Biden’s electric vehicle tariff strategy needs a united front

Last week, President Biden announced 100 percent tariffs on Chinese electric vehicles (EVs), and former President Trump reiterated his plan to put a 200 percent tariff on all auto imports from Mexico.

According to the administration, there are two major motivations behind these tariff increases: 1) Protect and stimulate US clean energy industries and supply chains, and 2) Counter a flood of Chinese goods, as Beijing turns to exports to compensate for weak internal demand.

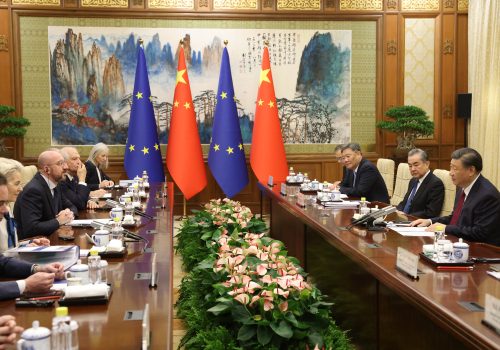

The challenge with the second objective is that, as was evident in the 2018 trade war, tariffs are not likely to change Chinese behavior. The question with this new wave of tariffs is if there will be a more united strategy with G7 allies, as Secretary Yellen called for in her speech yesterday in Frankfurt en route to the G7 finance ministers meeting.

A shared strategy among allies would not only communicate shared concern, but may also make China’s export-driven growth strategy less viable if important markets use tariffs and other barriers to reduce imports on rapidly growing industries like EVs.

This is easier said than done. The United States can impose high electric vehicle tariffs because China only represents 1-2 percent of the US EV imports. By contrast, EVs from China already comprise over 20 percent of Europe’s EV imports, making tariffs more likely to raise costs for consumers. Then there’s European exports to China. Over the last seven years, the EU’s share of China’s auto imports has been more than double the US’ share, at 45.5 percent compared to 20.2 percent.

The Biden Administration’s decision also means that Chinese manufacturers may further ramp up their exports to non-US destinations. That could put enormous pressure on US partners, especially Brussels. As G7 leaders meet this weekend in Stresa, Italy, from May 24 to 25, they’ll discuss the potential for a shared strategy on Chinese overcapacity.

Europe’s year-long anti-dumping investigation is wrapping up this month, and a decision is due by July 4. Will the EU impose anything close to the US policy on Chinese EVs? Unlikely. The potential retaliatory strike on European auto exports to China is just too costly to stomach.

The highest the EU may go is 30 percent, but as Rhodium Group has pointed out, a move like that would still not have a major impact on European demand given China’s subsidies and competitive pricing.

Then there’s Japan. Japan has no auto tariffs, but maintains many non-tariff barriers to auto imports to help ensure the success of its car companies. Last year, however, the top electric vehicle in Japan wasn’t made by Toyota or Honda—it was BYD’s Dolphin.

Still, Japan’s import market for electric vehicles is small, importing only 22,848 electric vehicles in 2023. Fully electric vehicles made up only 1.8 percent of total auto sales last year, as Japanese car manufacturers have gravitated towards hybrid models like the Toyota Prius. Japan’s primary concern is not China dominating its domestic import market—but rather holding on to its place as the top global exporter of vehicles.

In fact, China exported more cars than Japan for the first time last year, many of which went to Japan’s neighbors. In response, Japan and its ASEAN neighbors announced on May 20 that they will develop a joint strategy on auto production by September this year to compete with China, especially on electric vehicles.

The bottom line? In this sector, tariffs, working in isolation, can’t fully achieve all the objectives—no matter how high they go. It’s only when tariffs are relatively aligned across countries and then matched with positive inducements, new trade arrangements, and, ultimately, a better product, that the trajectory could change.

Josh Lipsky is the senior director of the Atlantic Council GeoEconomics Center and a former adviser to the International Monetary Fund.

Sophia Busch is an assistant director with the Atlantic Council GeoEconomics Center where she supports the center’s work on trade.

Ryan Murphy contributed research to this piece.

This post is adapted from the GeoEconomics Center’s weekly Guide to the Global Economy newsletter. If you are interested in getting the newsletter, email SBusch@atlanticcouncil.org

At the intersection of economics, finance, and foreign policy, the GeoEconomics Center is a translation hub with the goal of helping shape a better global economic future.

Further reading

Mon, Dec 11, 2023

China’s manufacturing overcapacity threatens global green goods trade

Econographics By Niels Graham

Chinese lending is exacerbating a growing glut in its green manufacturing sector. Beijing is increasingly looking abroad to absorb excess capacity. This may have devastating effects for the global trading system as economies move to protect their own domestic industry.

Tue, May 14, 2024

What to know about Biden’s new tariffs on Chinese EVs, solar cells, and more

New Atlanticist By

The Biden administration has imposed new tariffs on imports from China across a range of strategic industries. Atlantic Council experts dig into the details.

Mon, May 13, 2024

What US tariffs on Chinese batteries mean for decarbonization—and Taiwan

EnergySource By Joseph Webster

In response to Beijing’s attempts to cement its dominant position across the “new three” technologies of solar photovoltaics (PVs), electric vehicles (EVs), and batteries, the Biden administration is poised to issue tariffs on key Chinese products. A look at China’s battery exports, and its associated battery complex, reveals both opportunities and risks for US and allied […]