Five ways the West might increase pressure on the Russian economy

On Wednesday, Russia’s central bank announced new measures to speed up its sale of foreign currency ten-fold to prop up the wobbly ruble. Although the drop in the ruble’s exchange rate since Russia’s full-scale invasion of Ukraine is an imperfect indicator of true financial health, there is no denying that the West’s financial sanctions, export controls, and other economic measures have had a significant impact on the Russian economy. Russia’s macroeconomic woes are only increasing as its export revenues—especially hydrocarbons—continue their decline and its internal economy is increasingly fixated on wartime production at the expense of real economic development.

But can it last? As harsher sanctions have been imposed, Russian evasion efforts have stepped up. To increase pressure on Russian President Vladimir Putin’s regime further, or even to maintain that pressure as Moscow refines its evasion measures, the West would need to intensify sanctions and other tools of economic statecraft. The crumbling Russian macroeconomy and unstable domestic political sphere, following Wagner Group founder Yevgeniy Prigozhin’s failed coup and subsequent death, may entice Western policymakers to take the opportunity to knock Putin and his power centers further off balance.

These economic statecraft measures make up just one policy avenue of several in the fight against Russian aggression—including military, economic, and diplomatic backing for Ukraine—and are unlikely on their own to force Russia’s withdrawal from Ukraine in the near term. But they can cause problems for the Russian system, including diminishing wartime production.

Below are five core areas in which economic pressure could be intensified further.

1. Increase enforcement of export controls

Immediately after Russian forces begain an all-out invasion of Ukraine on February 24, 2022, the United States imposed the most sweeping export controls against Russia since the end of the Cold War. It did so in partnership with Group of Seven (G7) and a host of other countries, mostly European but including South Korea, Australia, and Taiwan as well. Targets for the controls notably include high-tech items, such as microchips, and a “broad scope of items that Russia seeks to advance its strategic ambitions,” according to the US Department of Commerce, the lead agency for export controls implementation and enforcement. The shortages, the Department of Commerce adds, will “consequently impair the country’s key industrial sectors.”

It is hard to overstate the breadth of the imposed export controls, even if they often get second billing in the media to financial sanctions and the oil price cap. As former US Assistant Secretary of Commerce Kevin Wolf characterized it in May, “there is little left to control other than basic commercial items, and even many such items are becoming subject to US and allied controls if they are of a type that could be repurposed to help Russia’s war machine.”

Rules, even multilateral ones, are one thing. Effective enforcement is another. Reports abound of prohibited technology and goods reaching Russia through elaborate third-country schemes to evade export controls. Stopping these illicit channels is labor intensive and the Biden administration has stepped up efforts to meet the challenge. Since February 2023, the US Department of Commerce’s Bureau of Industry and Security and the US Department of Justice have increased their cooperation to target evasion based in the United States. In addition, senior US officials are traveling the globe to caution governments to avoid becoming transit points for illicit trade.

These are good steps, but unlike financial sanctions that act as a bottleneck in a relatively small number of major global financial institutions, exporters of goods are much more widely spread and, crucially, have not been subject to the same intense US enforcement glare as the banking sector. More effective enforcement would require more ambition with and significant investment in the existing export control coordination and enforcement infrastructure across the G7 countries.

The old CoCom (“Coordinating Committee”) group of governments that supported export controls against the Soviet Union during the Cold War provides a precedent for such international coordination. After the Cold War, CoCom expanded to include Russia and became the Wassenaar Arrangement. The United States and its partners might seek to revive an export control coordination mechanism directed against Russia in the current global environment. A CoCom 2.0 could serve as a standing group to develop consensus on export restrictions and means to counter evasion across the partner nations. Such a mechanism would likely focus on developing and enforcing shared standards on aspects of export control on a national and international basis. This type of leveling-the-playing-field approach would make countering evasion a simpler task than it is today.

For example, the principles of “know your customer” are internalized within the banking industry. It would be logical for the US Department of Commerce, which has revised its enforcement approach in recent years, to be more akin to that of the US Treasury Department’s Office of Foreign Assets Control (OFAC), to apply similar concepts to high-tech manufacturers, freight forwarders, insurance firms, and others down the supply chain. These standards could be harmonized among likeminded nations through an active coordination mechanism. OFAC often says that it enforces to promote compliance by others, and the US Department of Commerce could take a similar approach via enforcement actions against companies, middlemen, brokers, and various facilitators that display negligence to discourage others. Information sharing about evasion and enforcement, already going on between the United States and key partners, could be harmonized on a regular basis.

Export controls against Russia will never be airtight; after all, the KGB Soviet spy agency, in which Putin grew up, devoted an entire section of the agency to stealing Western technology. But perfect enforcement does not have to stand in the way of good implementation. The friction, inefficiency, and added expense of even imperfect export controls have substantial impact, especially on an economy such as Russia’s whose top-down, kleptocratic nature deprives it of resilience.

Learn more from policymakers and experts at our forum

2. Tighten the oil price cap

In September 2022, the G7 launched a novel measure intended to reduce Russia’s revenues from oil sales while maintaining the supply of Russian oil to avoid shortages and price shocks. The oil price cap is enforced through the threat of denying G7 countries’ shipping, insurance, and financial services for any Russian oil sales above the price cap of sixty dollars per barrel. Initally, the price cap was dismissed as unworkable by skeptical analysts and energy company executives, often with derision. But thus far—and despite numerous allegations of cheating—the price cap’s high-level goals seem to have worked as intended: Russian oil revenue has dropped substantially—due to some combination of external macroeconomic factors, risk aversion in the market, and the G7 price cap—and without a major price shock.

Notwithstanding the impact on Russian revenues, recent reports suggest that the price cap’s enforcement is being tested as global energy prices climb. Indeed, the average price of Russian crude has recently surpassed the sixty-dollars-per-barrel cap, and Russia is reportedly attempting to circumvent the cap by inflating shipping costs. US Treasury officials have argued before that without adjustments, the effectiveness of economic pressure tends to weaken over time. If the United States and its partners want to keep the pressure on Russia’s economy consistent going forward, and to do so without spiking global energy markets, then one way is to focus on enforcement efforts that target price cap cheating.

These efforts could include investigations of G7 oil brokers, shippers, and insurance providers for Russian oil transactions. These actors are more on the hook for adherence to price cap constraints, and Western authorities have made clear to them that evasion through non-market shipping rates is a violation of the price cap safe harbor provisions. Western authorities could also make an example of a price cap cheater by imposing sanctions on a shipping firm circumventing the cap, though such action may spook others operating within the price cap to de-risk Russian oil transactions and inadvertently take more supply off the market than the West intends. G7 countries could also target Russian efforts to amass oil tankers that operate outside the G7 strictures by banning such vessels from their waters because they maintain inadequate insurance or by outright sanctioning the Russian front companies buying up these “ghost ships” and the vessels themselves.

Many observers, including former US Ambassador to Russia Michael McFaul, have advocated lowering the price cap to increase pressure on the Russian economy. The damage such a measure might do to a Russian economy already struggling under the weight of reduced hydrocarbon revenues seems clear. The United States, however, would likely weigh any such action against the risks of inadvertently taking more Russian product off of global energy markets that are already facing higher demand and increased prices.

The first phase of sanctions after Russia’s 2014 invasion of Ukraine included restrictions on higher-end oil producing technology designed to constrain Russian development of future capacity such as shale, deep-sea, and Arctic reserves. Future gas development was not explicitly included but was intended to be a target as well. Targeting gas remains a possible strategy but, again, enforcement and broadening these sanctions (e.g., to include Japanese participation in implementing restrictions) remain key challenges. Several European countries have managed to wean themselves off of much Russian piped gas—Poland after a systematic and successful effort and Germany on an emergency basis. European imports of Russian liquefied natural gas (LNG) remain high, however. As with oil, the challenge for Western policymakers in going after Russian LNG exports is how to find a balance between pressure on Russian earnings and world price stability. Given US assessments that non-Russian LNG will become more plentiful in the next two years, moving against Russian LNG exports may be a medium-term energy sanctions target, rather than a short-term one.

3. Tap immobilized Russian foreign exchange reserves for Ukrainian reconstruction

In February 2022, G7 countries immobilized an estimated $360 billion of Russian foreign exchange reserves held in their jurisdictions, with something over $200 billion held in Europe. It was one of the boldest strokes of economic pressure against Russia yet undertaken. Since then, G7 governments have debated whether to use these assets for Ukrainian reconstruction. Advocates point out that the funds are badly needed by Ukraine; their use would ease the burden on Europe, the United States, and other sources of support and can be justified under international law. Skeptics have argued that the legal basis for confiscating such assets is questionable and that doing so would set a dangerous precedent. The Biden administration appears divided on the question of whether to use those assets, and the European Union (EU) seems opposed, at least for the moment. The G7 issued a relatively neutral statement at its Tokyo summit in May that Russia’s foreign exchange reserves will remain immobilized until Russia pays for the damage it has caused to Ukraine.

Even as the debate continues, there does seem to be momentum building on both sides of the Atlantic, including among influential members of the US Congress, to use Russian assets in some form to help rebuild Ukraine. The direct effects on Russia of being permanently deprived of these assets might not affect Moscow in the short- to medium-term; Russia may have considered them as lost in any case. But the symbolic effects of taking more than half of Russia’s sovereign assets to compensate the victim of Russia’s illegal war would be enormous. Moreover, directing the Russian funds to Ukraine could relieve a key pressure point on Western governments, many of which have ramped up their spending to provide funds and weapons to Kyiv. This issue may be fraught with legal perils, but it is unlikely to go away.

4. Follow (and uproot) the money

Since 2014, Western sanctions have targeted Putin’s corrupt inner circle. The assets of some of Putin’s cronies have been frozen and even seized. But uncovering hidden Russian assets—private and state-linked—cannot be done simply by chasing sanctioned persons.

The use of corrupt financial channels to hide personal wealth abroad and to conceal state control of foreign assets is a Kremlin operating feature, larger under Putin but predating him. One aspect is the concealment of personal wealth by Russian oligarchs, Putin cronies, and reportedly Putin himself. Another is the use of Russian funds to buy up foreign companies, both for concealing wealth and controlling European or other companies out of sight.

Legislation and regulation to create greater transparency in the Western-dominated global financial system has been under discussion for decades at the intergovernmental Financial Action Task Force and in other forums, and has resulted in advances in beneficial ownership identification legislation and elimination of financial obfuscation techniques like bearer shares. But there are other areas identified by transparency advocates that have yet to become law in major jurisdictions such as the United States. One idea would be to extend anti-money laundering regulation to non-bank financial intermediaries such as lawyers, accountants, and real estate firms. Advocates for these transparency measures may find sympathetic lawmakers in Western capitals who want to leverage transparency tools to combat Russia.

5. Impose a full financial embargo (with carve-outs)

Following Russia’s 2014 invasion of Ukraine, the United States, EU, and other G7 members proceeded with care given the size of the Russian financial sector—by far the largest ever targeted by a sanctions regime—stopping short of full blocking sanctions against the major Russian state banks. In 2022, the United States and other G7 nations imposed full blocking sanctions on Russia’s largest state and private banks, including state powerhouse Sberbank and privately held Alfa-Bank.

In February 2023, on the one-year anniversary of the invasion, the United States and Western partners sanctioned the majority of the remaining Russian banks of any real size or with international linkages. While a few smaller Russian banks are still able to conduct business with the West, the Russian financial system is not that far away from a financial embargo.

Nevertheless, Western policymakers may be concerned that the largest Russian banks are hiding their own transactions among those conducted by unsanctioned Russian banks, a trend highlighted in that February 2023 sanctions action. Considering the extensive measures already in place, policymakers could judge that a formal financial embargo on Russia is an incremental but effective next step—and not the global-economy-wrecking action that it would have seemed as recently as 2021.

Any such financial embargo would likely be accompanied by carve-outs. To start, the price cap would almost certainly remain, allowing Russia to retain proceeds from oil exports. Food, medicine, and medical goods would also be carved out, as they are for all other comprehensive Western sanctions programs. And there may be other areas of Western economic intersection with Russia that require some exception to a broad financial embargo, such as patent maintenance and remittances.

Still, a formal financial embargo would likely isolate the Russian economy even more—its symbolism perhaps more powerful than the actual impact. It would certainly ease enforcement of existing sanctions and export controls. It is easier, for example, for enforcement authorities to quash all financing involving Russia and all exports to Russia (except specific carve-outs) rather than just certain types of exports falling under specific product codes.

If a full financial embargo were enacted, then Russia would likely seek to mitigate its impact by using non-G7 currencies, such as the Chinese yuan or the Indian rupee. Russia’s success, however, would likely be limited as those currencies are useful chiefly for purchases only from China or India, not in global markets. Issues of getting global buy-in beyond the G7 would be complicated, especially with the much of the collective “Global South” being unwilling to condemn Putin for the invasion. Even so, the added pressure on the Russian economy makes this measure a potentially viable next step.

Putin has bragged that the Soviet Union managed a generally autarkic economic existence and survived Western sanctions imposed for many years. That seems an ill-advised analogy, given the deterioration of the Soviet Union’s economy starting in the late 1970s that helped precipitate its collapse. Consistent economic pressure over time will weaken the Putinist system just as it weakened the Soviet system, with political shifts perhaps as dramatic as the early 1990s.

Brian O’Toole is a nonresident senior fellow with the Atlantic Council’s GeoEconomics Center. He is a former senior adviser to the director of the Office of Foreign Assets Control at the US Department of the Treasury. Follow him on Twitter @brianoftoole.

Daniel Fried is the Weiser Family distinguished fellow at the Atlantic Council. He was the coordinator for sanctions policy during the Obama administration, assistant secretary of state for Europe and Eurasia during the Bush administration, and senior director at the National Security Council for the Clinton and Bush administrations. He also served as ambassador to Poland during the Clinton administration. Follow him on Twitter @AmbDanFried.

Further reading

Tue, Sep 5, 2023

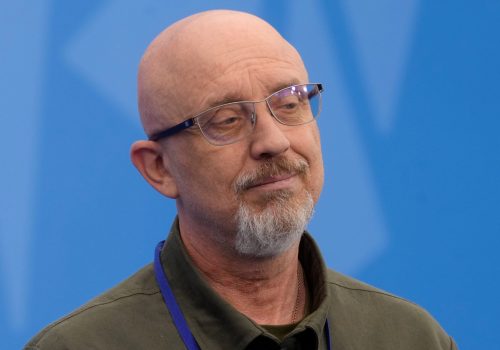

Removal of defense minister shows wartime Ukraine is changing

UkraineAlert By Melinda Haring

The removal of Ukrainian Defense Minister Oleksii Reznikov in early September came following a series of minor but damaging corruption scandals and signaled a zero tolerance approach to graft in wartime Ukraine, writes Melinda Haring.

Tue, Aug 29, 2023

Russia is ramping up its CBDC. Will Putin’s ‘robot ruble’ work?

New Atlanticist By Ananya Kumar, Charles Lichfield

Given the extent of financial sanctions following its full-scale invasion of Ukraine, Russia is trying to open alternative channels for cross-border payments.

Wed, Jul 19, 2023

Global Sanctions Dashboard: Sanctions alone won’t stop the Wagner Group

Econographics By

Existing sanctions against the Wagner Group, limitations around enforcing them, and what more Western allies can do to counter Wagner's influence in Africa.

Image: Russia's President Vladimir Putin attends a press conference following the Russia-Africa summit in Saint Petersburg, Russia, July 29, 2023. Sergei Bobylyov/TASS