reduction Act, which aims to reduce the country’s carbon emissions by 40 percent by 2030 compared to 2005 levels. As with all major legislation, the law has its detractors, but Congress’s incentive-laden approach, with its ample support for consumers and corporations, likely means the statute has staying power. And considering the United States’ status as the world’s largest economy, Washington’s massive investment in clean energy and corresponding supply chains will reverberate globally.

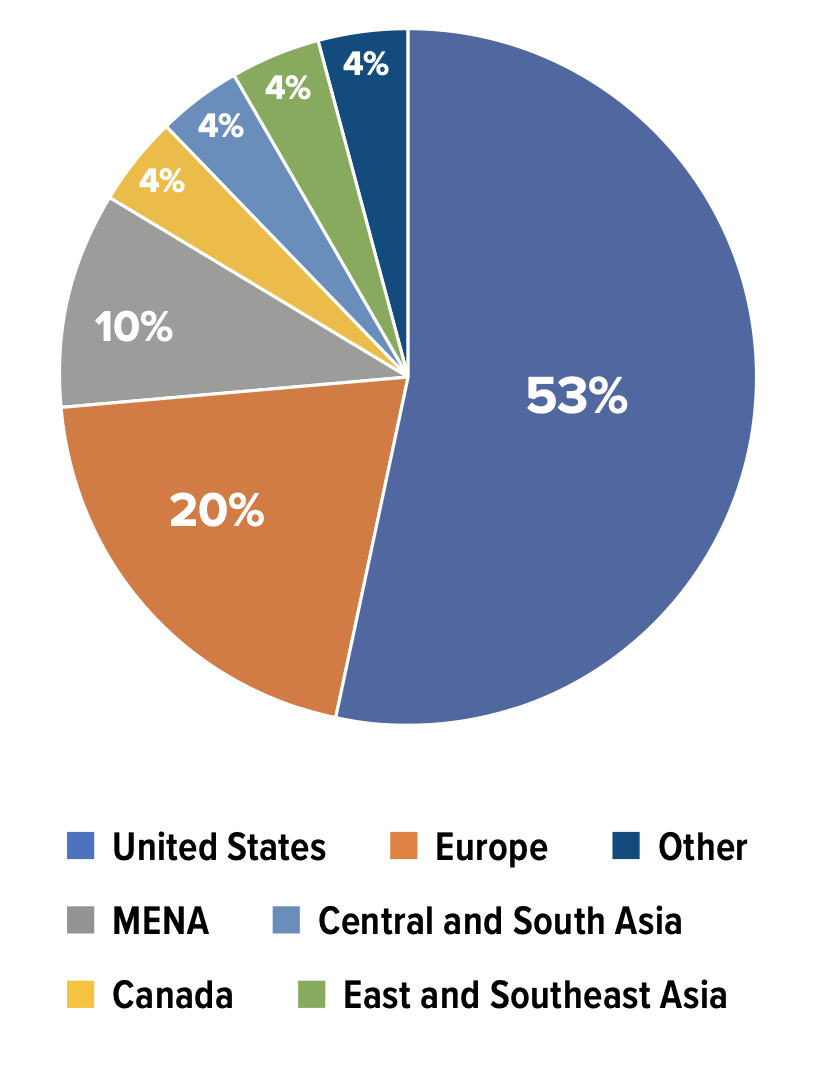

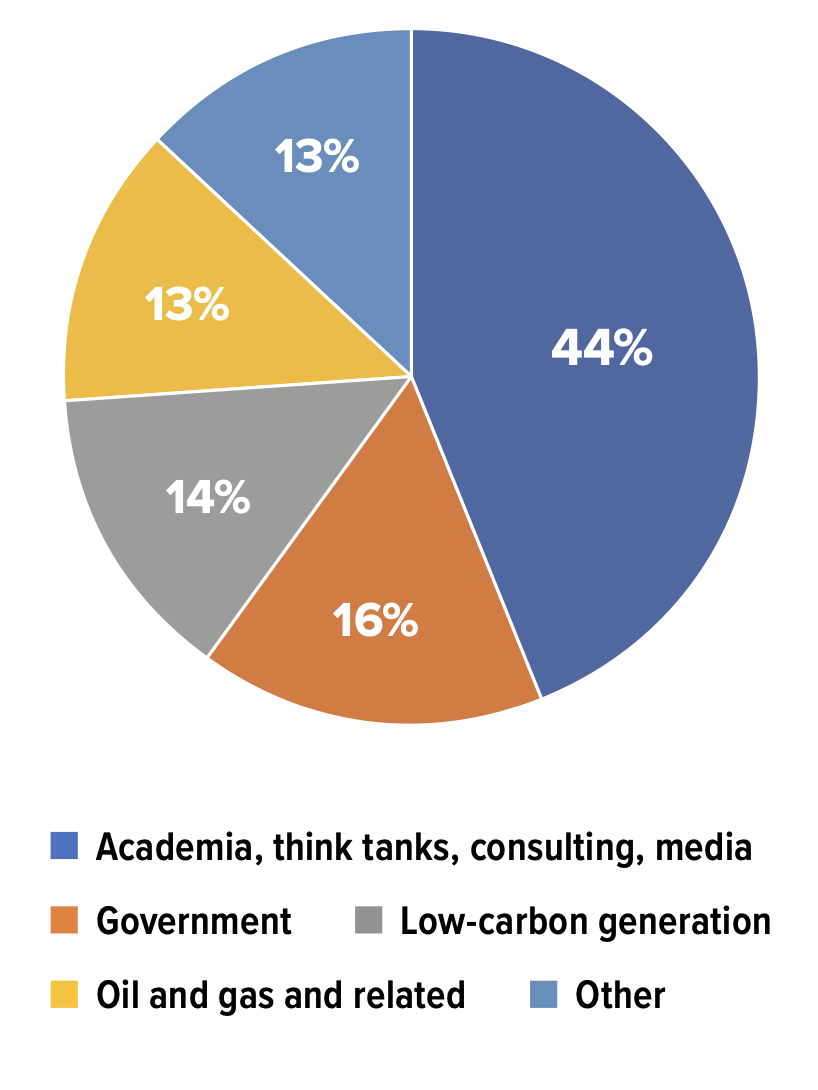

The 2023 Global Energy Agenda survey and expert perspectives

Given this context, it is unsurprising that energy leaders head into 2023 with a completely different outlook than a year prior. To gain insights into their thinking, the Atlantic Council conducted its third annual survey for its 2023 Global Energy Agenda. The survey was conducted from October 14 to November 23, a window that overlapped with the 2022 United Nations Climate Change Conference, widely known as COP27. This report distills the survey responses, drawing on the insights of energy stakeholders from more than fifty countries, and representing a variety of fields associated with the sector. An appendix provides additional demographic details. As with last year’s survey, the 2023 Global Energy Agenda continues a tradition of employing various questions and insights from prior years’ results and analyses to help hone key findings.

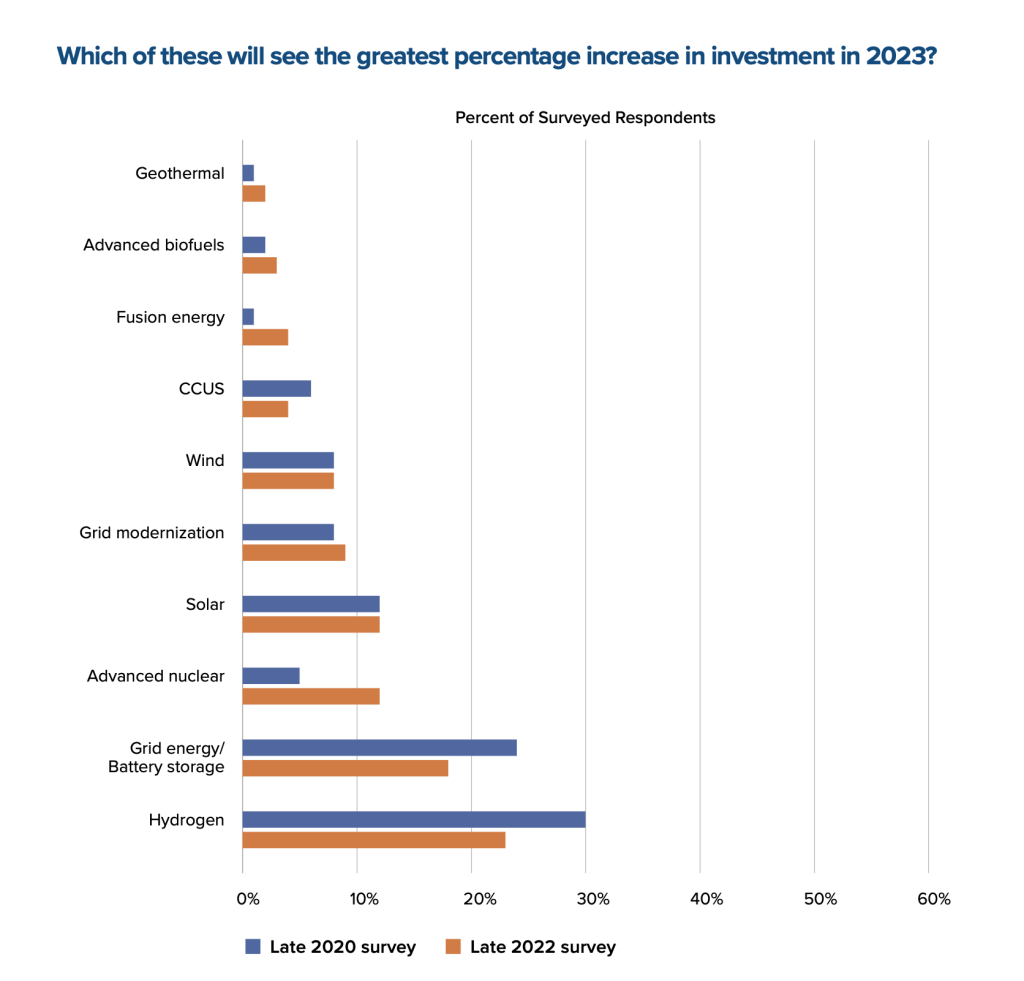

To complement our survey analysis, the Atlantic Council Global Energy Center invited global experts, corporate leaders, and government officials to con- tribute essays for this Global Energy Agenda to provide deeper insights into issues facing the energy sector and the world’s prospects for the energy transition. Our contributors span the globe and represent a diverse array of perspectives from energy leaders. The essays cover topics ranging from critical mineral supplies to advanced nuclear power to climate diplomacy, and altogether set the energy agenda for the year ahead as the world looks for a meaningful commitment to climate action on the road to COP28.

In this year’s edition, our analysis draws distinctions where significant differences existed between groups based on respondents’ geographic region; which industry they work in within the energy sector (oil and gas, nuclear power, renewables, etc.); and their views on when the world will reach peak oil demand. The latter group is further subdivided to provide key insights into those who see an accelerated energy transition (“energy transition bulls”) and those who predict a more enduring role for oil and gas in the global energy mix (“energy transition bears”). These categories tend to vote together as blocs in their responses throughout the survey.

Collectively, the survey results and expert essays that compose the 2023 Global Energy Agenda have yielded the following key insights.

The crisis in Europe is dusting off the playbook for geopolitics and energy

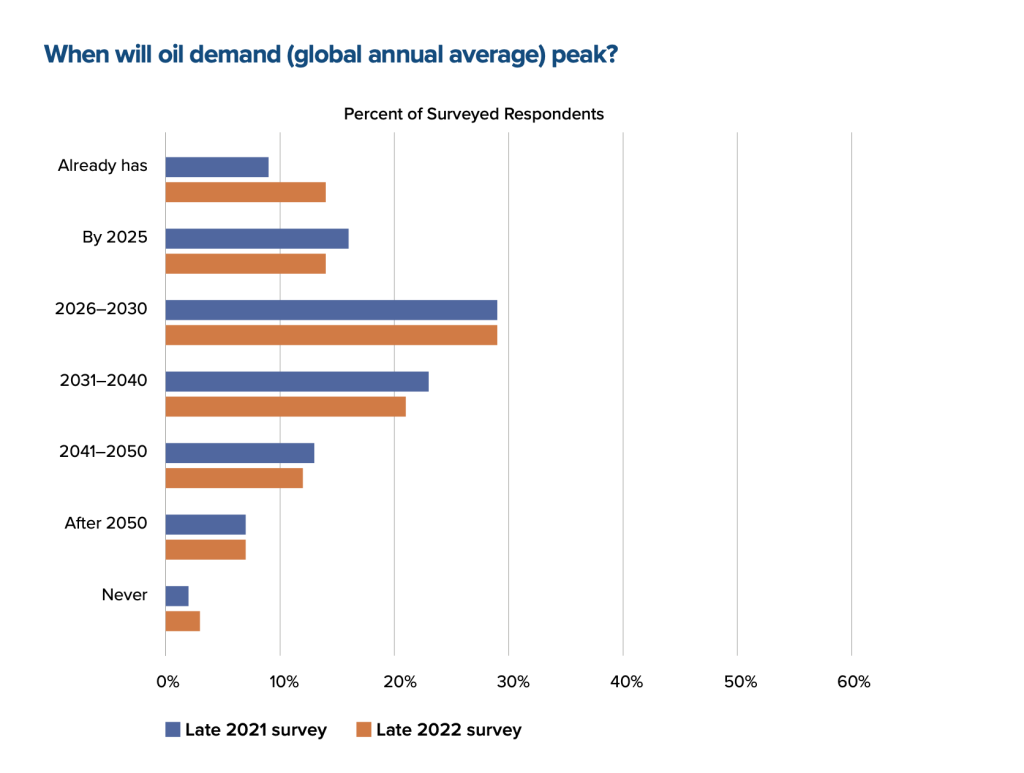

Russia’s war in Ukraine has recalibrated the contemporary wisdom on geopolitical risk that existed just a year ago. In the fall 2021 survey, which was conducted only a few months before Russia’s February 2022 invasion, the most frequently mentioned geopolitical risk facing the energy sector was a major cyberattack; however, at only about a quarter of respondents, there was no strong consensus. Additionally, a conflict including a major energy producer was at the top of the risk list for only 17 percent of respondents, despite mounting concerns in Western security circles at the time the survey was taken that Russia was preparing for an armed incursion into Ukraine.

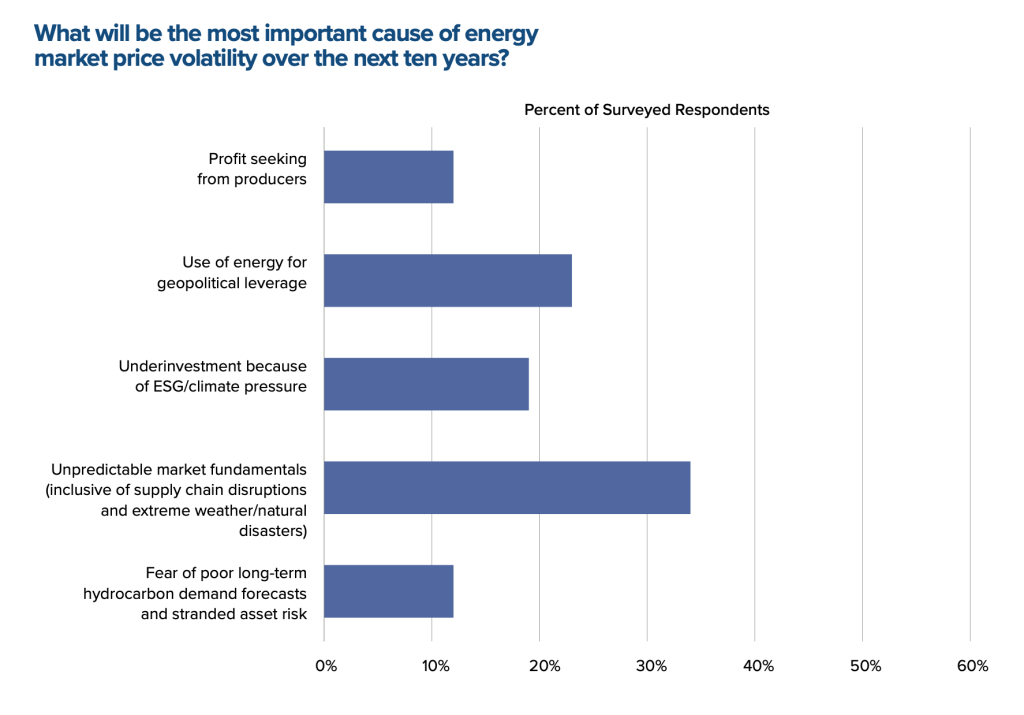

Naturally, in our fall 2022 survey, nearly half of respondents say that the Russia-Ukraine war is the top risk. Representing one-tenth of global oil and gas supply in 2020, Russia has historically served as a meaningful contributor to global energy trade, making it impossible to divorce the Kremlin’s decision to invade Ukraine from the stability of global energy markets, especially in a moment of increased fragility in the wake of the pandemic. The consequences of this political gamesmanship on energy policy and trade are on par with the 1973 Arab oil embargo and 1979 oil crisis. The marked effect on energy prices, however, is expected to be temporary, according to survey respondents: a notable contingent sees oil demand ebbing in the next decade. This expectation is perhaps an indicator as to why just 23 percent believe that geopolitical leverage will be the primary cause of price volatility come 2030.

Midcentury net-zero optimism is on the rise

There is little consensus on the means of achieving net-zero emissions by 2050, but the number of respondents that see the world meeting its zero-emission aims by midcentury is rapidly growing. Although still in the minority, the percentage of survey respondents that believe net zero is within reach in the next thirty years has spiked to 45 percent, a sizable increase from only 27 percent of participants predicting this outcome one year ago. In recent years, the concept of a net-zero energy system has unquestionably gained traction in political and industry circles around the world. Even dedicated oil-producing countries such as the United Arab Emirates and Saudi Arabia have set net-zero benchmarks—2050 and 2060, respectively—with the Kingdom closely associating net-zero goals with its aims of promoting key domestic policies such as the circular carbon economy framework. Interestingly, however, optimism for a net-zero future is most subdued among those working in zero-carbon sectors (i.e., renewables, nuclear, and advanced energy technologies), with 73 percent responding that it is “unlikely” that the world will reach net-zero by 2050, higher than those in oil and gas (62 percent).

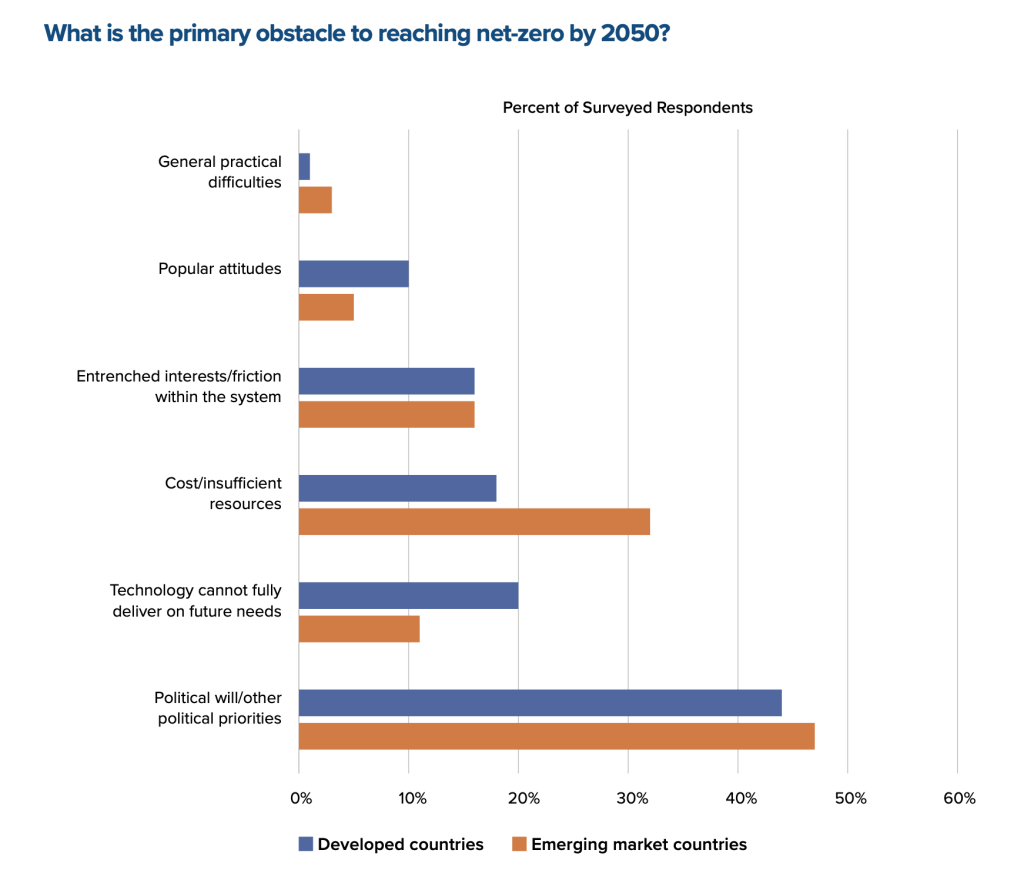

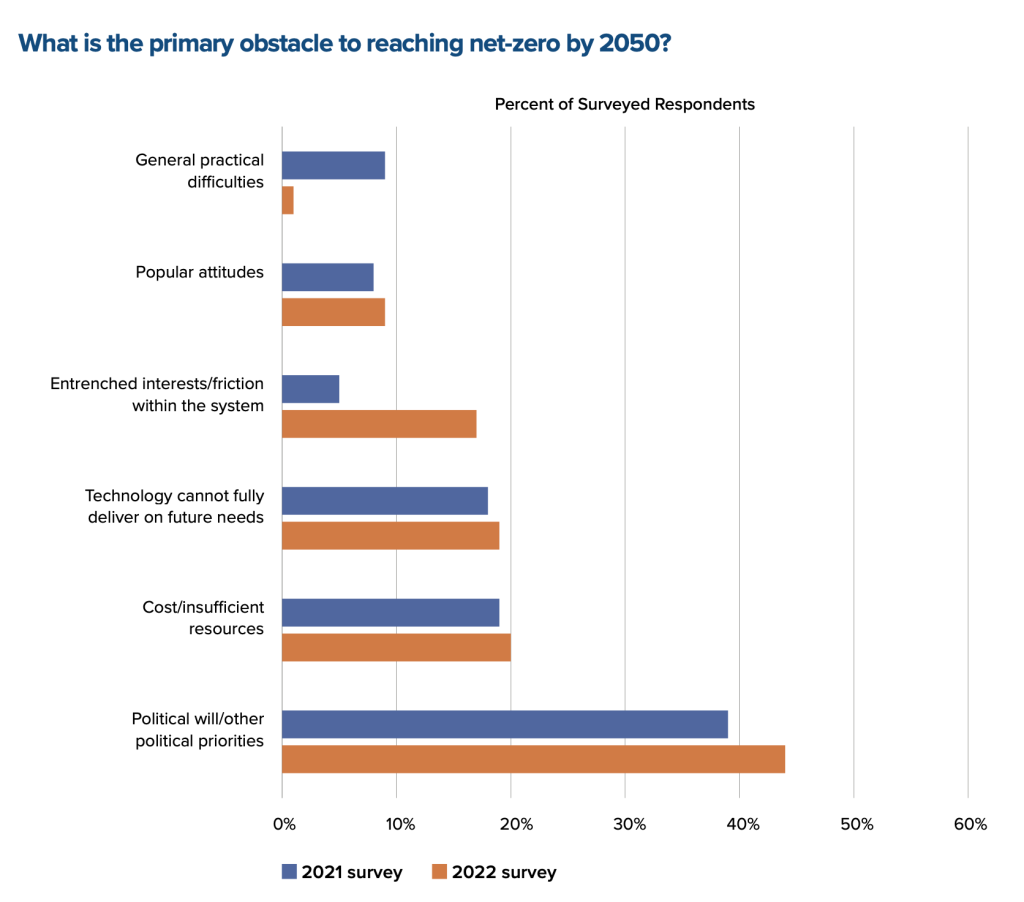

Global North-South divide on achieving the clean energy transition

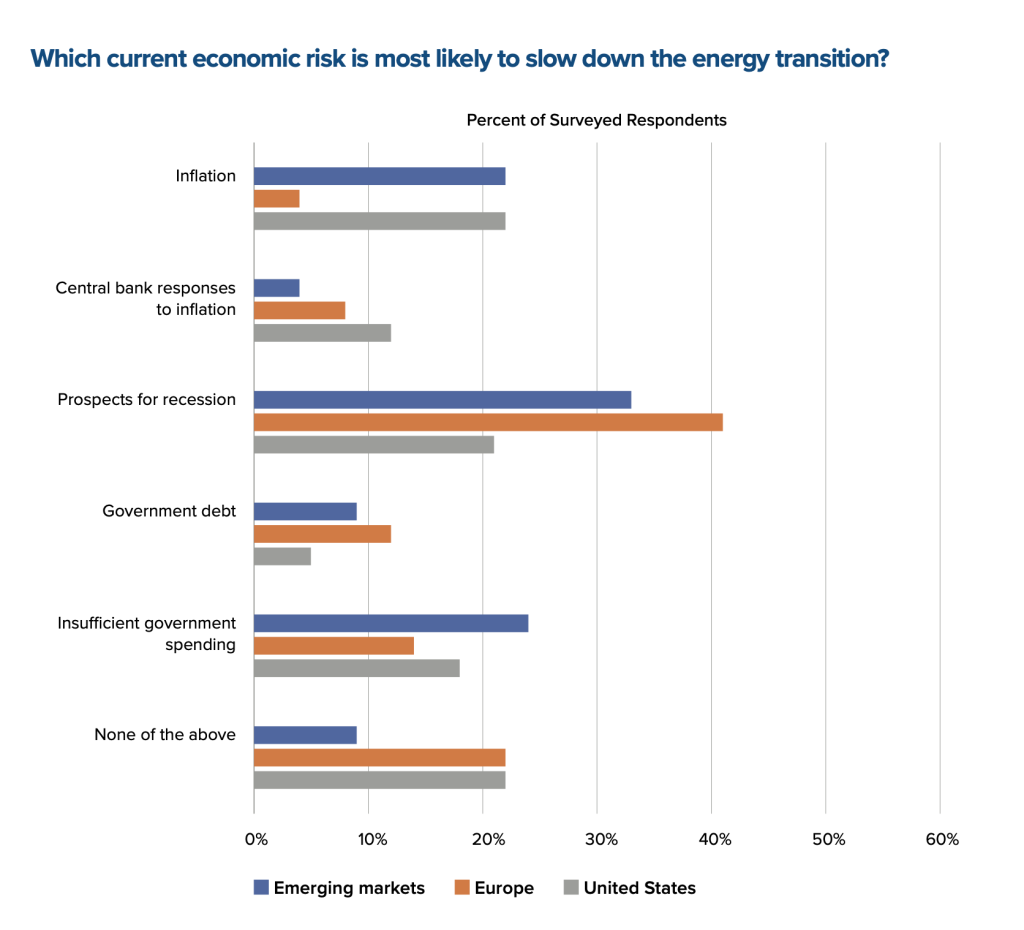

While political will is widely recognized as the predominant obstacle to reaching net-zero emissions among those surveyed, the cost of clean energy and access to capital meaningfully weighs on those outside of the North American and European continents. A number of respondents from emerging markets, for example, view insufficient resources as another major factor hindering progress. This is consistent with perspectives on the overall energy transition as well, where Europeans and Americans see broad macroeconomic trends, such as recession risk or inflation, as the principal headwinds, while those in developing countries more frequently cite a lack of government investment. These perspectives underscore a growing debate within the United Nations Framework Convention on Climate Change (UNFCCC). During COP27 in Sharm el Sheikh, Egypt, the Global South found success in drawing a renewed focus on how climate change is impacting developing nations, ultimately enabling the introduction of “loss and damage” into a formal negotiation process. Efforts to address inequities in financing billions of dollars in clean energy infrastructure, which will be necessary to avoid the worst impacts of climate change, will remain in focus during COP28.

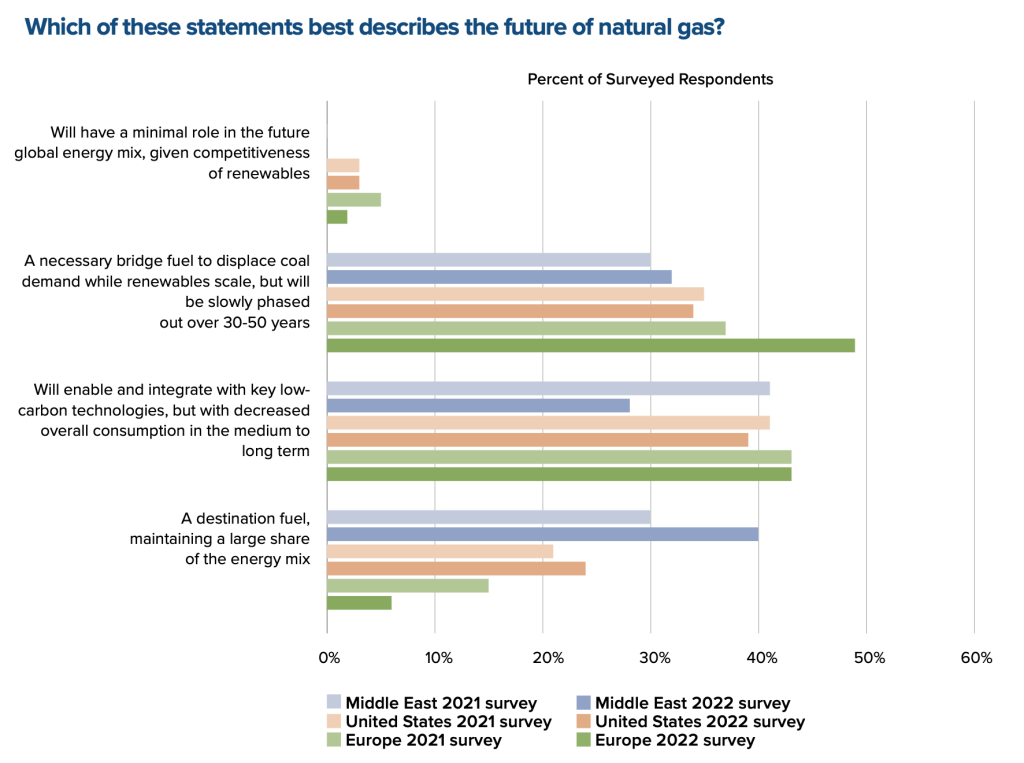

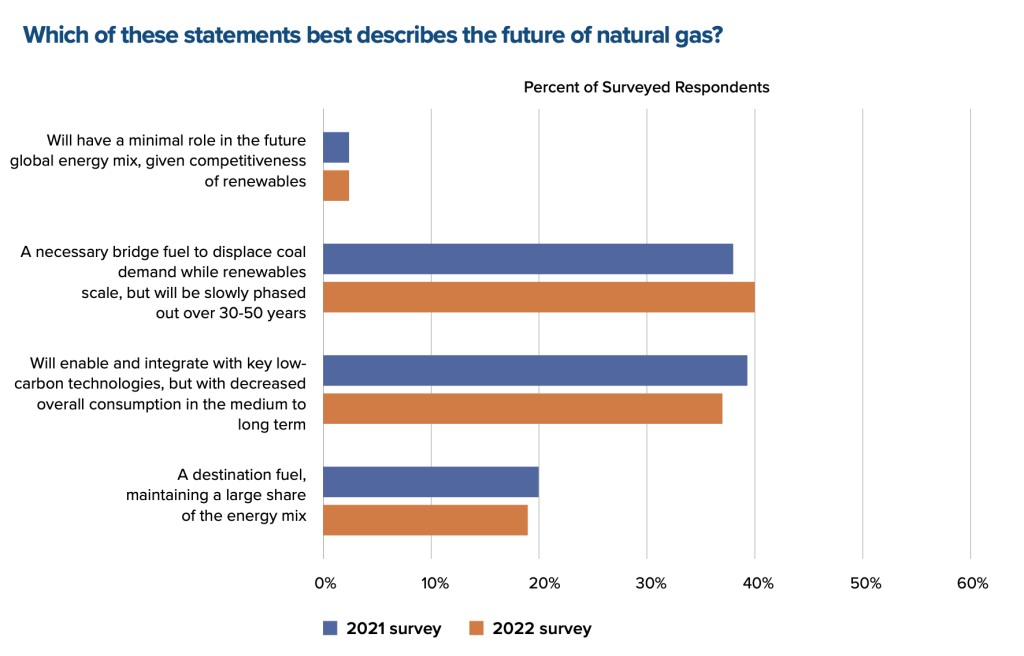

Natural gas’ appeal is ebbing in its most substantial near-term market

The roughly even division between those who see a long-term future for natural gas and those predicting a limited one remains consistent year-on-year, but with greater geographic variations. Of those surveyed, the majority see natural gas remaining a dominant—if not predominant—feature of the global energy mix. The vast majority of those remaining (40 percent of the total), think that natural gas will act as a long-term bridge fuel before disappearing. Only 3 percent see a minimal role for gas. While broadly consistent with last year’s analysis, Europeans—likely influenced by Russia’s weaponization of the resource—are increasingly resolute to wean their market from natural gas: now 49 percent say that the fuel will have a permanent role, down from 58 percent last year. Meanwhile, in the Middle East and North Africa—and, to a lesser extent, the United States—the anticipation that natural gas will remain a permanent fixture of the energy mix is growing, up to 40 percent from just 30 percent the prior year.

Taken together, we hope 2023 Global Energy Agenda survey responses, analysis, and essays will lay out the contours of the current energy system, assess the events and trends that will shape the energy system in 2023, inform fact-based debate and analysis about the best path forward, and set the shared energy agenda for the year.

Chapter 1: Geopolitics and energy security

Essays

Why today’s global energy crisis promises to be a turning point toward a cleaner and more secure future

By Fatih Birol

Post-war outlook on Russia as an energy power

By John E. Herbst

The geopolitics of energy

By Richard L. Morningstar

A precarious phase of war and Russian energy leverage

by Helima Croft

Nuclear energy is vital to ensuring energy security and an affordable, sustainable, and resilient energy system now and for the future

By Sama Bilbao y León

Russia’s invasion of Ukraine last February dramatically transformed political risk perceptions within the energy sector in 2022, surmounting even the most pressing global challenges from recent years, including the pandemic. Of course, current events often weigh heavily on public perception.

When the 2022 Global Energy Agenda survey was conducted in late 2021, the cyberattack on the Colonial Pipeline—which crippled fuel supply along much of the East Coast of the United States—had occurred recently and was front-of-mind for many respondents, while the specter of Russian aggression was still a distant-seeming possibility. It was therefore unsurprising that a military conflict was not a top concern among survey participants at the time, while the most frequently cited risk—according to 26 percent of respondents—was a major cyberattack.

Having now witnessed the brutality of Russia’s attack on Ukraine and the subsequent fallout impacting all facets of the global energy system, roughly half of the respondents name the war’s continuation or escalation as the dominant energy risk in geopolitics. Meanwhile, concern over cyberattacks to the energy system dropped by half, from 26 percent to 13 percent. Arguably, this decline is more of a testament to the enormous magnitude of the war’s impact on energy geopolitics rather than a diminishment in cyberattack risk.

Compared to the prior year’s response, however, most topics did not see drastic change in the face of Russia’s war. For instance, the percentage of respondents who envision a conflict in the South or East China Seas as the predominant risk rose from 7 percent last year to 10 percent this year. Additionally, trade-related disruptions still command roughly one tenth of respondents as well, shifting from 11 percent to 8 percent. It is worth noting that China and trade watchers represent well-defined communities with long-standing convictions regarding the risks and opportunities in their respective areas of expertise, lending some credence to why these respondents may be comparatively unmoved by the conflict in Ukraine in their assessment of future risks.

Meanwhile, two old worries fell off the radar of energy risks: Nord Stream 2 and COVID-19, after being collectively named by 17 percent of respondents as top concerns for the 2022 outlook. With one of the two Nord Stream 2 strings sabotaged in September 2022, the absence of the pipeline’s ranking this year is self-evident. COVID-19, in contrast, elicits deeper reflection. While generally there appears to be broad societal appreciation that the virus remains a feature of modern life, especially as China experiences a resurgence in infections resulting from the easing of Beijing’s zero-COVID policy, the fact that respondents no longer see the pandemic as a global risk illustrates how accustomed society has grown to the “new normal.”

Overall, other facets of the global geopolitical landscape may simply be outmatched now by Russia’s corrosive foreign policy and the irreparable harm it has brought to the stability of Europe. As the apex risk of 2022, it is worth diving deeper into how enduring Russia’s role will be in the European ecosystem and, by proximity, in the stability of the transatlantic partnership. Given the established history of energy trade between Russia as an exporter and European countries as consumers, understanding the perspective of survey respondents provides a glimpse into how the energy community sees Europe’s relationship with Moscow adjusting in coming years.

Even before February 2022, Russia had reduced energy exports to European customers in a presumed effort to exert political leverage. When the invasion started, sales contracted further and in response, European countries enacted a series of policies to reduce Russian oil and gas revenues. This includes the December 5, 2022, EU ban on Russian crude imports, a Group of Seven (G7) price cap on Russian seaborne exports, and a pending EU ban on Russian petroleum products, which is slated to go into effect on February 5, 2023. And while higher global prices enabled Russia to continue earning revenue from fossil fuel trading with European countries in 2022, the drop in European market share is significant. In 2021, Russia provided 40 percent of non-EU gas imports to the EU; by the fall of 2022, Russia’s share of EU imports had fallen to 7.5 percent.4“New Reports Highlight 2nd Quarter Impact of Gas Supply Cuts,” European Commission, October 17, 2022, https://ec.europa.eu/info/news/drop-gas-consumption-and-increase-renewable-energy-generation-q2-2022-2022-oct-14_en. In the first half of 2022, Russian oil imports to the EU also declined.5Eurostat, “EU Imports of Energy Products–Recent Developments,” September 2022, https://ec.europa.eu/eurostat/statistics-explained/index.php?title=EU_ imports_of_energy_products_-_recent_developments#Main_suppliers_of_natural_gas_and_petroleum_oils_to_the_EU.

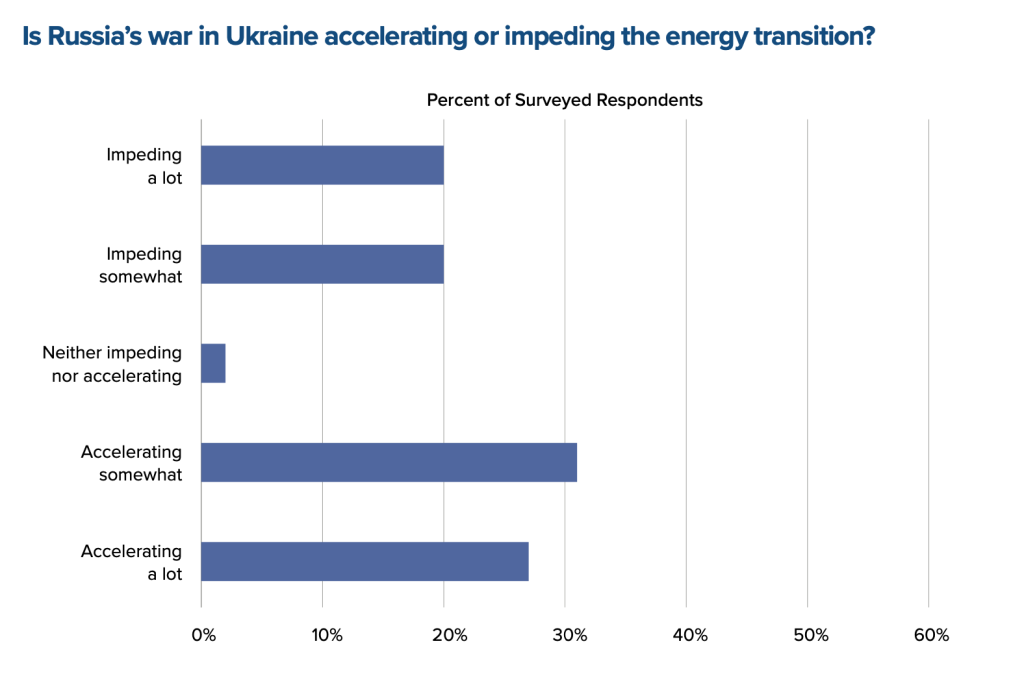

If survey respondents are right, the initial disruption to these markets will last through the end of this decade. The majority of respondents say that Russian exports to Europe of oil (58 percent of respondents) and gas (55 percent of respondents) will decrease substantially by 2030. Europe-based respondents are even more likely to forecast reduced fossil fuel imports from Russia. The horrors inflicted on Ukraine have forced a seismic shift in thinking about the costs—financial, social, and geopolitical—of energy security. There is less consensus, however, on how these events will shape the global energy transition. While respondents resoundingly agree that the war in Ukraine and Europe’s anticipated pivot away from Russia will have an impact on climate action, there is an equally stark divide on whether it is a headwind or tailwind for a zero-emissions future. Nearly 60 percent say it will accelerate the energy transition, while 40 percent say the war will impede it.

There are merits to both perspectives, of course, which are explored in more detail by our essay authors in this chapter. The war has highlighted the need for greater energy security, which could lead to increased investment in indigenous clean energy resources. However, the development of capacity from renewables and nuclear energy will take time, and the need to replace Russian gas is likely to lead to a boost to conventional energy resources in the face of few immediate alternatives for European importers, not to mention the corresponding implications for emerging markets that cannot financially compete with Europe for supply.

Leadership insight

Why today’s global energy crisis promises to be a turning point toward a cleaner and more secure future

By Fatih Birol

Russia’s invasion of Ukraine in February has thrown energy markets into turmoil, setting off the first truly global energy crisis, with impacts that will be felt for years to come. International trading routes and investment flows that had built up over decades are being profoundly reshaped. Households, businesses, and entire economies are struggling to pay for food and energy, leading to rising poverty and insecurity. Geopolitical risks are on the rise.

Despite these major difficulties, I’m optimistic about the long-term effects of the current crisis on the global energy sector. Thanks to the policy responses by many governments around the world, the crisis is set to accelerate our transition to an energy system that is not only cleaner, but more affordable and secure.

In our recent World Energy Outlook 2022, the International Energy Agency’s (IEA) analysis shows that for the first time ever, today’s prevailing government policies will result in a distinct peak in global demand for fossil fuels in the coming years as clean energy technologies expand. In this scenario, coal’s recent crisis-driven rebound is temporary, and its use falls back within the next few years; natural gas demand reaches a plateau by the end of the decade; and rising sales of electric vehicles mean that oil demand levels off in the mid-2030s before ebbing slightly to midcentury. This is nothing short of historic. Ever since the start of the Industrial Revolution in the 18th century, fossil fuel use and economic growth have risen in tandem. Now, they are parting ways. However, the transition to clean energy is not yet happening quickly enough to avoid severe impacts from climate change.

What we do see is increasing ambition and action around the world to accelerate the transition. While a lot of public attention has focused on the short-term measures many governments have taken to shield consumers and businesses from higher energy prices, many of those same governments are also taking longer-term steps to address the underlying fragilities of our energy systems.

The most notable responses include the US Inflation Reduction Act, the European Union’s Fit for 55 package and REPowerEU plan, Japan’s Green Transformation (GX) program, South Korea’s aim to increase the share of nuclear and renewables in its energy mix, and ambitious clean energy targets in China and India. The Inflation Reduction Act alone puts close to $400 billion on the table in the form of tax incentives, subsidies, and support for technologies ranging from hydrogen to solar to carbon capture—and this will mobilize far more in private sector investment. Taken together, these new measures by governments worldwide are set to help propel global clean energy investment to more than $2 trillion a year by 2030, a rise of more than 50 percent from today.

How has the current crisis accelerated these moves? With the droughts and floods we’ve witnessed in recent years highlighting the growing impacts of climate change, the environmental case for clean energy needed no reinforcement. But today’s soaring energy prices have made the economic arguments in favor of cost-competitive and affordable clean technologies stronger than ever. Now, with the war in Ukraine, the energy security case for clean energy has come to the fore, with countries recognizing the risks of relying too heavily on imported fossil fuels.

This alignment of economic, climate, and security priorities is moving the dial toward a better outcome for the world’s people and for the planet. If all countries achieve their current national climate pledges on time and in full, IEA analysis shows that it would limit the rise in global average temperatures to 1.7 degrees Celsius. The increasingly robust clean energy plans we’re seeing provide grounds for optimism that countries can move closer to delivering the concrete policies and implementation needed to make these ambitious pledges a reality. However, there still remains an “implementation gap” between today’s policy settings—which would most likely lead to a temperature rise of around 2.5 degrees Celsius, far too high to avoid severe climate risks—and what’s needed to achieve national climate pledges.

And we need even greater ambition and stronger implementation to reach net zero globally by 2050 and have a chance of stabilizing the temperature rise at around 1.5 degrees Celsius. This would require doubling global clean energy investments from the current projected level to around $4 trillion a year by 2030.

We can accomplish this faster progress if strong action is taken immediately. Investments in clean electricity and electrification, along with an expanded and modernized grid, offer clear and cost-effective opportunities to cut emissions more rapidly while bringing down electricity costs. Maintaining today’s growth rates for deployment of solar PV, wind, electric vehicles, and batteries requires supportive policies not just in the early leading markets for these technologies but across the world.

A major concern that demands urgent attention is the uneven distribution of clean energy investment around the world. If China is excluded, then the amount being invested in clean energy each year in emerging and developing economies has remained flat since the Paris Agreement in 2015.The cost of capital for a solar PV plant in 2021 in key emerging economies is between two and three times higher than in advanced economies. Today’s rising borrowing costs risk further exacerbating this divide.

International efforts, especially from multilateral development banks, are needed to step up climate finance in developing and emerging markets, and to tackle the perceived risks that deter investors. There is immense value in broad national transition strategies such as Just Energy Transition Partnerships, like the one announced by Indonesia and a group of leading economies at the G20 Summit in November, that integrate international support and ambitious national policy actions, while also providing safeguards for energy security and the social consequences of change.

What is undeniable is that energy markets and policies are changing dramatically before our eyes as a result of the war in Ukraine. And these aren’t just short-term blips, but changes that will play out for decades to come. I am convinced that when we look back, we will see 2022 as a historic turning point towards a cleaner, more secure, and more affordable energy system.

Fatih Birol is the executive director of the International Energy Agency.

Leadership insight

Post-war outlook on Russia as an energy power

By John E. Herbst

In the winter of 2005-2006, one year after the Orange Revolution, Moscow shut off the gas to Ukraine in an effort to punish Ukraine for rejecting Putin’s candidate for president, Viktor Yanukovych. Ultimately, Russia’s actions successfully coerced newly elected President Victor Yushchenko to accept a corrupt deal for the delivery of gas in the future. That did little to inhibit Moscow from shutting off the gas to Ukraine a second time in 2009.

As ambassador to Ukraine in 2005, I had warned of these very scenarios, sending formal messages back to Washington regarding the legitimacy of Moscow’s hints of shutting off gas supplies to Europe. Yet, European energy dependence on Moscow only grew after gas cutoffs to Ukraine, starting with the gas pipeline Nord Stream 1, which stretches from Russian to Germany and became operational in 2011.

Even after Moscow seized Crimea and began its hybrid war in eastern Ukraine, German Chancellor Angela Merkel in 2015 increased this dependence by signing a deal to construct another gas pipeline—Nord Stream 2—to bring more Russian gas to Germany. Plans to certify and put into operation this controversial pipeline proceeded throughout 2021, despite clear Russian manipulation of gas supply for political gain and its military buildup on Ukraine’s border in preparation for the massive invasion of February 2022.6Hans Von Der Burchard, “EU’s Borrell Fires Back at Putin by Saying Gas Price Surge is Political,” Politico, October 18, 2021, https://www.politico.eu/ article/eu-josep-borrell-putin-gas-price-surge-political/. Only Moscow’s “annexation” of Ukraine’s occupied Luhansk and Donetsk Oblasts and then the invasion definitively stopped Nord Stream 2. The pipelines were ultimately sabotaged in September 2022.

All of this is a reminder that in the normal scheme of things, political economy trumps economics. Nearly forty years of growing European dependence on Russian hydrocarbons began with the opening of the Urengoi-Pomary-Uzhgorod pipeline in 1984. The economics of this growing dependence was obvious. Russia had major supplies, it was relatively nearby, and Russian hydrocarbons could be delivered by pipeline. While the early 1980s were still characterized by tense East-West relations, Gorbachev became the Soviet First Secretary in 1985; those relations warmed quickly; and six years later the Soviet Union collapsed. In the 1990s, a principal goal of the United States and its allies was to bring Russia fully into the international community, including membership in the International Monetary Fund (1992); the Group of Seven (G7), which became the G8 (1998); and the World Trade Organization (2012). In short, the clear improvement of political relations provided the right framework for closer economic ties.

This background is essential for considering what Russia’s role will be in world energy markets after its war of aggression against Ukraine ends. The answer to that question begins by asking how the war will conclude. This article is based on the presumption that US and Western aid either continues and even increases, in which case Ukraine will succeed in driving Russian forces out of all, or most, of its territory and negotiating a stable peace, even if some key questions, such as the status of Crimea, are left for future resolution. The second question is what sort of Russia emerges from this defeat. If it is a Russia seething with resentment—of the kind that characterizes major Russian media today—then the prospect of improved relations and growing economic ties is minute. The West would have to treat that Russia with great caution. But if it is a Russia recognizing that the invasion of Ukraine was illegitimate; that imperial polices to dominate its neighbors are a dispensable relic; and that Russia can only prosper if it empowers its people and seeks, in the twenty-year-old words of Russian analyst Dmitri Trenin, to become a normal country truly integrated into the international system, the circumstances will be very different.7Dimitri Trenin, The End of Eurasia: Russia on the Border Between Geopolitics and Globalization, (Washington: Carnegie Endowment for International Peace, 2001).

Before Moscow’s February invasion, the EU received approximately 40 percent of its gas sup- plies (plus more than 50 percent of its gas imports) and 25 percent of its oil from Russia.8Stefan Ellerbeck, “What Progress is the EU Making on Ending its Reliance on Russian Energy?” World Economic Forum, June 29, 2022, https://www.weforum.org/agenda/2022/06/russia-eu-energy-imports/. By October, approximately 9 percent of gas consumed in Europe (and 18 percent of gas imports) came from Russia, including gas going to Turkey and other non-EU members in the Balkans.9“Infographic – Where Does the EU’s Gas Come From?” European Council, updated November 7, 2022, https://www.consilium.europa.eu/en/infographics/eu-gas-supply/. Oil dependence also dropped in the fall of 2022 to 14.4 percent from over 24 percent in the previous year.10“EU Imports of Energy Products – Recent Developments,” Eurostat, December 2022, https://ec.europa.eu/eurostat/statistics-explained/index.php?title=EU_imports_of_energy_products_-_recent_developments#:~:text=The%20share%20of%20petroleum%20oils,higher%20prices%20of%20these%20commodities

Moscow’s oil future is also clouded by its declining reserves, which were 7 percent lower in 2020 than in 1991, and Russia’s Finance Ministry is projecting that 2023 production will drop by 7 to 8 percent.11Li-Chen Sim, “Russia vs Europe: Who Is Winning the Energy War?” Russia Matters, November 23, 2022, https://www.russiamatters.org/analysis/russia-vs-europe-who-winning-energy-war Moscow’s ability to maintain its natural gas system and to find new supplies of oil and gas are also being hindered by the effective export controls introduced by the West since the February invasion. Russia needs Western technology to access harder-to-reach oil and gas.

In a postwar world, those controls will stay in place if Moscow is still perceived as a potentially aggressive actor. If the Kremlin makes a clear break with its past, those controls will begin to unwind, but, as a precaution, only over time. But they will come off—which will be good for Russian oil and gas production—and at the same time, the West, albeit with a certain degree of caution, will be looking for new economic opportunities with Russia and for ways to promote its reintegration into the global economy.

But Europe’s move to alternate supplies of gas, including decisions to build liquefied natural gas terminals, means that, in the future, Europe will have less need for Russia’s pipeline-supplied gas. Developments here will be determined by economic factors. But Moscow might be able to build on its ongoing energy relationships with countries, like Turkey and non-EU Balkan states, whose oil and gas purchases are not limited by sanctions. It may also do the same with landlocked EU states—Slovakia, Hungary, and the Czech Republic—that have received sanctions exemptions that allow them to purchase Russian oil and gas via pipelines. Similarly, Russia could continue its energy relationship with Bulgaria, which has an EU exemption to purchase Russian oil through 2024.12Genka Shikerova, “Ahead of New Sanctions, Russia’s LUKoil Still Looking for a Loophole in Bulgaria,” Radio Free Europe, Radio Liberty, December 2, 2022, https://www.rferl.org/a/bulgaria-lukoil-european-union-embargo-russia-sanctions-loophole/32158973.html.

Moscow, of course, will be able to market its hydrocarbons to China, India, and other customers, but transaction costs are likely to be higher than they were with Europe. The headwinds facing Russia’s oil and gas industry, even in the more optimistic scenario, are the reasons some observers believe Russia will drop from being a “strategic petrostate” to a “reduced energy power.”13Sim, “Russia vs Europe.”

Ambassador John E. Herbst (ret.) is senior director of the Atlantic Council’s Eurasia Center and the former US ambassador to Ukraine.

Leadership insight

The geopolitics of energy

By Richard L. Morningstar

The world of energy changed on February 24, 2022. Moscow’s gas cutoffs, which aim to divide the West and break support for Ukraine, are the culmination of a strategy that has manufactured an energy crisis in Europe. Few knew then the depraved depths of the Kremlin’s plans. Now it is abundantly clear, as is the continuing importance of energy geopolitics.

The stakes of the great energy game are extremely high. Oil and gas exports provide revenue for the Kremlin to sustain its brutal and prolonged war—now approaching the one-year mark. Russian energy exports also undercut Western efforts to isolate Moscow, as the country pivots to new customers in the developing world. Moreover, the Kremlin’s increasing threats to cut supply could generate fresh chaos within already fragile global energy markets, and empower populist, pro-Russian sympathizers in democratic societies.

Such is the geopolitics of energy, the gray area between markets and power politics. Those in Europe who thought they knew Moscow best believed Russia would be a reliable supplier, because it had a business interest in keeping gas flowing. Economic interdependence—it was thought—would make Russia a normal European country.

But those who knew Moscow better understood the Kremlin has other interests, twisted and irrational as they may be. They understood energy is not just a market. It is power. By supplying low-cost gas to Europe, fueling the continent’s industry, and powering economic growth, Moscow had leverage. The European Union’s dependence on Russia enabled an autocracy to influence European politics and impose energy dysfunction on a democratic union.

Moscow did not maximize the economic benefits of this relationship. That was not the point. The point was to place Russia at the center of Europe’s economy—and therefore, its politics. This inoculated Moscow from the political consequences of its aggressive foreign policy, exemplified by the tepid reaction to the 2014 annexation of Crimea and invasion of the Donbas. Because of Russia’s energy—some thought—Moscow was too important not to have a seat at the table of global politics. Yet, last year may be remembered as the twilight for Russian energy leverage. After accounting for 40 percent of EU gas consumption, by the end of 2022, the continent was getting less than 8 percent of its gas from Moscow. Europe, nevertheless, is getting by. Moscow’s strategy is not working, and its ability to wield energy chaos as a geopolitical weapon is waning. EU aspirations to carry out a green transformation of its economic system have become an economic and security necessity, with the soaring cost of fossil fuels providing pressing incentives to decarbonize.

There is no better catalyst for the energy transition than the weaponization of oil and gas supply. Europe’s climate ambition has been galvanized by the crisis, increasing its 2030 emissions reduction target beyond “Fit for 55.” Europe needs to urgently degasify its industry to stay competitive as production costs become tied to LNG prices. Now, even the highest-hanging fruit for decarbonization, the hard-to-abate sectors, are immediate priorities for the continent.

Europe is determined to move rapidly and never be in a position of energy dependence again. Decoupling its economy from fossil fuel imports, through locally generated clean energy, is the surest way to do so. If Europe is successful in accelerating its green transformation, Russia’s days as an energy superpower will soon be behind it.

A page will have been turned—but not completely. Even as the global energy system transitions to a net-zero economy, the geopolitics of energy are not going away.

The geopolitical might once enjoyed by fossil fuel producers is shifting toward countries that produce clean energy metals and technologies. Russia’s influence over global hydrocarbon systems pales in comparison to China’s command of global critical mineral supply chains. In addition, energy is becoming a high-tech industry. As it does, intellectual property and complex manufacturing capacity will become a key factor in geostrategic energy competition among major powers. Ensuring that this competition is managed productively to combat the shared threat of climate change is the challenge of our time.

As the transition gathers momentum, it is paramount that policymakers heed the lessons offered by the current energy crisis and not allow old dependencies to be replaced by new ones. Diversifying sources and technologies remains the most tried-and-true method for neutralizing energy’s geopolitical power.

The geopolitics of energy are transforming, but they are not going away. Those who ignore this unwavering dynamic of the global energy system do so at their own peril.

Ambassador Richard L. Morningstar (ret.) is the founding chairman of the Atlantic Council Global Energy Center. He has served as the US ambassador to the Republic of Azerbaijan, as US ambassador to the European Union, and as the secretary of state’s special envoy for Eurasian energy.

Partner perspective

A precarious phase of war and Russian energy leverage

by Helima Croft

As the war in Ukraine enters its second year, a key question for market participants is whether Russia’s disruptive power is diminishing or whether it still has the capacity to cause significant pain for Western consumers by curtailing energy supplies. Has Moscow already played all of its strong cards by turning off the gas taps to much of Europe and in turn providing the catalyst for countries like Germany to seek new sources of supply and fast-track the buildout of critical liquefied natural gas infrastructure? Does President Vladimir Putin have any real economic option but to continue to sell oil at depressed prices in order to maintain the principal funding stream for his war machine? Or, have energy markets merely entered a fleeting period of calm as the Russian president prepares for another brutal winter campaign—with energy as an essential weapon—to test the resolve of the West to continue providing military and financial support for Kyiv?

From the start of the conflict, Western leaders signaled a clear concern about higher energy prices through sanction carve-outs and long lead timelines for the implementation of coercive measures such as the EU ban on seaborne oil imports. Russia has already made good on its threats to disrupt gas supplies, with piped flows to Europe currently down over 85 percent year-over-year. Gas has long been a weapon of choice for the Kremlin, given Europe’s high dependence on Russian supplies as well as its more modest revenue-generator role. Certainly, the remaining Russian gas flows through Ukraine would seem to be at elevated risk for curtailment, especially given the ongoing aerial bombardment of Ukraine’s energy infrastructure. With storage levels in Europe remaining relatively robust amid warmer weather and new sources of supply, the real challenge for the continent on the gas side could come toward the tail end of 2023 in the next storage-filling season, with no additional Russian volumes likely forthcoming.

Oil is a trickier card for Putin to play because of its centrality to state coffers. The architects of the Group of Seven (G7) price cap plan essentially wagered that Russia would have no option but to keep supplying that market at the $60 price point if it wanted to continue with the war effort. And yet, Putin at least continues to mount a rhetorical resistance to the price cap, pledging to cut supplies to any customer that participates in the plan from February onwards. India will likely be a key test case of Russian resolve to see this pledge through, as the country has emerged as the principal purchaser of distressed Urals barrels no longer welcome in the West. While Prime Minister Narendra Modi and Petroleum Minister Hardeep Singh Puri have publicly voiced opposition to the G7 plan, its refiners are still largely dependent on Western service providers to obtain their cargoes. Early indications are that these customers are continuing to avail themselves of Western services and therefore are presumably signing the requisite attestation that they were purchasing the barrels at or below the $60 cap.

There is certainly scope for Russia to engage in some symbolic export suspensions in order to create doubt about the viability of the G7 effort and attempt to drive oil prices higher. Unlike with gas, however, we think that Russian leadership will be much more strategic with their oil curtailments given the clear revenue imperative. Deputy Prime Minister Alexander Novak’s comments about a 5-7 percent reduction seemingly signals that supply restrictions will be deployed more like a scalpel than a blunt instrument. Moreover, a scenario could arise where the Kremlin seeks to rebrand disruptions due to compliance challenges and service provider problems as a deliberate policy choice. At the time of writing, we estimate that seaborne exports have fallen over 20 percent month-over-month in December, with lost flows primarily coming from Urals and East Siberia Pacific Ocean grades.

A crucial test for markets will come after the February 5 EU ban on the importation of Russian refined products. We have consistently maintained that the products ban will be more difficult to mitigate than the seaborne oil embargo. Asia has been the key release valve for crude, with India taking over 900,000 barrels per day more compared to historical levels. Even then, both China and India have seen month-over-month decreases in crude volumes last month following the embargo. There is no India market equivalent for seaborne diesel shipments, so a mass switch in crude supply like the one we saw with Asian refiners following the invasion is less likely. Moreover, replacing displaced product imports in Europe will also be more difficult given tight product markets; 500,000 barrels per day of diesel imports were still coming from Russia into the EU in October.

Another concerning scenario would be for Russia to disrupt oil supplies from other producers through sabotage or interference in internal affairs. There have already been a number of suspicious Caspian Pipeline Consortium (CPC) pipeline outages. In March 2022, loadings of Kazakh crude from the CPC were suspended at the Russian port of Novorossiysk, with Russian officials citing weather-related damage to loading berths as the cause for the weeks-long outages. However, senior energy officials from other governments have suggested that Moscow may have had an active hand in the CPC outage as part of a test run of its asymmetric disruptive capabilities. Hence, we would put CPC flows close to the top of a 2023 risk list.

Similarly, leading security experts contend that Russia has the ability to disrupt supplies from countries where the Federal Security Service (FSB) and Kremlin-linked mercenary groups maintain a significant presence, such as Iraq, Algeria, and Libya. Given that Washington has strongly signaled an aversion to higher oil prices, and has gone to quite extraordinary lengths to keep a lid on them, there remains an elevated risk that Putin will seek to exploit this pain point in 2023, even if it is principally through asymmetric action. Moreover, a case could be made that Moscow’s peak leverage point may be in the coming cold months, and once the green shoots of spring appear, many in the West may conclude that the worst is over from an economic warfare standpoint. Hence, our view is that we may be entering a particularly precarious phase in the conflict and that Putin may endeavor to demonstrate that he is not a spent force.

Helima Croft is the head of global commodity strategy and MENA Research at RBC Capital Markets, LLC. RBC Capital Markets, LLC, is a sponsor of the 2023 Atlantic Council Global Energy Forum.

Leadership insight

Nuclear energy is vital to ensuring energy security and an affordable, sustainable, and resilient energy system now and for the future

By Sama Bilbao y León

We keep hearing “Nuclear energy is back.”

I dare say nuclear energy has been here all along.

What is back is the recognition that nuclear energy is an essential element of our existing energy systems, with enormous positive impacts in terms of carbon-free electricity, energy independence, and accessible and affordable power. What is perhaps new is the realization from governments, large energy users, the finance community, the media, and the public that nuclear energy needs to play a greater role in the clean energy systems of the future if we are serious about reaching the Paris Agreement goals in a cost-effective and socially equitable manner.

Today, more than four hundred nuclear power reactors in thirty-two countries on every continent are quietly operating in the background, providing people across the world with 24/7 low-carbon energy, independent of geopolitical pressures, the weather, or the season. They have an incredibly small footprint, in terms of land, fuel, and raw material use, as well as the lowest lifecycle impacts of all electricity generation options.14“Carbon Neutrality in the UNECE Region: Integrated Life-Cycle Assessment of Electricity Sources,” United Nations Economic Commission for Europe, updated October 29, 2022, https://unece.org/sed/documents/2021/10/reports/life-cycle-assessment-electricity-generation-options.

Nuclear energy is today the second-largest source of low-carbon electricity—the largest in OECD countries—and over the past fifty years, the use of nuclear power has reduced CO2 emissions by over 70 metric gigatons—nearly two years’ worth of global energy-related emissions.

Events during the second half of 2021 and the first half of 2022 have brought energy security firmly to the top of the political agenda. While the current energy crisis has been prompted by a series of extraordinary events, the vulnerability of many energy systems has long been predicted. Energy woes in many parts of the world are the result of decades of short-sighted policies, lack of investment in basic infrastructure, and dysfunctional energy markets. This has allowed the premature shutdown of nuclear power plants and an overreliance on intermittent renewables solely backed up by fossil fuels.

When the price of oil on world markets increased dramatically in 1973, several major energy importers reviewed their energy policies and took steps to reduce their vulnerability to political and economic uncertainties. Many countries rapidly adopted nuclear power for electricity generation, with construction starting on almost 200 gigawatts (GW) of nuclear power plants in the decade that followed. Although almost 50 years have passed since then, the lessons learned are now more pertinent than ever, with geopolitical, economic, and availability implications for countries that rely on energy imports.

Despite enormous investment in renewable energy and the carefree perception of much of the Western world that we are making progress in addressing climate change, the percentage of electricity that comes from low-carbon sources today (37 percent) is almost unchanged from the mid-1980s.15Hannah Ritchie and Max Rosner, “Electricity Mix,” Our World in Data, last visited December 30, 2022, https://ourworldindata.org/electricity-mix. Currently only countries that produce most of their electricity from hydropower, geothermal, or nuclear energy, or a combination of the three, have successfully decarbonized their electricity grids. With global electricity use expanding by at least 50 percent by 2050, and the global population projected to increase to almost ten billion, it is crucial to use cost-effective and proven solutions that provide secure access to 24/7 low-carbon electricity to everyone.

Historically, nuclear energy has proven to be the fastest way to increase populations’ access to low-carbon electricity, and a catalyst for socioeconomic development. Thanks to its energy density, nuclear energy is immune to severe fuel market fluctuations. It can also operate for at least sixty to eighty years, making nuclear one of the most affordable, secure, 24/7 energy sources currently available. It also generates thousands of long- term, high-pay, quality jobs, along with substantial socioeconomic spillover in local, national, and regional economies.

Beyond electricity, which accounts for only one-fifth of total energy use, nuclear enables the rapid decarbonization of the entire economy via dispatchable low-carbon heat. This heat is ideal for industrial processes, district heating, or hydro- gen and synthetic fuel production.

Ambitious yet realistic net-zero climate scenarios performed by reputable independent organizations such as the Intergovernmental Panel on Climate Change and the United Nations Economic Commission for Europe forecast a need for 1250 GW of nuclear capacity by 2050.

If we are to keep the Paris Agreement’s 1.5-degree Celsius target within reach—in a cost-effective and socially equitable manner—we urgently need significantly more nuclear energy. New build rates for nuclear need to ramp up to 50 GW per year over the next ten years and stabilize at that level through 2050.

Now more than ever, it is crucial for governments to put in place clear and pragmatic policy actions to facilitate and accelerate the deployment of nuclear energy. Such actions include establishing a level playing field for all low-carbon technologies and reforming energy and electricity markets to recognize the security and reliability of nuclear power. It is also very important to recognize nuclear energy as one of the investable technologies under the various environmental, social, and governance (ESG) and sustainable finance frameworks across the world.

Once the value of nuclear power is fully recognized by policies and markets as a way to provide price stability as well as long-term predictability of revenue, investment will flow into new nuclear energy projects and incentivize the development of stable supply chains.

When facing the challenge of COVID-19, the pharmaceutical community rallied researchers, regulators, policymakers, and industry, uniting them and enabling them to find a way to deliver lifesaving vaccines in record time. This energy crisis presents a similar opportunity, and nuclear is uniquely placed to contribute significantly to both clean electricity and non-electrical uses by 2050. To achieve this, the nuclear industry and decision-makers all need to work together with a fast-track “Apollo-style” program mindset.

We have less than thirty years to reach net zero. Nuclear energy offers a golden opportunity to build a cleaner, more equitable world, in which everyone has secure access to clean abundant 24/7 energy and a high quality of life.

Sama Bilbao y León is director general of the World Nuclear Association.

Chapter 2: The pursuit of market stability

Essays

It’s time to focus on making lasting carbon reductions

By Majid Jafar

Financing a sustainable and inclusive energy transition with an eye toward COP28

By Bernard Mensah

Tackling the global energy crisis in 2023 requires a greater emphasis on energy security

By Steven Kobos

Road to COP28: Why the growth of nuclear must be part of the net-zero solution

By H.E. Mohamed Al Hammadi

Electrification and decarbonization: the UAE as a springboard for action for 2023’s top two priorities

By Roger Martella

Since the onset of the pandemic, energy markets have experienced significant volatility, a trend that, under the current geopolitical climate, was sustained throughout 2022. And while oil and gas prices often garner the most headlines, the past year was unique in that electricity prices witnessed wild swings as well; at one point, European power prices reached the equivalent of $1,000 per barrel of oil.16Anna Shiryaevskaya, “How Much Is Power in Europe? It’s Now Equal to Oil at $1,000 a Barrel,” Bloomberg news article on BNN Bloomberg site, Bell Media, August 23, 2022. However, for the United States and, especially, for Europe, the underlying cause of what might previously be considered unfathomable power market prices points to an imbalance in the natural gas market.

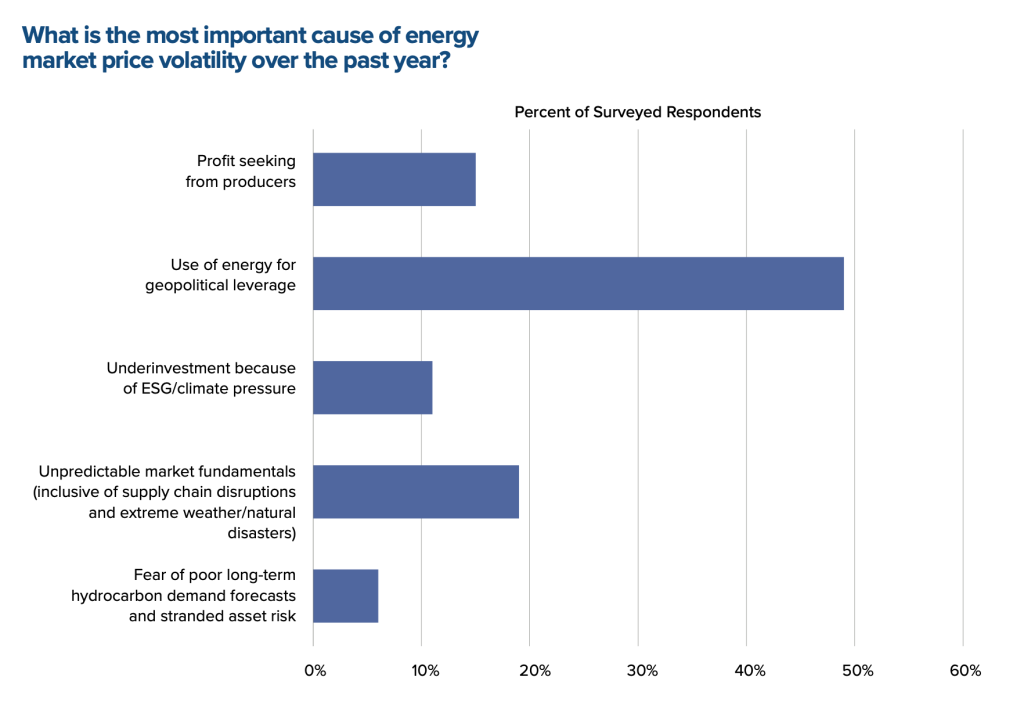

While the increase in global natural gas and crude oil prices predates Russia’s invasion of Ukraine, there was an undeniable price spike after February 24, 2022. Following the invasion, a combination of constrained supply and international sanctions against Russia further affected prices, with the cost of natural gas in early autumn rising higher due to European efforts to fill its storage facilities before winter, including through imports of US liquefied natural gas (LNG). These challenging market conditions were com- pounded by weather-induced demand following record-busting summer heatwaves, including one that saw temperatures in the United Kingdom soar 36 degrees Fahrenheit (20 degrees Celsius) above normal for the country.17Matthew Cappucci and Jason Samenow, “These Maps Show How Excessively Hot It Is in Europe and the U.S.,” Washington Post, July 18, 2022, https://www.washingtonpost.com/climate-environment/2022/07/18/heatwave-europe-unitedstates-records-uk/. As the war in Ukraine carries on, it is no surprise that, among survey respondents, the dominant explanation for price volatility in 2022 is the use of energy for political leverage, cited by 49 percent of respondents.

The events of 2022 illustrate how instability in conventional energy markets can weigh on the global economy and impact the public debate about how best to pursue an inclusive and equitable energy transition. Global upheaval in natural gas trade over 2022, however, did little to dissuade respondents of natural gas’ utility to global market stability. Respondents to the 2022 survey continue to see a long-term role for natural gas, consistent with the perspective of respondents in 2021. In fact, the majority (56 percent) believe that natural gas has a permanent future in the energy mix, although many also predict total consumption will decline somewhat. Meanwhile, among those who say the world will phase out gas, almost all think that the process will take decades.

While general consensus about the role of natural gas has not extensively changed over the past two years, the most recent survey did reveal pronounced geographic shifts. MENA respondents are now more likely than last year’s respondents from the same region to see gas as a destination fuel with a permanently large share of the market. The proportion of Europeans predicting that status for gas dropped markedly, from 15 percent to 6 percent, and now, for the first time, more than half believe that the fuel will eventually be phased out. The supply shock of 2022 may not just have an effect on the Russian market for gas in the region; from a European perspective, it could reduce the market overall.

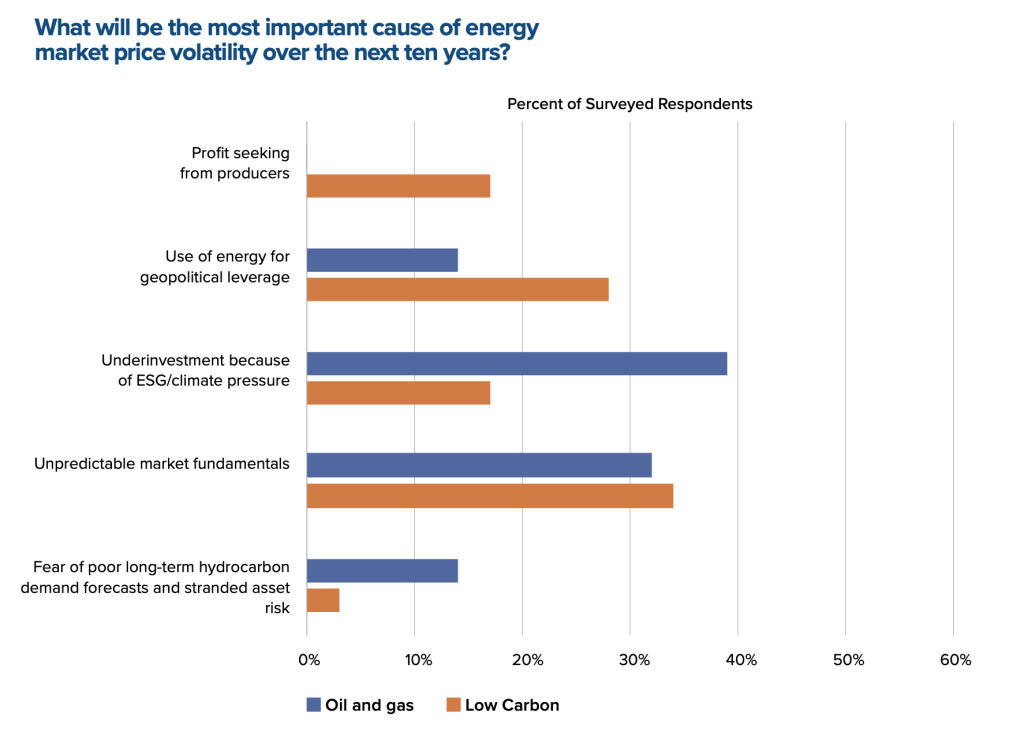

Moving forward, the turmoil of 2022 has led to little change in the perception of the primary driver of energy price changes in the coming decade: about a third of respondents see unpredictable market fundamentals as the top cause of energy price volatility. As in the prior year, however, those who see a global shift away from fossil energy occurring in rapid fashion (energy transition bulls) more often point to the risk of countries seeking geopolitical leverage as the primary market driver. On the other hand, those who are skeptical of the world’s ability to wean itself from reliance on oil and gas (energy transition bears) more frequently point to a lack of investment due to environmental, social, and governance (ESG) factors and unpredictable market fundamentals, which they see as the leading cause of greater energy price volatility in the decade ahead. Interestingly, the total number of respondents citing use of energy for geopolitical leverage declined by six percentage points to 23 percent, a change that perhaps reflects the view that Russia’s shift from speculative to active hostility results in its diminished ability to leverage energy for geopolitical gain.

Starker differences in opinion emerge when looking at survey data through an industry lens (i.e., oil and gas respondents versus those from zero-emission industries such as renewables and nuclear). While about a third of both groups think that unpredictable fundamentals will be the biggest driver of volatility, their other responses diverge. Survey participants that work in the oil and gas industry reject the idea that profit seeking will be a leading issue in markets. Instead, they assert that green-driven underinvestment will play a more substantial role than even market fundamentals. Respondents working in clean energy see geopolitics as a major cause of market uncertainty, and one in six respondents also point to producer profit seeking.

Even assuming those in the clean energy sector are correct and the risk is diminishing, as 2023 progresses and Russia’s aggression persists, policymakers and the private sector would be wise to consider how to mitigate the geopolitical risks of energy. As our essay authors in this chapter explain, the antidote is investment.

Investing in the old energy system and the new is not an either-or proposition. New oil and gas projects are needed to avoid geopolitically motivated volatility and ensure as smooth an energy transition as possible. Stable energy markets are needed to guarantee societal buy-in for the transition and avoid empowering anti-decarbonization populists. Longer-term investments in clean technologies and their supply chains can maximize the geopolitical benefits of distributed energy production and avoid future supply shocks. In all cases, the diversification of all facets of the energy system is key.

Partner perspective

It’s time to focus on making lasting carbon reductions

For years, policymakers focused on novel solutions to tackle one leg of the energy trilemma—pushing renewables at the cost of hydrocarbons. 2022 taught us that real cuts to carbon emissions require reliability and affordability to also be in balance.

By Majid Jafar

The year 2022 will be remembered as one of economic pain and missed opportunities, as the first truly global energy crisis took hold. After years of pushing renewable energy projects at the cost of oil and gas development, almost every government from Europe to the Americas has found itself reversing some of those policies or putting them on hold to overcome the crisis. In turn, policymakers have turned to energy producers from Venezuela to the Middle East and North Africa to boost energy flows and even reopened old coal-fired plants.

In the United States, the Biden administration, which has promised a clean energy revolution, called for a suspension of gasoline taxes, and lobbied Saudi Arabia to pump more oil. In Germany, concerns that the Mittelstand would not be able to keep the lights on sent leaders scrambling to secure supplies of liquefied natural gas (LNG) on world markets, pricing out developing countries. And in the United Kingdom, mothballed coal power plants were restarted as policymakers urged residents to lower their thermostats in a bid to cut energy demand.

The biggest lesson in this human-made crisis is that the path to the carbon transition is just as important as the destination itself. Policies that glossed over the importance of resilience in the energy system meant supply shortfalls quickly had massive economic and political impact. That may ultimately hamper long-term efforts to make lasting reductions in the world’s carbon footprint, which is the ultimate goal.

The International Energy Agency estimates that, to reach net-zero emissions by 2050, annual investment in energy supply must reach $5 trillion a year; the energy crisis, and the chaotic response to it, may have dampened enthusiasm for that level of investment.

Like good health, it was easy to forget about energy supply when it was plentiful, but it became central as soon as shortages began in 2021. In the case of energy supply, however, shortfalls are experienced more like a heart attack to the economy.

Investment shortfall

Sadly, this was a predictable and preventable crisis. For years, an estimated $300-billion shortfall in investment in oil and gas has been met with warnings of impending shortages. On average, the world loses four to five million barrels a year from natural decline in existing oil fields, even if demand were steady. Significant investment is needed to maintain production levels, but that investment wasn’t being made to scale.

Worse, the focus on climate-lulled policymakers into believing that oil and gas will be obsolete, leading financial markets to shy away from long-term investments in the sector. This was common across the energy system: underinvestment in nuclear power, for example, meant even further energy supply shortfalls.

Investment in renewables did not keep pace with the lost energy supply either. In 2021, 13.5 percent of global primary energy came from renewable technologies, representing double-digit growth over recent years, but far from replacing any other source of energy. More significantly, two-thirds of that total actually came from existing hydropower, biomass, and other sources which have been impacted by drought and other weather challenges. Most projections agree that renewable energy sources will remain just one part of the energy mix.

The third major challenge has been the shutdown of nuclear power plants in Europe and the commensurate increased reliance on coal in some countries, which proved self-defeating just as energy demand rose in the post-COVID recovery period. As nuclear is phased out from some European countries, the United States, Japan, and others have taken a renewed interest in nuclear. However, it may take years to bring the next generation of reactors online.

By 2022, years of chronic underinvestment across the energy spectrum and rapidly growing demand, particularly from the developing world, turned a supply imbalance into a global crisis. The conflict in Ukraine simply accelerated the crisis just as demand began to spike due to the global economic recovery.

Putting the developing world up front

Nowhere will these factors have a bigger impact than in the developing world, where many view the energy crisis as a problem created elsewhere that they must now pay for. Policymakers in the developing world say they will ultimately bear the biggest burden in tackling the effects of climate change, despite having had a small, even negligible, role in creating it.

Unlike the rich world, developing countries face a notably different set of considerations. As energy demand in the developing world climbs at double digit rates, current systems remain highly centralized and inefficient. Traditional regulation has been ineffective, and basic access to energy remains limited, with many suppliers operating at a net loss. Many consumers are subsidized, but subsidies aren’t always well targeted, and can often lead to inefficient consumption patterns. Ultimately, the ability to pay for new infrastructure is limited.

With barely a fraction of the carbon footprint of developed countries, developing countries in Africa and Asia say they are being forced to give up access to traditional low-cost energy supplies just as they enter a stage of rapid growth. With more than one billion people still lacking access to basic electricity service, the pressure to eschew traditional energy systems risks dampening badly needed economic growth. The result, especially in the developing world, is an increase in energy poverty even as demand continues to rise.

It behooves policymakers to enable the developing world to move to lower carbon emitting fuels such as natural gas, as well as solar power, to begin the process of cutting emissions without burdening their economies with major costs they cannot afford.

Taking a more holistic view

There is another path forward to a more sustainable world. The global energy crisis has lent credence to the concept of the energy trilemma, which encourages a holistic view of the energy system to bring about real change to the system. The trilemma posits that healthy energy systems must be in careful balance with supply availability, affordability, and sustainability to work efficiently. Fundamentally, climate change is a matter of emissions, not of energy consumption. To reduce the world’s carbon footprint, we must cut carbon emissions for a given amount of energy consumed. Many policies in recent years have targeted energy production, effectively starving the world of supply even as demand continued to rise.

Maintaining this balance in the context of the energy transition is challenging as trade-offs between equally critical priorities become clear. By balancing resilience and affordability with sustainability, policymakers can ensure that the carbon transition process continues and the effects bring about true change.

Finding balance in the trilemma also helps clarify priorities and defines long-term roadmaps. For example, ensuring energy resilience, especially with cleaner burning natural gas, to avoid future supply shocks as energy systems are electrified will be crucial. Similarly, hydrogen from natural gas or electrolysis will further reinforce resilience in the system. So, too, will an embrace of modern nuclear power.

Finally, a more holistic view of the trilemma enables greater predictability in the energy system even as renewable energy adds further uncertainty due its intermittent nature. Spurring investment in resilience will require steadily extending measures with more certainty about which energy sources can be used, for how long, and for what purpose.

Politicians and policymakers, particularly in the West, must now confidently stand before voters to champion a more balanced energy system that includes oil and gas, nuclear power, and renewables. The net result of this balance is that real cuts in emissions will take hold; investment in renewables will continue, but not at the cost of resilience and balance.

The energy shock of 2022 will change the world in countless ways. But it can also be a moment to trigger smarter policy and the investment needed to resolve the conflict between resilient energy supply and lower carbon emissions.

Majid Jafar is the chief executive officer of Crescent Petroleum and a member of the Atlantic Council’s International Advisory Board. Crescent Petroleum is a sponsor of the 2023 Atlantic Council Global Energy Forum.

Partner perspective

Financing a sustainable and inclusive energy transition with an eye toward COP28

By Bernard Mensah

Climate change demands an urgent call to action. Identifying the problem—or indeed the solution—is the easy part. We must slash carbon emissions to maintain a livable planet.

Taking the goals set out in the Paris Agreement as the aspirational baseline, COP27 highlighted that there remain large ambition, policy, and implementation gaps. Crucially, COP27 underlined a lack of alignment between developed and developing countries regarding the best way forward with factors beyond climate coming into play. Before the climate talks even began, host nation Egypt said soaring food and fuel prices combined with ballooning foreign debt complicated its climate ambition.18“Egypt’s First Updated Nationally Determined Contributions,” United Nations Framework Convention on Climate Change, June 8, 2022, https://unfccc.int/sites/default/files/NDC/2022-07/Egypt%20Updated%20NDC.pdf

This lack of alignment across countries means that we are, at best, currently on a slow route to victory. However, finance can play a critical role in accelerating the path forward. Finding the right balance and interplay between public and private finance will be a key catalyst. And importantly, innovation in finance can help ensure a just transition that allows the developed and developing worlds to be better aligned towards our shared goals.

The needs are vast: worldwide, 770 million people still live without access to electricity.19“Access to Electricity,” International Energy Agency, April 2022, https://www.iea.org/reports/sdg7-data-and-projections/access-to-electricity. Alongside the expansion of renewables, significant investment will be needed to build sustainable grid capacity, introduce electric vehicles, and produce green hydrogen for industrial use.

According to a report commissioned by the governments of Egypt and the United Kingdom ahead of COP27, cutting carbon emissions, strengthening climate resilience, and dealing with historical loss and damage resulting from climate change will require an estimated total annual investment in developing countries (excluding China) of $1 trillion by 2025 and over $2 trillion by 2030.20“COP27 Report Calls for International Investments of $1 Trillion Annually by 2030 in Climate Action in Developing Countries,” Graham Research Institute on Climate Change and the Environment, press release, November 8, 2022, https://www.lse.ac.uk/granthaminstitute/news/cop27-report- calls-for-international-investments-of-1-trillion-annually-by-2030-in-climate-action-in-developing-countries/. While the bulk of that finance must come from the private sector, governments can enhance the effectiveness of each dollar of private capital raised.

For example, investors’ perception of risk is far higher in emerging markets. According to the International Energy Agency, the cost of capital for a solar project can be as low as 2.6 percent in Europe and as high as 10 percent in India— and that was before the recent Federal Reserve interest rate hikes.21“The Cost of Capital in Clean Energy Transitions,” International Energy Agency, December 17, 2021, https://www.iea.org/articles/the-cost-of-capital-in-clean-energy-transitions. Arguably, on a climate risk-adjusted basis, this risk premium is much too high and leads, therefore, to a suboptimal allocation of resources and a slower route to our destination.

There are several ways governments can play a part in reducing this risk premium:

• Regulation. The UK is a world leader in off-shore wind, with around 13 gigawatts installed.22“Energy Security Bill Factsheet: Offshore Wind Environmental Improvement Package,” GOV.UK, updated December 29, 2022, https://www.gov.uk/government/publications/energy-security-bill-factsheets/energy-security-bill-factsheet-offshore-wind-environmental-improvement-package. Alongside its island geography, “contracts for difference” play a critical role in the UK’s regulatory framework. These incentivize private investment by providing revenue certainty, while being awarded through an auction system to keep costs down.