Middle East business leaders provide perspective on the economic impact of the upcoming US presidential election

In an empowerME survey conducted in the last thirty days, thirty-two Middle East business leaders shared their views on the possible economic impact of the 2020 US Presidential election. Atlantic Council experts Kirsten Fontenrose, Amjad Ahmad, Mohsin Khan, and Jean-Francois Seznec analyzed the data and provided the following key takeaways.

Key Takeaways

Scowcroft Middle East Security Initiative Director and former US National Security Council Director for the Gulf Kirsten Fontenrose

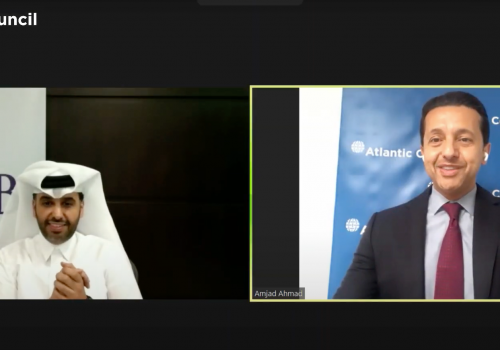

- 91 percent of survey respondents agree that US political and economic engagement is essential for future economic development and growth in the Middle East. This should be a glaring beacon to a next administration that the international business community at home and in the region desires the United States to remain at the table on issues of policy and fiscal and financial matters. However, this is not a statement on the US military presence in the region.

- To what degree can the United States draw down its security engagement and maintain its influence on political and economic issues? How much of a footprint is necessary to have leverage with governments in the region on human rights, on contracting regulations or decisions about foreign ownership of companies, or on OPEC decisions? The challenge for US policymakers will be in striking that balance.

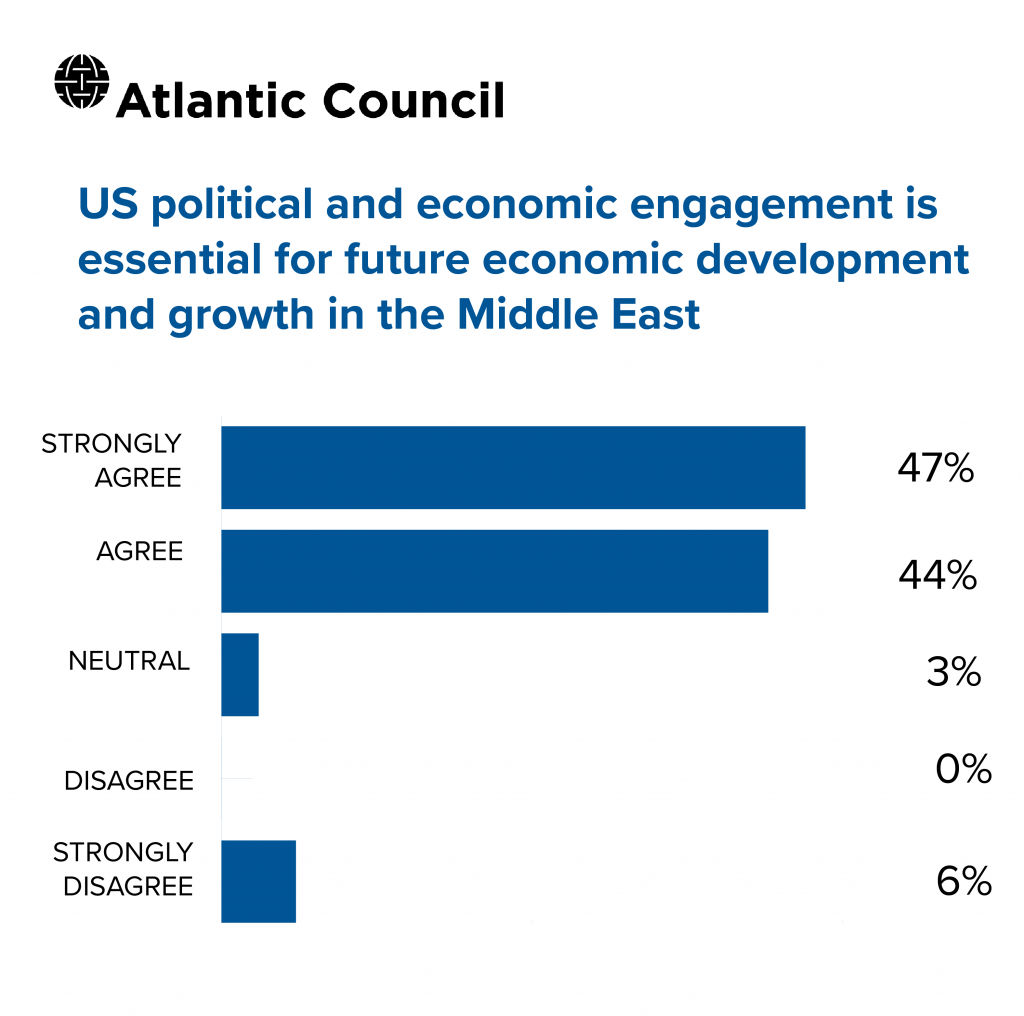

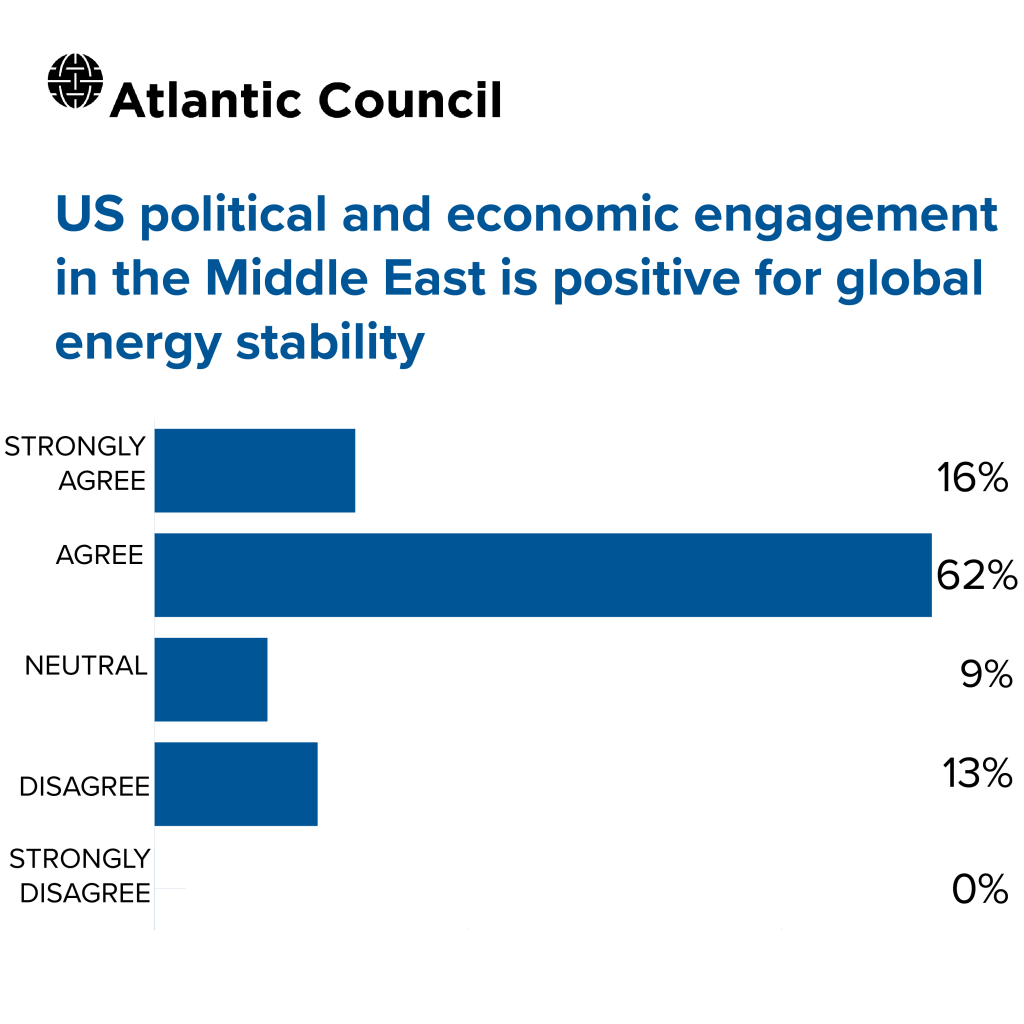

- Almost a quarter of respondents were neutral or in mild disagreement with the idea that US political and economic engagement is positive for global energy stability. This may reflect feelings about the intense pressure placed on OPEC this summer before its meeting to discuss production cuts. It may also reflect the fact that US engagement on energy issues has, of late, carried with it the interests of the US shale industry.

- But if we pull back and assume these respondents are talking about US engagement on political and economic issues more broadly, then we see that 78 percent of respondents feel that US engagement positively impacts the stability of global energy markets. For a next US administration, this is an overwhelming majority of a sample from the international trade sector operating in the region telling us that US engagement is important for international business operations, shipping and transport, manufacturing, and byproduct supply chains since quakes in the global energy market impact multiple areas of operation for multinational businesses.

- The survey responses may also reflect fear that if the United States ignores the region, market forces or the interests of players like a self-interested Russia, or a hard-bargaining and transactional China or an Iran pumping without restrictions, would create market fluctuations that would be crippling to multinational businesses for whom energy stability is a critical component of their financial forecasts. The message is for the United States to keep a hand in the game.

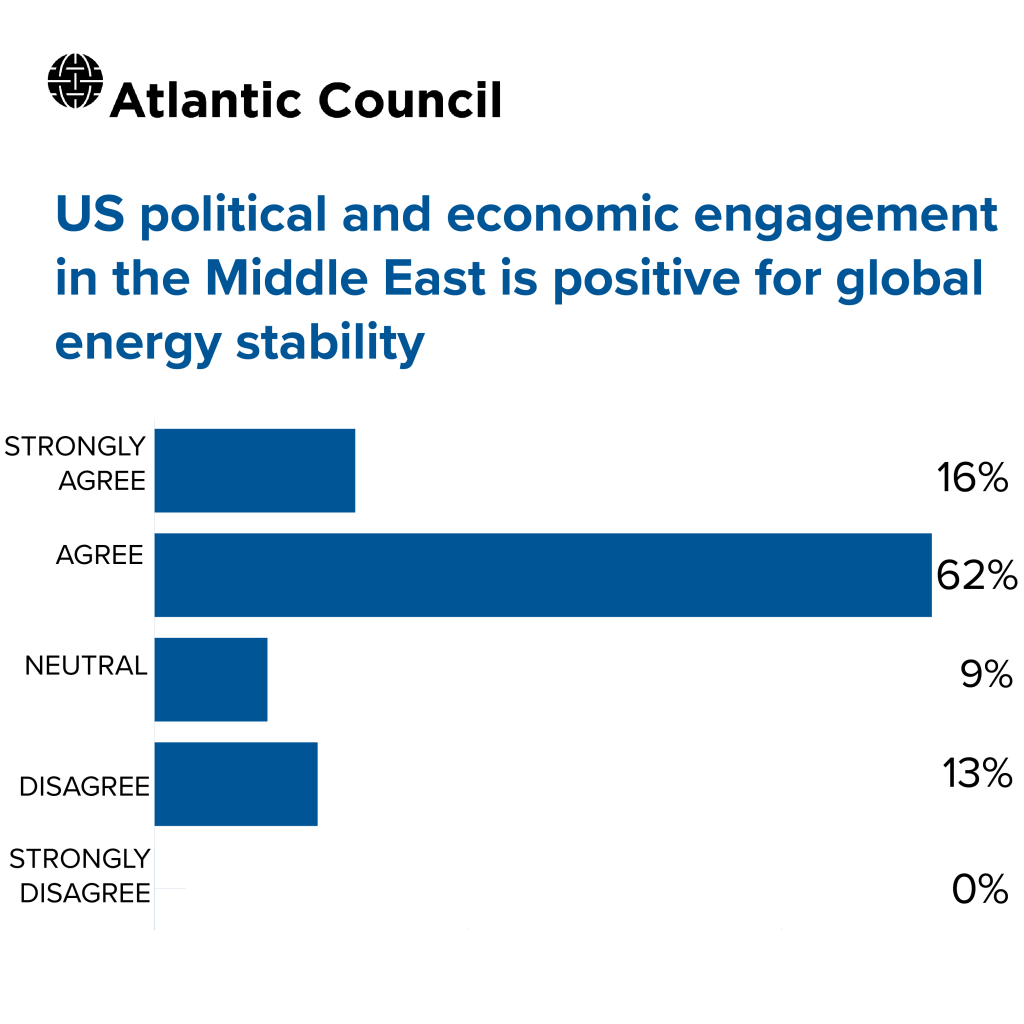

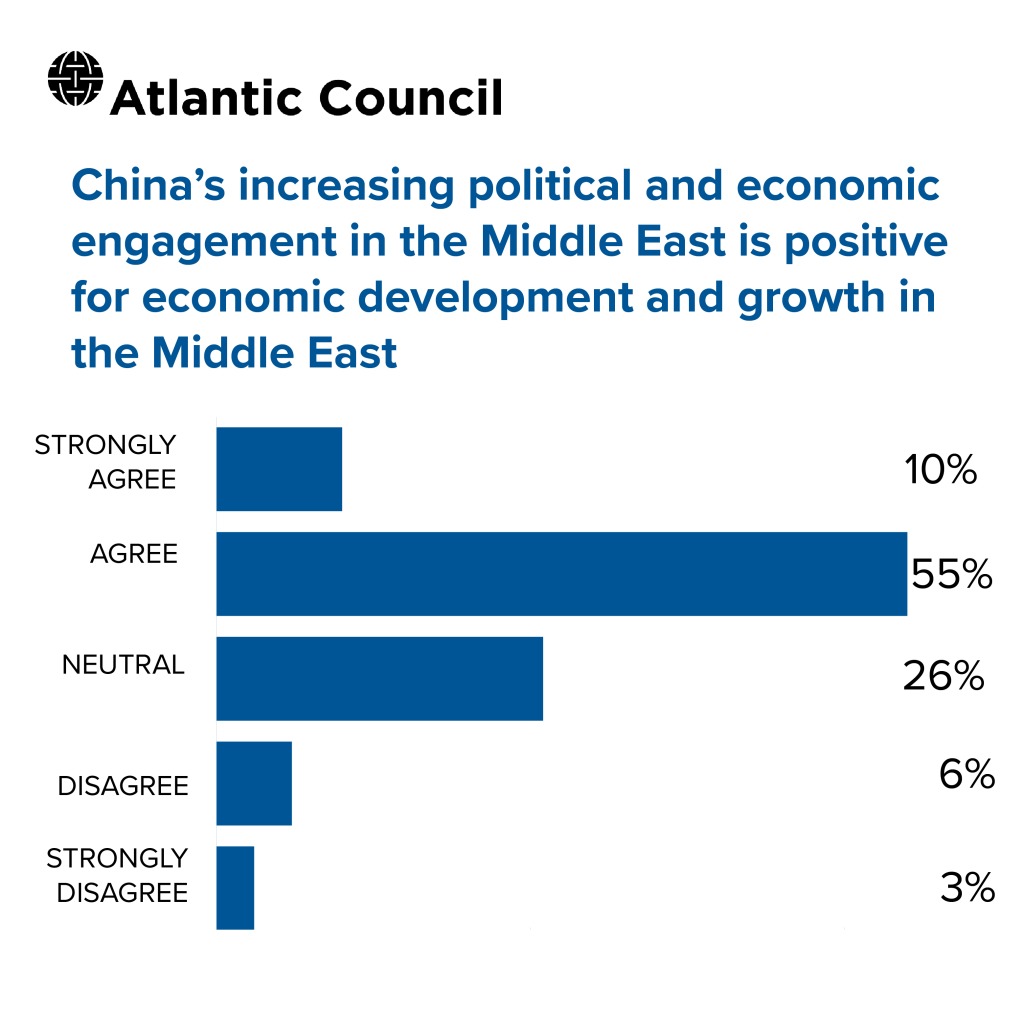

- 65 percent of respondents agree that China’s engagement in the region is driving growth. About 9 percent disagree, which may reflect concerns about competition or about the nature of Chinese political and economic engagement to benefit elites only and therefore not result in lasting development or growth.

- What is interesting is that over 25 percent of respondents are neutral on the issue of China. US policymakers should take note of this. These are the people who will be on the fence about the pressure that any next US administration will inevitably place on Middle Eastern partner governments to scale back their involvement with China. The US government will need to state in very clear terms what the benefit to multinational business actors will be if these governments agree to do this, and demonstrate very clearly what the long term negative implications of increased Chinese engagement in the Middle East will be on the interests of multinational businesses.

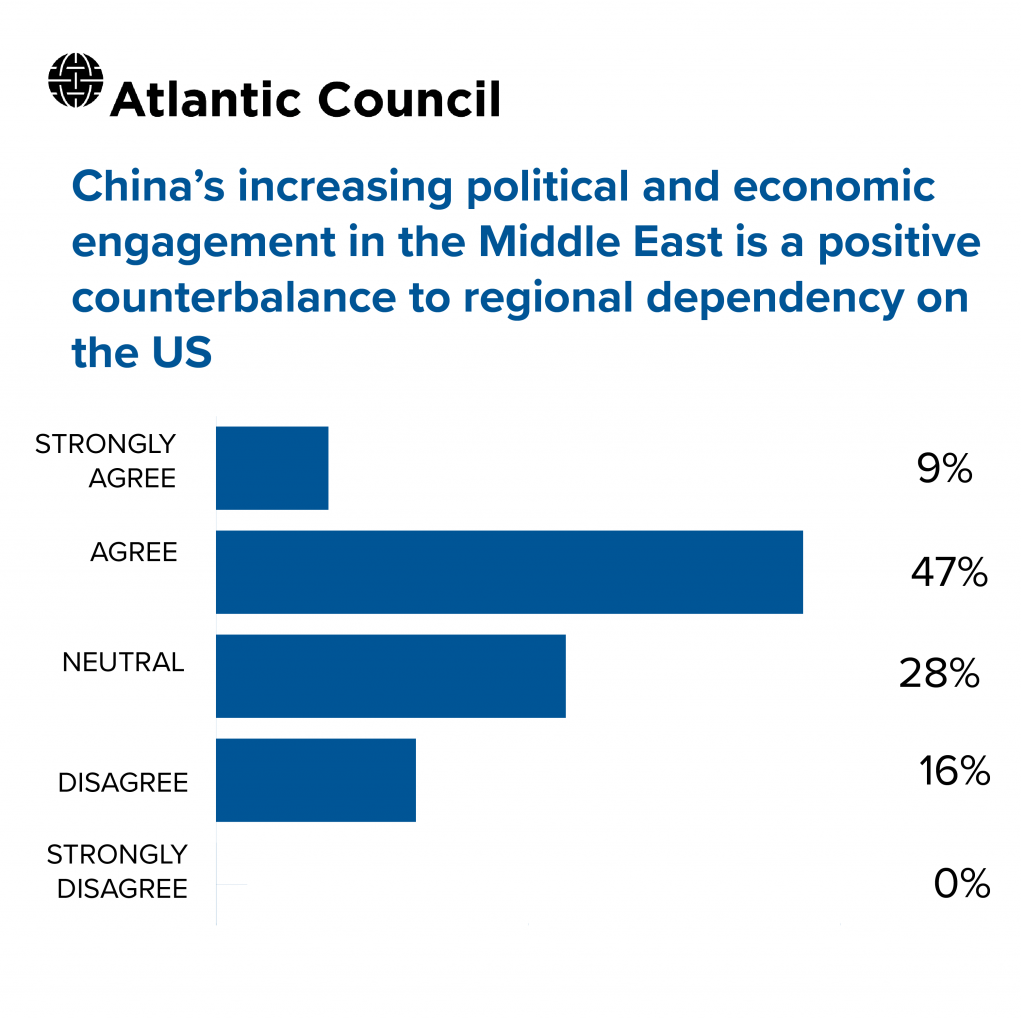

- 56 percent of respondents agreed or agreed strongly that China is a positive counterbalance to the United States. This should make US policymakers stand up and take notice. The United States hears frequently from regional leaders that China is a transactional partner while the United States is a strategic partner. But being perceived as an additional partner for transactional business is very different than being perceived as a positive counterbalance.

- These responses tell us: 1) a majority of the sample of business leaders feels a counterbalance to the United States in the region is necessary and 2) that China is filling this need and doing a good job at it. However, is the investment good for societal members who may not be receiving the largesse from these transactions? It may be that in the long-term Chinese investment is good for business leaders and negative for societies.

empowerME Director and venture capital investor Amjad Ahmad

- 65 percent of survey respondents agreed that China’s increasing political and economic engagement in the Middle East is positive for economic development and growth in the Middle East.

- China is viewed positively in the Middle East, and the question for the United States over the next decade is, can we keep those that are neutral about China (26 percent of respondents) on the US side rather than having them go over to China’s side? The United States needs to make sure that its soft power, which took us generations to build, doesn’t disappear to China and other actors.

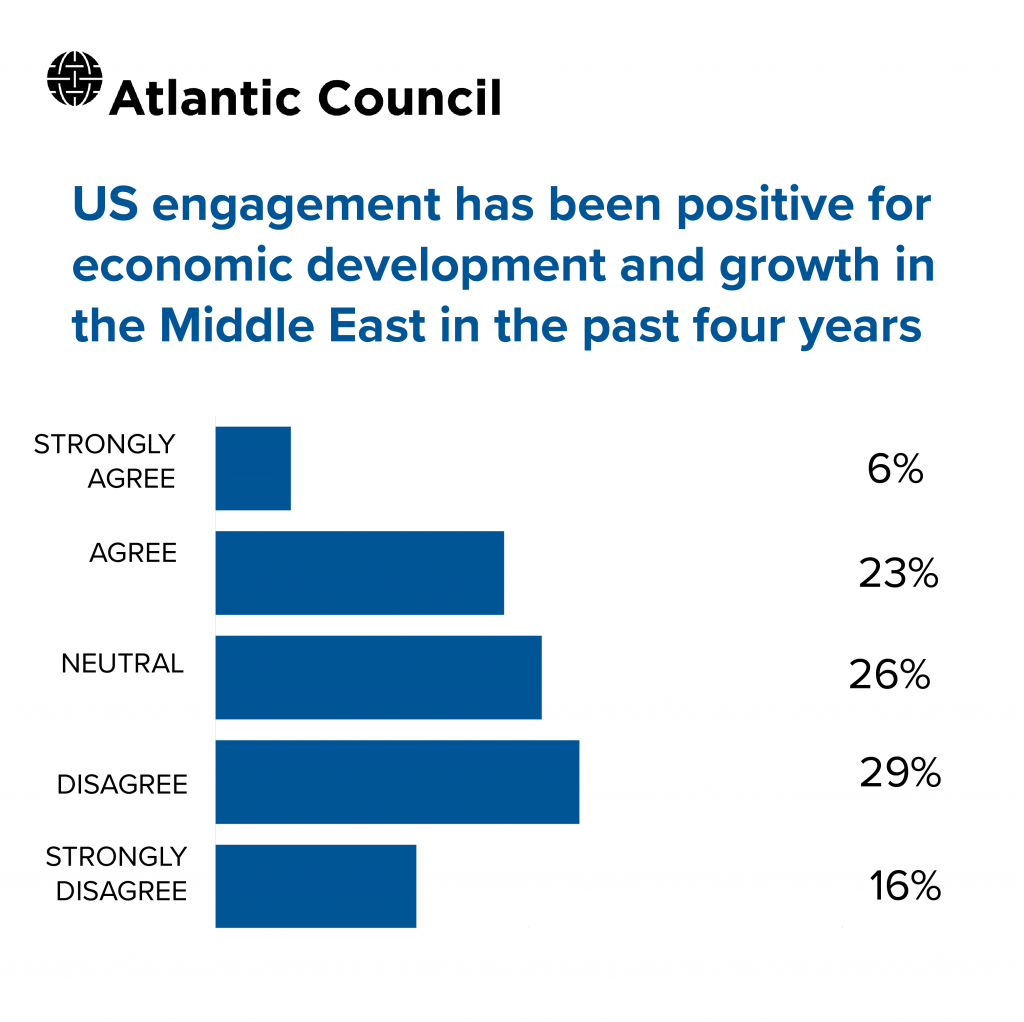

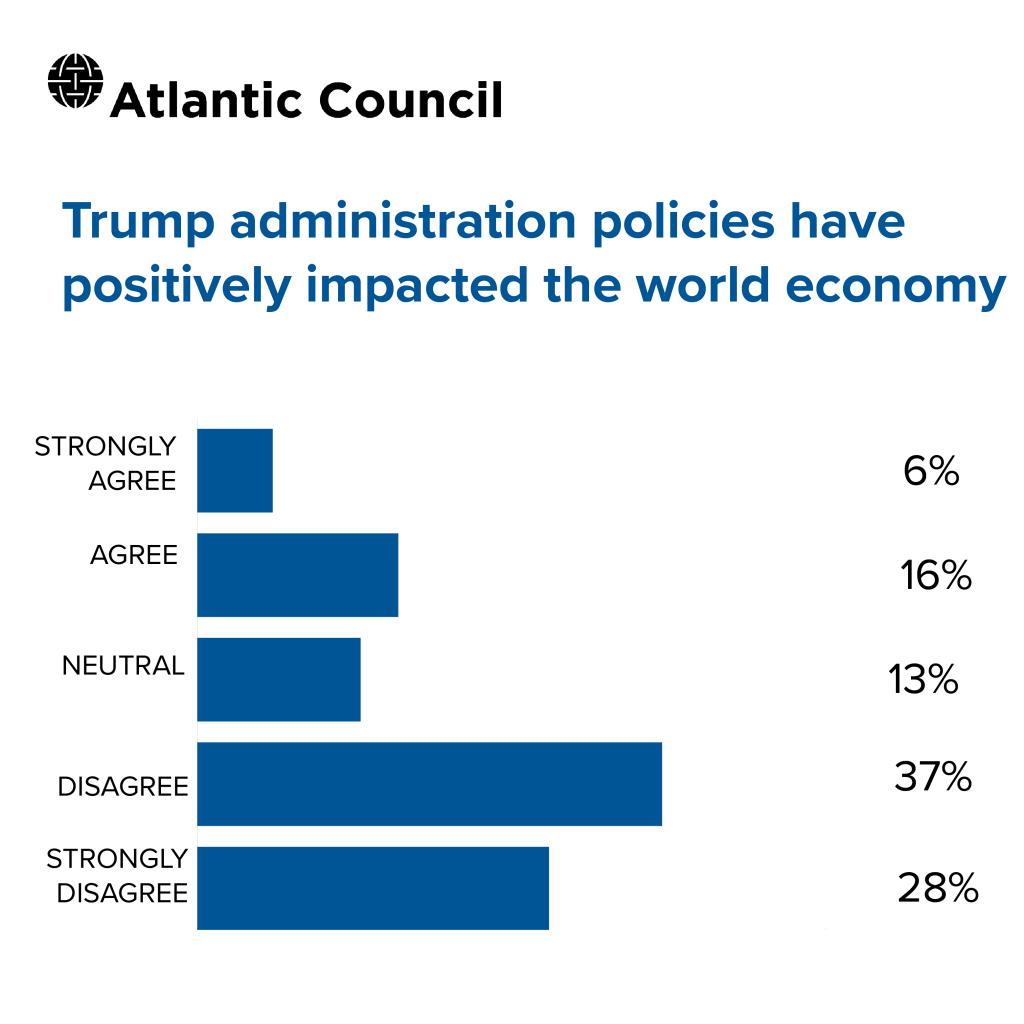

- Only 29 percent of survey respondents agreed that US engagement has been positive for economic development and growth in the Middle East in the past four years. This is tied to President Trump’s impact globally, which has been negative. Sparking trade wars with China has negatively impacted the region since it is a trading hub. Sanctions, overall uncertainties, and pulling out of agreements also impacted trade. In addition, the energy issue seems very transactional now. Though you would think that regional business leaders would see Trump’s support of Gulf leaders (against Iran) as positive, the reality is that people in region do business with Iran, so it may be seen as the pendulum swinging too far in one direction.

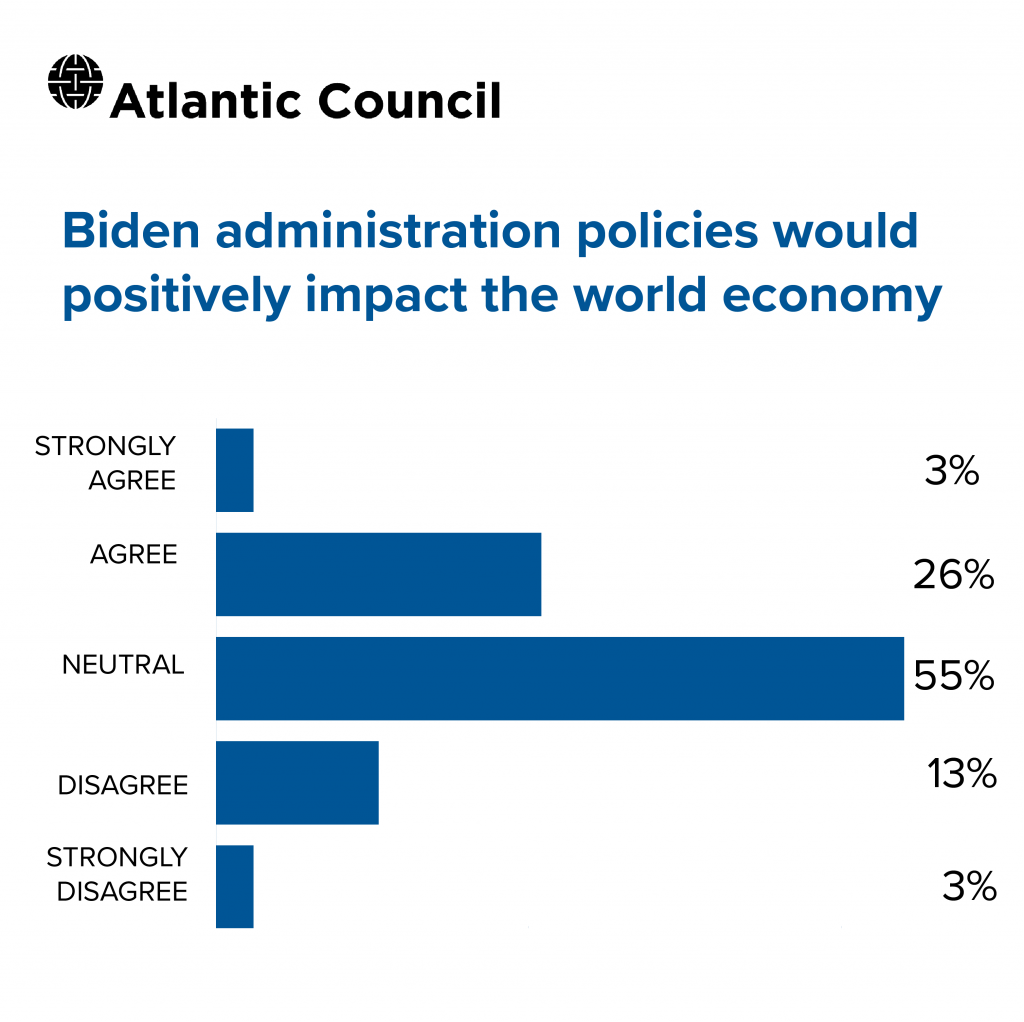

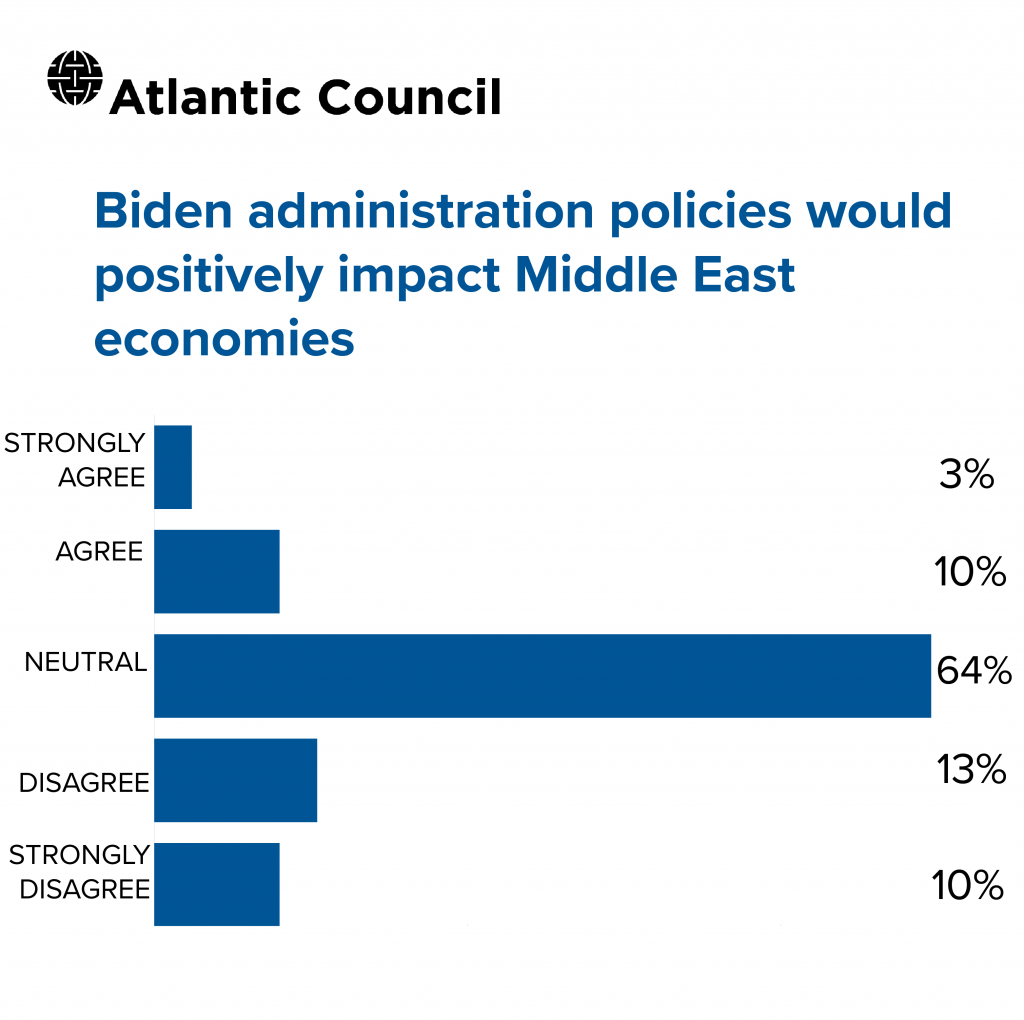

- 55 percent of survey respondents are neutral about whether Biden administration policies would positively impact the world economy. This underscores that the verdict is out on Biden. He hasn’t effectively articulated a vision for the global economy due to his focus on the pandemic and inequality domestically. The world doesn’t know what his economic vision is for the United States or the world. The results from the survey indicate a “wait and see” attitude about a possible Biden administration.

- However, their views on Trump are clear with 65 percent of respondents suggesting that his policies have been negative for Middle East economies.

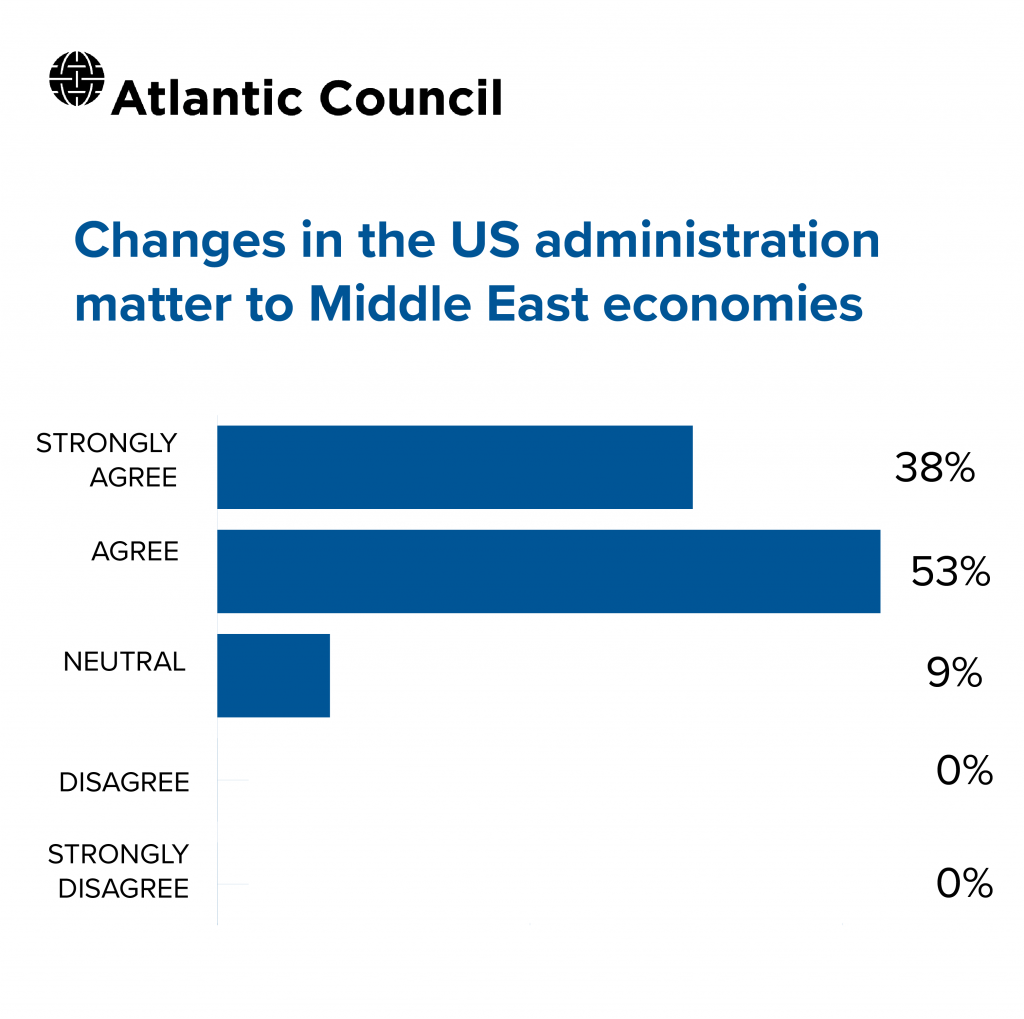

- Given that 91 percent of respondents feel that changes in the US administration matter to Middle East economies, it signals that business leaders may welcome a change in the US administration.

- 78 percent of survey respondents believe that US engagement is key to the future of global energy markets. Business leaders continue to believe that energy is a dominant force for the region given the slow pace of economic diversification. While economic diversification has dominated many agendas across the region, more needs to be done to invest in sectors of the future.

- One interesting finding from this survey is that views on US engagement are positive overall but negative on Trump and neutral on Biden. One explanation for this is that there’s always a positive bias when it comes to the US economy. The United States is still the number one performing economy in the world. Many Middle Eastern investors have significant interests in the United States. Sovereign wealth funds are overwhelmingly invested in US real estate and capital markets. There is a notion that the United States will get its act together and make the world a better place. The volatility of the past few years has impacted feelings about this administration and business leaders are yearning for stability Business executives want to reduce uncertainty and unfortunately this administration has created volatility both politically and economically across the world.

- The market has digested a change in the US administration but has not factored in a contested election. Should this election be contested, it will likely be worse that the Bush-Gore election of 2000 given Trump’s stance on the legitimacy of the election process.

Nonresident Senior Fellow and former International Monetary Fund Middle East and Central Asia Director Mohsin Khan

US economic policy relating to Middle East and North Africa (MENA) is not going to change in any meaningful way in the near future, irrespective of the administration in power in 2021 onwards. Aside from existing aid commitments, specifically to Egypt, there is really no likelihood of additional US official financing flowing to the region. The virtual absence of US financial assistance is being filled by China and all signs point to it growing over time. The United States can influence multilateral financial institutions, like the IMF and the World Bank, to provide MENA countries additional financing, but the amounts are unlikely to be significant as these institutions themselves will be under financial pressure because of the resources they have made available to combat the economic costs of the pandemic. The IMF alone has already loaned over $10 billion or so to MENA countries this year. The US can also arm-twist the wealthier Gulf oil exporters to kick in more money, but it likely to impose political and strategic conditions on the recipient countries, which they may or may not accept.

The United States can certainly play a positive and constructive role in external debt reductions and debt payment moratoriums, which the current administration has supported and presumably the next one will too. This support has no consequences for the US taxpayer. Trading arrangements are another channel through which US economic policy can benefit MENA countries. But here the idea of a free-trade agreement, like the one with Morocco, between the US and other MENA countries anytime soon is a non-starter.

At the same time, US domestic economic policy can have important positive effects on Middle East economies. If these policies lead to a robust recovery, or what has come to be called a “V-shaped” recovery, then there is reason for some optimism. Faster growth of real GDP and demand in the United States will lead to increased imports from the Middle East, increased remittances from expatriate workers in the United States, and higher tourist receipts. Additional US investments, particularly financial investments, could also be forthcoming, easing the perennial external financing constraints that MENA countries, other than the Gulf countries and other oil exporters in the region, face. All In all, on the economic front, the United States certainly matters for the Middle East, but it is more the US private sector and not the US government directly.

Senior Fellow Jean-Francois Seznec

The Gulf business community sees the United States as having been a stabilizing element for the economies, politics and security of the region. However, the United States is no longer the only frame of reference. The main products of the Gulf, namely oil, natural gas and increasingly the high value-added chemicals, fertilizers and metals, by and large go to the Far East and to a lesser extent Europe. In return, the Gulf main imports are from the Far East (China, Taiwan, Korea and Japan) and from the European Union. The United States is still important, but its market share and economic influence is declining rapidly.

The region’s businesses are concerned by a potential US withdrawal from the Gulf. However, they do see China as a major partner now and increasingly so in the future. On the other hand, even though China’s trade and economic leadership has passed the United States’, Korea, Japan and Taiwan are economically very important to the region as well. In fact, these US allies may end up replacing somewhat the US economic influence and partly balance China’s growing importance. As long as the United States remains the guarantor of freedom of navigation, which does benefit China, this will continue to benefit the Asian allies of the United States.

Perhaps the Achille’s heel of the United States and its allies’ economic influence in the region is the Gulf’s complete dependence on the US dollar. One can expect that China will very actively seek to transfer its trade to Renminbi based transactions, even if it means making the Renminbi freely convertible. Seeing the size of trade between China and the Gulf, this may happen sooner rather than later and the business community of the region is well aware of it.

Future of Iran Initiative Director Barbara Slavin

The most striking results from this survey are the large numbers – pluralities and in some cases large majorities – that view Trump policies as hurtful to regional economies. This contrasts with the widespread perception in the United States that conservative Arab states prefer Trump because of his “maximum pressure” campaign against Iran. Instead, it appears that most top business people in the region see sanctions and rising military tensions – as well as perhaps Trump’s mishandling of the COVID crisis – as negative for business and economic growth. They may not be thrilled by the idea of a Biden presidency but there will be few regrets, at least from a business perspective, to see the back of Trump.