Global China Newsletter – Risky Business: The Challenge of Reducing Dependencies on China

Subscribe to the Global China Hub

China’s economic ties with developed democracies traditionally have constituted the ballast for relationships otherwise subject to tensions over human rights, security, and other contentious subjects. This has certainly been the case in Europe.

But as we mark one year since European Commission President Ursula von der Leyen’s landmark speech outlining a new vision for Europe’s relationship with China framed around “de-risking” and reducing dependencies on Beijing, economic issues are increasingly a source of friction in relations with China – and central to transatlantic alignment on China policy.

Just this week, the EU announced a new anti-subsidy probe into China’s wind turbine industry and extended its guide on China’s distortions in different sectors of its economy, further indication Brussels is preparing for more trade actions to defend key industries. This comes after a year of strengthening Europe’s economic defenses against China’s leverage, including the publication of an economic security strategy.

The de-risking approach has also become the adopted framing of transatlantic coordination on China. US Treasury Secretary Yellen echoed European messaging in her trip to China this week, as our editor-in-chief Tiff Roberts notes below, underscoring that the U.S. would not allow Chinese subsidies to hollow out US manufacturing and that Washington might place tariffs on clean energy imports from China.

Meanwhile, China’s commerce minister was on a trip to Europe where he dismissed concerns about Chinese overcapacity as groundless and denied that subsidies were responsible for China’s success in green industries.

China, not surprisingly, rejects the concept of de-risking. But Beijing is betting that EU member states’ disunity, and the enduring draw of the Chinese market, will stall Europe’s economic security measures.

And China has plenty to point to. China’s Ambassador to Germany recently cheered German businesses’ continued investment in China and claimed resilient bilateral trade reflected the “unpopularity” of de-risking. Chancellor Scholz will meet with President Xi early next week, accompanied by German business leaders, on his first trip to China since Germany released its own China strategy focused on de-risking.

As I and colleagues from the Council’s GeoEconomics and Europe Centers argued recently, European economic dependency on China is indeed beginning to retreat (see below), but Brussels has much more to do.

Europe’s progress in implementing lofty de-risking plans amidst intra-European and transatlantic differences – and a continuing stream of Chinese inducements and pressure – may be the clearest gauge of allies’ ability to remain in sync on China policy in the years ahead.

We’ve got plenty more on this and other topics below. Over to you, Tiff!

-David O. Shullman, Senior Director, Atlantic Council Global China Hub

China Spotlight

Secretary Yellen, a Chinese cuisine epicurean?

To read the news, one might think Treasury Secretary Janet Yellen came to China to enjoy Chinese delicacies. “One thing stands out during Yellen’s whirlwind trip… just as how closely watched the content of her talks, what she chose to eat also gained widespread attention,” wrote the Global Times. Phoenix News reported how after arriving in Beijing, Sec. Yellen went immediately to a Sichuan restaurant.

But Sec. Yellen was there for a serious purpose: to warn Beijing that a flood of exports washing up on American shores would not be welcomed. “I think the Chinese realize how concerned we are about the implications of their industrial strategy,” and how it could “make it difficult for American firms to compete,” she said. The fear is that as the economy worsens, China will respond by pumping more cheap products onto global markets.

That’s because Beijing seems to have no clear plan how to stimulate growth domestically, a reality that became clear following the closing of the National People’s Congress last month. As GeoEconomics Center senior fellow Jeremy Mark writes, government spending plus nearly five trillion yuan of new bonds will likely go to building more infrastructure, plus developing higher-value added industries like green energy technology and electric vehicles (EVs)—both areas where China’s surging exports have spooked the US and Europe. “There was no sign that the government was prepared to channel resources to boost household spending, which is necessary if growth is to revive,” writes Mark.

Xi Jinping’s focus on “new quality productive forces,” including EVs, as well as lithium-ion batteries, and renewable energy products such as solar panels and wind turbines, “is intrinsic to China’s economic model—and therefore that calls to end it amount to wishful thinking,” writes GeoEconomics Center senior fellow Hung Tran in “Breaking down Janet Yellen’s comments on Chinese overcapacity.” This means that the US must prepare itself for trade tensions on this issue for the foreseeable future and recognize that China will address the issue on its own timeline only when “its domestic impact becomes unacceptably negative.”

China mulls economic retaliatory options in event of a Taiwan crisis

Meanwhile, volatile China-Taiwan relations are back in the news as former Taiwanese president Ma Ying-jeou makes an 11-day visit to the mainland, where he met with Xi Jinping, even as China’s leader refuses to renounce the use of force against the island. How might Beijing respond to U.S.-led economic sanctions, in the frightening event of a military conflict in the Taiwan Strait? That’s the question addressed in “Retaliation and resilience: China’s economic statecraft in a Taiwan crisis,” the second report in a series by the Geoeconomics Center and Rhodium Group, as well as in the report’s April 2 launch event.

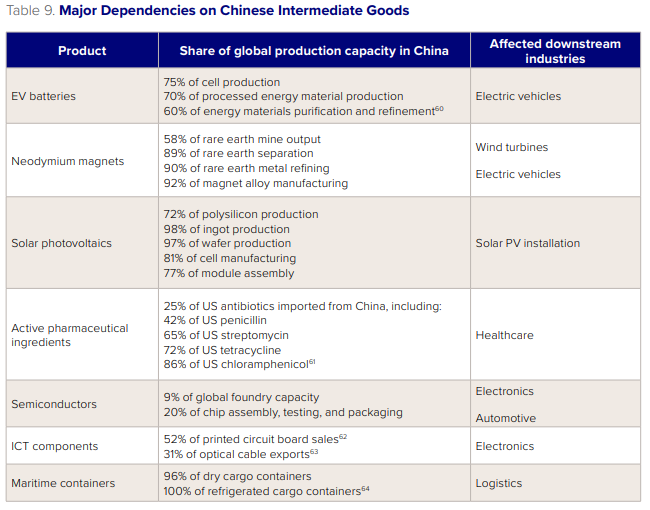

After watching Western countries impose unprecedented sanctions on Russia following the invasion of Ukraine, “China is developing capacities that are making its economy more resilient,” in the event of a Taiwan crisis, the report notes. With over 100 million Chinese jobs tied to its exports, China is expected to be strategic in its response: “as a result of the major costs to its citizens, China is unlikely to follow a tit-for-tat approach but will target sectors where it can inflict asymmetric pain, particularly through the use of export controls or trade restrictions on critical goods such as rare earths, active pharmaceutical ingredients, and clean energy inputs (e.g., graphite).”

China Global: countering growing influence in the Pacific Islands

There is a new arena of rising Chinese influence: the Pacific Islands, made up of 16 countries and territories near the equator, including the Solomons, Samoa, Kiribati, and Papua New Guinea, the only Pacific country with a population over one million. While their economic heft is small—with a combined GDP of only $36 billion–they are geopolitically important, helping China build support in international forums such as the United Nations, and in isolating Taiwan.

Key to countering Beijing’s efforts: strengthening cooperation between members of the Quad, the security grouping that includes, Japan, India, Australia, and the US, and the Pacific Island countries, as the Indo-Pacific Security Initiative (IPSI) and Hub’s Parker Novak and IPSI’s Kyoko Imai write in a new issue brief (IPSI also held a virtual seminar on the same topic.) One important policy recommendation the authors raise: the Quad must “expand its focus beyond just traditional security issues,” and focus on cooperation on issues important to the region, including climate change, maritime management and public diplomacy that “emphasizes shared values, and does not overemphasize geopolitics.”

The Quad is just one mechanism for the US to engage with the region. Although the US is beginning to move on issues related to the Pacific Islands, such as Congress’ much belabored renewal of the Compacts of Free Association (COFA) with Palau, the Federated States of Micronesia, and the Republic of the Marshall Islands, this may not be enough, according to Hub fellow Will Piekos. He writes that “[T]he delay in ratifying the COFA reinforced the perception that the United States is an unreliable partner.” To counter this perception and compete with China, the US should “facilitate private-sector involvement to spur growth, developing partnerships with local actors and nongovernmental organizations, and helping to increase governance capacity.”

ICYMI

- The Global China Hub hosted an event with the GeoEconomics Center and IPSI titled, “Indo-Pacific economic security: Issues and strategies” which featured a keynote fireside chat with House Select Committee on the CCP’s Ranking Member Raja Krishnamoorthi who discussed the recommendations from their report, “Reset, Prevent, Build: A Strategy to Win America’s Economic Competition with the Chinese Communist Party.”

- The latest installment of the China-MENA podcast invited Steve Tsang, Director of the China Institute at SOAS University of London, to explore Xi Jinping’s political philosophy and how it propels a new state ideology, autocratic alliances, and what it means for the future of China and the Middle East and North Africa.

- In his latest New Atlanticist piece, “The G7 needs a permanent secretariat. The 2024 elections cycle demonstrates why,” Europe Center Research Assistant Francis Shin argues that a permanent secretariat would support the G7’s efforts to combat continuing strategic competition with China.

- The GeoEconomics Center’s Kimberly Donovan and Maia Nikoladze write about how Iran and Russia have redirected much of their oil shipments to China to evade sanctions. They suggest that Western authorities should start looking into financial linkages between heavily sanctioned regimes to begin addressing this growing issue.

Welcome to our newest fellow!

Global China Hub

The Global China Hub researches and devises allied solutions to the global challenges posed by China’s rise, leveraging and amplifying the Atlantic Council’s work on China across its 15 other programs and centers.

Follow us on Twitter @ACGlobalChina