Global Strategy 2023: Winning the tech race with China

Table of contents

As strategic competition between the United States and China continues across multiple domains, the Scowcroft Center for Strategy and Security in partnership with the Global China Hub, has spent the past year hosting a series of workshops aimed at developing a coherent strategy for the United States and its allies and partners to compete with China around technology. Based on these workshops and additional research, we developed our strategy for the US to retain its technological advantage over China and compete alongside its allies and partners.

Strategy Paper Editorial board

Executive editors

Frederick Kempe

Alexander V. Mirtchev

Editor-in-chief

Matthew Kroenig

Editorial board members

James L. Jones

Odeh Aburdene

Paula Dobriansky

Stephen J. Hadley

Jane Holl Lute

Ginny Mulberger

Stephanie Murphy

Dan Poneman

Arnold Punaro

Executive summary

The United States and the People’s Republic of China (PRC) are engaged in a strategic competition surrounding the development of key technologies. Both countries seek to out-compete the other to achieve first-mover advantage in breakthrough technologies, and to be the best country in terms of the commercial scaling of emerging and existing technologies.

Until recently, the United States was the undisputed leader in the development of breakthrough technologies, and in the innovation and commercial scaling of emerging and existing technologies, while China was a laggard in both categories. That script has changed dramatically. China is now the greatest single challenger to US preeminence in this space.

For the United States, three goals are paramount. The first is to preserve the US advantage in technological development and innovation relative to China. The second is to harmonize US strategy and policy with those of US allies and partners, while gaining favor with nonaligned states. The third is to retain international cooperation around trade in technology and in scientific research and exploration.

The strategy outlined in these pages has three major elements: the promotion of technologically based innovation; the protection of strategically valuable science and technology (S&T) knowhow, processes, machines, and technologies; and the coordination of policies with allies and partners. The shorthand for this triad is “promote, protect, and coordinate.”

On the promotion side, if the United States wishes to remain the leading power in scientific research and in translating that research into transformative technologies, then the US government—in partnership with state and local governments, the private sector, and academia—will need to reposition and recalibrate its policies and investments. On the protect side, a coherent strategy requires mechanisms to protect and defend a country’s S&T knowledge and capabilities from malign actors, including trade controls, sanctions, investment screening, and more. Smartly deploying these tools, however, is exceedingly difficult and requires the United States to hone its instruments in a way that yields only intended results. The coordination side focuses on “tech diplomacy,” given the need to ensure US strategy and policy positively influence as many allies, partners, and even nonaligned states as possible, while continuing to engage China on technology-related issues. The difficulty lies in squaring the interests and priorities of the United States with those of its allies and partners, as well as nonaligned states, and even China itself.

This strategy assumes that China will remain a significant competitor to the United States for years to come. It also assumes that relations between the United States and China will remain strained at best or, at worst, devolve into antagonism or outright hostility. Even if a thaw were to reset bilateral relations entirely, the US interest in maintaining its advantage in technological development would remain.

Any successful long-term strategy will require that the US government pursue policies that are internally well coordinated, are based on solid empirical evidence, and are flexible and nimble in the short run, while being attentive to longer-run trends and uncertainties.

There are two major sets of risks accompanying this strategy. Overreach is one because decoupling to preserve geopolitical advantages can be at odds with economic interests. A second involves harms to global governance including failure to continue cooperation surrounding norms and standards to guide S&T research, and failure to continue international science research cooperation focused on solving global-commons challenges such as pandemics and climate change.

The recommendations that follow from this analysis include the following, all directed at US policymakers.

- Restore and sustain public research and development (R&D) funding for scientific and technological advancement.

- Improve and sustain STEM (science, technology, engineering, and math) education and skills training across K–12, university, community college, and technical schools.

- Craft a more diverse tech sector.

- Attract and retain highly skilled talent from abroad.

- Support whole-of-government strategy development.

- Ensure private-sector firms remain at the cutting edge of global competitiveness.

- Improve S&T intelligence and counterintelligence.

- Ensure calibrated development and application of punitive measures.

- Build out and sustain robust multilateral institutions.

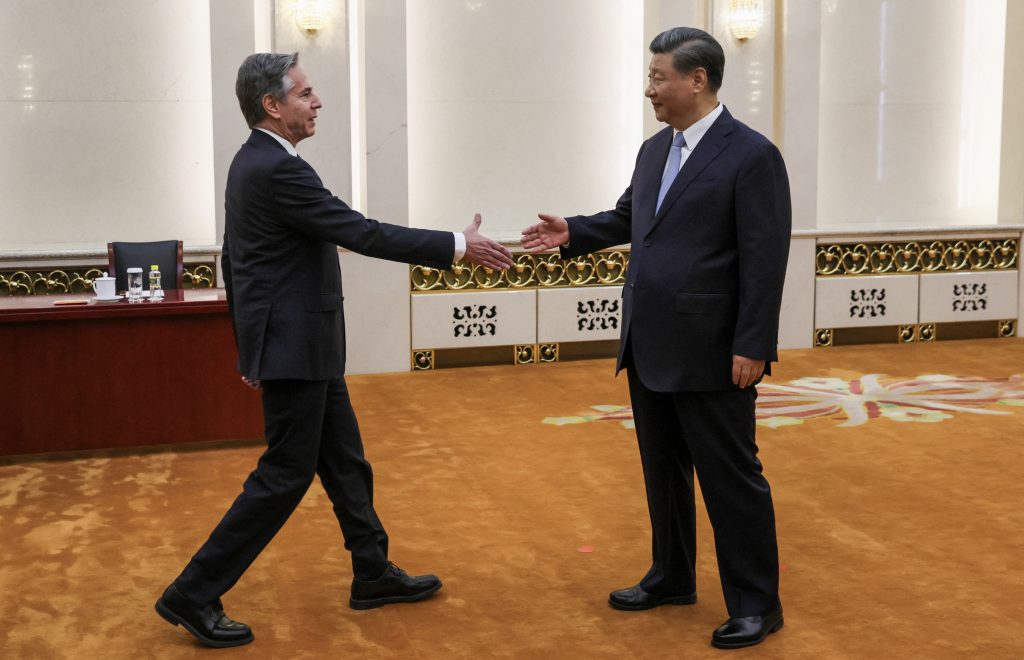

- Engage with China, as it cannot be avoided.

A 2033 What If…

Imagine that it is the year 2033. Imagine that China has made enormous strides forward in the technology arena at the expense of the United States and its allies and partners. Suppose that this outcome occurred because, between 2023 and 2033, China’s economy not only does not weaken substantially but instead goes from strength to strength, including (importantly) increasing its capabilities in technological development and innovation. Suppose, too, that the US government failed to craft and maintain the kinds of investments and policies that are needed to sustain and enhance its world-leading tech-creation machine—its “innovation ecosystem”—to stay ahead of China. Suppose that the US government also failed to properly calibrate the punitive measures designed to prevent China from acquiring best-in-class technologies from elsewhere in the world—where calibration means the fine-tuning of policies to achieve prescribed objectives without spillover consequence. Finally, suppose that the United States and its allies and partners around the world failed to align with one another in terms of strategies and policies regarding how to engage China and, just as critically, about alignment of their own ends. What might that world look like?

Looking at that world from the year 2033, a first observation is that US scientific and technological (S&T) advantage, a period that lasted from 1945 to the 2020s, has come to an end. In its place is a world where China’s government labs, universities, and firms are often the first to announce breakthrough scientific developments and the first to turn them into valuable technologies.

For the US government and for allies and partners in the Indo-Pacific region, the strategic consequences are severe, as China has not only closed much of the defense spending gap by 2033 but is able to employ weaponry as advanced, and in some cases more advanced, than those of the United States and its allies.1Although China likely will not close the spending gap with the United States by the mid-2030s, current spending trajectories strongly suggest that China will have narrowed the gap considerably. See the US-China bilateral comparison in: “Asia Power Index 2023,” Lowy Institute, last visited June 13, 2023, https://power.lowyinstitute.org; “China v America: How Xi Jinping Plans to Narrow the Military Gap,” Economist, May 8, 2023, https://www.economist.com/china/2023/05/08/china-v-america-how-xi-jinping-plans-to-narrow-the-military-gap. Military planners from Washington to New Delhi watch China’s rising capabilities with much anxiety, given the geostrategic leverage that such changes have given Beijing across the region.

Nor is this problem the only headache for the United States and its coalition of partners in 2033. For a variety of reasons, many of China’s tech firms are outcompeting those elsewhere in the world, including some of the United States’ biggest and most important firms. Increasingly, the world looks as much to Shenzhen as to Silicon Valley for the latest tech-infused products and services.

China’s long-standing ambition to give its tech firms an advantage has paid off. The Chinese state has successfully pursued its strategy of commercial engagement with other countries, one that has been well known for decades and is characterized by direct and indirect financial and technical aid for purchases of Chinese hardware and software. This approach, while imperfect, drove adoption of Chinese technology abroad, with much of that adoption happening in the Global South.2See, e.g., the arguments presented by: Bryce Barros, Nathan Kohlenberg, and Etienne Soula, “China and the Digital Information Stack in the Global South,” German Marshall Fund, June 15, 2022, https://securingdemocracy.gmfus.org/china-digital-stack/. Across much of Africa, Latin America, South and Southeast Asia, and the Middle East, China has grown into the biggest player in the tech space, with its technologies appealing both to consumers and to many governments looking for financial assistance in upgrading their tech infrastructure. Moreover, China’s tech assistance has aided authoritarian governments seeking the means to control access to information, especially online, and the desire to surveil citizens and suppress dissent.3For a brief overview of China’s efforts in this regard, see: Bulelani Jili, China’s Surveillance Ecosystem and the Global Spread of Its Tools, Atlantic Council, October 17, 2022, https://www.atlanticcouncil.org/in-depth-research-reports/issue-brief/chinese-surveillance-ecosystem-and-the-global-spread-of-its-tools/. China’s efforts have been a major reason why the internet has fractured in many countries around the world. The ideal of the internet as an open platform is largely gone, replaced by a system of filtered access to information—in many instances, access that is controlled by authoritarian and illiberal states.

In 2033, even the biggest US-based tech firms struggle to keep pace with Chinese firms, as do tech firms based in Europe, Asia, and elsewhere. Although still formidable, Western firms find themselves at a disadvantage in both domestic and foreign markets. China’s unfair trading practices have continued to give its firms an edge, even in markets in mature economies and wealthy countries. China has continued its many unfair trading practices, including massive direct and indirect state subsidies and regulatory support for its firms, suspect acquisition—often outright theft—of intellectual property (IP) from firms abroad, and requiring that foreign firms transfer technology to China in exchange for granting access to its enormous domestic consumer market, in 2033 the biggest in the world.4For background to these practices, see: Karen M. Sutter, ““Made in China 2025’ Industrial Policies: Issues for Congress,” Congressional Research Service, March 10, 2023, https://sgp.fas.org/crs/row/IF10964.pdf; Gerard DiPippo, Ilaria Mazzocco, and Scott Kennedy, “Red Ink: Estimating Chinese Industrial Policy Spending in Comparative Perspective,” Center for Strategic and International Studies, May 23, 2022, https://www.csis.org/analysis/red-ink-estimating-chinese-industrial-policy-spending-comparative-perspective; “America Is Struggling to Counter China’s Intellectual Property Theft,” Financial Times, April 18, 2022, https://www.ft.com/content/1d13ab71-bffd-4d63-a0bf-9e9bdfc33c39; “USTR Releases Annual Report on China’s WTO Compliance,” Office of the United States Trade Representative, February 16, 2022, press release, 3, https://ustr.gov/about-us/policy-offices/press-office/press-releases/2022/february/ustr-releases-annual-report-chinas-wto-compliance. When added to the real qualitative leaps that China has made in terms of the range and sophistication of its tech-based products and services, foreign firms are often on the back foot even at home. In sector after sector, China is capturing an increasingly large share of global wealth.

Nor is this all. China’s rising influence means that the democratic world has found it impossible to realize its preferences concerning the global governance of technology. This problem extends beyond China’s now significant influence on technical-standards development within the range of international organizations that are responsible for standards.5 On China and technical standards, see: Matt Sheehan, Marjory Blumenthal, and Michael R. Nelson, “Three Takeaways from China’s New Standards Strategy,” Carnegie Endowment for International Peace, October 28, 2021, https://carnegieendowment.org/2021/10/28/three-takeaways-from-china-s-new-standards-strategy-pub-85678. The problem is much larger than even that. Since the early 2020s, because of decreasing interest in scientific cooperation, the United States, China, and Europe have been unable to agree on the basic norms and principles that should guide the riskiest forms of advanced tech development. As a result, big gaps have appeared in how the major players approach such development. This patchwork, incomplete governance architecture has meant that countries, firms, and even individual labs have forged ahead without common ethical-normative frameworks to guide research and development. In such fields as artificial intelligence (AI), China has increased its implementation of AI-based applications that have eroded individual rights and privacies—for example, AI-driven facial-recognition technologies used by the state to monitor individual activity—not only within China, but in parts of the world where its technologies have been adopted.6China’s current (2023) AI regulations are generally seen as more developed than those in either Europe or the United States. However, analysts argue that the individual rights and corporate responsibilities to protect them, as outlined in China’s regulations, will be selectively enforced, if at all, by the state. See: Ryan Heath, “China Races Ahead of U.S. on AI Regulation,” Axios, May 8, 2023, https://www.axios.com/2023/05/08/china-ai-regulation-race.

Nor is even this long list all that is problematic in the year 2033. Scientific cooperation between the United States and China—and, by extension, China and many US allies and partners—has declined precipitously since 2023. Cross-national collaboration among the world’s scientists has always been a proud hallmark of global scientific research, delivering progress on issues ranging from cancer treatments to breakthrough energy research. Collaboration between China on the one hand, and Western states on the other, used to be a pillar of global science. Now, unfortunately, much of that collaboration has disappeared, given the rising suspicions and antagonism and the resulting policies that were implemented to limit and, in some cases, even block scientific exchange.7The scientific community has warned that this scenario is a real risk, owing to heightened Sino-American tension. James Mitchell Crow, “US–China partnerships bring strength in numbers to big science projects,” Nature, March 9, 2022, https://www.nature.com/articles/d41586-022-00570-0.

From the perspective of developments that led to this point in the year 2033, the United States and its allies and partners failed to pursue a coherent, cooperative, and united strategy vis-à-vis strategic competition with China. Policymakers were unable to articulate, and then implement, policies that were consistent over time and across national context. Various international forums were created for engagement on strategy and policy questions, but they proved of low utility as policy harmonization bodies or tech trade-dispute mechanisms.

Strategic context

The above scenario, which sketches a world in 2033 where China has gained the upper hand at the expense of the United States and its allies and partners, is not inevitable. As this strategy paper articulates, there is much that policymakers in the United States and elsewhere can do to ensure that more benign futures, from their perspectives, are possible. However, as this strategy paper also articulates, their success is far from a given.

The United States and the People’s Republic of China (PRC) are engaged in a strategic competition surrounding the development of key technologies, including advanced semiconductors (“chips”), AI, advanced computing (including quantum computing), a range of biotechnologies, and much more. Both countries seek to out-compete the other to achieve first-mover advantage in breakthrough technologies, and to be the best country at the commercial scaling of emerging and existing technologies.

These two capabilities—the first to develop breakthrough technologies and the best at tech-based innovation—overlap in important respects, but they are not identical and should not be regarded as the same thing. The first country to build a quantum computer for practical application (such as advanced decryption) is an example of the former capability; the country that is best at innovating on price, design, application, and functionality of electric vehicles (EVs) is an example of the latter capability. The former will give the inventing country a (temporary) strategic and military advantage; the latter will give the more innovative country a significant economic edge, indirectly contributing to strategic and military advantage. The outcome of this competition will go a long way toward determining which country—China or the United States—has the upper hand in the larger geostrategic competition between them in the coming few decades.

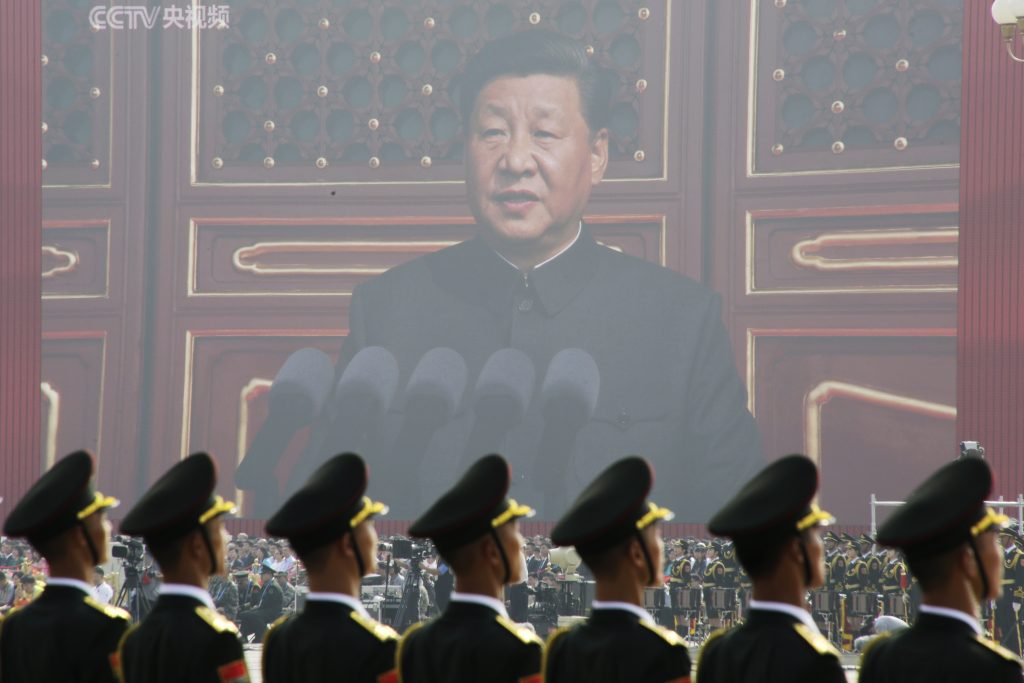

For China, the primary goal is to build an all-encompassing indigenous innovation ecosystem, particularly in sectors that Chinese leadership has deemed critical. Beijing views technology as the main arena of competition and rivalry with the United States, with many high-level policies and strategy documents released under Xi Jinping’s tenure emphasizing technology across all aspects of society. Under Xi’s direction, China has intensified its preexisting efforts to achieve self-sufficiency in key technology sectors, centering on indigenous innovation and leapfrogging the United States.

On the US side, the Joe Biden administration and Congress have emphasized the need to maintain leadership in innovation and preserve US technological supremacy. Although there are many similarities between the Donald Trump and Biden administrations’ approaches to competition with China, one of the primary differences has been the Biden administration’s focus on bringing allies and partners onboard and trying to make policies as coordinated and multilateral as possible. While a laudable goal, implementation of a seamless allies-and-partners coordination is proving difficult.

Until recently, the United States was the undisputed leader in the development of breakthrough technologies, and in the innovation and commercial scaling of emerging and existing technologies. Until recently, China was a laggard in both categories, falling well behind the United States and most, if not all, of the world’s advanced economies in both the pace of scientific and technological (S&T) development and the ability to innovate around technologically infused products and services.

That script has changed dramatically as a result of China’s rapid ascension up the S&T ladder, starting with Deng Xiaoping’s reforms in the 1970s and 1980s and continuing through Xi Jinping’s tenure.8Deng Xiaoping’s reforms included pursuit of “Four Modernizations” in agriculture, industry, science and technology, and national defense. In the S&T field, his reforms included massive educational and worker-upskilling programs, large investments in scientific research centers, comprehensive programs to send Chinese STEM (science, technology, engineering, and math) students abroad for advanced education and training, experimentation with foreign technologies in manufacturing and other production processes, and upgrading of China’s military to include a focus on development of dual-use technologies. Bernard Z. Keo, “Crossing the River by Feeling the Stones: Deng Xiaoping in the Making of Modern China,” Education About Asia 25, 2 (2020), 36, https://www.asianstudies.org/publications/eaa/archives/crossing-the-river-by-feeling-the-stones-deng-xiaoping-in-the-making-of-modern-china/.

Although analysts disagree about how best to measure China’s current S&T capabilities and its progress in innovating around tech-based goods and services, there is no dispute that China is now the greatest single challenger to US preeminence in this space. In some respects, China may already have important advantages over the United States and all other countries—for example, in its ability to apply what has been labeled “process knowledge,” rooted in the country’s vast manufacturing base, to improve upon existing tech products and invent new ones.9Dan Wang, “China’s Hidden Tech Revolution: How Beijing Threatens U.S. Dominance,” Foreign Affairs, March/April 2023, https://www.foreignaffairs.com/china/chinas-hidden-tech-revolution-how-beijing-threatens-us-dominance-dan-wang.

This competition represents a new phase in the two countries’ histories. The fall of the Berlin Wall and the decade that followed saw US leadership seek to include China as a member of the rules-based international order. In a March 2000 speech, President Bill Clinton spoke in favor of China’s entry into the World Trade Organization (WTO), arguing that US support of China’s new permanent normal trade relations (PNTR) status was “clearly in our larger national interest” and would “advance the goal America has worked for in China for the past three decades.”10“Full Text of Clinton’s Speech on China Trade Bill,” Federal News Service, March 9, 2000, https://www.iatp.org/sites/default/files/Full_Text_of_Clintons_Speech_on_China_Trade_Bi.htm. China’s leadership returned the favor, with President Jiang Zemin later stating that China “would make good on [China’s] commitments…and further promote [China’s] all-directional openness to the outside world.”11“Speech by President Jiang Zemin at George Bush Presidential Library,” Ministry of Foreign Affairs of the PRC, October 24, 2002, https://perma.cc/7NYS-4REZ; G. John Ikenberrgy, “The Rise of China and the Future of the West: Can the Liberal System Survive?” Foreign Affairs 87, 1, (2008), https://www.jstor.org/stable/20020265.

Despite some US concerns, the period from 2001 through most of the Barack Obama administration saw Sino-American relations at their best.12Elizabeth Economy, “Changing Course on China,” Current History 102, 665, China and East Asia (2003), https://www.jstor.org/stable/45317282; Thomas W. Lippman, “Bush Makes Clinton’s China Policy an Issue,” Washington Post, August 20, 1999, https://www.washingtonpost.com/wp-srv/politics/campaigns/wh2000/stories/chiwan082099.htm. The lure of the Chinese market was strong, with bilateral trade in goods exploding from less than $8 billion in 1986 to more than $578 billion in 2016.13 Kurt M. Campbell and Ely Ratner, “The China Reckoning: How Beijing Defied American Expectations,” Foreign Affairs, February 18, 2018, https://www.foreignaffairs.com/articles/china/2018-02-13/china-reckoning. People-to-people exchanges increased dramatically as well, with tourism from China increasing from 270,000 in 2005 to 3.17 million in 2017, and the number of student F-visas granted to PRC students increasing tenfold, from approximately 26,000 in 2000 to nearly 250,000 in 2014.14 “Number of Tourist Arrivals in the United States from China from 2005 to 2022 with Forecasts until 2025,” Statista, April 11, 2023, https://www.statista.com/statistics/214813/number-of-visitors-to-the-us-from-china/; and “Visa Statistics,” U.S. Department of State, https://travel.state.gov/content/travel/en/legal/visa-law0/visa-statistics.html. US direct investment in China also grew significantly after 2000, as US companies saw the vast potential of the Chinese market and workforce. Notably, overall US investment in China continued to grow even after the COVID-19 pandemic.15“Direct Investment Position of the United States in China from 2000 to 2021,” Statista, January 26, 2023, https://www.statista.com/statistics/188629/united-states-direct-investments-in-china-since-2000/.

So what changed? In a 2018 essay titled “The China Reckoning,” China scholars Ely Ratner and Kurt Campbell—now both members of the Biden administration—described how the US plan for China and its role in the international system had not gone as hoped.

Neither carrots nor sticks have swayed China as predicted. Diplomatic and commercial engagement have not brought political and economic openness. Neither US military power nor regional balancing has stopped Beijing from seeking to displace core components of the US-led system. And the liberal international order has failed to lure or bind China as powerfully as expected. China has instead pursued its own course, belying a range of American expectations in the process.

Campbell and Ratner, “The China Reckoning.”

These sentiments were shared by many others in Washington. Many felt like China was taking advantage of the United States as the Obama administration transitioned to its “pivot to Asia.” For example, in 2014 China sent an uninvited electronic-surveillance ship alongside four invited naval vessels to the US-organized Rim of the Pacific (RIMPAC) military exercises, damaging what had appeared to be improving military-to-military relations.16 Robbie Gramer, “Washington’s China Hawks Take Flight,” Foreign Policy, February 15, 2023, https://foreignpolicy.com/2023/02/15/china-us-relations-hawks-engagement-cold-war-taiwan/; Sam LaGrone, “China Sends Uninvited Spy Ship to RIMPAC,” USNI News, July 18, 2014, https://news.usni.org/2014/07/18/china-sends-uninvited-spy-ship-rimpac. On the economic side, despite the two sides signing an agreement in April 2015 not to engage in industrial cyber espionage, it soon became clear that China did not plan to uphold its side of the bargain. In 2017, the US Department of Justice indicted three Chinese nationals for cyber theft from US firms, including Moody’s Analytics, Siemens AG, and Trimble.17“Findings of the Investigations into China’s Acts, Policies, and Practices Related to Technology Transfer, Intellectual Property, and Innovation Under Section 301 of the Trade Act of 1974,” Office of the United States Trade Representative, March 22, 2018, https://ustr.gov/sites/default/files/Section%20301%20FINAL.PDF. When asked in November 2018 if China was violating the 2015 cyber-espionage agreement, senior National Security Agency cybersecurity official Rob Joyce said, “it’s clear that they [China] are well beyond the bounds today of the agreement that was forced between our countries.” See: “U.S. Accuses China of Violating Bilateral Anti-Hacking Deal,” Reuters, November 8, 2018, https://www.reuters.com/article/us-usa-china-cyber/u-s-accuses-china-of-violating-bilateral-anti-hacking-deal-idUSKCN1NE02E.

Within China, political developments were also driving changes in the relationship. Xi Jinping assumed power in November 2012, and most expected him to continue on his predecessors’ trajectory. However, in 2015 a slew of Chinese policies caught the eye of outside observers, especially the “Made in China 2025” strategy that caused a massive uproar in Washington and other global capitals, given its explicit focus on indigenization of key sectors, including the tech sector.

On the US side, when President Trump was elected in 2017, the bilateral economic relationship came under further fire, sparked by growing concerns surrounding China’s unfair trade practices, IP theft, and the growing trade deficit between the two countries. First the first time, frustration over these issues brought about strong US policy responses, including tariffs on steel, aluminum, soybeans, and more, a Section 301 investigation of Chinese economic practices by the US trade representative, and unprecedented export controls on the Chinese firms Huawei and ZTE. On the Chinese side, a growing emphasis on self-reliance, in conjunction with narratives surrounding the decline of the West, has dominated the conversation at the highest levels of government. In many instances, some of these statements—like China’s relatively unachievable indigenization goals in the semiconductor supply chain—have pushed the US policy agenda closer toward one centering on zero-sum tech competition.

In 2023, the Biden administration continued some Trump-era policies toward China, often reaching for export controls as a means to prevent US-origin technology from making its way to China. The Biden administration is even considering restricting outbound investment into China, stemming from concerns around everything from pharmaceutical supply chains to military modernization. The bottom line is that US-China competition is intense, and is here to stay for the foreseeable future.

Goals

There are three underlying goals for policymakers in the United States to consider when developing a comprehensive strategy.

- Preserve the US advantage in technological development and innovation relative to China. Although the United States has historically led the world in the development of cutting-edge technologies, technological expertise, skills, and capabilities have proliferated worldwide and eroded this advantage. Although the United States arguably maintains its first position, it can no longer claim to be the predominant global S&T power across the entire board. As a result, US leadership will have to approach this issue with a clear-eyed understanding of US capabilities and strengths, as well as weaknesses.

Further, it is impractical to believe that the United States alone can lead in all critical technology areas. US policymakers must determine (with the help of the broader scientific community) not only which technologies are critical to national security but also how these technologies are directly relevant in a national security context. This point suggests the need for aligning means with ends—what is the US objective in controlling or promoting a specific technology? Absent strong answers to this question, technology controls or promotion efforts will likely yield unintended results, both good and bad.

Further, it is impractical to believe that the United States alone can lead in all critical technology areas. US policymakers must determine (with the help of the broader scientific community) not only which technologies are critical to national security but also how these technologies are directly relevant in a national security context. This point suggests the need for aligning means with ends—what is the US objective in controlling or promoting a specific technology? Absent strong answers to this question, technology controls or promotion efforts will likely yield unintended results, both good and bad.

Further, the United States’ capacity to transform basic research into applications and commercial products is an invaluable asset that has propelled its innovation ecosystem for decades. In contrast, Chinese leadership is keenly aware of its deficiencies in this area.

First-mover advantage in laboratory scientific research is not the same thing as innovation excellence. A country needs both if it seeks predominance. A country can have outstanding scientific capabilities but poor innovation capacity (or vice versa). Claims that China is surpassing the United States and other advanced countries in critical technology areas are premature, and often fail to consider how metrics to assess innovative capacity interact with one another (highly cited publications, patents, investment trends, market shares, governance, etc.).18Jacob Feldgoise, et. al, “Studying Tech Competition through Research Output: Some CSET Best Practices,” Center for Security and Emerging Technology, April 2023, https://cset.georgetown.edu/article/studying-tech-competition-through-research-output-some-cset-best-practices. Assessing a country’s ability to preserve or maintain its technological advantage requires a holistic approach that takes all of these factors into account. - Harmonize strategy and policy with allies and partners, while gaining favor with nonaligned states. With respect to strategic competition vis-a-vis China, the interests of the United States are not always identical to those of its allies and partners. Any strategy designed to compete in the tech space with China needs to align with the strategies and interests of US allies and partners. Simultaneously, US strategy should offer benefits to nonaligned states within the context of this strategic competition with China, so as to curry favor with them.

This goal is especially important, given that the United States relies on and benefits from a network of allies and partners, whereas China aspires to self-sufficiency in S&T development. To preserve the United States’ advantage, US leadership must first recognize that its network is one of the strongest weapons in the US arsenal.

US allies and partners, of which there are many, want to maintain and strengthen their close diplomatic, security, and economic ties to the United States. The problem is that most also have substantial, often critical, economic relationships with China. Hence, they are loath to jeopardize their relationships with either the United States or China.

This strategic dilemma has become a significant one for US allies in both the transpacific and transatlantic arenas. As examples, Japan and South Korea, the two most advanced technology-producing countries in East Asia, are on the front lines of this dilemma. Their challenging situation owes to their geographic proximity to China on the one hand—and, hence, proximity to China’s strategic ambitions in the East and South China Seas, as well as Taiwan—and to their close economic ties to both China and the United States on the other.19The World Intellectual Property Organization’s annual “Global Innovation Index,” considered the gold standard rankings assessment of the world’s tech-producing economies, ranks South Korea sixth and Japan thirteenth in the 2022 edition. “Global Innovation Index 2022. What Is the Future of Innovation-Driven Growth?” World Intellectual Property Organization, 2022, https://www.globalinnovationindex.org/analysis-indicator. Although both have been attempting an ever-finer balancing act between the United States and China for years, the challenge is becoming more difficult.20For a general review of the Japanese case, see: Mireya Solis, “Economic Security: Boon or Bane for the US-Japan Alliance?,” Sasakawa Peace Foundation USA, November 5–6, 2022, https://spfusa.org/publications/economic-security-boon-or-bane-for-the-us-japan-alliance/#_ftn19. For the South Korean case, see: Seong-Ho Sheen and Mireya Solis, “How South Korea Sees Technology Competition with China and Export Controls,” Brookings, May 17, 2023, https://www.brookings.edu/blog/order-from-chaos/2023/05/17/how-south-korea-sees-technology-competition-with-china-and-export-controls/. In January 2023, Japan reportedly joined the United States and the Netherlands to restrict sales of advanced chipmaking lithography machines to China, despite the policy being against its clear economic interests.21Jeremy Mark and Dexter Tiff Roberts, United States–China Semiconductor Standoff: A Supply Chain under Stress, Atlantic Council, February 23, 2023, https://www.atlanticcouncil.org/in-depth-research-reports/issue-brief/united-states-china-semiconductor-standoff-a-supply-chain-under-stress/. In April and May 2023, even before China banned sales of chips from Micron Technology, a US firm, the US government was urging the South Korea government to ensure that Micron’s principal rivals, South Korea’s Samsung Electronics and SK Hynix, did not increase their sales in China.22Yang Jie and Megumi Fujikawa, “Tokyo Meeting Highlights Democracies’ Push to Secure Chip Supplies,” Wall Street Journal, May 18, 2023, https://www.wsj.com/articles/tokyo-meeting-highlights-democracies-push-to-secure-chip-supplies-54e1173d?mod=article_inline; “US Urges South Korea not to Fill Chip Shortfalls in China if Micron Banned, Financial Times Reports,” Reuters, April 23, 2023, https://www.reuters.com/technology/us-urges-south-korea-not-fill-china-shortfalls-if-beijing-bans-micron-chips-ft-2023-04-23/.

For nonaligned states, many of which are in the Global South, their interests are manifold and not easily shoehorned into a US-versus-China bifurcation. Many states in this category have generalized concerns about a world that is dominated by either Washington or Beijing, and, as such, are even more interested in hedging than are the closest US allies and partners. Their governments and business communities seek trade, investment, and access to technologies that can assist with economic development, while their consumers seek affordable and capable tech. Although China has made enormous strides with respect to technological penetration of markets in the Global South, there also is much opportunity for the United States and its allies and partners, especially given widespread popular appetite for Western ideals, messaging, and consumer-facing technologies.23See, e.g., the arguments in: Matias Spektor, “In Defense of the Fence Sitters. What the West Gets Wrong about Hedging,” Foreign Affairs, May/June 2023, https://www.foreignaffairs.com/world/global-south-defense-fence-sitters. - Retain cooperation around trade and scientific exploration. One of the risks that is inherent in a fraught Sino-American bilateral relationship is that global public-goods provision will be weakened. Within the context of rising tensions over technological development, there are two big concerns: first, that global trade in technologically based goods and services will be harmed, and second, that global scientific cooperation will shrink.

An open trading system has been an ideal of the rules-based international order since 1945, built on the premise that fair competition within established trading rules is best for global growth and exchange. The US-led reforms at the end of the World War II and early postwar period gave the world the Bretton Woods system, which established the International Monetary Fund (IMF), plus the Marshall Plan and the General Agreement on Tariffs and Trade (GATT). Together, these reforms enabled unprecedented multi-decade growth in global trade.24On the expansion of trade under Bretton Woods during the first postwar decades, see: Tamim Bayoumi, “The Postwar Economic Achievement,” Finance & Development, June 1995, https://www.elibrary.imf.org/view/journals/022/0032/002/article-A013-en.xml. China’s accession to the WTO in 2001, which the US government supported, marked a high point as many read into China’s entry its endorsement of the global trade regime based on liberal principles. However, since then—and for reasons having much to do with disagreements over China’s adherence to WTO trading rules—this global regime has come under significant stress. In 2023, with few signs that the Sino-American trade relationship will improve, there is significant risk of damage to the global trading system writ large.25For a review of the history of the bilateral trade relationship, see: Anshu Siripurapu and Noah Berman, “Backgrounder: The Contentious U.S.-China Trade Relationship,” Council on Foreign Relations, December 5, 2022, https://www.cfr.org/backgrounder/contentious-us-china-trade-relationship.

Any damage done to the global trading system also risks harm to trade between the two countries, which is significant given its ongoing scale (in 2022, bilateral trade in goods measured a record $691 billion).26Eric Martin and Ana Monteiro, “US-China Goods Trade Hits Record Even as Political Split Widens,” Bloomberg, February 7, 2023, https://www.bloomberg.com/news/articles/2023-02-07/us-china-trade-climbs-to-record-in-2022-despite-efforts-to-split?sref=a9fBmPFG#xj4y7vzkg. Tech-based trade and investment remain significant for both countries, as illustrated by the February 2023 announcement of a $3.5-billion partnership between Ford Motor Company and Contemporary Amperex Technology Limited (CATL) to build an EV-battery plant in Michigan using CATL-licensed technology.27Neal E. Boudette and Keith Bradsher, “Ford Will Build a U.S. Battery Factory with Technology from China,” New York Times, February 13, 2023, https://www.nytimes.com/2023/02/13/business/energy-environment/ford-catl-electric-vehicle-battery.html. A priority for US policymakers should be to preserve trade competition in tech-infused goods and services, at least for those goods and services that are not subject to national security-based restrictions and where China’s trade practices do not result in unfair advantages for its firms.

Beyond trade, there are public-goods benefits resulting from bilateral cooperation in the S&T domain. These benefits extend to scientific research that can hasten solutions to global-commons challenges—for example, climate change. China and the United States are the two most active countries in global science, and are each other’s most important scientific-research partner.28“Tracking the Collaborative Networks of Five Leading Science Nations,” Nature 603, S10–S11 (2022), https://www.nature.com/articles/d41586-022-00571-z. Any harm done to their bilateral relationship in science is likely to decrease the quality of global scientific output. Further, the benefits from cooperation also extend to creation and enforcement of international norms and ethics surrounding tech development in, for example, AI and biotechnology.

Major elements of the strategy

The strategy outlined in these pages has three major elements: the promotion of technologically based innovation, sometimes labeled “running faster”; the protection of strategically valuable S&T knowhow, processes, machines, and technologies; and the coordination of policies with allies and partners. This triad—promote, protect, and coordinate—is also shorthand for the most basic underlying challenge facing strategists in the US government and in the governments of US allies and partners. In the simplest terms, strategists should aim to satisfy the “right balance between openness and protection,” in the words of the National Academies of Sciences, Engineering, and Medicine.29 “Protecting U.S. Technological Advantage,” National Academies of Sciences, Engineering, and Medicine, 2022, 12, https://doi.org/10.17226/26647. This strategic logic holds for both the United States and its allies and partners.

- Promote: The United States has been the global leader in science and tech-based innovation since 1945, if not earlier. However, that advantage has eroded, in some areas significantly, in particular since the end of the Cold War. If the United States wishes to remain the leading power in scientific research and in translating that research into transformative technologies (for military and civilian application), then the US government, in partnership with state and local governments, the private sector, and academia, will have to reposition and recalibrate its policies and investments.

The preeminence of America’s postwar innovation ecosystem resulted from several factors, including: prewar strengths across several major industries; massive wartime investments in science, industry, and manufacturing; and even larger investments made by the US government in the decades after the war to boost US scientific and technological capabilities. The 1940s through 1960s were especially important, owing to the whole-of-society effort behind prosecuting World War II and then the Cold War. The US government established many iconic S&T-focused institutions, including the National Science Foundation (NSF), Defense Advanced Research Projects Agency (DARPA), the National Aeronautics and Space Administration (NASA), most of the country’s national laboratories (e.g., Sandia National Laboratories and Lawrence Livermore National Laboratories), and dramatically boosted funding for science education, public-health research, and academic scientific research.30 Robert W. Seidel, “Science Policy and the Role of the National Laboratories,” Los Alamos Science 21 (1993), 218–226, https://sgp.fas.org/othergov/doe/lanl/pubs/00285712.pdf.

This system, and the enormous investments made by the US government to support it, spurred widespread and systematized cooperation among government, academic science, and the private sector. This cooperation led directly to a long list of breakthrough technologies for military and civilian purposes, and to formation of the United States’ world-leading tech hubs, Silicon Valley most prominent among them.31 The federal government’s hand in creating Silicon Valley is well known. For a short summary, see: W. Patrick McCray, “Silicon Valley: A Region High on Historical Amnesia,” Los Angeles Review of Books, September 19, 2019, https://lareviewofbooks.org/article/silicon-valley-a-region-high-on-historical-amnesia/. A forceful defense of the federal government’s role in creating and sustaining Silicon Valley is: Jacob S. Hacker and Paul Pierson, “Why Technological Innovation Relies on Government Support,” Atlantic, March 28, 2016, https://www.theatlantic.com/politics/archive/2016/03/andy-grove-government-technology/475626/.

The trouble is that after the Cold War ended, “policymakers [in the US government] no longer felt an urgency and presided over the gradual and inexorable shrinking of this once preeminent system,” in particular through allowing federal spending on research and development (R&D) and education to flatline or even atrophy.32 Robert D. Atkinson, “Understanding the U.S. National Innovation System, 2020,” International Technology & Innovation Foundation, November 2020, 1, https://www2.itif.org/2020-us-innovation-system.pdf. From a peak of around 2.2 percent of national gross domestic product (GDP) in the early 1960s, federal R&D spending has declined since, reaching a low of 0.66 percent in 2017 before rebounding slightly to 0.76 percent in 2023.33 “National Innovation Policies: What Countries Do Best and How They Can Improve,” International Technology & Innovation Foundation, June 13, 2019, 82, https://itif.org/publications/2019/06/13/national-innovation-policies-what-countries-do-best-and-how-they-can-improve/; “Historical Trends in Federal R&D, Federal R&D as a Percent of GDP, 1976-2023,” American Association for the Advancement of Science, last visited June 13, 2023, https://www.aaas.org/programs/r-d-budget-and-policy/historical-trends-federal-rd.

Today, US competitors, including China, have figured out the secrets to growing their own innovation ecosystems (including the cultural dimensions that historically have been key to separating the United States from its competition) and are investing the necessary funding to do so. For example, several countries, especially China, have outpaced the United States in R&D spending. Between 1995 and 2018, China’s R&D spending grew at an astonishing 15 percent per annum, about double that of the next-fastest country, South Korea, and about five times that of the United States. By 2018, China’s total R&D spending (from public and private sources) was in second place behind the United States and had surpassed the total for the entire European Union.34 Matt Hourihan, “A Snapshot of U.S. R&D Competitiveness: 2020 Update,” American Association for the Advancement of Science, October 22, 2020, https://www.aaas.org/news/snapshot-us-rd-competitiveness-2020-update. From the US perspective, other metrics are equally concerning. A 2021 study by Georgetown University’s Center for Security and Emerging Technology (CSET) projected that China will produce nearly twice as many STEM PhDs as the United States by 2025 (if counting only US citizens graduating with a PhD in STEM, that figure would be three times as much). This projection is based, in part, on China’s government doubling its investment in STEM higher education during the 2010s.35Remco Zwetsloot, et al., “China is Fast Outpacing U.S. STEM PhD Growth,” Center for Security and Emerging Technology, August 2021, 2–4, https://cset.georgetown.edu/publication/china-is-fast-outpacing-u-s-stem-phd-growth/.

The United States retains numerous strengths, including the depth and breadth of its scientific establishment, number and sizes of its Big Tech firms, robust startup economy and venture capital to support it, numerous world-class educational institutions, dedication to protection of intellectual property, relatively open migration system for high-skilled workers, diverse and massive consumer base, and its still-significant R&D investments from public and private sources.36As reviewed in: Robert D. Atkinson, “Understanding the U.S. National Innovation System, 2020,” International Technology & Innovation Foundation, November 2020, https://www2.itif.org/2020-us-innovation-system.pdf.

In addition, over the past few years there have been encouraging signs of a shift in thinking among policymakers, away from allowing the innovation model that won the Cold War to further erode and toward increased bipartisan recognition that the federal government has a critical role to play in updating that system. As was the case with the Soviet Union, this newfound interest in strengthening the US innovation ecosystem owes much to a recognition that China is a serious strategic competitor to the United States in the technology arena.37See, e.g., the arguments laid out by Frank Lucas, chairman of the House Science, Space, and Technology Committee, in: Frank Lucas, “A Next-Generation Strategy for American Science,” Issues in Science and Technology 39, 3, Spring 2023, https://issues.org/strategy-american-science-lucas/. The Biden administration’s passage of several landmark pieces of legislation, including the CHIPS and Science Act, the Inflation Reduction Act (IRA), and the Infrastructure Investment and Jobs Act (IIJA), increased the amount of federal government spending on S&T, STEM education and skills training, and various forms of infrastructure (digital and physical), all of which are concrete evidence of the degree to which this administration and much of Congress recognize the stiff challenge from China. - Protect: A coherent strategy requires mechanisms to protect and defend a country’s S&T knowledge and capabilities from malign actors. Policy documents and statements from US officials over the past decade have called out the many ways in which the Chinese state orchestrates technology transfer through licit and illicit means, ranging from talent-recruitment programs and strategic mergers and acquisitions (M&A) to outright industrial espionage via cyber intrusion and other tactics.38 “Findings of the Investigations into China’s Acts, Policies, and Practices Related to Technology Transfer, Intellectual Property, and Innovation Under Section 301 of the Trade Act of 1974”; “Threats to the U.S. Research Enterprise: China’s Talent Recruitment Plans,” Permanent Subcommittee on Investigations, Committee on Homeland Security and Governmental Affairs, US Senate, November 2019, https://www.hsgac.senate.gov/wp-content/uploads/imo/media/doc/2019-11-18%20PSI%20Staff%20Report%20-%20China’s%20Talent%20Recruitment%20Plans%20Updated2.pdf; Michael Brown and Pavneet Singh, “China’s Technology Transfer Strategy: How Chinese Investments in Emerging Technology Enable A Strategic Competitor to Access the Crown Jewels of U.S. Innovation,” Defense Innovation Unit Experimental (DIUx), January 2018, https://www.documentcloud.org/documents/4549143-DIUx-Study-on-China-s-Technology-Transfer.

On the protect side, tools include trade controls, sanctions, investment screening, and more. On the export-control side, both the Trump and Biden administrations have relied on dual-use export-control authorities to both restrict China’s access to priority technologies and prevent specific Chinese actors (those deemed problematic by the US government) from accessing US-origin technology and components.39 Steven F. Hill, et. al, “Trump Administration Significantly Enhances Export Control Supply Chain Restrictions on Huawei,” K&L Gates, September 2020, https://www.klgates.com/Trump-Administration-Significantly-Enhances-Export-Control-Supply-Chain-Restrictions-on-Huawei-9-2-2020; and “Implementation of Additional Export Controls: Certain Advanced Computing and Semiconductor Manufacturing Items; Supercomputer and Semiconductor End Use; Entity List Modification,” Bureau of Industry and Security, US Department of Commerce, October 14, 2022, https://www.federalregister.gov/documents/2022/10/13/2022-21658/implementation-of-additional-export-controls-certain-advanced-computing-and-semiconductor. Investment screening has also been a popular tool; in 2018, Congress passed the bipartisan Foreign Investment Risk Review Modernization Act (FIRRMA) that strengthened and modernized the Committee on Foreign Investment in the United States (CFIUS)—an interagency body led by the Treasury Department that reviews inbound foreign investment for national security risks.40“The Committee on Foreign Investment in the United States,” US Department of the Treasury, last visited June 13, 2023, https://home.treasury.gov/policy-issues/international/the-committee-on-foreign-investment-in-the-united-states-cfius. Under the Biden administration, a new emphasis on the national security concerns associated with US outbound investment into China has arisen, with an executive order focused on screening outbound tech investments in the works for almost a year.41Hans Nichols and Dave Lawler, “Biden’s Next Move to Box China out on Sensitive Tech,” Axios, May 25, 2023, https://www.axios.com/2023/05/25/china-investments-ai-semiconductor-biden-order. On sanctions, although the United States has so far been wary of deploying them against China, the Biden administration has, in conjunction with thirty-eight other countries, imposed a harsh sanctions regime on Russia and Belarus following Russia’s unprovoked invasion of Ukraine.42“With Over 300 Sanctions, U.S. Targets Russia’s Circumvention and Evasion, Military-Industrial Supply Chains, and Future Energy Revenues,” US Department of the Treasury, press release, May 19, 2023, https://home.treasury.gov/news/press-releases/jy1494.

Trade controls can be effective tools, but they need to be approached with a clear alignment between means and ends. For decades, an array of export controls and other regulations have worked to prevent rivals from accessing key technologies. However, historical experience (such as that of the US satellite industry) shows that, with a clear alignment between means and ends, trade controls can have massive implications for the competitiveness of US industries and, by extension, US national security.43 Tim Hwang and Emily S. Weinstein, “Decoupling in Strategic Technologies: From Satellites to Artificial Intelligence,” Center for Security and Emerging Technology, July 2022, https://cset.georgetown.edu/publication/decoupling-in-strategic-technologies/.

Before deploying these tools, it is critical for policymakers to first identify what China is doing—both within and outside its borders—in its attempts to acquire foreign technology, an evaluation that should allow the United States to hone more targeted controls that can yield intended results. Trade controls that are too broad and ambiguous tend to backfire, as they create massive uncertainties that lead to overcompliance on the part of industry, in turn causing unintended downside consequences for economic competitiveness.

Understanding China’s strategy for purposes of creating effective trade controls is not as difficult as it once appeared. For instance, a 2022 report from CSET compiled and reviewed thirty-five articles on China’s technological import dependencies.44 The articles were published in China’s state-run newspaper, Science and Technology Daily. Ben Murphy, “Chokepoints: China’s Self-Identified Strategic Technology Import Dependencies,” Center for Security and Emerging Technology, May 2022, https://cset.georgetown.edu/publication/chokepoints/. This series of open-source articles, published in Chinese in 2018, provides specific and concrete examples of Chinese S&T vulnerabilities that can be used by policymakers to assess where and how to apply trade controls. Other similar resources exist. Although the Chinese government appears to be systematically tracking and removing these as they receive attention, there are ways for US government analysts and scholars to continue making use of these materials that preserve the original sources. - Coordinate: The final strategy pillar is outward facing, focused on building and sustaining relationships with other countries in and around the tech strategy and policy space. This pillar might be labeled “tech diplomacy,” given the need to ensure US strategy and policy positively influences as many allies, partners, and even nonaligned states as possible, while continuing to engage China on technology-related issues. As with the other two pillars, this pillar is simple to state as a priority, but difficult to realize in practice.

In a May 2022 speech, US Secretary of State Antony Blinken said that the administration’s shorthand formula is to “invest, align, [and] compete” vis-a-vis China.45 Antony J. Blinken, “The Administration’s Approach to the People’s Republic of China,” US Department of State, May 26, 2022, https://www.state.gov/the-administrations-approach-to-the-peoples-republic-of-china/. Here, he meant “invest” to refer to large public investments in US competitiveness, “align” to closer coordination with allies and partners on tech-related strategy and policy, and “compete” largely to geostrategic competition with China over Taiwan, the East and South China Seas, and other areas.

Blinken’s remarks underscore the Biden administration’s priority for allies and partners to view the United States as a trusted interlocutor. When it comes to technology policy on China, the trouble lies in the execution—in particular, overcoming the tensions inherent within the “invest, align, compete” formula. After Blinken’s speech, for example, the IRA became law, which triggered a firestorm of protest among the United States’ closest transpacific and transatlantic allies. Viewing the IRA’s ample support for domestic production and manufacturing of electric vehicles and renewable-energy technologies—designed to boost the US economy and tackle climate change while taking on China’s advantages in these areas—the protectionist European Union (EU) went so far as to formulate a Green Deal Industrial Plan, widely seen as an industrial policy response to the IRA.46 “Media Reaction: US Inflation Reduction Act and the Global ‘Clean-Energy Arms Race,’” Carbon Brief, February 3, 2023, https://www.carbonbrief.org/media-reaction-us-inflation-reduction-act-and-the-global-clean-energy-arms-race/; Théophile Pouget-Abadie, Francis Shin, and Jonah Allen, Clean Industrial Policies: A Space for EU-US Collaboration, Atlantic Council, March 10, 2023, https://www.atlanticcouncil.org/blogs/energysource/clean-industrial-policies-a-space-for-eu-us-collaboration/. Much of the row over the IRA resulted from the perception—real or not—that the United States had failed to properly consider allies’ and partners’ interests while formulating the legislation. In the words of one observer, “amid the difficult negotiations at home on the CHIPS Act and the IRA, allies and partners were not consulted, resulting in largely unintended negative consequences for these countries.”47 Shannon Tiezzi, “Are US Allies Falling out of ‘Alignment’ on China?” Diplomat, December 19, 2022, https://thediplomat.com/2022/12/are-us-allies-falling-out-of-alignment-on-china/.

Long-term investment by US policymakers in multilateral institutions focused on technology will be a critical aspect of any potential victory. The Biden administration is already making strides on this front through several multilateral arrangements, including the resurrection of the Quadrilateral Security Dialogue (the Quad) and the establishment of the US-EU Trade and Technology Council (TTC) and AUKUS trilateral pact. All three of these arrangements have dedicated time and resources to specific technological issues in both the military/geopolitical and economic spheres, and all three have the potential to be massively impactful in terms of technology competition.

However, history has shown that these types of arrangements are only effective as long as high-level political leadership remains involved and dedicated to the cause. Cabinet officials and other high-level leaders from all participating countries—especially the United States—will have to demonstrate continued interest in and commitment to these arrangements if they want them to produce more than a handful of documents with broad strategic visions.

Assumptions

The strategy outlined in these pages rests on two plausible assumptions. First, this strategy assumes that China will not follow the Soviet Union into decline, collapse, and disintegration anytime soon, which, in turn, means that China should remain a significant competitor to the United States for a long time to come.

China’s leadership has studied the collapse of the Soviet Union closely and learned from it, placing enormous weight on delivering economic performance through its brand of state capitalism while avoiding the kind of reforms that Mikhail Gorbachev instituted during the 1980s, which included freer information flows, freer political discourse, and ideological diversity within the party and state—all of which Chinese leadership believes to have been key to the Soviet Union’s undoing.48 “The Fall of Empires Preys on Xi Jinping’s Mind,” Economist, May 11, 2023, https://www.economist.com/briefing/2023/05/11/the-fall-of-empires-preys-on-xi-jinpings-mind; Kunal Sharma, “What China Learned from the Collapse of the USSR,” Diplomat, December 6, 2021, https://thediplomat.com/2021/12/what-china-learned-from-the-collapse-of-the-ussr/; Simone McCarthy, “Why Gorbachev’s Legacy Haunts China’s Ruling Communist Party,” CNN, August 31, 2022, https://www.cnn.com/2022/08/31/china/china-reaction-mikhail-gorbachev-intl-hnk/index.html. China also does not have analogous centrifugal forces that threaten an internal breakup along geographic lines as did the Soviet Union, which had been constructed from the outset as a federation of republics built upon the contours of the tsarist empire. (The Soviet Union, after all, was a union of Soviet Socialist republics scattered across much of Europe and Asia).49 For a review of the complex history of the construction and deconstruction of the Soviet Union, see: Serhii Plokhy, “The Empire Returns: Russia, Ukraine and the Long Shadow of the Soviet Union,”Financial Times, January 28, 2022, https://www.ft.com/content/0cbbd590-8e48-4687-a302-e74b6f0c905d.

These factors weigh against an assessment that China will soon collapse. Nicholas Burns, the US ambassador to China, has said recently that China is “infinitely stronger” than the Soviet Union ever was, “based on the extraordinary strength of the Chinese economy” including “its science and technology research base [and] innovative capacity.” He concluded that the Chinese challenge to the United States and its allies and partners “is more complex and more deeply rooted [than was the Soviet Union] and a greater test for us going forward.”50 Phelim Kine, “China ‘Is Infinitely Stronger than the Soviet Union Ever Was,’” Politico, April 28, 2023, https://www.politico.com/newsletters/global-insider/2023/04/28/china-is-infinitely-stronger-than-the-soviet-union-ever-was-00094266.

A more realistic long-term scenario is one in which the United States and its allies and partners would need to manage a China that will either become stronger or plateau, rather than one that will experience a steep decline. Both variants of this scenario are worrisome, and both underscore the need to hew to the strategy outlined in this paper. A stronger China brings with it obvious challenges. A plateaued China is a more vexing case, owing to the very real possibility that Chinese leadership might conclude that, as economic stagnation portends a future decline and fall, the case for military action (e.g., against Taiwan) is more, rather than less, pressing. The strategist Hal Brands, for example, has suggested that a China that has plateaued will become more dangerous than it is now, requiring a strategy that is militarily firm, economically wise (including maintenance of the West’s advantages in the tech-innovation space), and diplomatically flexible.51 Hal Brands, “The Dangers of China’s Decline,” Foreign Policy, April 14, 2022, https://foreignpolicy.com/2022/04/14/china-decline-dangers/.

Second, the strategy outlined here assumes that relations between the United States and China will remain strained at best or, at worst, devolve into antagonism or outright hostility. In 2023, the assumption of ongoing strained relations appears wholly rational, based on a straightforward interpretation of all available diplomatic evidence.

How this strategy should shift if the United States and China were to have a rapprochement would depend greatly on the durability and contours of that shift. Even if a thaw were to reset bilateral relations to where they were at the beginning of the century (an unlikely prospect), the US interest in maintaining a first-mover advantage in technological development would remain. As reviewed in this paper, there was a long period during which the United States and China traded technologically based goods and services in a more open-ended trading regime than is currently the case. During that period, the United States operated on two presumptions: that China’s S&T capabilities were nowhere near as developed as its own, and that the US system could stay ahead owing to its many strengths compared with China’s.

The trouble with returning to this former state is that both presumptions no longer hold. China has become a near-peer competitor in science and technological development, and its innovative capabilities are considerable.

If China and the United States were to thaw their relationship, the policy question would concern the degree to which the United States would reduce its “protect” measures—the import and export restrictions, sanctions, and other policies designed to keep strategic technologies and knowhow from China, while protecting its own assets from espionage, sabotage, and other potential harms.

Guidelines for implementation

As emphasized throughout this paper, any successful long-term strategy will require that the US government pursue policies that are internally well coordinated, are based on solid empirical evidence, and are flexible and nimble in the short run, while being attentive to longer-run trends and uncertainties. The government will need to improve its capabilities in three areas.

- Improved intelligence and counterintelligence: The US government will need to reassess, improve, and extend its intelligence and counterintelligence capabilities about tech development. The intelligence community will need to be able to conduct ongoing, comprehensive assessments of tech trends and uncertainties of relevance to the strategic competition with the United States. To properly gauge the full range of relevant and timely information about China’s tech capabilities, the Intelligence Community’s practice of relying on classified materials will need to be augmented by stressing unclassified open-source material. Classified sources, which the Intelligence Community always has prioritized, do not provide a full picture of what is happening in China. Patent filings, venture-capital investment levels and patterns, scientific and technical literature, and other open sources can be rich veins of material for analysts looking to assess where China is making progress, or seeking to make progress, in particular S&T areas. The US government’s prioritization of classified material contrasts with the Chinese government’s approach. For decades, China has employed “massive, multi-layered state support” for the “monitoring and [exploitation] of open-source foreign S&T.”52 Tarun Chhabra, et al., “Open-Source Intelligence for S&T Analysis,” Center for Security and Emerging Technology (CSET), Georgetown University Walsh School of Foreign Service, September 2020, https://cset.georgetown.edu/publication/open-source-intelligence-for-st-analysis/. There is recognition that the US government needs to upgrade its capabilities in this respect. In 2020, the House Permanent Select Committee on Intelligence observed that “open-source intelligence (OSINT) will become increasingly indispensable to the formulation of analytic products” about China.53 A summary of and link to the committee’s redacted report is in: Tia Sewell, “U.S. Intelligence Community Ill-Prepared to Respond to China, Bipartisan House Report Finds,” Lawfare, September 30, 2020, https://www.lawfareblog.com/us-intelligence-community-ill-prepared-respond-china-bipartisan-house-report-finds.

An intelligence pillar will need a properly calibrated counterintelligence element to identify where China might be utilizing its means and assets—including legal, illegal, and extralegal ones—to obtain intellectual property in the United States and elsewhere (China has a history of utilizing multiple means, including espionage, to gain IP that is relevant to their S&T development).54 William Hannas and Huey-Meei Chang, “China’s Access to Foreign AI Technology,” Center for Security and Emerging Technology (CSET), Georgetown University Walsh School of Foreign Service, September 2019, https://cset.georgetown.edu/publication/chinas-access-to-foreign-ai-technology/. Here, “properly calibrated” refers to how counterintelligence programs must ensure that innocent individuals, including Chinese nationals who are studying or researching in the United States, are not brought under undue or illegitimate scrutiny. At the same time, these programs must be able to identify, monitor, and then handle as appropriate those individuals who might be engaging in industrial espionage or other covert activities. The Trump administration’s China Initiative was criticized both for its name (it implied that Chinese nationals and anyone of East Asian descent were suspect) and the perception of too-zealous enforcement (the program resulted in several high-profile cases ending in dismissal or exoneration for the accused). In 2022, the Biden administration shuttered this initiative and replaced it with “a broader strategy aimed at countering espionage, cyberattacks and other threats posed by a range of countries.”55 Ellen Nakashima, “Justice Department Shutters China Initiative, Launches Broader Strategy to Counter Nation-State Threats,” Washington Post, February 23, 2022, https://www.washingtonpost.com/national-security/2022/02/23/china-initivative-redo/. - Improved foresight: Strategic-foresight capabilities assist governments in understanding and navigating complex and fast-moving external environments. Foresight offices in government and the private sector systematically examine long-term trends and uncertainties and assess how these will shape alternative futures. These processes often challenge deeply held assumptions about where the world is headed, and can reveal where existing strategies perform well or poorly.

This logic extends to the tech space, where the US government should develop a robust foresight apparatus to inform tech-focused strategies and policies at the highest levels. The purpose of this capability would be to enhance and deepen understanding of where technological development might take the United States and the world. Such a foresight capability within the US government would integrate tech-intelligence assessments, per above, into comprehensive foresight-based scenarios about how the world might unfold in the future. The US government has impressive foresight capabilities already, most famously those provided by the National Intelligence Council (NIC). However, for a variety of reasons, including distance from the center of executive power, neither the NIC nor other foresight offices within the US government currently perform a foresight function described here. The US government should institutionalize a foresight function within or closely adjacent to the White House—for example, within the National Security Council or as a presidentially appointed advisory board. Doing so would give foresight the credibility and mandate to engage the most critical stakeholders from across the entire government and from outside of it, a model followed by leading public foresight offices around the world.56 Tuomo Kuosa, “Strategic Foresight in Government: The Cases of Finland, Singapore, and the European Union,” S. Rajaratnam School of International Studies, Nanyang Technological University, 43, https://www.files.ethz.ch/isn/145831/Monograph19.pdf. This recommendation is consistent with numerous others put forward by experts over the past decade, which stress how the US government needs to give foresight more capabilities while bringing it closer to the office of the president.57 For a review, including a summary of such recommendations, see: J. Peter Scoblic, “Strategic Foresight in U.S. Agencies. An Analysis of Long-term Anticipatory Thinking in the Federal Government,” New America, December 15, 2021, https://www.newamerica.org/international-security/reports/strategic-foresight-in-us-agencies/. - Improved S&T strategy and policy coordination: One of the major challenges facing the US government concerns internal coordination around S&T strategy and policy. As technology is a broad and multidimensional category, the government’s activities are equally broad, covered by numerous statutes, executive orders, and administrative decisions. One of many results is a multiplicity of departments and agencies responsible for administering the many different pieces of the tech equation, from investment to development to monitoring, regulation, and enforcement. In just the area of critical technology oversight and control, for example, numerous departments including Commerce, State, Defense, Treasury, Homeland Security, and Justice, plus agencies from the Intelligence Community, all have responsibilities under various programs.58 See, for example: Marie A. Mak, “Critical Technologies: Agency Initiatives Address Some Weaknesses, but Additional Interagency Collaboration Is Needed,” General Accounting Office, February 2015, https://www.gao.gov/assets/gao-15-288.pdf.

Moreover, the US government’s approach to tech oversight tends to focus narrowly on control of specific technologies, which leads to an underappreciation of the broader contexts in which technologies are used. A report issued in 2022 by the National Academies of Sciences, Engineering, and Medicine argued that the US government’s historic approach to tech-related risks is done through assessing individual critical technologies, defining the risks associated with each, and then attempting to restrict who can access each type of technology. Given that technologies now are “ubiquitous, shared, and multipurpose,” the National Academies asserted, a smarter approach would be to focus on the motives of bad-faith actors to use technologies and then define the accompanying risks.59 “Protecting U.S. Technological Advantage,” 97. This approach “requires expertise that goes beyond the nature of the technology to encompass the plans, actions, capabilities, and intentions of US adversaries and other bad actors, thus involving experts from the intelligence, law enforcement, and national defense communities in addition to agency experts in the technology.”60 Ibid.

Major risks

There are two major sets of risks accompanying this strategy, both of which involve the potential damage that might result from failure to keep the strategic competition within acceptable boundaries.

- Decoupling run amok: Overreach is one of the biggest risks associated with this strategy. Geopolitical and economic goals contradict, and it can be difficult to determine where to draw the line. As such, reconciling this dilemma will be the hardest part of a coherent and effective competition strategy.

Technology decoupling to preserve geopolitical advantages can be at odds with economic interests, which the United States is currently experiencing in the context of semiconductors. The October 7, 2022, export controls were deemed necessary for geopolitical reasons, as the White House’s official rationale for the policy centered around the use of semiconductors for military modernization and violation of human rights. However, limiting the ability of US companies like Nvidia, Applied Materials, KLA, and Lam Research to export their products and services to China, in addition to applying complex compliance burdens on these firms, has the potential to affect these firms’ ability to compete in the global semiconductor industry.

In addition, the continued deployment of decoupling tactics like export controls can put allies and partners in a position where they feel forced to choose sides between the United States and China. On the October 7 export controls, it took months to convince the Netherlands and Japan—two critical producer nations in the semiconductor supply chain whose participation is critical to the success of these export controls—to get on board with US policy.61Toby Sterling, Karen Freifeld, and Alexandra Alper, “Dutch to Restrict Semiconductor Tech Exports to China, Joining US Effort,”Reuters, March 8, 2023, https://www.reuters.com/technology/dutch-responds-us-china-policy-with-plan-curb-semiconductor-tech-exports-2023-03-08/. Even now, although media reporting says an agreement has been reached, no details of the agreements have been made public, likely due to concerns surrounding Chinese retaliation.