Iraq needs to address the economy’s structural imbalances to halt the dinar’s volatility

A planned implementation of global procedural requirements for cross-border payments by the Central Bank of Iraq (CBI) in mid-November 2022 had a detrimental effect on the volumes of the CBI’s daily “Foreign Currency Selling Window,” better known as the CBI’s US Dollar (USD) auction. The decreased volumes versus the continued high demand for USD led to a supply-demand mismatch and, consequently, to a depreciation of the market price of the Iraqi Dinar (IQD) versus the USD. As a result, it ignited a firestorm of controversy.

Among the melee of misconceptions, rumors, and misinformation, were claims that the US government was exerting indirect pressure on Iran through the new Iraqi government, believed to be backed by pro-Iranian groups. Other controversies included claims of USD smuggling to Iran to evade sanctions; the US Federal Reserve Bank restricting Iraq’s use of its oil revenues; and the smuggling of ill-gotten gains by perpetrators of corruption, such as the embezzlement of 3.7 trillion Iraqi dinars (about $2.5 billion) from the General Commission of Taxes’ bank accounts.

The Iraqi government and the CBI subsequently introduced a series of measures to create domestic demand for the IQD and to accelerate the adoption of banking in the economy—crucial measures to de-dollarize the economy and accelerate its evolution away from the dominance of cash and informality, which are the structural causes behind the currency’s turmoil. As crucial as these measures are, their full effectiveness will take place over several years, and so the IQD has continued to depreciate.

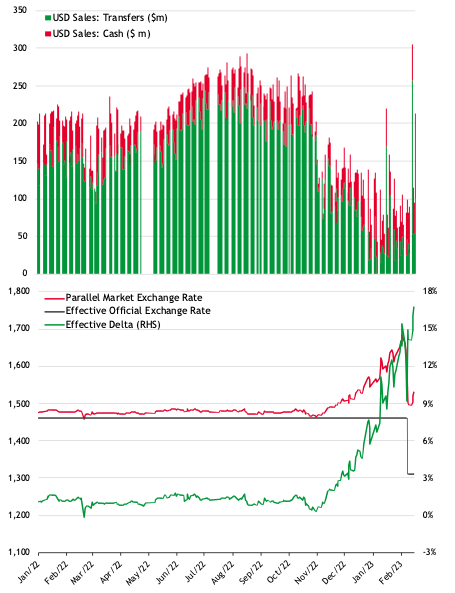

The IQD’s depreciation accelerated following the raiding of two of Baghdad’s largest Forex trading houses in late January, which had a chilling effect on the market; most other Forex houses in the capital stopped providing quotes for the purchase and sale of USD, resulting in a very illiquid market that exaggerated the currency’s depreciation. By February, it was about 13 percent lower than mid-November’s levels, and the spread between the effective official exchange rate (1,460 IQD to the USD) and the market rate (1,685 IQD to the USD) rose from an average of around one percent in the two months prior to the implementation of the new requirements to about 15 percent. Pressured by the public’s furor for immediate solutions from the authorities,the CBI, spurred by populist rhetoric, and with the government’s blessing, opted for a 10 percent revaluation of the IQD exchange rate against the USD in the hope that the IQD would reverse its depreciation.

Fundamentally, the revaluation in nominally lowering the official exchange rate does not change the current relationship between the market and the official exchange rates. Hence, it does not alter the picture pre-revaluation. Paradoxically, it could have the opposite intended effect, resulting in domestic price increases by magnifying the effects of the government’s upcoming planned expansionary budget. Moreover, it would have significant long-term effects on Iraq’s fiscal position, which would worsen its structural imbalances and, thus, its vulnerabilities to external shocks (the economic crisis in the wake of the emergence of COVID-19 and the collapse in oil prices in 2020 being an extreme manifestation of this vulnerability).

Nevertheless, the procedural requirements implemented by the CBI in mid-November 2022 were the latest stages of a process that started over two years ago, which were the product of extensive planning by the CBI and the Ministry of Finance on the Iraqi side and the Federal Reserve and the Treasury Department on the US side. The aim was to bring Iraqi banking technical procedures for cross-border payments fully in line with global standards, which themselves evolved over the last two decades. These procedures typically involve a number of banking intermediaries in more than one country and, thus, are subject to multiple regulations and jurisdictions that ensure compliance with increasingly complex global anti-money laundering provisions (AML), the financing of terrorism (CFT) provisions, and sanctions provisions.

The new procedural requirements are transformational in that they move the process of compliance by Iraqi banks—with global anti-money laundering provisions, counter terrorism financing provisions, and sanctions provisions—from an essentially paper-based process to a digitized one that shifts the onus of compliance to complex systems used for years by most global banks, thereby eliminating human errors and failings. As such, the new procedures, unlike the old ones, require full disclosure of the details of cross-border payments—including those of the ultimate beneficiary and the sender—before the payment takes place. Crucially, they do not involve the provision of new information by Iraqi banks. Instead, they lead to a digitized, effective, and electronically verifiable means of transmitting the same information they provided in the past.

Their implementation, however, had a significant detrimental effect on the volume of the transfers portion of the CBI’s USD auction—bank transfers to facilitate the imports of goods and services as represented by green bars in the chart—with the daily transfer average observed during January 2022-mid-November 2022 dropping by 63 percent from $180 million to $67 million for the period mid-November 2022-mid-February 2023. The cash portion of the USD auction’s (physical USD for Iraqis traveling abroad as represented by red bars in the chart) daily average in the same time frame increased by 24 percent from $38 million to $47 million, with the value of the total average daily USD sales dropping by 48 percent from $218 million to $114 million. The effect was immediately transmitted through a decline in the market price of the IQD versus the USD.

The 63 percent decline in the average daily transfer volumes—which are made up of wire transfers and letters of credit (LCs)—are a function of the rejection of most wire transfers by the new procedural requirements—a decline that was magnified by banks self-sanctioning after a number of rejections. The remaining volumes are likely LCs that are more secure and less prone to fraud and corruption than wire transfers. However, the remaining transfer volumes—in combination with the increased volumes of cash—represented 48 percent of prior total daily averages and, consequently, are not enough to satisfy the demand for USD leading to a depreciation in the market price of the IQD versus the USD. These decreased volumes in the CBI’s USD auctions versus the continued high demand for USD to satisfy the need for imports—amplified by an expansionary budget—will continue to pressure the market price of the exchange rate of the IQD versus the USD.

As such, the triggers for the exchange rate volatility are technical. Nevertheless, the underlying causes are fundamental and due to the structural fault lines of the Iraqi government’s processes and the economy. In the government’s case, it’s the predominance of static and obscure paper-based processes in its functions. In the economy’s case, it’s a structure in which banking plays second fiddle to cash—especially in economic transactions and payments—in a manner that is heavily dollarized and in which large informal sectors drive the bulk of economic activities. All of these create the perfect environment for the prevalence and persistence of corruption and fraud on a large scale with impunity. As a result, this makes the country vulnerable to becoming a conduit for money laundering and sanctions evasion schemes.

The top priority for Iraq and its international partners and stakeholders should not be a narrow focus on addressing the symptoms of corruption, money laundering, and sanctions evasion. Instead, it should be a multi-year collaboration on addressing their structural enablers along three broad fronts: the modernization of the government’s outdated bureaucratic paper-based processes; increasing adoption of banking in the economy by accelerating its evolution away from the dominance of cash and informality; and furthering the government’s new measures to de-dollarize the economy.

Ahmed Tabaqchali is a nonresident senior fellow with the Atlantic Council’s Middle East Programs. He is an experienced capital markets professional with over 25 years’ experience in US and MENA markets, and the Chief Strategist AFC Iraq Fund.

Further reading

Tue, Jan 24, 2023

Rising inflation is hurting Egypt’s economy. Will the country’s powerful military cede economic power to salvage it?

MENASource By Shahira Amin

The prices of food and other basic commodities including housing and medical services have soared over the past few months as the country faces rising inflation.

Fri, Jan 13, 2023

US sanctions on Syria aren’t working. It’s time for a new sanctions approach that minimizes humanitarian suffering and increases leverage.

MENASource By

Before making concessions, the United States can increase its leverage in Syria by dedicating resources to make use of the smart sanctions that US policymakers have already developed.

Wed, Jan 4, 2023

Jordanians are protesting again. It’s time for economic and administrative reforms.

MENASource By

Without tackling the root causes of Jordan's issues, the country will only delay the crisis and it will snowball into something larger in the future.

Image: Iraqi demonstrates take part in a protest near the Central Bank against the devaluation of Iraq's currency and economic woes. via Reuters