The Economic Statecraft Initiative

Housed within the GeoEconomics Center, the Economic Statecraft Initiative (ESI) publishes leading-edge research and analysis on sanctions and the use of economic power to achieve foreign policy objectives and protect national security interests. Coercive and positive economic statecraft measures are increasingly used by the United States, European Union, and their allies and partners to address global challenges.

ESI convenes public events and private roundtable discussions to explore challenges and opportunities, providing policymakers and the private sector with unbiased data-driven analysis and actionable recommendations to shape economic statecraft solutions to global challenges.

The Economic Statecraft Initiative resides within the GeoEconomics Center, a translation hub at the nexus of economics, finance, and foreign policy with the goal of helping shape a better global economic future.

Research and Analysis

Testimony

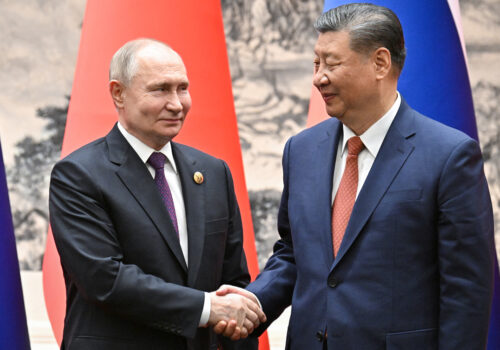

On February 20, 2025, Economic Statecraft Initiative Director Kimberly Donovan testified to the US-China Economic and Security Review Commission at a hearing titled, “An Axis of Autocracy? China’s Relations with Russia, Iran, and North Korea.

Featured Report

The economic statecraft landscape is becoming more complex as transatlantic partners increasingly leverage economic power to counter transnational threats. There is a growing need to understand how these tools are used, by whom, and when, as well as their intended and real impacts worldwide.

Lexicon

Economic Statecraft Lexicon

A comprehensive resource designed to clarify and enhance understanding of key terms and concepts in the economic statecraft field. The Lexicon represents a collaborative effort to support more effective communication and informed decision-making on economic statecraft.

Events

Transatlantic Forum

The Transatlantic Forum on GeoEconomics is our annual flagship conference convening economic and financial leaders from both sides of the Atlantic, and launches cutting-edge research and analysis on transatlantic alignment on economic statecraft.

Upcoming events

Check back soon for more upcoming events!

Follow us on social media!