China is getting comfortable with the Gulf Cooperation Council. The West must pragmatically adapt to its growing regional influence.

The People’s Republic of China’s (PRC) expanding political and economic footprint has been welcomed by the Middle East and North Africa (MENA) region—so far.

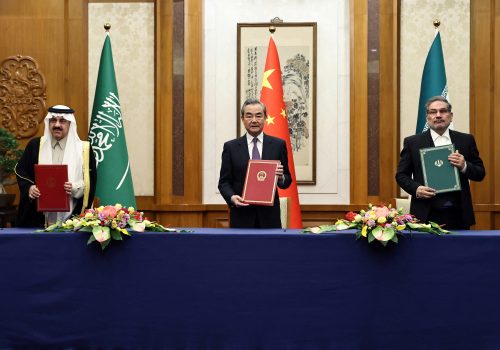

Beijing’s brokering of the recent Saudi Arabia-Iran agreement was borne out of necessity and opportunity. The countries in the Gulf Cooperation Council (GCC) are of critical importance to China’s energy security needs, while Beijing feels increasingly sure-footed in its regional diplomacy.

Still, as other great powers have learned the hard way, navigating the region’s contentious politics will prove difficult, as Beijing’s regional role is subject to key uncertainties. While China’s “no questions asked” approach to human rights within MENA will find a receptive audience across much of the region, other aspects of its foreign policy will prove less palatable.

China, the world’s largest oil importer, has a structural interest in low hydrocarbon prices, essentially runs an open-air prison camp for Uyghur Muslims, and may now be responsible for mediating between two bitter rivals. It’s unclear if Beijing has the acumen or the will to manage these contradictions. In any event, adapting to a greater Chinese role will require pragmatism. The West should proceed thoughtfully in the region; recognize the enduring reality of the Chinese presence; provide security and technological alternatives to Beijing; and enhance energy, educational, and economic cooperation with the GCC countries when mutually beneficial.

The GCC’s energy and economic relationship with China

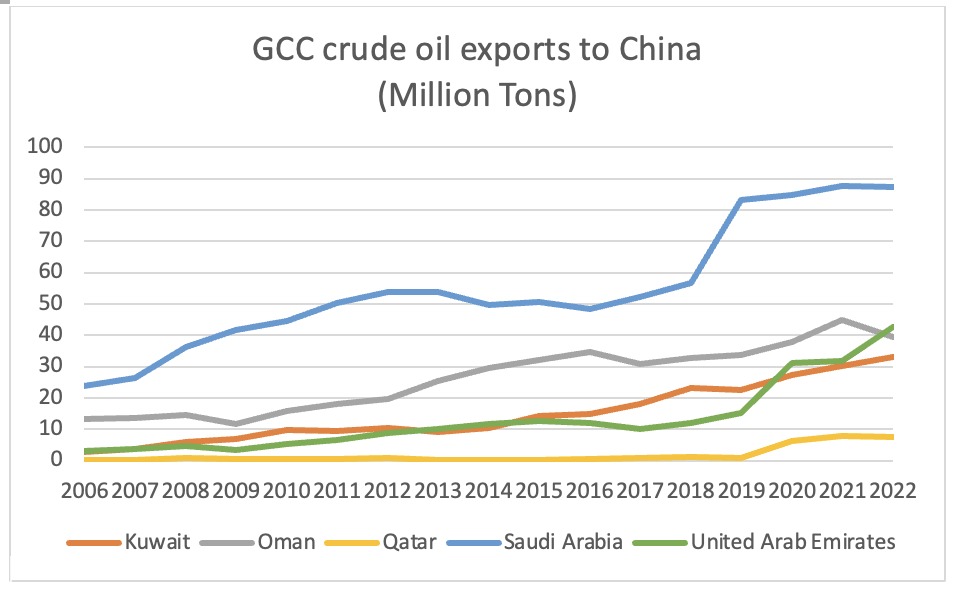

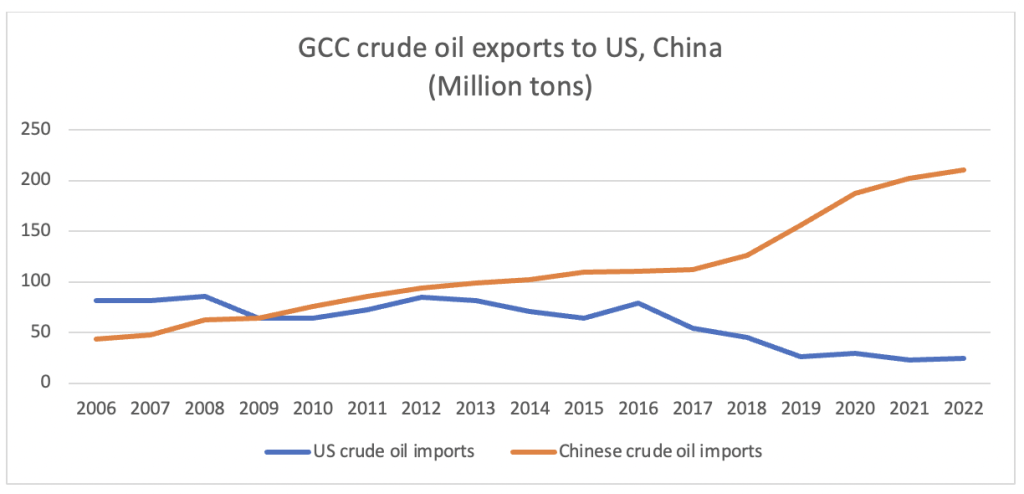

China’s economy grew by over 550 percent from 2006 to 2022. Over the same period, its crude oil imports rose from 145 million tons in 2006 to over 508 million tons in 2022. Unsurprisingly, China’s rapid economic growth and energy demand have led it to import more of the GCC’s crude oil. As US crude oil import demand has fallen on greater domestic production, Gulf countries have redirected exports to the Indo-Pacific, including China; the GCC exported just over 210 million tons to China in 2022, more than double its 2014 shipments.

Saudi Arabia is, by far, the region’s largest exporter to China, as it shipped nearly 88 million tons to the PRC in 2022. Oman’s exports to China are more striking, however. Despite Muscat’s relatively minor role in world energy markets, Oman has historically been the GCC’s second-largest crude oil exporter to China, before being surpassed by the United Arab Emirates (UAE) in 2022, potentially due to Abu Dhabi’s re-export of Russian crudes.

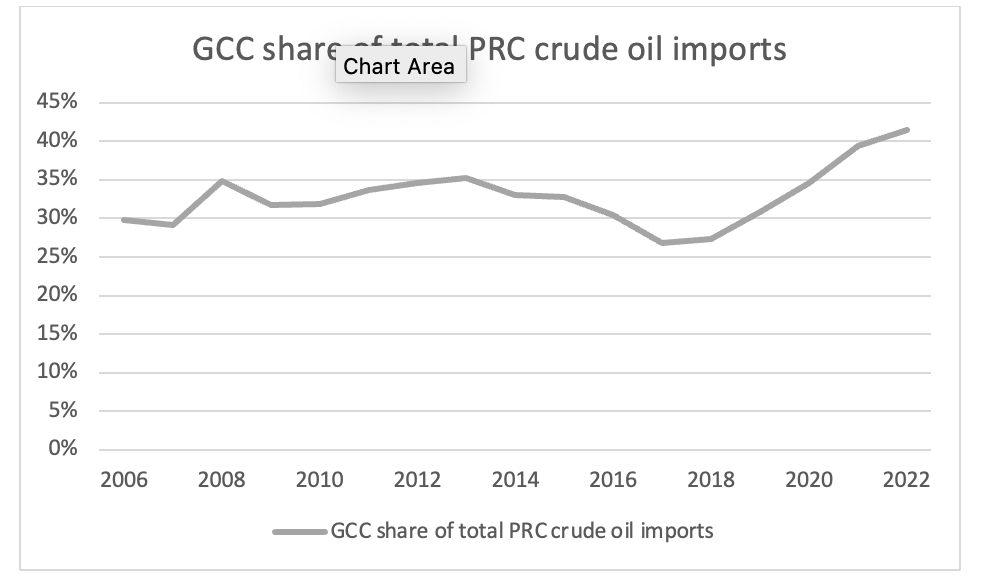

Surging GCC-China crude ties have made the region increasingly important to the PRC’s energy security. In 2022, more than 41 percent of all Chinese crude imports were shipped from the GCC, up from 35 percent a decade ago.

However, the GCC’s share of China’s crude oil mix could decline slightly in the near future due to shifting dynamics in international oil markets. Western sanctions in response to the invasion of Ukraine have sharply reduced Russian exports to Europe and forced Moscow to reach other markets, including India and China. Indeed, Russian oil exports to China hit a post-invasion record in March 2023 and are expected to remain highly elevated. While Moscow will continue to compete with the GCC to enter the Chinese refinery market, China’s re-emergence from zero-COVID and rebounding oil demand will continue to support its demand for GCC crude.

For example, in 2019, China signed a $10 billion deal to develop a new industrial city in the UAE and has also been involved in major infrastructure projects in Saudi Arabia, such as the $10 billion Yanbu refinery. In 2023, Saudi acquired a 10 percent stake in a private Chinese oil refinery and will provide 480,000 barrels per day of crude—a deal that came right after Saudi Aramco announced a venture with two Chinese companies to build a new three hundred thousand barrels per day (bpd) refinery and petrochemical complex in northeast China.

China’s long-term oil demand will have major implications for the GCC, but most risks are to the downside. While China is expected to become the world’s largest refinery market—and may be so already—the war in Ukraine has heightened the PRC’s energy security fears. About a quarter of all new cars sold in China in 2022 were electric vehicles or plug-in hybrids, limiting Chinese consumers’ use of crude oil products, such as gasoline and diesel. With Beijing starting construction on six times as many coal plants as the rest of the world combined, it’s clear that Chinese policymakers hope to reduce consumption of foreign oil and gas imports as quickly as possible. Nevertheless, there are serious doubts about China’s long-term economic trajectory.

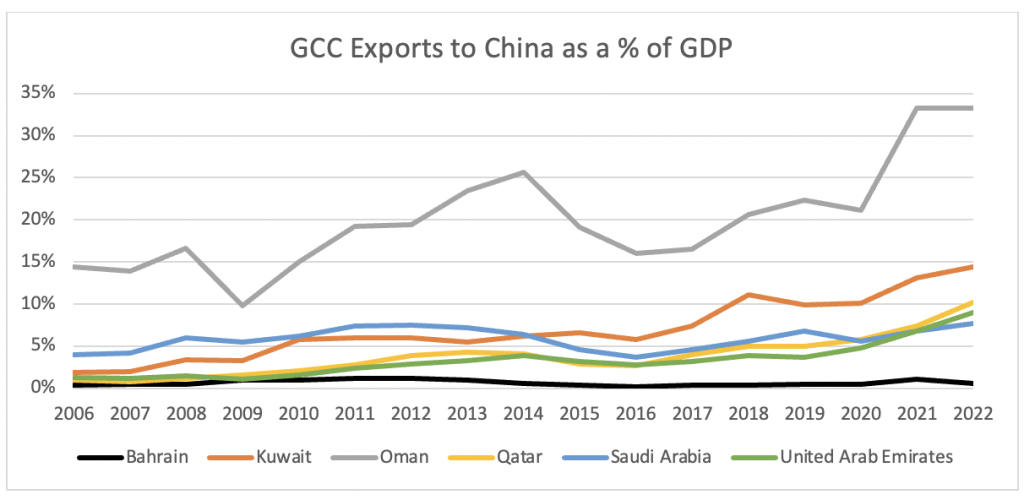

While these potential long-term trends could weigh on the GCC’s exports, China is and will remain an economic reality for the region. Each GCC economy, except for Bahrain, has significant ties to China. As seen in the chart below, exports to China accounted for nearly 8 percent of Saudi Arabia’s GDP in 2022, while nearly a third of Oman’s Gross Domestic Product (GDP) is directly tied to exports to China.

Moreover, these figures may understate China’s role in the Middle East’s political economy. Since regional governments rely on oil exports to finance the state sector and dispense patronage, Chinese oil demand is critical for the GCC’s power structures. In Oman, for instance, the oil and gas sector accounts for nearly 72 percent of government revenue, while China intakes about 90 percent of all Omani crude oil exports. Nowhere is China’s regional economic presence felt more greatly than in Oman. Perhaps not coincidentally, Oman is central to Beijing’s metastasizing role in regional security, which has been noted by the United States and other Western powers.

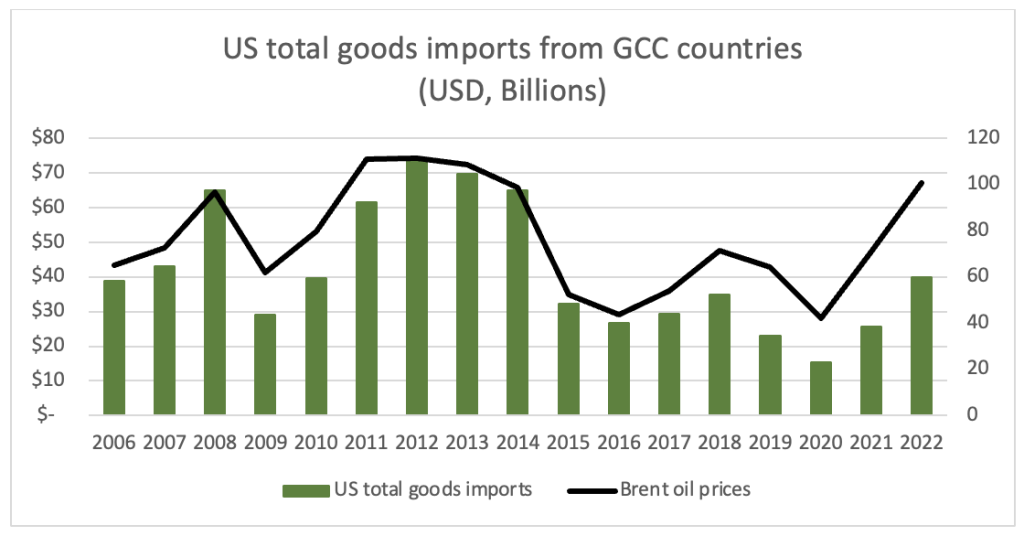

While China has become a more significant player in the Middle East, the United States’ economic role is receding. As the US increasingly meets domestic crude oil supply needs via its own production, the Middle East is no longer as critical for US energy security as it once was. US total goods imports from the GCC have fallen by nearly half compared to their 2012 levels, as measured by value.

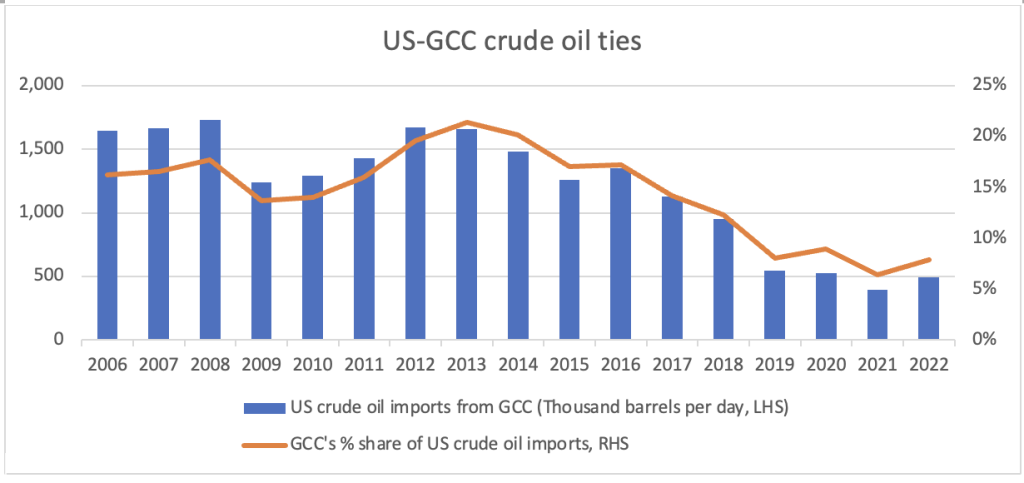

Declining US crude oil import volumes explain the trajectory of US-GCC goods trade. US production of light oil grew sharply in the 2010s, displacing GCC imports. US imports of GCC crude oil fell absolutely and relatively in the decade, with volumes declining from nearly 1.7 million bpd in 2012 to under 0.5 million bpd by 2022. Over the same period, the GCC’s share of total US crude oil import volumes fell from 20 percent to 8 percent.

MENA’s exports are shifting. While Washington remains a critical security and investment partner for the region, Beijing is the region’s most important oil export market by far. The GCC exported nearly 8.5 times more crude oil to China than the US in 2022.

China’s increasingly assertive regional role

China’s growing absolute and relative economic footprint in the GCC, reliance on the Gulf for energy supplies, and concerns over a potential Saudi-Iran conflict have led Beijing to take a more active political role in the region. Beijing’s primary regional objective is to ensure the stable flow of energy supplies, but it also seeks to reduce Western—especially US—influence wherever possible. Beijing prefers to use diplomacy and economic tools to advance its regional objectives, but there are some embryonic signs that Beijing is considering expanding its regional military presence.

Modern Chinese engagement with GCC countries has traditionally been centered on mutual economic interests, but these interactions increasingly have political dimensions. China has traditionally expressed a “non-interference principle,” aligning with the GCC’s stated preference for non-intervention in each other’s affairs. However, as seen in the Iran-Saudi deal, Beijing’s increasingly assertive political role in the region seeks to reduce disruption to its energy supplies. Some scholars such as Tuvia Gering, a nonresident fellow at the Atlantic Council, see Beijing exhibiting a “firmer determination to get more involved in regional security and politics, most notably through Xi Jinping’s Global Security Initiative and New Security Architecture for the Middle East.”

Beijing has recently taken several concrete steps to enhance its role in Middle Eastern security. On March 10, Saudi Arabia, Iran, and China issued a joint statement—from Beijing—announcing the restoration of diplomatic ties between Riyadh and Tehran. On March 29, Saudi King Salman approved a Memorandum of Understanding (MOU) granting the Kingdom the status of a dialogue partner in the Shanghai Cooperation Organization (SCO).

These recent announcements suggest growing China-GCC security cooperation, especially amid regional dissatisfaction with the West for either doing “too much,” a la Iraq, or “not doing enough,” as in the case of Iran. Indeed, it’s important to note that Beijing’s growing presence is not purely driven by its desire to challenge the US. In addition to Beijing’s greater “push” for influence, many regional capitals seek to “pull” in Beijing politically.

Several GCC countries believe Beijing provides them with an economic and now political partner, thus giving them leverage vis-à-vis the US. According to Jonathan Fulton, a senior fellow at the Atlantic Council, multipolarity is in full swing across the region amid the uncertainty about Washington’s long-term commitment to regional security. Regional actors cite internal US political conditions and whiplash-inducing policy changes, including on the Iranian nuclear issue, as major challenges and damaging to long-term trust. China has noted this opportunity, branding itself as an alternative to the West and major broker in regional security—at least for now.

Still, China-GCC political ties are subject to uncertainty, particularly due to Iran. Tehran remains one of the main sponsors of terrorism, separatism, and interference in Arab countries’ affairs, and the deep mistrust between Riyadh and Tehran is unlikely to turn simmering tensions into a warm peace any time soon. China’s growing political ties with the GCC are complicated by the enduring Arab-Persian split.

Beijing’s increasing reliance on GCC countries for its vital energy and regional economic interests, as well as continuing concerns about the risks of a regional conflict, might lead the PRC to reinforce its diplomatic role by beefing up its regional security capabilities and preparedness as it increasingly turns to military tools to support its global ambitions. Beijing’s establishment of its first overseas military base in Djibouti in 2017—strategically located near the Bab-el-Mandeb Strait and the Gulf of Aden—suggests that Beijing seeks to project military power beyond its borders (in tandem with its expanding regional economic interests). While China initially denied any intention of using the base for military purposes, its location and capacity suggest otherwise. The PRC’s increasing naval presence in the Indian Ocean and participation in anti-piracy patrols in the Gulf of Aden since 2008 are further examples of this trend. Furthermore, China has sold military drones and other equipment to various countries in the Middle East, including Saudi Arabia and the UAE.

Recently, classified satellite imagery and US intelligence reports in 2021 pointed at China’s desire to build a secret military facility anchored in a Chinese-operated container terminal at Khalifa port in Abu Dhabi—a project that was eventually halted after an intense diplomatic effort by the Joe Biden administration. This development appeared to resemble Beijing’s Military-Civil Fusion Development Strategy, part of which aims to “build military requirements into civilian infrastructure” and “leverage civilian service and logistics capabilities for military purposes.”

Oman, often overshadowed by larger and more influential countries—such as Saudi Arabia and the UAE—has traditionally maintained a neutral stance in the Middle East but has sought to expand its economic ties with China in recent years. Beijing has invested heavily in Oman’s infrastructure, including $10.7 billion in constructing the Duqm port and industrial zone—strategically located near the Strait of Hormuz, signaling China’s interest in furthering its presence in the Arabian Sea. Duqm, at the intersection of land and sea routes, allows China to better access and secure its energy supply lines through the region. This makes Oman an important partner for China in the security realm, and Muscat has already hosted joint naval exercises with China in 2017. Omani-Chinese military ties, especially regarding Duqm, will remain closely watched in the months and years to come.

Recommendations for Western policymakers

The US and its allies and partners must pragmatically adapt to China’s growing regional influence by providing credible alternatives to Beijing, especially in key technological areas. This also includes providing a positive economic agenda for the region and, when necessary, vigorously opposing the PRC’s role in regional security. The following recommendations seek to maintain regional peace and prosperity by upholding the rules-based international order.

- Recognize that China is a reality for the region. China, the world’s largest oil and gas importer, will remain enmeshed with GCC countries. Western and PRC interests in the region are very often in tension, but both sides have an interest in preserving stable energy flows. The West must thoughtfully manage its limited regional resources, contesting Chinese initiatives where necessary while avoiding unnecessary disputes.

- Maintain Western unity of purpose in the region. Western constitutional democracies—stretching from North America to Europe to the Indo-Pacific—face enormous and complex challenges but easily form the world’s most powerful political, economic and military bloc. While each Western economy has heterogeneous interests in the Middle East, these democracies should speak in one voice wherever possible, especially on critical issues.

- Capitalize on Beijing’s missteps, especially if Chinese economic growth falters. Beijing’s disastrous zero-COVID policy and failure to deploy effective vaccines raise questions about its ability to competently execute its ambitious foreign policy agenda. Moreover, if China’s economy stalls, Beijing’s “inevitable rise” narrative could be punctured, leading the GCC to reappraise the PRC’s usefulness.

- Pushback on PRC and Kremlin narratives. Narratives promoted by the PRC and Kremlin, including over the Ukraine war, have clearly gained a foothold in the region. Although admittedly easier said than done—given the region’s lingering distrust of the West due to the disastrous invasion and occupation of Iraq—the West must identify and implement effective public diplomacy strategies.

- Provide credible alternatives to Beijing, especially in technology. Chinese telecoms are progressively active across the GCC, increasing the risk that Beijing will wrap the GCC in a surveillance blanket. The West should ensure it provides the GCC with credible technological alternatives, not only in 5G, but also in solar manufacturing, hydrogen electrolyzers, and more. The West, including the US, should consider negotiations on Free Trade Agreements (FTAs) with the GCC. FTAs would promote and encourage trade partnerships and investment in Gulf ventures. Furthermore, they would also serve as a good model in assisting GCC countries in building bureaucratic and institutional capacity to engage in these negotiations and partnerships, which they can later use with other countries, including China, especially regarding regulatory issues.

- Creatively expand cooperation with key regional partners. Possible initiatives include encouraging coal-to-gas switching in South and Southeast Asia, catalyzing investment into Western supply chains, expanding educational exchanges, and more.

- Have respectful dialogue with the region and listen to its concerns carefully. GCC countries have unique economic and security interests and priorities, and acknowledging that is essential for the West to effectively counter China’s influence in the region. Regional actors complain that the Iran nuclear deal ignored their interests. This perceived lack of consultation and communication during the negotiation process, even during its potential revival, damaged trust in the US as a reliable partner and gave Gulf states the impression that their interests were not being taken into account. The continuous perception of being sidelined or ignored remains a significant concern for many countries in the Gulf. The West should carefully listen to GCC countries’ concerns and consult with them on decision-making processes related to the region’s security.

- Emphasize building a long-term interagency strategy towards the Gulf. A consistent strategy that transcends any single administration provides additional security and policy stability and reduces the use of simple short-term adjustments.

Joseph Webster is a senior fellow at the Atlantic Council’s Global Energy Center and edits the China-Russia Report.

Joze Pelayo is an Assistant Director of the Scowcroft Middle East Security Initiative.

This article represents their own personal opinion.

Further reading

Thu, Jan 27, 2022

China is trying to create a wedge between the US and Gulf allies. Washington should take note.

MENASource By Jonathan Fulton

Recent events indicate that leaders in Beijing are no longer satisfied with the logic of strategic hedging and are pursuing a more muscular approach to the Gulf.

Thu, Feb 3, 2022

China may now feel confident to challenge the US in the Gulf. Here’s why it won’t succeed.

MENASource By Ahmed Aboudouh

Despite China’s growing aggressive approach towards the United States in the region, it has no detailed plan to execute it successfully.

Tue, Mar 21, 2023

China’s mediation between Saudi and Iran is no cause for panic in Washington

MENASource By Ahmed Aboudouh

The deal is a mere statement of intentions by both countries to improve relations, meaning reconciliation is not complete.

Image: Saudi Crown Prince Mohammed Bin Salman shakes hands with Chinese President Xi Jinping during his welcome ceremony in Riyadh, Saudi Arabia December 8, 2022. Saudi Press Agency/Handout via REUTERS