Stay updated

Sign up to receive emails on new research & reports, program highlights, and events.

our pillars of work

Future of capitalism and trade

The center believes that international cooperation and free markets provide the best architecture to enable prosperity but it is time to revitalize capitalism and trade in the 21st Century. This involves reimagining global governance, promoting inclusive growth, and charting China’s economic trajectory.

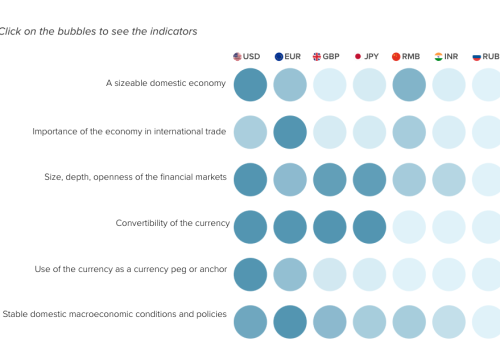

Future of money

The center develops in-depth writing and convenes on Central Bank Digital Currencies (CBDCs), stablecoins, and cryptocurrencies. We seek to accelerate US action on creating new technical and regulatory standards on digital assets to ensure the continued strength of the dollar, pound, and euro.

Economic statecraft

Our Economic Statecraft Initiative publishes leading-edge research and analysis on sanctions and the use of economic power to achieve foreign policy objectives and protect national security interests. As security challenges evolve, governments are increasingly relying on coercive and positive economic statecraft measures.

Our Trackers

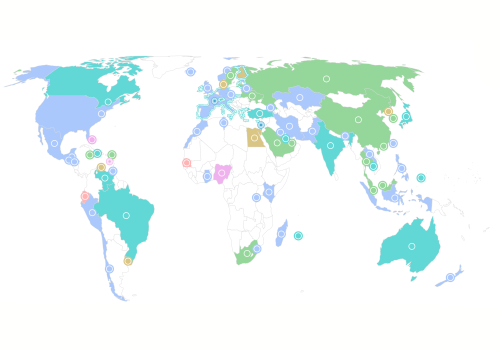

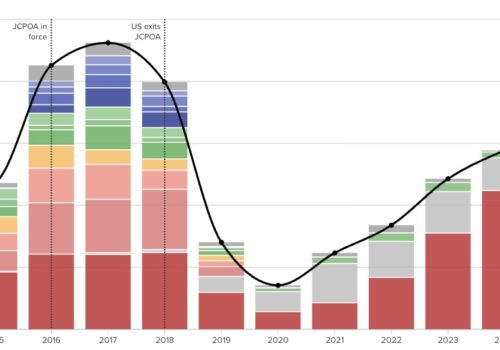

Econographics

A visualization series

Econographics

Econographics is the GeoEconomics Center’s in-depth look at key trends in the global economy utilizing state-of-the-art data visualization tools.

Spotlight

Trade and tariffs

Our team monitors the evolution of the second Trump administration’s tariffs and provides context on the economic conditions driving their creation—along with their real-world impact.

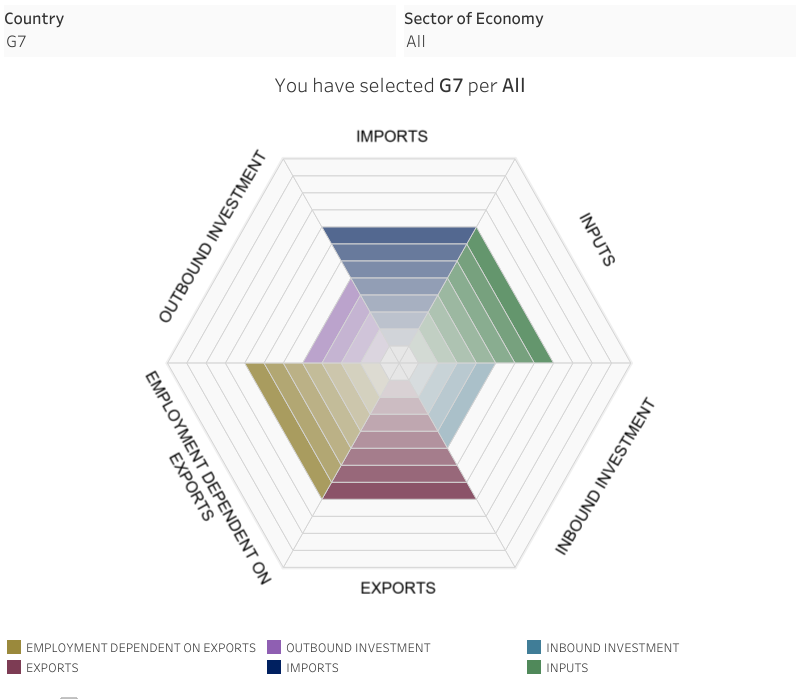

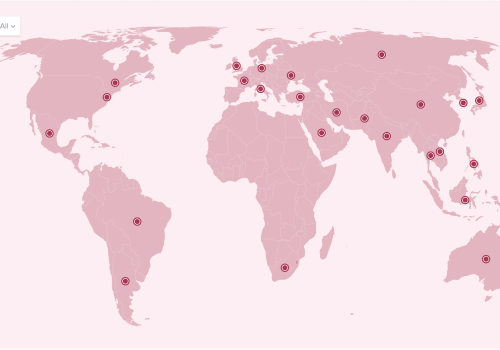

G7-China Economic Statecraft

G7-China Economic Radar

This interactive radar maps levels of exposure that G7 countries have to the Chinese economy across 12 different sectors.

Follow us on Twitter