our pillars of work

Econographics

A visualization series

Econographics

Econographics is the GeoEconomics Center’s in-depth look at key trends in the global economy utilizing state-of-the-art data visualization tools.

Spotlight

Trade and tariffs

Our team monitors the evolution of the second Trump administration’s tariffs and provides context on the economic conditions driving their creation—along with their real-world impact.

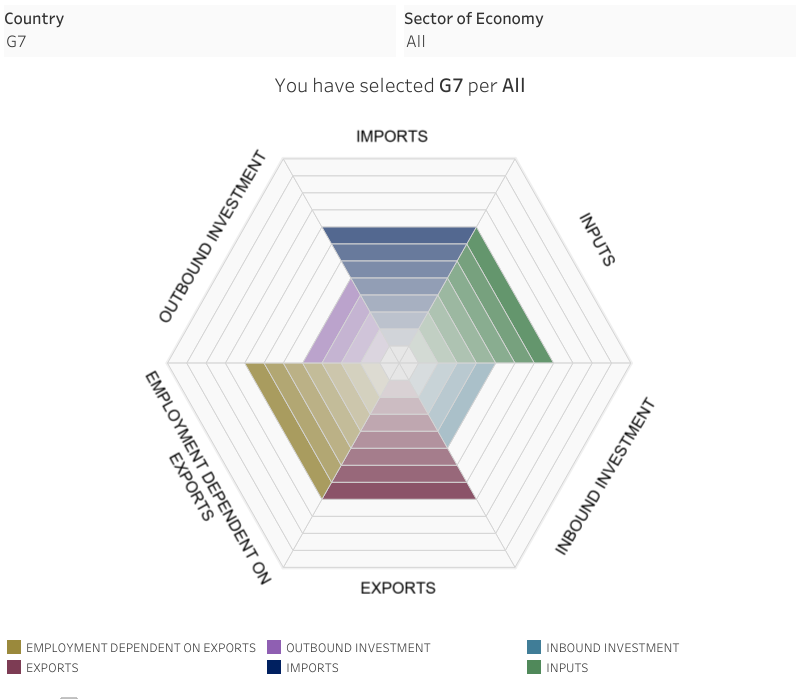

G7-China Economic Statecraft

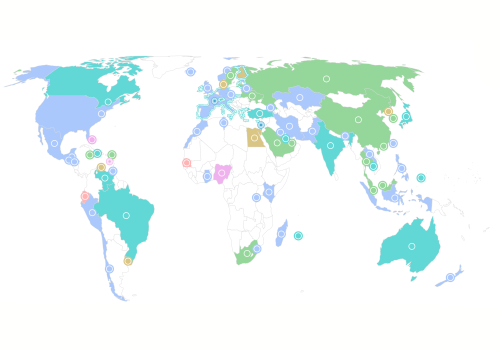

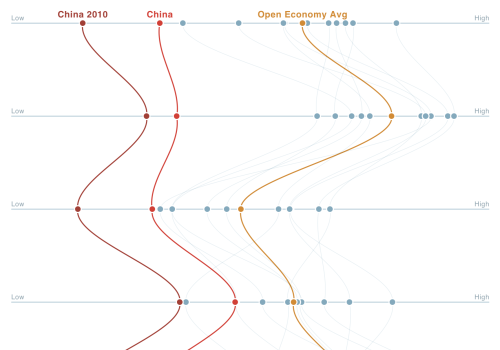

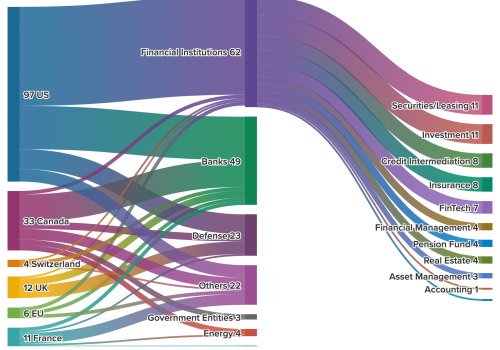

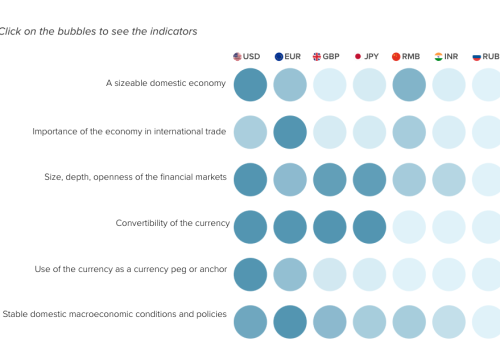

G7-China Economic Radar

This interactive radar maps levels of exposure that G7 countries have to the Chinese economy across 12 different sectors.

Stay updated

Sign up to receive emails on new research & reports, program highlights, and events.

The Taiwan Trilogy

Trackers

Flagship convenings

Bretton Woods 2.0 Project

The Bretton Woods 2.0 Project examines the deep challenges facing the IMF, World Bank, and the World Trade Organization and works to reimagine the governance of international finance for the modern global economy.

Recent Commentary & Analysis