Tough times ahead for African oil producers

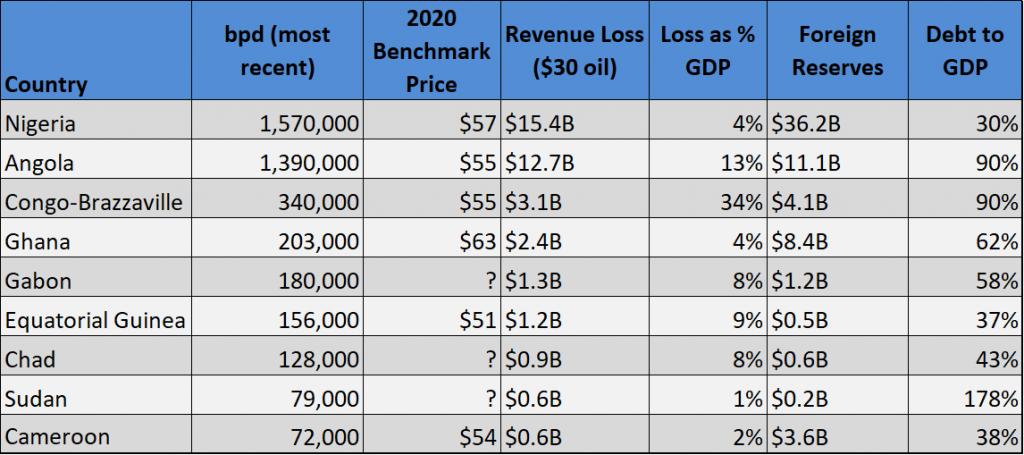

The closed borders and travel bans that have accompanied the spread of the novel coronavirus have dramatically dampened the demand for oil, leading to a precipitous decline in prices. This will have significant economic knock-on effects for all of Sub-Saharan Africa’s top producers. In straight losses, Nigeria and Angola lead the pack with expected losses exceeding $10 billion if prices were to stay around $30. For context, Brent crude, the international benchmark, hit an eighteen-year low on March 18, and closed at $27.03 on March 23. Accounting for factors such as economy size, foreign reserve levels, and debt to GDP, Central African producers look to be the most vulnerable. Angola and Congo-Brazzaville both already have heavy debt burdens, and oil accounts for 37 percent of Angola’s GDP and 55 percent of Congo’s. With already highly speculative B- bond ratings on their sovereign debt, both countries may find borrowing difficult if they look to inject cash and stabilize reserves.

To make matters worse, Angola sends over 60 percent of its oil to China, and shipments have recently had to be offloaded at discounts due to reduced demand. The country also uses oil as collateral for its $25 billion in Chinese debt. For Congo-Brazzaville, as elsewhere, disruptions related to COVID-19 will also likely stall progress on new projects, including a recent, yet dubious, find in the country’s Cuvette region. While the Congolese operator claims the find could quadruple annual production and serve as an economic lifeline, a compelling report by Global Witness casts doubt on the size and viability of the reserves, while voicing further concerns over corruption and risks to the environment. Thus, while COVID-19 may be immaterial in this case, operations and exploration in the country’s other fields may too be affected, as Italian ENI “will consider a strong reduction in [its] capex and expected costs to levels that are consistent with the new price scenario,” according to the company’s Chief Executive Officer.

The shocks will be felt everywhere, though. Despite oil only making up 10 percent of GDP in Nigeria, the government’s budget relies on oil for 57 percent of all revenue. Oil also accounts for 94 percent of exports and a similar percent of foreign exchange earnings. Thus, government coffers will be hit harder than GDP, and as a result, public services in oil producers will be constrained, just as these countries scramble to shore up their health and education sectors in response to the virus.

Note: This article was originally published on March 24. It was updated on March 25 to incorporate recent analysis from Global Witness on the status of Congo’s oil find.

Luke Tyburski is a project assistant with the Atlantic Council’s Africa Center.

Questions? Tweet them to our experts @ACAfricaCenter.

For more content, go to our Coronavirus: Africa page.

Image: Outside an oil refinery in Port Harcourt, Nigeria. (Flickr/Wish For Africa)